Coolest exit you've seen?

For all the IB vets out there, what's the coolest/most unique exit opportunity you've seen a peer or colleague pursue? How'd it worked out for them? Did they start the next SpaceX or get elected to Congress or something?

For all the IB vets out there, what's the coolest/most unique exit opportunity you've seen a peer or colleague pursue? How'd it worked out for them? Did they start the next SpaceX or get elected to Congress or something?

| +4,039 | Bank of America - Juniors Strike to start Monday May 6th | 437 | 2s | |

| +855 | BOFA ALREADY TRYING TO COVER UP THEIR TRACKS | 79 | 1d | |

| +608 | This is a dark day for Wall Street. | 46 | 16h | |

| +463 | BofA Associate Death - WSJ, FT, CNBC, Bloomberg | 53 | 19m | |

| +195 | How to strike without being fired. | 23 | 3s | |

| +194 | Analyst at Bofa FIG-Thoughts | 30 | 9m | |

| +171 | Big Layoff at Barclays - 5/1/24 | 88 | 1d | |

| +167 | Hey WSJ, BBG, CNBC, FT, it's been more than 72 hours that this BofA IBD Associate was reported dead | 23 | 14h | |

| +154 | BofA List | 37 | 13h | |

| +144 | Reporters, please post your info in this thread for visibility so people can easily reach out. | 4 | 5h |

Career Resources

following

Heard about this VP at a BB that worked on a deal with a big media company and quickly became their CFO which is pretty cool. Also have heard about Netflix M&A.

This happens quite a bit LMM or a least I have seen it enough in my tenure to say this happens more than I expected.

It happens in lending too. Some clients offer to hire the lenders/analysts they work with.

The guy who created dudewipes works at DB i think haha

analyst in my group left during his second year to join the navy seals

That's so sick

What?how?

deal team --> seal team

I'm here for this exit

Navy Deals (Shipping fund) --> Navy Seals

Financial Sponsors group at a BB?

Friend’s older brother worked at a BB for like 8 months and then went back to play soccer. Played USL for a few seasons and is on an MLS roster now. He played soccer in college though.

I think you would get paid more at the BB than in the MLS.

You would probably get paid more at Tobin than playing pro soccer in the US lol. I guess you do it for the love of the game.

Girl in my team left to create her own brand of designer bags, she now sells at harrods. Thought it was quite unique and she does very well.

That's amazing! Literally my dream job. Idk if I'll ever have the courage to leave IB (I just started) or any other "good" job to start from scratch and do something on my own. Do you know more about her background, how she started her line and how it's doing now. Also is she based in NY? Would love to know!

Don’t know more than that - she was few analyst classes above me (believe around 2012~) but the team head told me about her as he had met her few days days before our discussion in Harvey Nichols (luxury department store in London). She is London based apparently and worked in London.

Guy I know went to play professional football as a QB, then did UMM PE, then had another stint in one of the minor league football team, and went to an EB.

Just google Steve Bannon

While not easy to get elected, this is not impressive to me. If you've met and spent time with any members of Congress, particularly Reps in the House, you'll know what I mean. They may know little about a multitude of topics, but lack depth and intellect.

Excuse me, have you heard of Alexandria ocasio Cortez. Take this back

It's embarrassing that bimbo came from my school...

Ayyyyy! Yaaaaas!! I can not wait until she becomes POTUS!

.

Lyin' Ted isn't even the smartest one in his own house

Lmao dude stfu

Following

Rick Rescorla went from being a paratrooper in the British Army, to a detective in the Rhodesian police, to a captain in the London Metropolitan Police, to a captain in the US Army, served in Vietnam, earned a Purple Heart, went to law school, and then joined Morgan Stanley.

Sounds like Rick Rescorla fucks

.

You forgot to mention that he died during the 9/11 attacks, but only after evacuating nearly 3,000 Morgan Stanley employees. He actually anticipated the attacks and had put comprehensive procedures in place that ended up saving many, many lives. A true American hero.

Nice

.

Andrew Friedman was an analyst at Bear Stearns from 1999–2002, and then was an associate at MidMark Capital from 2002-04. He met the owner of the Tampa Bay Rays in 03, and dude hired Friedman as Director of Baseball Development just cause they had similar ideas about the game. Then, he became GM in 05 at 28, and in 2014 was hired as President of Baseball Operations for LA Dodgers. Pretty sick if you ask me

HSBC trader to football director: https://www.yorkshirepost.co.uk/news/manhattan-football-management-ex-i…;

Look up Maurizio Sarri

Used to work for Montepaschi as a banker

If I end up getting this role at Brazzers I'll have to revisit this thread

This probably doesn't count as an exit, but I found a guy on Reddit who got fired and went to do standup comedy. He did a bit about it too if anybody wants to watch it

A short-lived career in ops

UBS TMT IB

Ed Woodward, JPM IB to CEO of Manchester United after advising the Glazer family's acquisition

look how he's doing now

Yeah he’s bottled that one pretty hard...ManU heading towards mid-table...

Most bankers make (a) shit managers and (b) shit operators...both vital skillsets for managing a club

Aged well

jeff bezos left banking and made more money than god

Bezos never worked in banking. He held a technical role at DE Shaw, a quant hedge fund.

He worked at Banker's Trust from 1988-1990

https://en.wikipedia.org/wiki/Jeff_Bezos#Early_career

Oxford PPE -> GS IBD -> HF -> marrying a Billionaire’s daughter -> GSB MBA -> HF -> Politician -> Chancellor of the Exchequer -> Prime Minister (?)

https://en.wikipedia.org/wiki/Rishi_Sunak

His political views are retarded but I would vote for him purely out of respect

Not just any hedge fund but TCI as well...

For a split second I read "executioner". That would make for quite an exit

Lincoln College gang

Apparently after working at GS from 2001-2004 he then made partner at TCI in Sep 2006. How is that timeline possible? He made partner within 5 years of graduating Oxford???

Maybe they inflate titles like VC firms and wasn't a partner in the traditional sense.

“Like all the investment team, Mr Sunak was a partner at TCI. He was, however, among the most junior analysts at the firm, said individuals familiar with the fund.”

https://amp.ft.com/content/da662f74-5a25-11ea-a528-dd0f971febbc

out of interest, what don't you like about his political views?

Have seen some people exit into roles for sports teams or entertainment companies. Seems pretty sick.

Roles for sports teams as in like corp strat / dev or are you referring to something else?

Yeah like corp strat. Or a strat/investments role at a company that owns sports teams, like Kraft Group or MSG

Ed Woodward worked for JP Morgan in the mergers and acquisitions department as an investment banker. In 2005, Woodward advised Malcolm Glazer and the Glazer family during its successful takeover of Manchester United. The Glazer family then recruited Woodward to join the club in a "financial planning" role. In 2020 Ed Woodward is now the executive vice chairman of Manchester United. God tier level exit!

On a side note losing 6-1 to Tottenham LOL

You forgot to mention that he’s a scrub #WoodwardOut

Saw someone who did BB IB for 2 years then ran his own independent sell-side M&A process ($20mm TEV), probably collected around half a million in fees from that deal all for himself. Jumped back into IB as a senior associate after a year.

Why would you collect great fees on your own to then go back to IB and work for someone?

probably didnt collect great fees

Pulled a "Michael Scott Paper Company" and got paid to come back and stop undercutting their clients lmaoo

Family friend did 3 years at a BB a2a then exited into a NFL/NBA strategic/economic role. Not at a team, but helping to run the actual league. Super sick.

Were they in media/CNR/etc. banking that was semi-relevant, or did they just jump from P&U to the MLB?

not even related at all. super sick.

How did they swing this? Was that a goal of theirs or strategic opportunity pop up?

Analyst left for a corp dev role at a startup and got promoted to head of corp dev in 1.5 years. Just got taken public via SPAC and he made $50MM on his 1.5 points of equity at 25

$50MM?? Really....

That’s unreal

Phuck me. I hate banking. Phuck models and vdrs and PowerPoint. Phuck everything. Why am I doing this.

Don't buy that for a second. What $3B+ company has a 25 year old head of corp dev.

Some 28 year old was CEO of burger king

The luck is real

knew a guy that went

BB (MS,GS) ----> PMC (Academi, Multi National United). Never heard back from him after he went to South Africa. Hopefully he's still alive

An A->A promote who went to CAA as a Sports Agent.

Is this common? Did he have to do anything specific to get himself prepared considering he didn’t have a law degree? Or was it on the finance side

Any former analysts who became doctors or lawyers?

this thread is called "coolest exits"

hahahaha

I used to be a premed and I couldn’t agree more with this comment

Merchant Banking -> CFO of Matt Stone and Trey Parker's production company. Feel like that would be a fun job.

The guy that signs our money worked at Goldman. Pretty cool exit gig if you ask me.

America's sweetheart, Paige Jennings

hahaha best exit ever. I actually went to school with her...

Marine Biologist

Shaun Atwood had a pretty sick exit from stock brokerage in the 90's. Not sure I'd go the same route but I would definitely be enticed by the opportunity to say the least.

too many to explain in detail, to be honest.

here a few brief examples

1) ex colleague who was a contractor at a bank at standard daily rates left to do a stealth startup. After a few short years the company is among the best known startups in the entire nation. they had really intense growth after they launched.

2) a friend left after his IBD years even though he had a promotion waiting. He founded a chain of car dealerships while bootstrapping the whole thing. After a decade he now owns 15, I believe, and also planning on expanding to electric vehicle servicing.

3) few years after I joined IBD an analyst literally flew through the ranks and got promoted way faster than others due to skills, IQ/EQ, deals,... he was a director at.. 28 or so. BB.

4) A family friend has a 2nd level CxO title in NYC within AM. Has been in that role for about a year now. So got to that level around 38 years of age. which is impressive. afaik he reports into the CEOs direct line.

Malcolm Turnbull went from partner at Goldman —> Prime Minister of Australia.

Almost a downgrade really

anyone see any ibd thots exit to onlyfans?

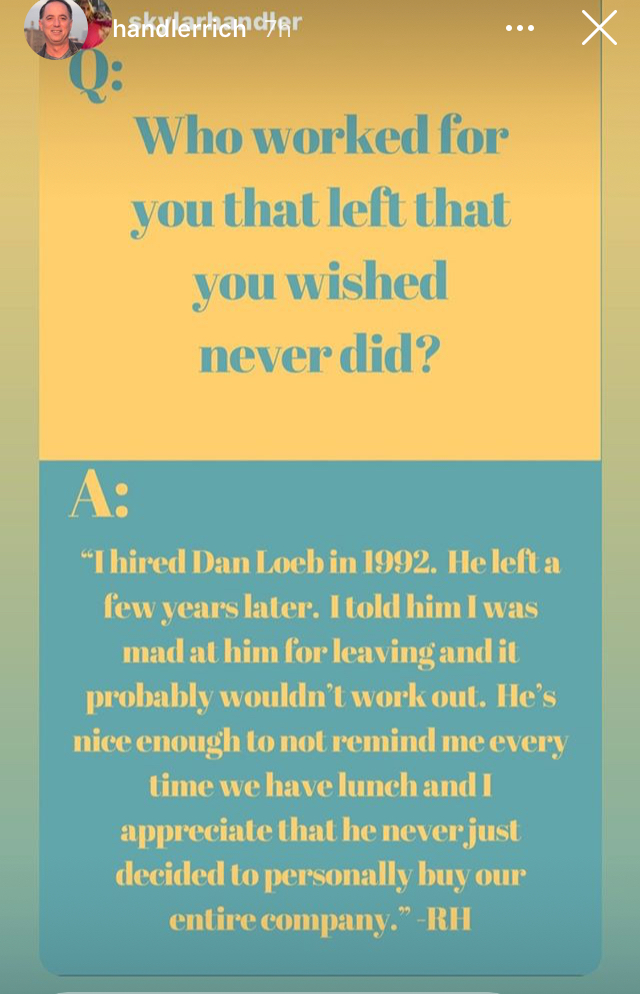

Jefferies > Third Point

Emmanuel Macron

Not bankers but these two guys (one lawyer, one former NFL player) founded a company called Game Plan and they do IB and Consulting for pro sports transactions: Celtics, Warriors, etc. that would be a dream job for me.

Officiis nihil ut ut doloribus officia officia maiores. Ipsam aut velit sit earum totam. Mollitia omnis omnis rerum cumque qui.

Non non id voluptates eum enim aut et. Necessitatibus sed quos delectus doloribus a.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Ex occaecati ducimus in laboriosam libero earum a. Voluptatem optio porro aut molestiae. Voluptate fugit in ut et nobis corrupti recusandae. Est facilis qui corrupti maiores qui.

Et est in qui fugiat autem. Atque ut recusandae saepe id repellat deserunt. Numquam rem minima asperiores at temporibus sit quis. Voluptates et ipsam odit aliquid perferendis minima. Nulla qui quisquam aut dignissimos possimus. Sed quas et ut.

Qui rerum molestiae beatae impedit. Quis qui nihil deserunt excepturi illo consequuntur maiores. Corporis rem culpa sunt est. Facere aut non eos impedit.

Voluptatibus perferendis porro id eum in culpa. Veritatis sed est enim veniam delectus. Corrupti quisquam sit enim sed ullam. Sed magni quis et sequi iste.

Rerum qui ea exercitationem ut sequi asperiores est. Vel aperiam impedit enim quia. Voluptates sapiente quaerat consequatur beatae repellat.

Tempora deleniti enim illo quasi quis aut quia voluptatum. Impedit et aut voluptas non. Voluptas vitae architecto sunt quia neque enim. Autem voluptas in voluptatum quasi earum. Magni laborum earum asperiores impedit atque.

Ea rerum fugiat et quo corporis. Facilis labore repudiandae facilis quia consequatur. Accusantium autem vel illo minus quisquam. Minus beatae sit est laudantium nam. Ratione sequi ducimus suscipit eveniet commodi quasi eum.

Voluptates molestias quia et sed fugit quos dolore. Repellendus itaque consequuntur aut enim ipsam. Eveniet officia voluptas qui eos. Mollitia perspiciatis eveniet debitis non et sit sit.

Est et eum voluptatem sit hic. Cumque ex itaque voluptatem voluptatem qui cum. Perferendis sed odit corporis. Voluptas voluptas deserunt sit suscipit. Cum magnam distinctio occaecati qui.

Cupiditate sed consequatur ullam ipsam ut. Quia quia ut aliquam et et. Nesciunt id voluptatem quis suscipit. Aut pariatur fugit exercitationem iure. Accusantium veniam tempore similique. Quasi vel iste nisi reprehenderit ex.

Ratione aspernatur et eligendi autem ducimus repellat. Molestiae dignissimos reprehenderit veritatis voluptatibus.

Tenetur dolor quaerat sit veniam eos. Deleniti vel fuga blanditiis eaque laboriosam officiis.

Incidunt commodi eum architecto eum. Ut itaque ut itaque ut qui voluptate. Sunt temporibus quod quasi dolores rerum qui. Nobis suscipit iste officiis corrupti laudantium optio qui.

Vel expedita dolorem fuga. Architecto rerum earum distinctio doloremque molestiae maxime amet.