Sovereign Bond

It is a debt instrument issued by the organization for government needs.

A sovereign bond is a debt instrument issued by the organization governing an economy to raise funds to finance government programs, debts, interest payments on current debt, or any other government needs.

These bonds are denominated either in a foreign currency or a domestic currency. They are a source of finance for the government alongside tax revenue.

Most developing economies prefer issuing foreign currency-denominated government bonds over domestic currency-denominated sovereign bonds considering the bondholders' level of risk, especially in less stable economies' domestic currencies.

Also known as Government Bonds, like any other bond, a sovereign bond entitles owners to periodic interest payments from the issuer. In this case, the government and the bond's face value repayment when it matures.

As with other bonds, the yield or interest rate paid depends on the risk profile of the issuer. The interest rate charged depends on three factors:

-

The creditworthiness of the government,

-

Potential risks to the economy, and

-

The exchange rates.

In the case of government bonds, the yield will be higher for economies generally seen as having a higher risk of default. As a result, these countries tend to issue bonds in denominations of other countries with stronger economies.

Investors consider the country's economic profile and exchange rate to estimate the likelihood of defaulting on sovereign debt obligations.

The bond's ratings are associated with its creditworthiness. Rating agencies, including Moody's, Standard & Poor's (S&P), and Fitch Ratings, provide credit ratings for investors seeking to invest in these bonds.

They also provide credit ratings on corporations and corporate debt securities.

Although these bonds are often discounted because of the default risk, less stable economies issue their bonds with high-interest rates due to a perceived high risk of default.

History

In 1517, the Dutch Republic became the first to finance its debt through bonds. At that time, The average interest rate fluctuated around 20%.

In late 1671, King Charles II of England was preparing to wage another war against the Dutch, then continental Europe's financial and commercial center. So the monarch called in the major goldsmith bankers of the day and asked them for a massive loan.

However, these influential and wealthy bankers refused to give him a shilling. Instead, strutting with their financial muscles, the bankers claimed they had extended the king enough credit via the collateralized treasury orders (CTOs) they held.

This could be described as one of the earliest forms of long-term government bonds.

The Bank of England issued the first official government bond issued by a national government in 1694 to raise funds to fund a war against France. The form of these bonds was both annuity and lottery.

William III of England, who founded England's war operations by imitating the strategy of issuing bonds and generating government debt from the Seven Dutch Provinces, where he reigned as a Stadtholder, introduced the Government and Bank of England bonds in England.

Later, European governments also started following the trend and issuing perpetual bonds to fund their wars and another government spending.

During the American Revolution, the United States government started issuing bonds (they were called loan certificates) to raise money. The total amount generated by bonds (loan certificates) was $27 million and helped finance the war.

Investing in Sovereign Bonds

Bonds can be a means of preserving capital along with earning a predictable return.

An investment here provides steady streams of income from interest payments.

The interest from a municipal bond generally is exempt from federal income tax and may be exempt from state taxes and local taxes for residents in the states where the bond is issued.

Investing in U.S. foreign bonds is relatively straightforward and can be done through TreasuryDirect.gov. Buying foreign bonds is a bit more challenging and is done via a broker through an account for foreign trading.

The broker would buy the bond at the prevailing market price. However, depending on what bonds are available, this route can be limiting, and transaction costs could be high.

An alternative is to buy mutual funds or exchange-traded funds(ETFs) that hold foreign sovereign bonds. A diversified ETF typically holds several bonds at various maturities and provides a more stable investment than an individual government bond.

In addition, these funds provide diversification with exposure to foreign bonds, which may mitigate investment risk.

Some of the popular sovereign bond ETFs include

- Franklin Liberty International Aggregate Bond ETF (FLIA)

- SPDR Bloomberg International Treasury Bond ETF (BWX)

- iShares International Treasury Bond ETF (IGOV)

Sovereign Bond Denominations

The currency of these bonds depends on the status of the economy. They can be subdivided into:

1. In Developed Economies

Countries with developed economies account for the most significant portion of the issuance of bonds in international capital markets.

Therefore, the debt securities are primarily denominated in the most popular currencies for trading, which includes the U.S. Dollar, Euro, British Pound, Japanese Yen, Canadian Dollar, and Swiss Franc.

The currencies mentioned combined account for most of the debt issuance.

2. In Developing Economies

Developing economies do not issue debt denominated in their home currency due to difficulty issuing government bonds. Instead, these economies need to assume foreign-currency debt.

Several reasons explain why most emerging markets and developing economies cannot issue a sovereign bond in their currency. First, the political framework in most developing economies wanes investor confidence because of its vulnerability to corruption.

The government's ineffectiveness and lack of discipline increase the chances of external debts and government investments being utilized in unnecessary projects.

Such countries suffer from economic instability, leading to high inflation rates, which absorb the investors' real rates of return.

International agencies, such as the World Bank and the International Monetary Fund (IMF), may also be determinants of external lending to developing countries. Such complimentary lending programs can seal approval, catalyze private capital flows, and reassure investors.

Even so, these developing countries are forced to obtain debts in foreign currencies, subjecting them to a perilous economic situation by exposing the devaluation of currencies that may drive up their borrowing costs.

For example, the Pakistani government issues bonds denominated in U.S. Dollars to raise capital. In addition, the Pakistani government agrees to a nominal annual interest rate of 5%.

Throughout the bonds' term, the Pakistani rupee depreciates by 10% annually versus the Dollar. As a result of this depreciation, the real interest rate on the Dollar-denominated debt to the Pakistani government is 15% in rupee terms.

Risks Associated

These Bonds also attract risk, like any other bond. Here are a few ways to measure a bond's risk:

1. Currency Risk

This type of risk arises when the home currency of the bondholders is higher than the bond currency denominated following a currency devaluation.

Exchange rate fluctuation is the primary source of currency risk. Therefore, any bond offered in foreign currency with a history of volatility may not be good for investment, even if the debt instrument provides a high-interest rate.

Investors prefer investing in bonds that have a good history of volatility.

2. Credit Risk

This type of risk is realized when the government chooses to default on bonds. On the other hand, a bond issued in local currency is risk-free because the government may opt to pump additional currency if it decides.

Check for the credit rating. An AAA-rated bond is considered the best, while anything below a BBB rating is terrible.

These bonds are subject to interest risk. The interest rates on the bonds and the bond prices are inversely proportional. An increase in interest rate leads to a fall in bond price and vice versa.

Investors must decide whether the potential gains from coupons outweigh the opportunity loss before investing in a particular bond.

This type of risk comes from the overtime decline of the value held by a sovereign bond. As a result, investors expect a certain level of inflation, but inflation risk arises when inflation is higher than expected.

If the country's sovereign bond coupon does not meet the inflation numbers, try diversifying in international markets. Developing markets often give higher coupons since they are hungry for capital.

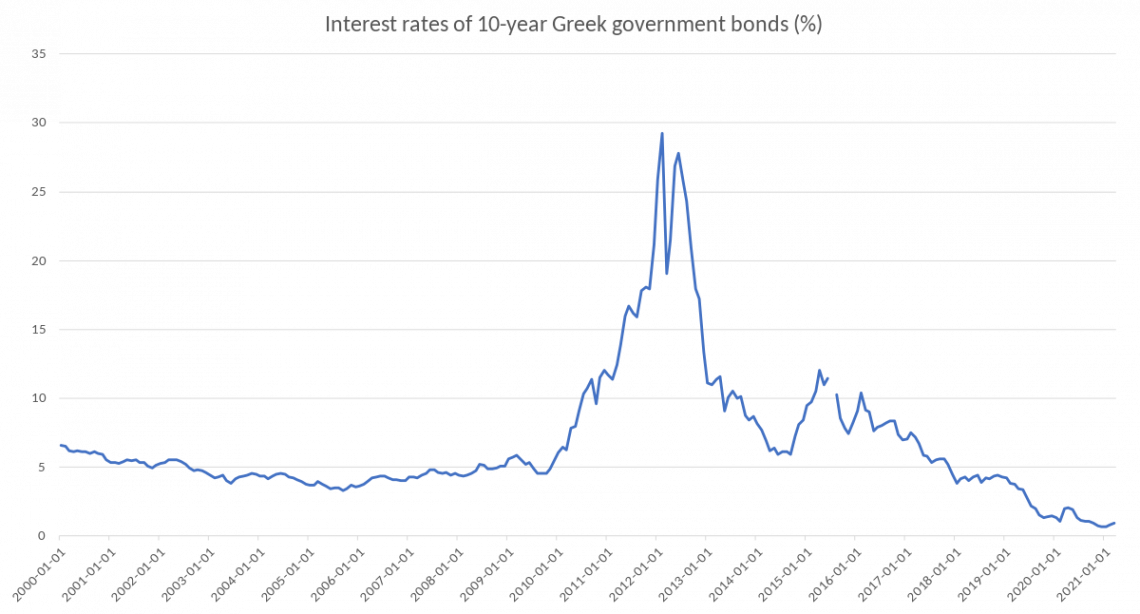

Greek Sovereign Debt Crisis

Greece's economy suffered from high debt levels, leading to the Greek debt crisis, which had a ripple effect across the European Union.

International confidence in Greece's ability to repay sovereign debt dropped, forcing the country to adopt strict austerity measures. As a result, Greece received two rounds of bailouts under the express demand that the government adopts more austerity measures and financial reforms.

At one point, Greece's debt was moved to junk status. As part of the loan agreements, countries receiving the bailout funds were required to meet the austerity measures designed to slow down the growth of public-sector debt.

The European sovereign debt crisis was when several European countries experienced the collapse of their financial institutions, rapidly rising bond yield spreads in government securities and high government debt.

The crisis began in 2008 with the collapse of the banking system in Iceland and spread to Portugal, Greece, Italy, Ireland, and Spain in 2009. The crisis led to a loss of confidence in European businesses and economies.

European countries' financial guarantees feared the euro's collapse, and the International Monetary Fund (IMF) eventually controlled the crisis. As a result, rating agencies downgraded several Eurozone countries' debts.

U.S. and U.K. Sovereign Bond Market

The United States of America and the United Kingdom are two of the biggest sovereign bond markets in the world. So let us look at these two of the biggest issuers in the world.

1. The United States

The United States Treasury offered several types of bonds. Certain bonds pay interest; others do not. These bonds could be

-

Savings bonds: These bonds are considered one of the safest investments.

-

Treasury notes (T-notes):

These bonds provide fixed coupon payments every six months with a face value of $1,000.the maturity of these bonds is two, three, five, or ten years.

-

Treasury bonds (T-bonds or long bonds) come with the longest maturity, from twenty to thirty years. They also have a coupon payment every six months.

-

Treasury Inflation-Protected Securities (TIPS):

These bonds are the inflation-indexed bond issued by the United States Treasury. The principal amount is adjusted to the Consumer Price Index. In other words, the principal amount increases with inflation and decreases with deflation.

The argument for investors to hold U.S. government bonds is that these bonds are exempt from state and local taxes.

These bonds are sold through an auction by the government. The bonds are bought and sold on the secondary market, the same financial market where financial instruments such as stocks, options, and futures are traded.

2. The United Kingdom

In the U.K., government bonds are called gilts. The newer issues are called "Treasury Gilt," and Older issues have names such as "Treasury Stock."

Inflation-indexed gilts are called Index-linked gilts implying that the value of the Inflation-indexed gilts rises with inflation. They are fixed-interest securities issued by the British government to raise money.

The Debt Management Office manages the issuance of gilts, an executive agency of the H.M. Treasury. Before April 1998, gilts were issued by the Bank of England. Computershare manages purchase and sales services.

The gilts have maturities stretching further into the future than other European government bonds. As a result, they influenced the development of pension and life insurance markets in their respective countries.

A conventional gilt might look like "Treasury stock 3% 2020". On the 27 of April 2019, the U.K. 10Y Government Bond had a 1.145% yield. The Central Bank Rate is 0.10%, and the A.A. United Kingdom rating, according to Standard & Poor's (S&P).

- The national government of an economy issues this bond to raise funds for financing government programs like debts and interest payments on current debt.

- Depending on the bondholder's risk, these bonds can be dominated in local or foreign currency.

- A diversified ETF typically holds several bonds at various maturities and provides a more stable investment than individual government bonds.

- Developing economies have difficulty issuing these bonds in their local currencies because of a weak political framework that lowers investor confidence.

- Developed economies issue them in their local currency.

- Riskier sovereign borrowers, those with a developing economy or higher political risk, tend to denominate these bonds in the currencies of stable economies.

- A simpler alternative is to buy mutual funds or exchange-traded funds(ETFs) that hold foreign sovereign bonds.

- The United States of America and the United Kingdom are two of the biggest government bond markets in the world.

or Want to Sign up with your social account?