Fixed Income Interest Rate Risk

Fixed-income investments prioritize steady income and capital preservation over speculative assets.

What Is Fixed Income Interest Rate Risk?

Fixed-income investments are an investment instrument in assets that offer steady income payments over time. Investors of fixed income place a higher priority on protecting capital and creating steady income than they do on speculative assets like growth stocks.

The major goal of fixed-income investing is to keep the investment's value stable while producing income via interest and dividends. Investors seek to reduce the risks of volatile assets like common stocks by investing in fixed-income instruments.

The structure of the securities itself is referred to as "fixed income" since they provide regular payments throughout the course of their lifetime.

Bonds, for instance, have set interest rates and refund the principal at a certain maturity date. Coupon bond interest rates are predetermined and stable even though the market value of the bond can still fluctuate based on changes in interest rates, affecting its yield.

These interest payments are often safeguarded by law, meaning bondholders have the first claim of the firm’s assets through bankruptcy procedures if a corporation fails to make payments.

The additional layer of safety that fixed-income securities provide to investors is their main benefit. Although they might not have the same potential for price growth as stocks, they offer a reliable income stream and the chance for some overall value growth.

This helps in providing a secured stream of income from investment and gives them a secure environment.

Furthermore, fixed-income investments are renowned for their benefits to diversification. They may be used to balance a portfolio of investments, including higher-risk assets like equities and their risk exposure.

Investors can lower overall volatility and limit possible losses during market downturns by including fixed-income assets in their portfolios.

Key Takeaways

-

Fixed-income investments prioritize steady income and capital preservation over speculative assets.

-

They provide a reliable income stream and potential value growth, offering an additional layer of safety compared to stocks.

-

Fixed-income securities, like bonds, have predetermined and stable interest rates, providing regular payments throughout their lifespan.

-

Including fixed-income assets in an investment portfolio helps to diversify and reduce overall volatility, offering a potential hedge against market downturns.

Fixed Income Security And Fixed Income Interest rate

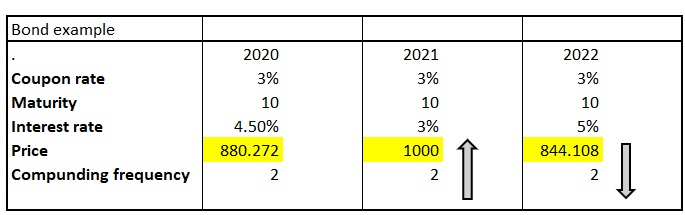

The relationship between fixed-income security and interest rate is inverse. Let us consider bonds and interest rates.

Bond prices and interest rates are inversely related; as in when the interest rate rises, bond prices fall, and vice versa.

When coupon rates rise, they become more appealing to investors as they have fixed coupon payments, whereas these bonds' prices rise when demand rises.

When market interest rates rise, fixed-rate bonds become less desirable relative to new bonds with higher coupon rates, causing bond values to fall.

This link is critical for investors to grasp because it shows the possible risk associated with fixed-rate bonds and aids in the management of interest rate risk in their investment portfolios.

Duration And Fixed Income Interest Rate Risk

Duration, especially modified or effective duration, is the major statistic used to estimate interest rate risk.

The decision between these indicators is determined by the complexity of the portfolio's investments and the organization's desire to calculate them using financial management software.

Modified duration measures the percentage change in the value of a bond that does not have embedded options, such as a callable bond, in reaction to a 100 basis point change in rates. It indicates the portfolio's exposure to interest rate risk in detail.

For instance, a portfolio with a duration of 4 will see a 4% decline in market value for every 1% increase in interest rates.

The effective duration is employed when dealing with fixed-income instruments that include embedded options. It properly monitors price volatility by considering how the cash flow characteristics of the bond may fluctuate due to variables such as interest rate changes.

For example, if a callable asset moves in or out of the interest rate range at which it can be called, effective duration might assist in predicting price volatility.

The calculation of effective duration is based on many assumptions regarding interest rate direction and volatility.

Note

Investment portfolio managers must first comprehend these assumptions before relying on effective duration as a valid indicator of their exposure to interest rate risk.

A bond's price sensitivity to changes in interest rates can be predicted with some help from duration. In common, For every 1% increase or decrease in interest rate, the bond price will fluctuate in the opposite direction.

Let us consider a bond, which has a 5-year term and an interest rate increase of 1%; the price will reduce by 5%. In contrast, the interest rate that reduces by 1% impacts the price that increases by 5%.

| Duration | Interest Rate Change | Bond Price Change |

|---|---|---|

| 5 | +1% | -3% |

| 5 | -1% | +3% |

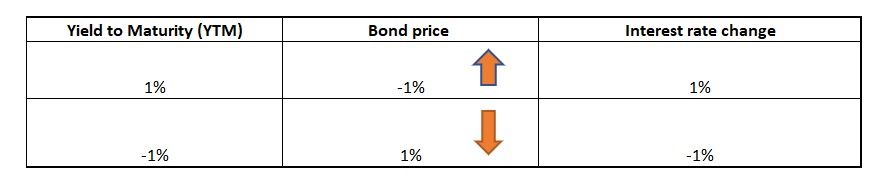

Yield to Maturity (YTM) And Fixed Income Interest Rate Risk

A bond's Yield to Maturity (YTM) is the yearly return an investor would get if they purchased the bond and held it until maturity. Market interest rates impact it, and the link between YTM and interest rates is inverse.

When interest rates rise, existing bonds' yield-to-maturity (YTM) rises to meet the greater income investors require. Existing bonds' YTM falls to match the lower yield required when interest rates fall.

Interest rate changes have a direct influence on bond prices. Bond prices typically decrease when interest rates increase and increase as interest rates decrease.

This connection is founded on the idea that when interest rates fluctuate, a bond's fixed coupon payments become less appealing compared to freshly issued bonds with varying coupon rates.

As a result, bond prices rise when YTM decreases, whereas bond prices fall when YTM increases.

Note

Bonds with greater YTMs (higher yields) are less susceptible to changes in interest rates, resulting in smaller price volatility.

The YTM of a bond influences its price sensitivity to changes in interest rates. Bonds with lower YTMs (lower yields) are more sensitive to interest rate variations, resulting in bigger price swings for a given interest rate change.

Bond longevity, which gauges a bond's susceptibility to fluctuations in interest rates, must be considered. Bonds having longer maturities are more vulnerable to interest rate fluctuations and have a higher risk of price volatility.

Duration considers both the YTM and the timing of cash flows, resulting in a more exact assessment of a bond's interest rate.

Types Of Fixed Income Interest Rate Risk

Bond prices and the interest rates move in opposite directions. Bondholders and investors who suffer losses due to shifting interest rate environments are concerned about these types of interest rate risks:

1. Price Risk:

The change in the market value of stocks or bonds will result in a loss that results in price risk or market risk. Bond prices often decrease when interest rates increase.

This occurs due to rising interest rates, which make borrowing more expensive and make current bonds look less valuable to investors.

2. Reinvestment Risk

Risk is added when an investor reinvests the earnings from a financial product—like a bond or a certificate of deposit (CD), for instance—at a lower interest rate.

Reinvestment risk can affect the fixed interest rate on fixed assets like bonds and certificates of deposit (CD).

Note

Investors intending to have safer returns are allowed to think of investing at a lower rate when a fall leads to poorer returns than expected.

3. Cash Flow Risk

Cash flows from loans, investments, and financial instruments arise from the variation that is the cause of cash flow risk.

For instance, corporations pay more interest when they borrow money at a fixed rate, impacting cash flow and profitability.

4. Maturity Risk

Maturity risk is the possibility of financial loss brought on by fluctuations in interest rates as a bond or asset gets closer to its maturity date.

The potential loss brought on by shifts in the yield curve's form is called yield curve risk.

Note

Long-term bonds lose market value when the yield curve flattens or inverts, which makes them less desirable to investors.

6. Optionality Risk

The possible loss resulting from fluctuating interest rates when a bond is callable or prepayable is what risk means. If issuers decide to exercise their call option in a declining interest rate environment, investors will receive less money back.

Measuring Interest Rate Risk

To measure the approximate effect of the Interest rate risk, industries follow many methods to determine the risk assessment.

The following methods are:

1. Gap Analysis

The gap between the amount of rate-sensitive assets and liabilities that are predicted to be repriced over a given length of time in the future can be calculated using the gap analysis approach.

This gap, which may be positive, negative, or neutral, can be used to predict how changes in interest rates may affect net income. One may consider both assets' and liabilities' repricing features while doing a gap analysis.

Variable-rate loans and adjustable-rate securities are two examples of rate-sensitive assets; they both have interest rates that can be adjusted or repriced in response to changes in market rates.

Liabilities that are susceptible to changes in interest rates include variable-rate deposits and short-term loans.

The gap analysis assists in determining whether one should anticipate a favorable or negative impact on net income depending on one’s expectations for future interest rate movements.

Rising interest rates might potentially result in an increase in interest revenue that would improve net income if rate-sensitive assets were greater than rate-sensitive liabilities (a positive gap).

On the other hand, if rate-sensitive liabilities exceed rate-sensitive assets (a negative gap), rising interest rates can cause greater interest expenditures, which might have a negative effect on net income.

Note

It is critical to remember that gap analysis has some restrictions. The implications of embedded options, which can greatly impact the cash flows and repricing features of some financial instruments, are not considered.

For instance, a bond with an embedded call option can be more susceptible to fluctuations in interest rates than its length would imply. Additionally, non-linear shifts in yield curves, when various maturities suffer distinct rate changes, may not be adequately captured by gap analysis.

Finally, basis risk, which results from the asymmetrical impact of interest rates on assets and liabilities, is not specifically considered in traditional gap analysis.

With the complexities of operations and holdings, other measuring methodologies may be required in addition to gap analysis.

More advanced models, such as scenario analysis or option-adjusted spread (OAS) analysis that account for the impacts of embedded options can be included.

Stress testing may also be used to assess portfolio resilience in the face of severe interest rate scenarios. You may acquire a more thorough picture of interest rate risk and make more educated decisions to manage it efficiently by integrating several measuring approaches.

2. Duration And Convexity

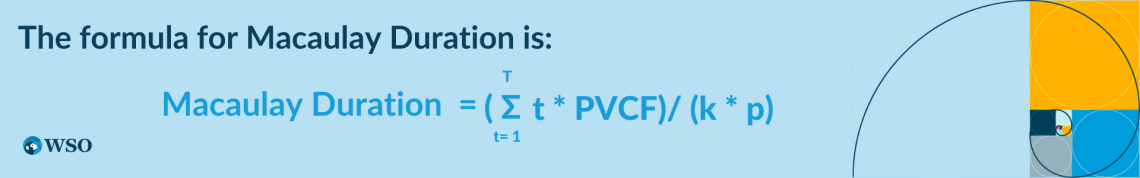

Duration is a gauge of a bond's price sensitivity to changes in interest rates. It calculates the percentage change in bond value for a given change in interest rates.

The duration of a bond accounts for both the time and the present value of its future cash flows. It assists investors in understanding how interest rate swings affect bond prices.

Where,

- PVCF = Present Value of Cash Flow

- K = number of payments per year

- P = bond price

Convexity is a measure of the curvature of a bond's price/yield relationship. It takes into consideration the non-linear relationship between bond price and yield.

Note

Bonds with higher convexity are less sensitive to interest rate hikes and more sensitive to interest rate declines.

Convexity reflects the impact of changes in interest rates more precisely than duration, which implies a linear connection.

Convexity = {1/(P * (+ Y)^2} *Σ [((CFt/ (1 + Y)t * t* (1 + t)]

Where,

- CF = Cash Inflow

- P = Price of the Bond

- Y = Yield to Maturity

- t = number of periods

- T = Time to Maturity

3. Economic Value of Equity (EVE)

The Economic Value of Equity (EVE) and Net Economic Value (NEV) models are used to evaluate a company's long-term interest rate risk by calculating the net present value of its assets, liabilities, and off-balance-sheet cash flows.

Through stress testing, these models reflect the influence of changes in interest rates on future cash flows.

Note

EVE and NEV fully show a company's vulnerability to interest rate swings. They aid in quantifying the possible impact of changes in interest rates on the institution's overall financial status.

These models enable institutions to evaluate their vulnerabilities and adopt required risk-mitigation steps by stress-testing alternative interest rate scenarios. However, it is critical to understand the limits of the EVE and NEV models.

One constraint is the difficulty in estimating cash flows for financial instruments that do not have a fixed maturity date. Uncertainty over the duration and cash flows put uncertainty into the models.

Furthermore, these models may not correctly value embedded options or represent the intricacies of more sophisticated financial instruments.

Note

Despite the limitations, the EVE and NEV models are nevertheless useful for controlling interest rate risk. They provide a framework for institutions to analyze and plan for shifting interest rate environments.

Institutions can protect their financial stability in the face of interest rate volatility by examining the net present value of their assets, liabilities, and off-balance-sheet cash flows.

Managing Fixed Income Interest Rate Risk

For investment managers, determining and documenting their return targets and risk tolerance is a critical first step in controlling interest rate risk. Each agency will have a different risk tolerance depending on its unique circumstances and objectives.

Investment managers may design a suitable investment plan that strikes a balance between safety, liquidity, and yield by establishing an acceptable risk threshold.

Investment managers must evaluate the possible impact of interest rate risk, develop an investment strategy, and design their portfolios accordingly.

Note

To safeguard the principle, maintain liquidity, and generate an acceptable rate of return, they prioritize taking on a suitable degree of risk exposure.

The process of managing a passive portfolio is creating a portfolio that is measured against a defined benchmark. The benchmark might be based on reaching the return of a given index or amassing enough money to cover any liabilities.

In passive management, interest rate risk is controlled by either keeping assets until they mature and then reinvesting the proceeds to preserve the appropriate risk profile or by regularly rebalancing the portfolio to do so.

Contrarily, active portfolio management allows the portfolio manager to decide whether to buy or sell assets based on strategies meant to boost portfolio performance.

Active management calls for meticulous research and decision-making to take advantage of market possibilities.

Investment managers must carefully choose a portfolio structure that fits their chosen strategy and satisfies the agency's safety and liquidity standards, regardless of their chosen management technique.

The choice of the best portfolio structure is essential for efficient risk management since different structures may be more or less efficient depending on the yield curve environment and cash flow requirements.

Note

Controlling interest rate risk necessitates a methodical strategy that considers market conditions, risk tolerance, and investment objectives into account.

Investment managers may successfully handle interest rate swings and maximize portfolio performance by employing a well-defined investment strategy and suitable portfolio structures.

or Want to Sign up with your social account?