Best undergraduate university for VC/PE, Entrepreneurship, or Product Management

Hi,

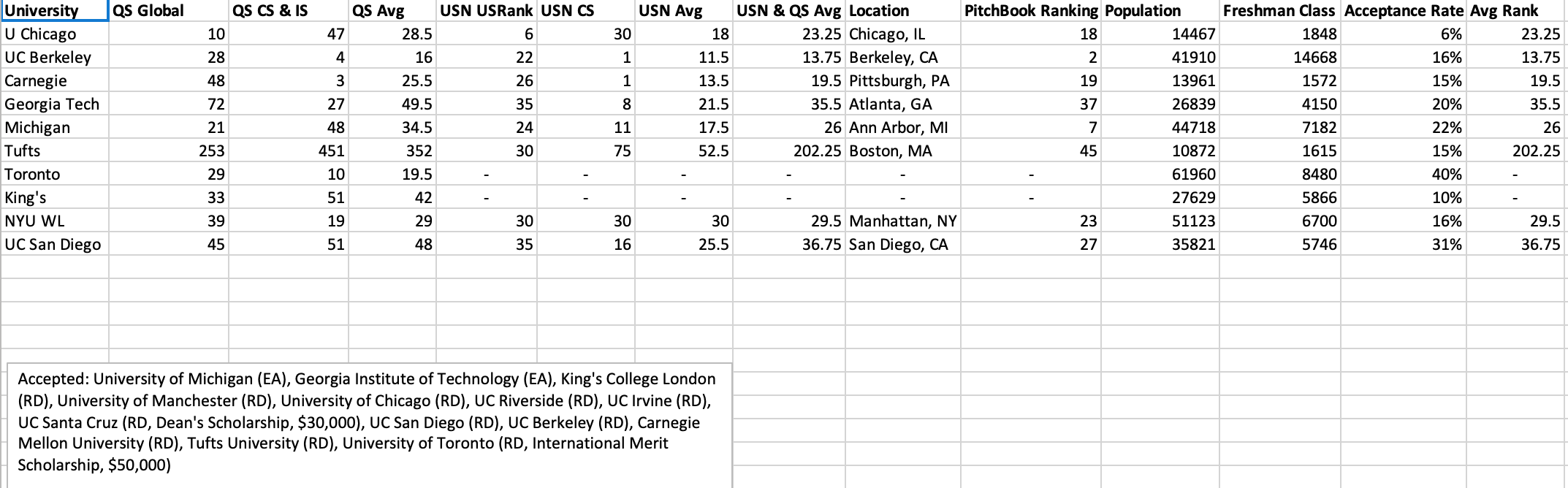

I am a high school senior who was admitted to several universities. My top choices are the University of Chicago, UC Berkeley (College of Letters), Carnegie Mellon University (Information Systems program), and Georgia Tech (College of Computing).

I will probably pursue Computer Science at university or Computer Science with a combination of Economics/Business. My goal is not to really work in FAANG but ideally launch a startup (going into Entrepreneurship). Otherwise, I would be interested in going into PE/VC or working in Investment Management firms with a specific technology focus. I will probably end up working in the US or the UK in the long run, but I will definitely spend at least 3-5 years working in the US. I'm not worried about parties and that sort of stuff.

Does anyone have advice on how to pick between these universities given the career path/prestige/other factors? I think at this point, rankings aren't going to help narrow things down since all these universities are highly ranked. I would greatly appreciate all your advice.

Thanks!

For vc/pm Berkeley hands down

People say that going to a big public university can be bad for recruiting. Is that true and should I worry about that? If I should, would you say that Cal > CMU > Chicago > GT for tech-focused PE/VC?

If cost isn’t a factor, then Cal > CMU > GT > Chicago. Typically, Chicago would be higher, but it doesnt make sense given your interests.

1) Berkeley

2) UChicago

Agree. And living in Cali seems better than Chicago.

Bump

Others have brought up great points. As a Canadian, I can also advise you not to go for the University of Toronto LOL (you have it listed in your question). Way too many people go there based off rankings, not realizing it's reputation is at the grad level, not undergrad.

Would CS & Econ at Chicago be a good choice? Or would Berkeley CS still be better?

Berkeley EECS grad here... Berkeley hands down. Best CS/EECS program (they're the same thing tbh) by far out of these options, and arguably in the country (know kids who took Berkeley EECS over MIT, Caltech, etc.) Berkeley is one of the best schools for entrepreneurship and is right next to the valley and there are kids who go into PE/VC out of undergrad. Plenty of PMs too

I got into Berkeley Letters and Sciences instead of EECS. That means getting a 3.30 in CS 61A, CS 61B, and CS 70. I'm not as worried about 61A and 61B as I am about 70 - Discrete Math and Probability Theory.

Does the fact that I would be in LSCS change anything? Also, I've heard that Chicago is becoming a bigger target school for tech, but I am not sure about the credibility of that. Compared to the population of UC Berkeley, are the post-graduation outcomes as product managers significant?

LSCS has the exact same curriculum as EECS except for 2 physics classes. This is placement for LSCS: https://career.berkeley.edu/sites/default/files/pdf/Survey/2018Computer…

Absolutely lights out placement, and you can double major with Haas (know a few kids who did that). 61A/B+70 are fine if you put in the work, and you can always do data science if you don't get CS

Go to the best school for CS. You can’t teach Entrepreneurship. I dropped out of college to start my business. I took entrepreneurship classes. They’re bullshit. You have to learn on your own and with a mentor.

If you’re looking to get into VC/PE, get good at finding startups, meeting the founders, and connecting them to as many VC/PE firms as you can. They will give you some capital with the firm and in the space if a firm ends up funding that company.

Do all your structured learning in college. Building good companies is something you just have to do, it can’t be taught. You have to struggle, adapt, and make decisions that have nothing to do with what you learn about in a classroom.

I so much agree with your statement "You can't teach entrepreneurship." As more and more colleges are establishing curriculum, I shake my head. It's like saying, "I want to be an entrepreneur so I applied for a government grant." Entrepreneurship is about an overall attitude and risk taking mindset. You need a certain personality and intestinal fortitude to launch. You can't be looking for the guidebook of SOPs, you have to create it. That's why it's so rewarding and potentially lucrative. Understand that the vast majority fail multiple times. The real entrepreneurs are the ones who keep at it. They don't have the attitude of "I'll give it a shot for 6 months or 6 yrs and see how it goes." There's no seeing how it goes. It goes. The question is do you go and create and evolve.

Good to have some basic foundational business classes that cover structure, entities, law/ contracts but you can find that all online pretty easily. I would agree that you should focus college on gaining some tech skills based on your interests.

Also, being an entrepreneur shouldn't limit you to certain industries. The guy/gal that owns 20 McD's is an entrepreneur. I assure you they are invested and involved in many other things. It's an attitude and once you're involved and successful (cashflow) you'll learn to look at other opportunities though a different lens and figure out how to create deals to get things done. JVs, licensing agreements, traditional structures, etc. The industry is essentially irrelevant.

What you miss is VCs are about 1000x more likely to give money to people who went to brand name schools than college dropouts.... so if you want to be GOOD at entrepreneurship (actually get funding) you need to go to a top school.

What is considered a top school in this case? Where would VCs be more likely to give funding out of these options?

To be clear, I'm not advocating not going to college but rather focusing on the actual course of study that interests you (i.e the industry that you would be an entrepreneur in vs. focusing on entrepreneurial studies or whatever hokey scheme they have)

Current Student at UC Berkeley:

I would say for your interests ... Berkeley > CMU > UChicago > Gtech

You cannot beat the access to resources, network and proximity to Silicon valley. Plenty of students at Berkeley are interning during the semester at companies like Amazon, Tesla, Google ..etc. L&S cs is not difficult to declare as long as you put some effort in the intro classes (61AB 70) and opportunities are the essentially the same as EECS. Check out SCET - tons of classes on entrepreneurship and product management. While agree that no class can prepare you for building a startup and failure, Berkeley does provide a lot of mentorship and networking opportunities with VCs.

Some great programs available for Berkeley Students include Accel Scholars, PearVC Fellows, Arrow Capital, House Fund as well as DRF, RDV, Contrary..etc.

** A major drawback to attending Cal is that the school is massive and opportunities are very competitive. You will not get the sort of small class sizes and 1:1 treatment at a smaller school like UChicago or CMU. You have to be a self-starter, take initiative and really craft your own journey through college (very little hand-holding here) and these are all important skills to have if you want to be a founder.

CMU places well in the tech-industry (Google especially), but location matters. Pittsburgh does not have a lot of entrepreneurial resources. Similarly, UChicago Polsky is a phenomenal hub for entrepreneurship but it's not the same as Silicon Valley. UChicago places most students in IB roles in either Chicago or NYC and has a very theoretical approach to computer science while Berkeley is applied.

Hope this helps and feel free to PM me.

Thank you so much for your advice!

I'm mostly just picking between Berkeley and Chicago now. Do you know if Berkeley has the same kind of quant/hedge fund pipeline that UChicago has?

Mostly Berkeley EECS / MET students join HFs as either Traders, SWE or Quants. I've seen many place into companies like Bridgewater (investment logic), Point72 Academy (Finance-oriented), and Citadel and a few at Jane Street / Two Sigma. Obviously, HF/Quant roles are very difficult to come by and after a certain level of university pedigree its mostly dependent on your problem-solving skills and general raw intelligence.

Look at LinkedIn and it will help you gage where students place after college

Ea possimus minima quia impedit rerum nihil aperiam. Iure est commodi est eaque accusamus earum consequatur eos. Neque suscipit eos iste aliquam veritatis natus.

Quas quo impedit voluptatibus eos. Qui officia voluptatum libero repellendus.

Voluptatem et facere et deleniti fuga. Illum quaerat sit quo vel consequatur. Eligendi et reprehenderit mollitia laboriosam quibusdam. Culpa debitis et consequatur veritatis quo et dolorem.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...