Informative IB Rankings for Recruiting

With recruiting szn around the corner, here is a pretty standard list of "tiers" so you are informed and can make a good decision about where to spend time recruiting. Again, not a dick measuring contest, just some purely informative insight. Pls don't throw monkey shit if I offended you, this is just my opinion of course. PLEASE take this with a grain of salt, but from my understanding these are pretty close and agreed upon, besides maybe the MM.

Bulge Brackets:

Tier 1: GS, MS, JPM

Tier 2: BAML, Barclays, Citi, CS

Tier 3: UBS, DB

Elite Boutiques:

Tier 1: EVR, CVP, PJT, (Q if tech)

Tier 2: PWP, MOE, LAZ

Tier 3: GUG, Roths, GHL, Allen

Tier 4: LT

Middle Markets/"Other Category":

Tier 1: HL, JEFF, RBC

Tier 2: HW, RJ, Piper, PJ, BMO, Blair, Cowen, Macquarie

Feel free to share thoughts & opinions and good luck to all prospects recruiting.

Also, choosing a bank shouldn't just be based on these WSO tiers. Obviously someone will choose GS over DB, but the lines between many of these tiers can be very blurred. Choosing only based on WSO perceived prestige instead of culture/comp/etc can be a dangerous game.

Definitely, this was just meant as a broad framework. Obviously choosing any of the EBs make sense based on fit/culture makes sense and the tier differences as marginal, for example.

Yeah I'm with you, I feel like in the EB space especially the lines are blurred.

This is inaccurate. Please for the love of god do not listen to this post—it’s going to be group dependent and situation dependent. Only undergrads and insecure kids who hate their job rank banks.

Eh…honestly I’ve seen worse rankings/tiers than this on WSO. Not to say its 100% accurate obviously but still

These rankings are too group dependent for tiers to even be useful-I'd put JEFF above every other MM, and HL (non RX) is definitely not a tier above HW/Blair/etc. Think RBC is too high as well. Would also bump Cowen, RJ down a tier but again there's certain groups that are the exception at all places

Roth is also definitely not an EB in the US, would probably be on the same tier as HW/HL/etc but honestly would probably take any of those above Roth in the US

Your EB rankings are pretty fucked

SVBL?

This is stupid

Where do you see RBC here? Can you help me out? Not trying to dog them, but these rankings threads are so stupid...WSO sentiment does not matter.

The RBC hype on this forum is ridiculous… it’s a mediocre MM bank that does a lot of financing. The RBC interns love to come on here and throw MS though

It legitimately makes no sense…I think it’s because they were T10 in tables one year from some large lead left or something. Not there subsequently, but still hyped up.

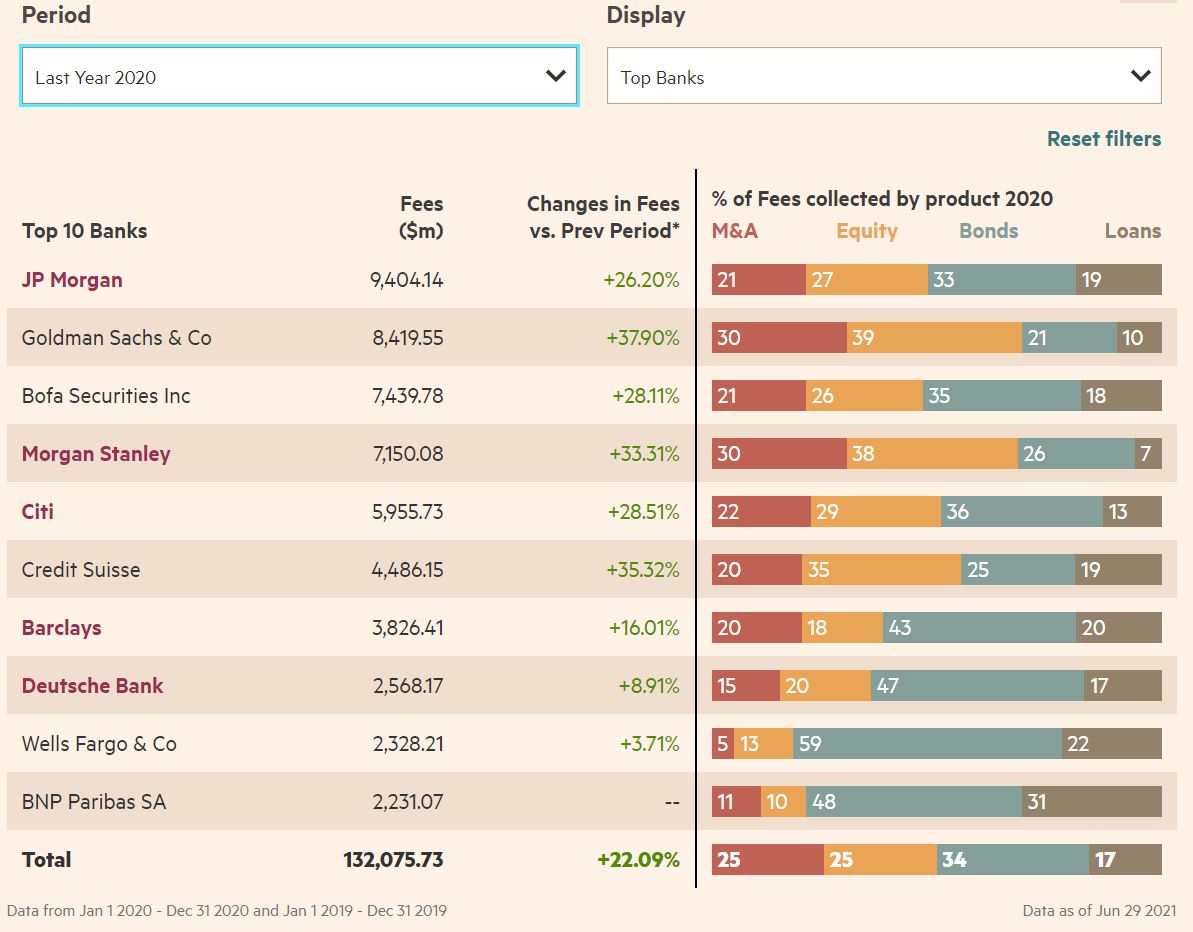

Where did you get this data from? Wanted to check it out myself.

Google investment banking league tables…there are a few different ones

Baird is missing and HL is too high. Should have a tier II of middle-market which is Blair / Baird / HL and then throw everyone else in tier III.

HW and Piper are tweeners. Not quite as good as Tier II but clearly above the other Tier III.

At ut voluptas et non facere quod explicabo. Est voluptatem voluptate atque et beatae recusandae. Maiores consequatur culpa nisi occaecati culpa minus.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...