Alpha

One of the stock market's most common technical analysis ratios

What Is Alpha?

Alpha is one of the stock market's most common technical analysis ratios. It is denoted by the Greek letter (α). It depicts a stock's absolute value at which its performance deviates from a benchmark index value.

It is one of five standard performance ratios commonly used to evaluate stocks or an investment portfolio. The other four ratios are:

It is used in conjunction with Beta (β), which measures the broad market's overall volatility or risk, known as systematic market risk.

This greek letter in the stock market is widely used to track the active returns generated by an investment, along with the stock's degree of volatility.

The yield generated due to aggressive fund management by fund managers tends to be higher or lower than the benchmark index values, and the difference between these represents the alpha value of a fund.

For example, an actively managed investment generates a 15% return, whereas the benchmark index value during the same period yields returns of 10%.

Consequently, α stocks can be calculated as 5% (15% – 10%), indicating a fund's excess returns over its corresponding index value.

A positive α of (+5) means that the portfolio’s return exceeded the benchmark index’s performance by 5%.

A negative α (-5) indicates that the portfolio underperformed the benchmark index by 5%. In contrast, an α of (0) means that the investment earned a return that matches the overall market return, as reflected by the benchmark index.

On the other hand, Beta can be earned through passive index investing.

α is also often referred to as “abnormal rate of return” or “excess return,” which refers to the idea that markets are efficient, so there is no way to earn returns that exceed the broad market systematically. α was created to compare active investments with index investing.

Key Takeaways

- Alpha (α) measures how a stock's performance differs from a benchmark index.

- Alpha is one of five key ratios, along with Beta, Standard Deviation, R-squared, and Sharpe ratio.

- Alpha assesses returns exceeding benchmark values due to aggressive fund management.

- Positive alpha indicates portfolio outperformance, while negative alpha signifies underperformance.

- Used together, alpha and beta help analyze, compare, and evaluate investment returns and performance.

Origin of Alpha

A belief in efficient markets led to the creation of market capitalization-weighted index funds seeking to replicate the performance of the entire market in the weights that each of the equity securities comprises in the overall market.

The best examples for the US are the Wilshire 5000 and the S&P 500, which represent the largest 5000 securities and the 500 most widely held equities, accounting for approximately 99%+ and 80%+ of the total market capitalization of the US market as a whole.

To many investors, this phenomenon created a new standard of performance. An investment manager should avoid losing clients' money instead of making a certain amount.

However, an investment manager should make more money than the passive investing strategy, i.e., investing in everything equally (as this strategy appeared statistically more likely to be successful than any one investment manager).

The name assigned for the additional return above the expected return of the beta-adjusted return of the market is called "α."

The concept of α originated with the introduction of weighted index funds, which attempted to replicate the entire market performance and assign a weight to each investment area.

The development of an investing strategy created a new standard of performance.

Investors began to hire portfolio managers of actively traded funds to generate returns that exceeded what investors could make by investing in a passive index fund.

Alpha vs. Beta

Alpha and Beta are two distinct parts of an equation. They are collectively used to define the performance of stocks and investment funds.

On the one hand, α is the excess return on an investment after adjusting the market-related volatility and random fluctuations; on the other hand, Beta is a measure of volatility compared to a benchmark, such as the S&P 500.

α and Beta are used together by investment managers to:

- Calculate

- Compare

- Analyze returns

Investors can use α and Beta to evaluate an investment manager's performance.

If the investment manager has high α and high Beta, investors might have to withdraw their money from their investment when it is doing poorly.

Although investing in each stock appeared to perform better than 80% of investment managers, the stock market price fluctuated and could be bearish for years before returning to its previous price.

The passive strategy appeared to generate a market-beating return over 10 years or more. But, for example, this strategy may be risky for those who feel they might need to withdraw their money before a 10-year holding period.

Thus, investment managers who employ a less likely strategy to lose money in a particular year are often chosen by those who feel the need to withdraw their money sooner.

These concepts apply not only to investment professionals but to any investment.

Seeking Investment Alpha

This measures the performance of an investment with a market index or benchmark that is considered to express the market's movement as a whole. The investment's α is the excess return of an investment compared to the return of a benchmark index.

It is also commonly used to rank mutual funds and other investments. It is represented as a single number (like +2.0 or -3.0). This refers to a percentage measuring how the portfolio or fund performed compared to a benchmark index (i.e., 2% better or 3% worse).

A deeper analysis of α may also include "Jensen’s alpha." It considers the capital asset pricing model and consists of a risk-adjusted component in its calculation.

Beta or beta coefficient is used in the CAPM, which calculates the expected return on an asset based on its Beta and the expected market returns.

The investing universe offers:

- A broad range of securities

- Investment products

- Advisory options for investors to consider

Different market cycles also influence the α of investments across various asset classes. This is the reason why risk-return metrics are important to consider in conjunction with it.

Jensen’s Alpha

This measures the risk associated with market-linked security. The yield on an investment is compared to the interest accrued on the principal amount of investments made in a risk-free non-market linked asset (e.g., Waxed deposit).

The beta value of an index is considered while calculating it as it accounts for the stock's relative volatility concerning a benchmark index. It rejects an absolute yield accrued over time, based on which individuals can choose to invest in a stock.

Jensen’s Alpha = Actual realized return – [beta value x (index return – risk free rate of return) + risk free rate of return]

Jensen’s Alpha can be demonstrated with the help of an example. Suppose the ABC fund generated a return of 10%, while the corresponding index yield was 5% during the same period. Furthermore, the beta value of the stock was reported to be 2.5, while the risk-free return rate stood at 3%.

Hence, α can be calculated as:

Jensen’s α = 0.10 – [2.5 x (0.05 – 0.03) + 0.03] = 0.02

= 2%

Hence, the risk-adjusted rate of return is 2%, while an active rate of return (standard α) is 5%.

Importance of Alpha

Alpha, a measure of an investment's performance on a risk-adjusted basis, goes beyond mere profit and loss, encapsulating the unique value or skill that a portfolio manager adds (or fails to add) to a fund.

It is one of five significant risk management indicators for:

- Stocks

- Mutual funds

- Bonds

The concept of α became more popular with the advent of smart beta index funds tied to indexes like the Wilshire 5000 Total Market Index and the Standard & Poor's 500 indexes. These funds attempted to enhance the performance of a portfolio that tracks a targeted market subset.

A stock's α represents the monetary value a fund manager adds to a portfolio. Due to an economic boom and the consequent market upswing, high returns are generated by most stocks of companies, leading to high index points.

During such times, small-cap and mid-cap companies tend to outperform the market, thereby earning returns higher than the blue-chip companies.

Portfolio managers have an aggressive investment strategy and a positive α value. Therefore, the excess returns percentage over the market rates generated can be attributed to the tactics of portfolio managers.

Conversely, negative α values reflect the poor performance of a particular fund even though generating a positive yield through an investment strategy due to inefficient fund allocation.

As beta risk can be isolated by diversifying and hedging various risks (which come with varied transaction costs), some individuals have proposed that α does not exist but represents the compensation for taking some un-hedged risk that had not been identified or was overlooked.

Limitations of Alpha

It contradicts the efficient market hypothesis, as it seeks to generate returns inconsistent with market performance.

Statistics suggest that a fund generating a relatively higher yield is unlikely to do so later, as share prices fluctuate in sync with their performance and adjust accordingly to reflect their real value.

To overcome this, investors often use smart Beta as an alternative technical analysis tool to incorporate passive investment strategies.

α works best when applied to stock market investments (rather than investments in other asset classes).

Secondly, if it is used as a fund comparison tool, it is best applied in evaluating similar funds – for example, two large-cap value mutual funds, rather than comparing a small-cap growth fund with a mid-cap growth fund.

Another consideration is choosing a benchmark index.

Generally, α values are calculated using the benchmark of a particular sector, as it measures a company's performance compared to other competitors. It also helps portfolio managers design a portfolio comprising various stocks to maximize the risk-return ratio.

The value of α is calculated and compared to a benchmark deemed appropriate for the portfolio. Therefore, investors should select a relevant benchmark. The most frequently used is the S&P 500 index.

Capital Assets Pricing Model (CAPM)

Alpha is a primary component in the capital asset pricing model (CAPM), developed to measure the risk involved with an investment and its profitability.

The Capital Assets Pricing Model calculates the amount of return an investor needs to realize to compensate for a level of risk.

Any stock market investment has inherent systematic risk due to the reasons like business cycle and socio-economic scenario.

The exposure of a security to the market has to be assessed in line with the returns generated to minimize losses due to uncertain fluctuations.

The CAPM is based on the principle that an investor should only assume a higher risk if the returns compensate for it.

α implements this principle and is subsequently used by portfolio managers in assessing the estimated returns to generate higher profits than the average stock market yield.

The CAPM formula is expressed as follows:

r = Rf + beta (Rm – Rf) + α

The calculation subtracts the risk-free rate from the expected rate and weighs it with a beta factor to get the risk premium. Then the risk premium is added to the risk-free rate of return to get the rate of return an investor expects as compensation for the risk.

Therefore,

α = R – Rf – beta (Rm-Rf)

Where:

-

R: is the portfolio return

-

Rm: is the market return per a benchmark

-

Rf: is the risk-free rate of return

-

Beta: is the systematic risk of a portfolio

Examples of Alpha

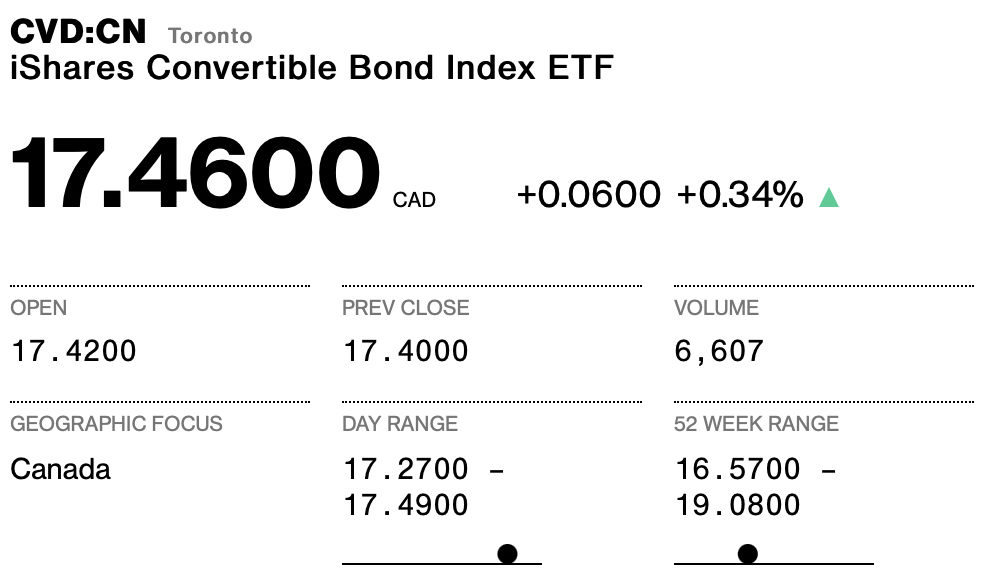

This is illustrated with the following examples for a fixed income ETF and an equity ETF:

iShares Convertible Bond ETF (ICVT) is a low-risk fixed-income investment. It tracks a customized index - the Bloomberg U.S. Convertible Cash Pay Bond > $250MM Index.

As of Feb. 28, 2022, the 3-year standard deviation was 18.94%, and the year-to-date return was -6.67%.

Bloomberg U.S. Convertible Cash Pay Bond > $250MM Index had a return of -13.17% during the same period.

Therefore, the α for iShares Convertible Bond ETF was -0.12% compared to the Bloomberg U.S. Aggregate Index.

Since the aggregate bond index is used instead of the Bloomberg Convertible index as the benchmark for ICVT, this α may not be as large as initially thought. It may be misattributed since convertible bonds are far riskier profiles than plain vanilla bonds.

WisdomTree U.S. Quality Dividend Growth Fund (DGRW) is an equity investment with a higher market risk that invests in dividend growth equities.

It tracks a customized index called the WisdomTree U.S. Quality Dividend Growth Index.

The 3-year standard deviation was 10.58%, higher than ICVT.

As of Feb. 28, 2022, DGRW's annualized return was 18.1%, which was also higher than the S&P 500 at 16.4%. It had an α of 1.7%.

S&P 500 index may not be the benchmark for this ETF since dividend-paying growth stocks are a particular subset of the overall stock market and may not even be inclusive of the 500 most valuable stocks in the US.

Conclusion

It is called the “holy grail” of investing and receives much attention from investors and advisors alike, and one should consider a couple of important considerations when using it.

1. The basic calculation of α subtracts the total return of an investment from a comparable benchmark in its asset category

This α calculation is primarily used against a comparable asset category benchmark, as noted in the above examples.

Therefore, it does not compare the outperformance of an equity Exchange Traded Fund (ETF) versus a benchmark. This α is used best when comparing the performance of similar asset investments.

Thus, the α of the fixed income ETF, ICVT, is not relatively comparable to the α of the equity ETF, DGRW.

2. Some references to α refer to a more advanced technique

Jensen’s α considers CAPM theory and risk-adjusted measures by utilizing the risk-free rate and Beta.

α can be calculated using various index benchmarks within an asset class. However, in some instances, there might not be a relevant pre-existing index, where financial advisors use algorithms and models to simulate an index for α calculation.

α also refers to the abnormal return rate on a security or portfolio more than what would be predicted by an equilibrium model like the Capital Assets Pricing Model (CAPM). A CAPM model aims to estimate returns for investors at various points along an efficient frontier.

A CAPM analysis might estimate that a portfolio should make a return of 10% based on the portfolio’s risk profile. If the portfolio earns 12%, the portfolio's α would be 2.0, or +2%, over what was predicted in the CAPM model.

Researched and authored by Rohan Kumar Singh | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?