FX Carry Trade

A strategy where a trader or investor borrows funds from a nation with a low-yielding currency to fund an investment in a nation with a high-yielding currency.

What Is FX Carry Trade?

An FX carry trade is a strategy where a trader or investor borrows funds from a nation with a low-yielding currency to fund an investment in a nation with a high-yielding currency.

A trader using this strategy attempts to capture the difference between the rates, which can often be substantial, depending on the amount of leverage used.

Currency carry trades entail borrowing a low-yielding currency and utilizing it to purchase a higher-yielding currency to profit from interest rate differentials and to profit from daily interest payments in addition to any currency appreciation from the actual trade.

Carry trades may appear to be an alluring opportunity to profit from your forex trading activities and significant interest rate differentials between currencies. Still, you should be aware that they also entail a considerable risk of loss.

For example, if an investor wants to profit from a British Pound investment, he can borrow money in a low-interest currency, such as the Japanese Yen. The investor would earn the difference in the interest rate. The Yen is the funding currency, while the Pound is the target currency.

Investors will get the yield differential in the absence of changes in the level of the exchange rate. To spread out the risk, creating an index or portfolio of carry transactions is typical.

Key Takeaways

- A carry trade’s primary driver is the interest rate differential between the two currencies involved. Traders borrow in a low-interest-rate currency and invest in a higher-yielding currency to earn the interest rate spread.

- Carry trades are typically executed using currency pairs where one currency has a significantly higher interest rate than the other.

- While carry trades can yield profits from interest rate differentials, they are not risk-free. Exchange rate fluctuations can offset interest rate gains, leading to potential losses. Increased volatility or sudden changes in market sentiment can amplify these risks.

- The performance of carry trades can vary over time. Historical data can provide insights into how different currency pairs and interest rate differentials have performed in the past.

Understanding FX Carry Trade

According to the financial dictionary, an asset's "carry" is the profit realized from keeping it. Therefore, a carry trade is purchasing a currency and "carrying" it until a profit is realized.

The purpose of FX carry trades is to profit from the difference in interest rates between two currencies

- Carry trading is the process of borrowing money at a low interest rate and investing it in a currency or financial instrument with a higher rate of return.

- Carry trades are only suitable for wealthy investors due to the dangers involved.

- Accepting a credit card with a 0% cash advance rate to invest the borrowed funds in securities with a greater yield is an excellent illustration of a carry trade. You may or may not make money using this carry-trade method.

Here’s an example: An investor borrows Japanese Yen and invests it in Australian Dollars. Because of its extremely low-interest rate, the Japanese Yen is regarded as the financing currency, whereas the Australian Dollar is seen as the target currency due to its high-interest rate.

The idea is that "cheap money" is borrowed, converted into another currency, and then lent at a higher interest rate. The carry trade can offer a significant income yield because most forex traders use leverage, and the trader then profits from the cash flows.

But there are dangers involved in this. The primary goal of the carry trade is to lend a currency with a higher interest rate while borrowing one with a lower interest rate.

This results in a positive cash flow. Any due interest is paid to the trader for as long as the position remains open. The carry trade can be implemented in many ways. One can use currency forwards, bank deposits, local currency sovereign bonds, or local currency corporate bonds.

Here’s another example: An investor would borrow Japanese yen from a bank at an interest rate of, say, 0.5%. They would then buy a US 10-year Treasury bond in US dollars, paying 5% interest.

The investor stood to make 4.5 percent from the interest rate differential, but always with the underlying risk that the currency exchange rate could go against the investment

Factors Affecting FX Carry Trade

Carry trades are influenced by a combination of factors, and traders must consider several elements when implementing and managing carry trade strategies.

Here are some key factors that affect carry trades:

- Changes in interest rates: The main factor of the carry trade is the interest rate differential between the two currencies. Even if the exchange rate remains the same, the trader will profit from overnight interest payments. But sometimes central banks change the rate, and it shows a potential risk to the carry trade.

- Exchange rate appreciation/depreciation: This factor focuses on the FX rate between the two currencies. If the target currency appreciates, traders go long, and when this happens, the payoff includes the daily interest payment. The trader can lose when the target currency depreciates against the funding currency.

- Risk tolerance: Carry trades expose traders to significant risk because they frequently involve borrowing low-yielding currencies and investing in higher-yielding ones. When determining whether to engage in carry trading, risk tolerance is a key consideration.

Pros and Cons of FX Carry Trade

With the right risk management and timely entry and exit in the market, FX carry trade can reap huge returns. Carry trading has its advantages and its disadvantages. Here’s a list of the pros:

- A great approach that will result in interest profit is placing transactions to benefit from carrying interest.

- Leverage is beneficial since it enables you to trade a lot of different assets. Daily carry trade interest is dependent on the leveraged amount, which results in profit.

- The ongoing fluctuations in the foreign exchange market exacerbate the dangers associated with carry trading. It could lead to higher profits or lead to higher risk

Here’s a list of cons:

- If a trader fails to hedge even tiny swings properly, the massive leverage used in carry trades could result in significant losses.

- Carry trades can be tailored to various risk tolerances and investment horizons. Traders can choose different currency pairs and time frames to suit their preferences.

- Holding positions overnight incurs rolling costs, which can reduce profits. These costs are associated with the interest rate differential between the two currencies and can eat into gains if the trade is not profitable.

Risks Associated with an FX Carry Trade

Traders can make huge profits from carry trades because of their high-risk factors. Risk management is important to manage the risk in your portfolio and ensure that none of the trades are exposed to risk because of market activity.

When the global financial crisis erupted, most of the G20 countries were forced to lower interest rates. Traders and investors started seeking riskier assets, safe havens, and high-yielding emerging markets to manage their losses. This is why risk management is crucial.

Market mood and risk tolerance have an impact on carry trades. Traders may unwind carry trades during periods of elevated risk aversion, which increases demand for the financing currency and decreases demand for the target currency.

It's vital to remember that carry trades include risks and that the market environment is subject to quick changes. To correctly manage risk, traders should perform extensive research, keep up with pertinent developments, and be ready to change or exit positions as necessary.

Additionally, spreading risk across different currency pairs in a carry trade portfolio can aid in lowering exposure to the swings of any one currency.

The dangers present are that traders who are long on the pair will see the trade move against them if the target currency weakens against the funding currency, but they will still receive daily interest.

The positive net interest rate will be lower, and the profitability of the FX carry trade is expected to decrease if the target currency's home nation lowers interest rates while the home country of the funding currency raises interest rates.

Trading Strategies Based on FX Carry Trade

This is one of the most popular fundamentally based FX trading strategies. Both small and large individual traders and major companies like investment funds use it.

Buying the currency with the highest interest rate and selling the one with the lowest interest rate is the basic tenet of carry trade strategies.

Such a strategy generates profits based on the difference in interest rates (used for overnight positions).

It is important to remember that this strategy should only be employed in normal situations and never during a worldwide economic crisis.

The main features of this system are the following:

- Potential for long-term profit

- It offers two sources of profit

- It works only in stable global economic conditions

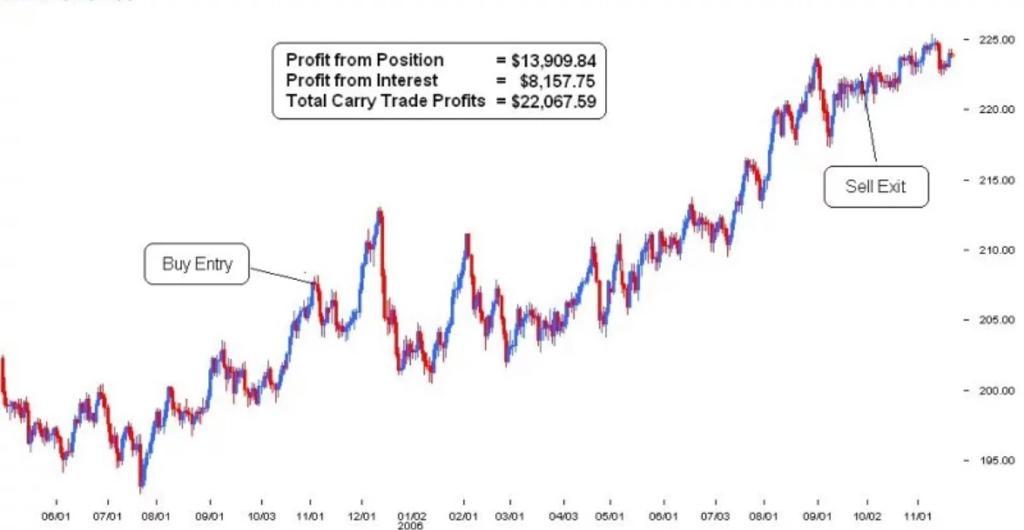

The following image shows an example of a typical case where the carry trade strategy could have been used with the best results.

This chart shows continuous price growth in the GBP/JPY currency pair from 2005 to 2006, which was caused, among other factors, by specialized carry traders who entered long positions to profit from the positive spread in interest rates between GBP and JPY.

Choose a suitable pair like AUD/JPY, NZD/USD, and more. It depends on the interest rate differential.

Paying attention to economic indicators and staying informed on geopolitical events and other global factors are important because they can have huge impacts on the currency markets.

Carry trading also works in options. The interest rate difference trade and the deterioration of the time value of selling an option may be combined. However, selling options requires planning and knowledge of what will happen to your position upon expiration if you are assigned.

In the event of an assignment, you want to be in a carry trade, which is when you are both a buyer of the carry currency and a seller of the funding currency. Sell a Put on the AUD/JPY and AUD/CAD pairs, for instance, or a Call on the EUR/TRY pair. You will then only need to select the maturity and strike price.

How Did The Global Financial Crisis Affect Carry Trades?

Carry transactions were significantly impacted by the Global Financial Crisis as a result of risk aversion, heightened volatility, changes in central bank policy, and a flight to safety that caused carry trades to unwind and negative exchange rate moves.

During this time, many traders experienced losses, emphasizing the significance of risk management and a grasp of market dynamics when carrying out carry trading.

In response to the crisis, central banks worldwide cut interest rates and launched various monetary stimulus programs. This impacted the interest rate differences that fuel carry trades.

Central banks frequently lowered interest rates, narrowing interest rate differentials and decreasing carry trades' profitability.

US Treasuries and gold were sought after as safe-haven assets by investors. Carry traders found it more difficult to profit from carry trades due to the strengthening of the USD and JPY as a result of this change in capital flows.

Interest rates in the US have dropped to all-time lows as the US dollar continues to lose value.

As a result, the US dollar has now become the base currency for carry trade, with outflows of US dollars into higher-yielding bonds overseas, as investors look for carry trade yield differentials with currencies such as the Chinese yuan.

The reason here is that this is one currency that the Chinese directly manipulate, and therefore, considered to be undervalued were it ever to become a free-floating currency

Why FX Carry Is An Anomaly

Robust FX presents an awkward conflict between theory and practice carry returns.

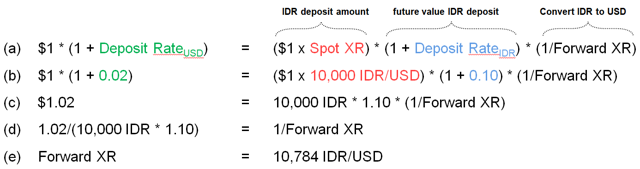

The interest rate parity (IRP) no-arbitrage idea explains why. IRP illustrates the connection between the USD deposit rate, IDR deposit rate, present IDR/USD exchange rate, and future IDR/USD exchange rate using the IDR/USD currency pair from the case study.

We'll look at IRP from 3 angles:

1. IRP Insight

Depositing $1 for a year at 2% yield results in $1.02; After converting $1 to Indian Rupiah (Symbol IDR), a deposit of 10,000 IDR for a year earning 10% results in 11,000 IDR. Then:

11,000 IDR should equal $1.02 in 1 year according to the predicted IDR/USD exchange rate.

Why? Otherwise, by favoring one deposit currency over the other, we may gain a risk-free profit (barring a government or bank default).

2. Mathematical Formulation of Interest Rate Parity

The future value of the USD deposit should be equal to the future value of the IDR deposit when the IDR deposit has been converted back to USD. The mathematical relationship between the deposit rates and the initial exchange rate yields the forward exchange rate (or "Forward XR").

One of the $5.3 trillion in currencies exchanged every day is the Forward XR, a tradable security also known as a currency forward (source: Bank of International Settlements). Although there are opportunities for currencies of emerging market nations, forwards are priced using this interest rate parity framework.

The heart of this financial oddity is right here. The IDR should fall from 10,000 to 10,784 (enough to offset the IDR deposit's 8% yield advantage), according to interest rate parity. However, full convergence to this forward rate typically does not occur over the long term.

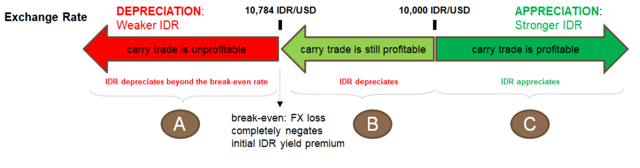

3. Graphical Description of Interest Rate Parity

- A: IDR depreciates more than anticipated by interest rate parity. Spot FX movement creates FX loss that is greater than the positive carry.

- B: IDR depreciates, moving in the direction implied by interest rate parity. Spot FX movement creates FX loss, but not enough to obliterate the positive carry.

- C: IDR appreciates, moving in the opposite direction implied by interest rate parity. Spot FX movement creates FX gain, adding to the positive carry.

The dark green and light green zones are where the spot exchange rate settles more frequently than the red zone. Why is the "break-even" conversion rate 10,784 IDR/USD?

The 11,000 IDR principal plus interest would be converted into $1.02 if the spot exchange rate ended at 10,784 IDR/USD at the end of a year (11,000/10,784 = 1.02). This amount of money earns the same rate of interest as a 2% USD deposit yield.

As a result, the 10,784 IDR/USD exchange rate generates a total return that makes you unsure whether to deposit in USD or IDR.

Conclusion

The FX carry trade is a popular and extensively utilized foreign exchange trading strategy that capitalizes on interest rate differentials between two currencies. To capitalize on the difference in interest rates, money is borrowed in a low-yielding currency and invested in a high-yielding one.

The FX carry trade includes significant dangers, such as variations in interest rates and currency rates, despite its potential for profit. Traders must be knowledgeable about the currencies involved, keep an eye on risk, and carefully assess market conditions.

Staying abreast of geopolitical and economic changes that could affect trade is also crucial. All things considered, if utilized thoughtfully and responsibly, the FX carry trade can be a valuable strategy in a trader's toolkit with proper risk management.

But it's critical to be mindful of the possibility of unanticipated market shocks and to remain alert in making position adjustments when the market conditions shift. Finally, when handled carefully and while carefully taking into account market circumstances, the FX carry trade can be a useful instrument in a diversified investing portfolio.

or Want to Sign up with your social account?