It’s 2 years, you got this

Just thought this was a great thread worth passing along. Remember - this is a two year job (if you’re an analyst) that teaches you a ridiculous amount and gives you more exposure to seniors and decision-making than 99.9% of jobs out there that are available to fresh college grads. And if/when you decide to leave, you’ll be in great shape to contribute in your future roles due to the great skillset, work ethic, and attention to detail that you developed. Yes it sucks terribly sometimes, but on your worst nights try to put things in perspective. Keep going ladies and gentlemen, you got this.

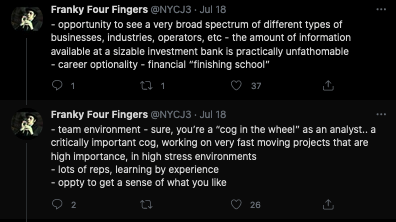

https://twitter.com/nycj3/status/1416757212383428…

This is gonna be an unpopular opinion but nothing in banking is as bad as people on WSO make it out to be lmao

Or WSO tends to lean towards kids who grew up around a lot of money (I'm one of them, I'll admit). When a friend of mine who went to a non-target whose parents home was probably worth <$500K and he was pulling $300K+ as an associate by his mid 20s - he was ecstatic. Eventually left to join the buyside (lifestyle fund, better WLB but likely less pay). But before the pandemic/WLB fiasco many people are facing now in the industry, he really saw banking as something he wanted to stay in (he was in a top group at one of the better paying BBs).

.

Yeah I think a lot of people overlook this. Most analysts in my group have parents pulling in $1MM+ and are upper class. Honestly, most of the analysts class across my bank are from very wealthy families. Unfortunately when you have this background, the $150,000 salary feels very insignificant. Essentially when you start your job in investment banking, you livelihood is absolutely unchanged from college. The only difference is you now have far less free time.

I honestly think some people lose touch of reality and are too focused on other person's careers and think a person has A, B, C their life would be the same. Even if they followed the same path, the end result will not always be identical. Plus, people should really weigh their options there is not a few paths but multiple. I tend to find most people that I define as successful do things most people are not prepared to do. Plus, their mindset is conditioned to focus on the price no matter the pain, setbacks etc.

Some groups are as bad as people on WSO make out to be, if not worse. Groups with strong deal flow at top banks (usually HC, TMT, M&A) have pretty consistently put in 90-110 hours a week for past year and often do not have weekends. Culture is pretty rough in these groups too.

On the whole, I do not think banking is as bad as a lot of people make it out to be. However, there are many exceptions and absolute nightmare groups still do exist.

Good thing about WSO is a lot of those "notorious" groups have long threads about them. Know of a few sweaty shops but are known to have great culture etc.

Also I think 90-100 is more of an analyst thing. I highly doubt many associates at the notorious groups are pulling 90-100+ weekly but I may be wrong. I've heard 75-80 is more realistic after 6 months on the job.

this

dude the fucking harvard kids make it seem as if you walk into work and you're getting raped and beaten and stabbed, repeatedly. They think because they've never worked a real job before they have it the worst on earth lmao.

Posts like this kind of piss me off.

"Exposure to seniors and decision making"- I spend all my day in powerpoint and excel because my associate wants to remove an oxford comma on page 17 of an appendix and my MD wants to add back the comma. Also, we aren't getting exposure to C suite execs. We take notes on calls to send around to the team that no one ever reads.

"It's 2 years"- Yeah that's a long time and 2 years of some of the best years of your life. Who cares if I'm making 150k a year when I get less than 20 minutes of sunlight a day, haven't seen my parents in months and never have time for friends.

Honestly, I don't think I have learned anything valuable. I know which obscure pages my MD likes to see and where to find some analysis we did 7 months ago on a pitch that went no where.

I'm not working on important transactions either. It's shitty pitches that never go anywhere and joint book runner on some low fee bond.

Maybe other analysts have had a better experience than I have. Good for you. Just putting perspective on here for college kids who think money and prestige make you happy (they don't). I'm looking forward to the day I quit and I log off for the last time.

"I spend all my day in powerpoint and excel because my associate wants to remove an oxford comma on page 17 of an appendix and my MD wants to add back the comma." – BS, no one spends "all day" doing that. In the past 6 months, I can count on one hand the times where Oxford comma consistency was scrutinized. Instead, almost every precedent deck I've seen has some kind of formatting inconsistency / error (e.g., how page title is capitalized, footnote position / format, line spacing across pages, etc.), and FWIW I work at a top group at top BB.

"Get less than 20 minutes of sunlight" – Again, BS. Days busy like that exist, but your schedule absolutely ebbs and flows; honestly have had a lot more days where I have hours of down time / doing simple tasks that don't require 100% attention so I can put on some Netflix / have little to do than I expected coming into the job. "Never have time for friends"? – You have less time and flexibility compared to in college, but again you absolutely have time for social things.

Yeah banking sucks in many ways, but what's up with people who only seem to remember the bad days / moments and try their best to make sure no one else would every forget about that?

Glad you're in a group with a better culture. You're lucky.

oxford comas rule, MD should curb stomp that associate

You’re a young kid fresh out of college. No job in the world is giving you the kind of exposure to c-suite execs you’re imagining. As someone with a lot of friends from high school in very “normal” jobs, I promise you even as a PPT bitch boy you have infinitely more exposure than they do. One of my friends works at a F500 in accounts receivable - all he does is go over invoices with places like Walmart and other retailers and call their accounts payable teams to try to get them to pay… guy has no idea what the big picture strategy of the company is. Do you get to see that in IB? Maybe not if all you’re doing is pitching, and I’m sorry to hear that if so. But I’m at a BB in a strong group, and when we go talk to the same caliber of F500 companies, it’s not a call with the accounts receivable team. You might have just put together the deck, but in the process if you take the time to read it you see how your senior bankers view the business and their strategy, what levers are available to the corporation to pull. Then you sit on the call with some of the most senior people in the entire corporation. Did you speak? No - but you’re a 20 something year old kid, no one cares to hear what you have to say yet. You still get to soak in what those execs think, and what your senior bankers say in response. And they’re talking about things that actually matter - not if Walmart pays 5 days earlier, but what if we acquire X competitor, or if we tender our bonds and issue new debt, or if we consider an equity financing how might that be viewed by our largest institutional holders. And that’s just a typical market update meeting - when you’re on a live M&A process with those companies, it’s all hands on deck and they involve their most important people in the deal that you’re working alongside with as a 20 something year old. If you have even the slightest idea of what your peers in “normal” jobs are doing, and just how little impact it has on the entire company, you’ll realize that you may both be cogs, but you’re a cog doing much more worthwhile work. Stop complaining and recognize it might suck now but it’s a hell of a lot better than what they’re stuck doing.

VC gives plenty of exposure to c-suite execs. I worked at a VC fund for a little over a year and got to directly interact with the senior management of Plaid, Relativity Space, and Wombo to name just a few companies. Additionally, my VC background helped me become an advisor for several high-growth startups. Now, I'm working 40 hr weeks, sightseeing around the country (my current firm is permanently wfh), and making $100K base plus 5-10% bonus with excellent benefits. Honestly, people need to see outside the IB bubble and realize that there are other jobs available that provide the same, or even better experience, without the insane hours.

Couldn’t put it any better

I know guys working as SDR's and AE's at enterprise SaaS startups who are making significant money and get exposure to c-suite execs.

Sounds like you should quit

dawg i wish you people would just live one day as poor just to see what true hardship is like. lmao go neck yourself

"best two years of my life"

NONONONONONON PLEASE PLEASE PLEASE DON'T TELL ME I'M GONNA MISS OUT ON PLAYING CALL OF DUTY FOR TWO HOURS AT NIGHT AND DRINKING BEER WITH PEOPLE THAT DON'T EVEN LIKE ME NONONONONONONONONO

interns barking the loudest once again.

I'm not sure if you know this or not, but just being on those calls is more exposure than the vast majority of early 20 somethings will ever see in the first 10 years of their career. Maybe more.

MS = "Reeeeeeee, facts hurt my feelings!"

I remember thinking “I can’t believe I have almost two more years of this ****” in September of my first year. Then I blinked and it was over.

mate i hope that happens for me too

are you mean to ib juniors in pe?

Did PE prove to be much better or you just got used to the workload?

I am losing hope that PE is the promised land.

FINALLY PEOPLE UNDERSTAND.

Sorry for the lack of structure in the below but I have to get this of my chest before OP makes more people take the same bad decisions I took.

Banking in 2021 is no longer a good choice for most people. Two years of absolutely..

...and for what? Money? Just work two 8h shifts at McDonalds. IB is a lot but you will never be really rich. Barely anyone in IB ever achieves self-employment either. No one that is intellectually interested in finance will actually like banking.

There is a reason we are paid that much, and it is to compensate for how shit the job really is. Thus, most people are in it either for money (unless you are poor it usually is not worth it, and 99% of your analyst class will be the opposite of poor) or for those mythical exit ops.

However, exit ops are overhyped and not actually worth it for most people nowadays. Why work those hours for 2-4 years only to end up in corp dev? You could have just done that straight out of college or from Big4. Same goes for VC and many start-ups. Banking is by no means the single or even the best pre-requisit for these careers. Go work for McKinsey, it will be more interesting, same money and better hours. Also, you will usually have more choices with a consulting background. Namely, apart from corp dev and some VC, the only exit that makes sense for most bankers is oh-so-glorious PE.

People tell themselves PE is the promised land. Lower hours, amazing carry and interesting work. But that is simply not true in the vast majority of funds:

At the end of the day, banking is a dead end except for those few people either really really greedy for some $$ or dead set on working in a small set of very specific investment roles. And on top of that you will be overqualified for many roles that might be more interesting if you want to make a career change at some point.

Having fallen into the banking rabbit hole back when I started uni, all I can say now as an Analyst is that from my POV it is not worth it, and I wish there had been people to tell me that when I first started applying.

So if any prospects read this, please do think very long and hard on what you really want to do with your lives before you lock yourself into this job. And do not rely on WSO. It is a great site for getting the job but the perspectives and opinions of most people here are removed from reality to an such extent that they will tell you to send a nice thank you email and prepare for a handover call when you end up in hospital with a heart attack (happened to one guy on my team recently) on the job, instead of quitting outright.

Tl:dr: remember that it is not banking or bust.

For PE, "your salary will remain essentially constant or lower than in banking." is this really true? Always thought PE paid more than banking

Didn't you just start FT a few weeks ago?

Why did you say you are not learning proper modeling?

Because most models are run by a bunch of quants nowadays, barely any analyst actually gets to touch the model. You will be making nice little charts based on it to put onto your ppt. Doing modeling in banking is an illusion nowadays, at most you will get to fill out a template in your second year.

Its 12 years you got this!

OP probably correct

I probably could’ve done another year at BB, not so much for the money, but just for the perseverance and it might have been nice to have a few more billion dollar deals on CV in first few years.

That said there’s also a limit to how long you’d stay. Staying beyond VP is pretty unrewarding financially considering how little the pay is if someone really rated themselves. When’s a D going to realistically save $10m? At that point you’ve really become a career banker, and your real out (without taking a pay cut) is to keep powering on and start politicking in the firm, which is great if you love being a salary person. Not if you want to make next level of big dollars.

Every IB Analyst ever:

;Aut hic similique voluptate. Iusto rerum ratione dolores suscipit animi. A odit animi adipisci dolorum ea. Dolore dolor incidunt nostrum blanditiis totam dolor illo. Aperiam similique nostrum dolor dignissimos facilis.

Vel laudantium nesciunt et sequi quos. Ducimus velit maiores perspiciatis sit maiores voluptatibus iusto.

Iusto quod iste totam consequatur eius voluptas aut est. Consectetur eligendi molestiae nesciunt quia nam maxime quibusdam illo. Nostrum qui et ut illum aut. Et aspernatur dignissimos alias id id accusamus.

Nihil rem a quis aspernatur qui unde ullam. Consequatur dolorem reiciendis officiis qui. Saepe tenetur quam consectetur dolor. Asperiores non consequatur perspiciatis aut. Illum aut blanditiis aliquid.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Vero explicabo laboriosam eos. Alias ut et quis explicabo molestias et. Est non aut ullam cupiditate ut aut. Eaque ea ea ut est reprehenderit sed cupiditate.

Reprehenderit et quisquam quia nobis. Tempore ad et vitae alias rerum explicabo quos. Perferendis et quo quo et dolores nesciunt. Fuga incidunt ea nam.