How To Build A Merger Model

The key steps to building a merger model

A merger model is created to analyze the effects of two companies joining together. Merger models are formed during the mergers and acquisitions process. These models help managers and analysts examine the financial impacts that will occur both during and after the merger.

A merger is when two companies form together into one entity. The main goal of this process is to create post-transaction synergies that will improve each company’s productivity and efficiency. Therefore, the modeling process is fundamental to this transaction to understand how to initiate the merger and the post-merger financial effects.

Creating a merger model can take between one hour to multiple days, depending on the complexity of the transaction and that of the model. An analyst will usually begin modeling the merger by organizing and understanding the model’s inputs.

They will then create a wide variety of model assumptions. After that, they will analyze the model to reach a conclusion.

- Model assumptions are drawn for an assortment of essential financial items such as capital expenditures, revenue growth, capital structure, and EBITDA margin.

- Analysis of the model allows for the interpretation of multiple different scenarios. These alternative scenarios can be accounted for in the acquisition cost via altering the offer price or in analyzing the effects of different funding options such as various combinations of debt and equity.

The main goal of the analyst post model creation will be to evaluate whether the acquiring company’s earnings per share will increase or decrease after the merger.

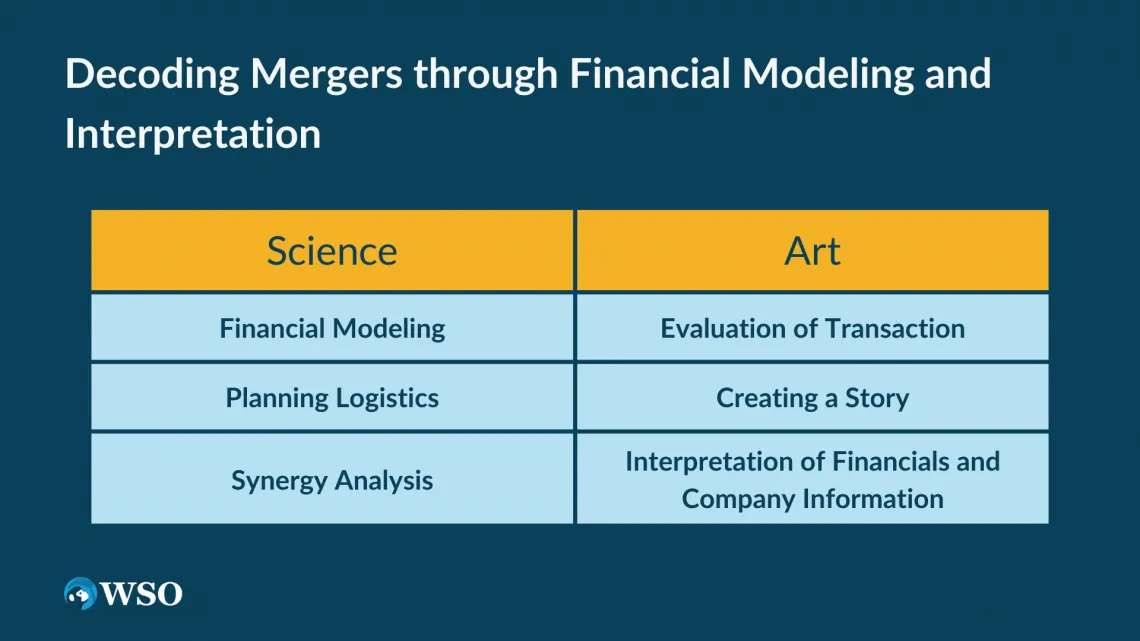

This process involves both an artistic and a scientific side. Financial modeling is largely scientific, aside from the various assumptions built into the model. The logistics of the merger and the analysis of potential synergies will also be scientific.

Meanwhile, the artistic side of the merger process involves the interpretation of financials and general company information, an overall evaluation of the transaction and its potential, and writing a story to sell to the board of directors, shareholders, employees, and customers.

Key Takeaways

- Merger models analyze the financial impact of a merger or acquisition.

- The goal of a merger is to create synergies and improve productivity.

- The modeling process involves assumptions, projections, and valuation techniques.

- Assessing accretion and dilution helps evaluate shareholder value.

- Synergies, competitive advantages, and industry expertise contribute to successful mergers.

Steps to building a merger model

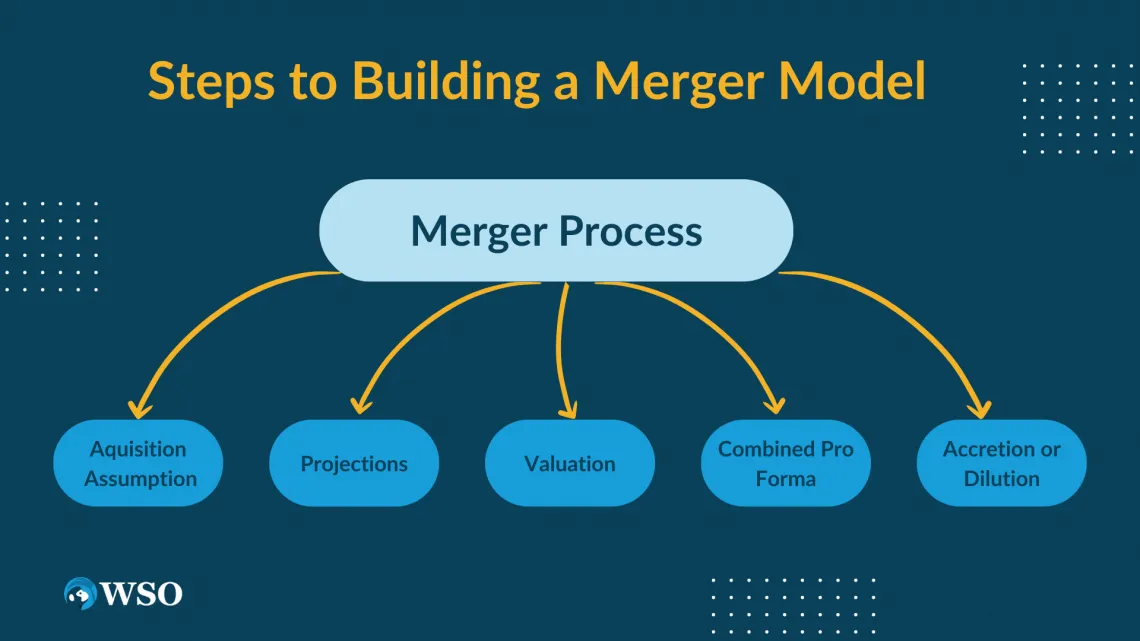

The modeling process begins with creating acquisition assumptions. After financial projections are developed for both companies, a business valuation is performed for the two companies. The financial projections are then combined to see the post-merger effects.

The final step is to assess whether the merger would have a positive or negative impact; this conclusion is most often examined through analysis of whether the deal is accretive or dilutive.

Assumptions

A number of assumptions are made during the modeling process. These assumptions often involve deriving figures related to both companies’ financial items by understanding their respective businesses. Assumptions are created for:

- The purchase price of the target company

- The number of new shares that will need to be issued

- The amount of capital that will need to be paid to the target company

- Synergies that are created post-merger

- The amount of time it will take for synergies to be realized

- The cost of integrating company operations

- Adjusting each company’s financial statements to reflect their true financial standing better

- The acquiring company’s ability to raise debt and the associated interest rates

- Potential flow back issues, which occur when an impending merger leads to a mass shareholder sell-off

- Transaction fees, equity issuance fees, debt issuance fees, and any advisory fees

Projections

Financial projections are created for each company’s income statement, balance sheet, and cash flow statement. Within the financial projection process, an analyst will need to make an additional number of assumptions regarding:

- Capital structure

- Revenue growth

- Capital expenditures

- Variable costs

- Fixed costs

- Net profit margin

- EBITDA margin

Valuation

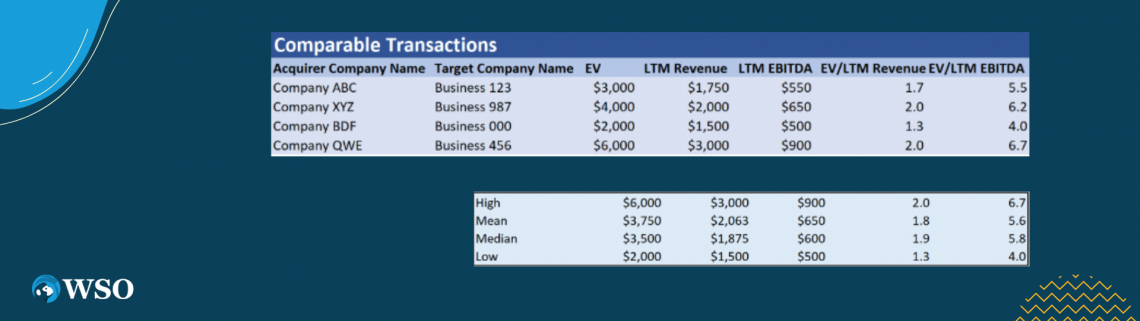

This process involves creating a discounted cash flow analysis model for both companies. In addition, it is crucial to conduct a comparable companies analysis and a precedent transactions analysis.

Key inputs that will be needed from both companies will include:

- The current share price

- The number of shares outstanding

- The current credit ratings

- Any dilutive securities

- The total amount of debt

During this step, analysts will also assess the impact of debt financing on each company’s post-transaction credit ratings. A section of Sources and Uses is created to identify how capital is raised and how it will be employed.

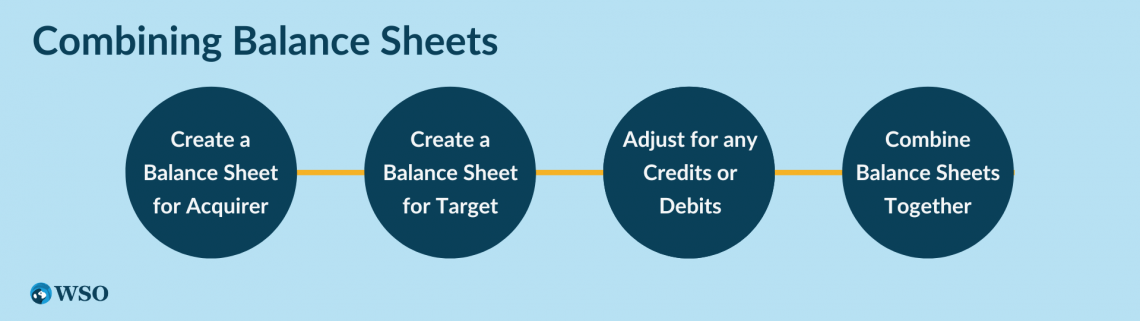

Combined Pro Forma

The combined pro forma step includes conjugating two companies’ income statements, balance sheets, and cash flow statements. The fused pro forma financial statements represent both company’s post-merger as one singular entity.

The combined pro forma will need to include:

- Any changes in accounting methodology

- Determination of goodwill produced by the acquisition

- Realized synergies (specifically those affecting revenue and operating costs)

During this step, it will be essential to analyze the combined capital structure and whether or not it has the proper amount of equity, debt, and cash.

Accretive or Dilutive

This part of the analysis involves factoring in the number of new shares issued alongside post-merger projected earnings. This analysis allows management to understand whether the deal will increase or decrease shareholder value.

Accretion and Dilution

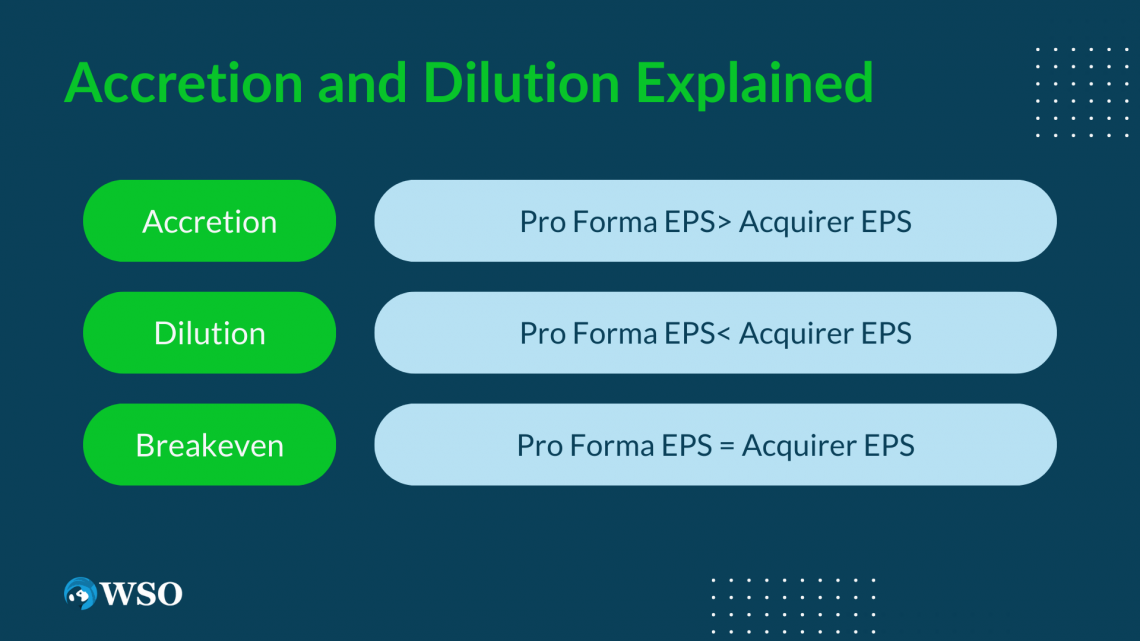

An accretion is when the pro forma earnings per share are larger than the acquirer's original earnings per share. If this is the case, then the deal is said to be accretive.

On the other hand, dilution occurs when the pro forma earnings per share are smaller than the acquirer's original earnings per share. If this is the case, then the deal is said to be dilutive.

If pro forma earnings per share are equal to the acquirers' original earnings per share, the deal will breakeven. In other words, it will not be accretive or dilutive.

Earnings per share are the best measure to assess whether the deal will have a positive effect. This is because pro forma earnings account for the post-merger shares issued, interest paid on new debt, and foregone interest on cash.

The management of a company always wants a deal to be accretive because it assists them in generating shareholder approval. Shareholder approval is fundamental for preventing flow back issues.

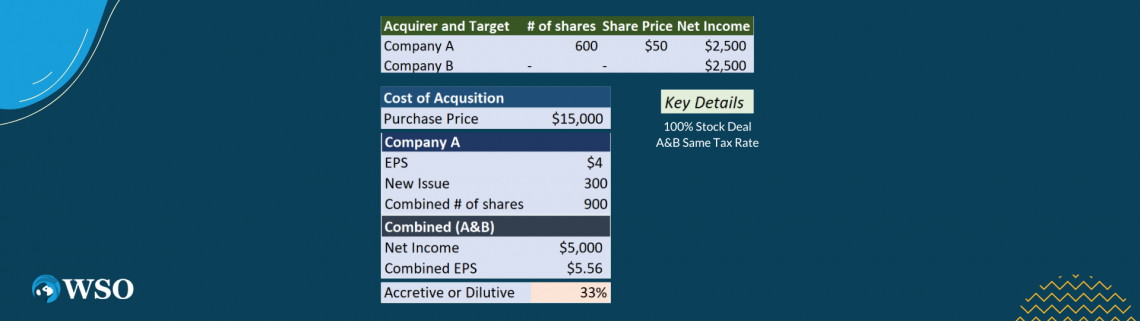

In the above example, we have two companies, Company A and Company B. They both have the same tax rate, and the deal will be conducted using 100% stock. The cost for Company A to acquire Company B is $15,000.

- We calculate Company A's earnings per share by taking their net income and dividing it by their shares outstanding:

$2,500 / 600 = $4.17 or $4 when rounded - We determine the new shares that need to be issued to conduct the acquisition. This is done by taking the acquisition cost and dividing it by the share price of Company A.

$15,000 / $50 = 300 - We combine the new issues with Company A's outstanding shares. The output of this calculation is the total amount of outstanding shares for the companies post-merger.

300 + 600 = 900 - We combine the net incomes of both companies.

$2,500 + $2,500 = $5,000 - We determine the earnings per share of the combined companies by taking their combined net income and dividing it by the combined number of outstanding shares.

$5,000 / 900 = $5.56 - Lastly, we take the combined earnings per share and divide it by Company A’s original earnings per share.

(($5.56 / $4.17) - 1) = 33%

Because earnings per share increased by 33%, this deal is accretive.

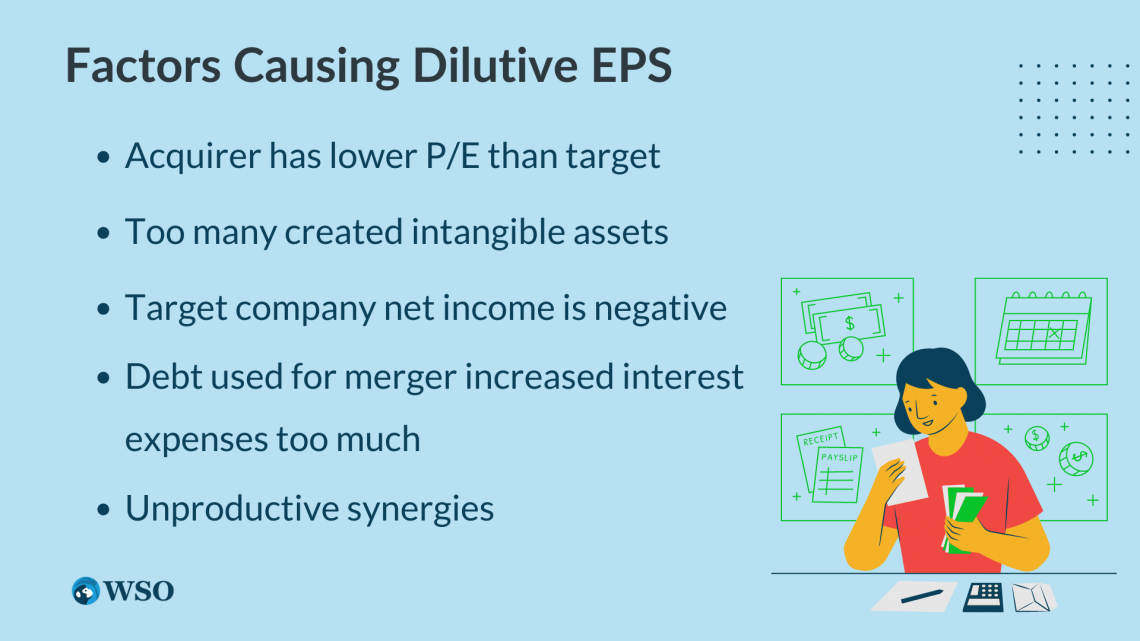

If the earnings per share decreased post-merger, then the deal would be dilutive. A multitude of factors can cause dilutive earnings per share. The above diagram illustrates some of the common causes that lead to dilution.

Driving forces behind a merger

The main motive behind conducting a merger is to increase profitability. However, this increase may derive from several factors, such as improving operational efficiency or selling products to a new customer base.

When a company chooses to acquire another company, they do so because they believe they will extract more value from the acquisition than their money to acquire it. In other words, the company will earn more than the acquisition cost.

There are different types of mergers:

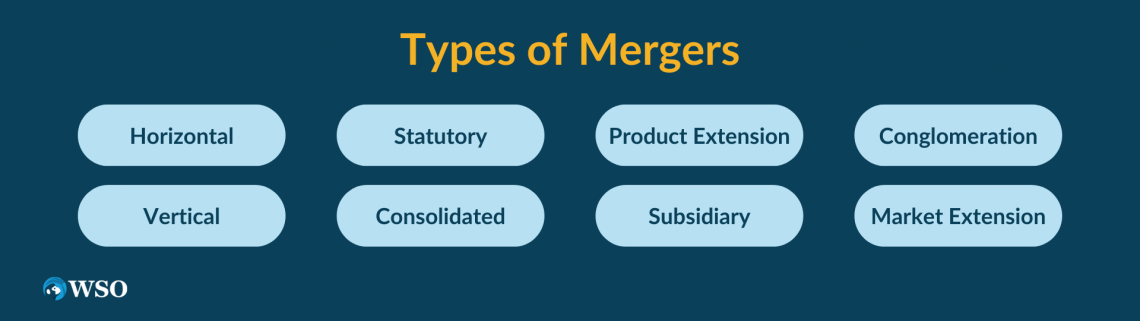

- A horizontal merger is when two companies that are competitors merge. These would be companies competing for market share and competing to do business with the same customer base.

- A vertical merger is when a distributor company merges with a supplier company. A good example could be a store that sells office equipment merges with a company that manufactures office chairs.

- A product extension merger is when two companies that sell different products in the same market merge together. An example of this could be a company that sells computers mergers with a company that sells keyboards.

- A conglomerate merger is when two companies that share no common ground merge together. Warren Buffett’s company Berkshire Hathaway is a holding conglomerate company that owns Geico and Dairy Queen. While these two companies sell entirely different products, they are both owned by Berkshire Hathaway.

- A statutory merger is when a large company acquires a small company. Once the merger is completed, the smaller company ceases to exist.

- A subsidiary merger is when the company that will be acquired continues as its own entity though under the ownership of the acquiring company.

- A market extension merger is when two companies that sell the same product in entirely different markets merge together.

Synergy is when two companies are able to come together to produce more value than they would have produced had the two companies continued to operate independently. Companies can create synergy when they work together to increase efficiency and productivity and increase profitability.

In the modeling process, an analyst will make assumptions about the synergies produced post-merger. Next, they will need to estimate synergies’ effect on revenue and operating costs. Finally, after this process is completed, the analyst will need to create a valuation for all of the synergies if they were to be realized.

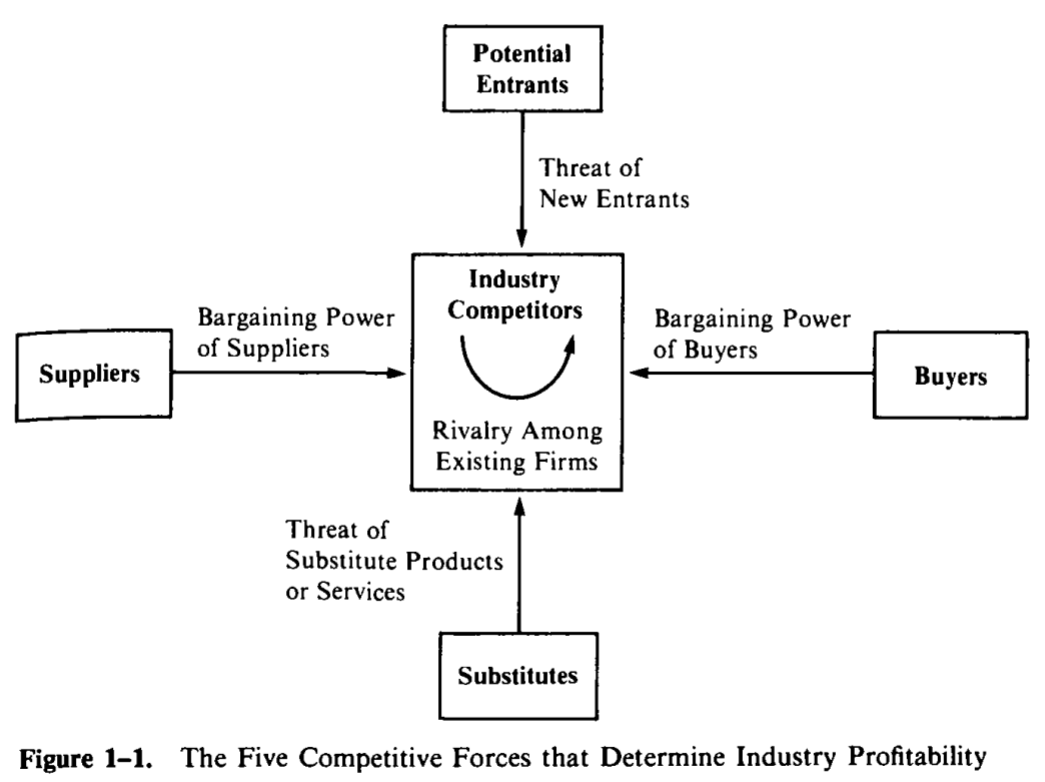

Image taken from Competitive Advantage: Creating and Sustaining Superior Performance written by Michael Porter

A company may establish a competitive advantage by having:

- Lower prices

- Higher quality products

- Superior customer service

- Faster shipping

A competitive advantage may also be a dynamic that prevents competition. This barrier can help mitigate supplier bargaining power and customer bargaining power. In addition, it may assist in preventing new companies from competing for market share by making it difficult for them to create products or services that can act as a substitute.

Management and analysts will look to target acquisition companies for opportunities to build a stronger competitive advantage within their industry. This drive for establishing a competitive advantage acts as one of the main driving forces behind the desire to enter into the merger process.

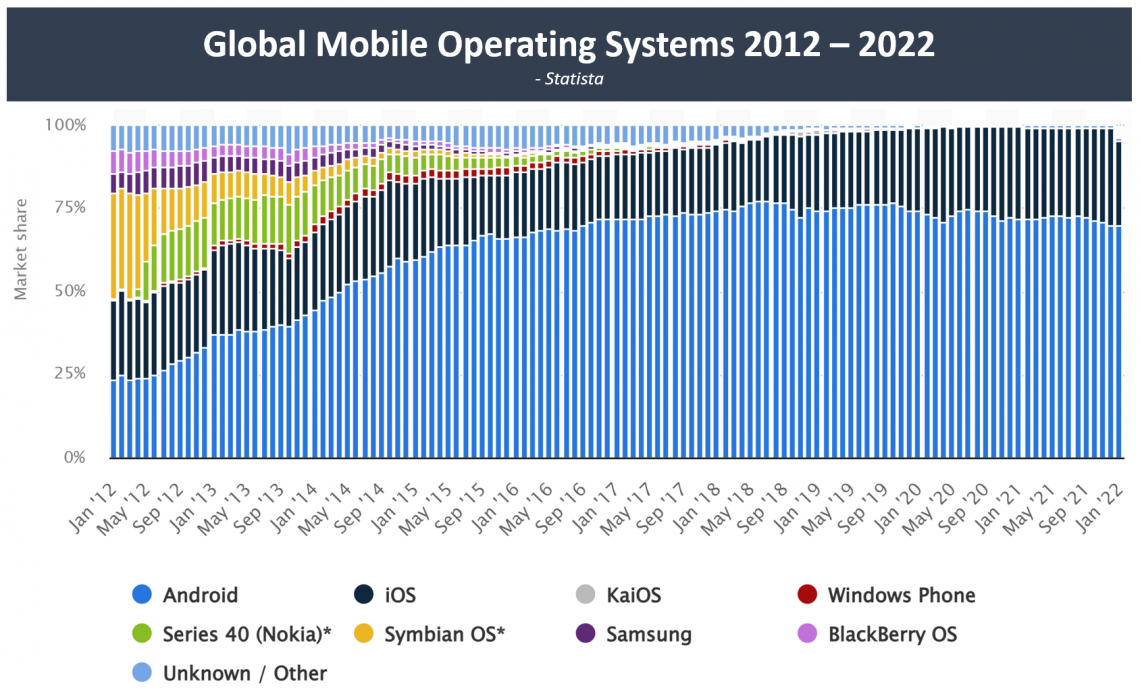

On July 11, 2005, Google acquired Android. At the time, Android was just a small startup founded by Andy Rubin in 2003. The company’s goal was to build an open-source operating system for mobile telephones.

Google acquired the company for $50 million. Over the next couple of years, Google helped Android develop its operating system. The first official Google/Android phone was released in 2008.

Google’s acquisition of Android allowed for multiple synergies to be created.

- Google was able to lend its industry expertise to create the Android operating system. They brought to the table brand awareness, funding, and technical knowledge.

- Android brought to the table its specialty in computer programming and a vision for an open-source operating system for mobile phones.

These synergies led to the merger becoming so successful in the long run. Today Android represents almost 70% of worldwide operating systems. According to Statista, Android will account for 87% of all smartphone shipments in the world by 2023.

More about financial modeling

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?