LO Comp (Fidelity, Wellington, Capital, TRowe)

For more established LOs, how does an analyst comp look like for firms like Fidelity, Wellington, and Capital for someone with 2+2 years of industry experience? And how does it look like maybe 4-5 years down the road after joining the firms? Love to hear examples splitting comp into base + bonus in a typical year.

Based on the most helpful WSO content, compensation at large, established long-only asset management firms (LOs) like Fidelity, Wellington, and Capital can vary widely depending on the firm, the role, and the individual's performance. However, the context provided doesn't give specific numbers for these firms. Generally, for someone with around 4 years of industry experience, you might expect:

After 4-5 years at the firm, if the individual has performed well and taken on more responsibility, both base and bonus can increase substantially. Senior analysts might see their compensation structured more heavily towards bonuses, reflecting their impact on the fund's performance.

For a more detailed breakdown, you might want to look at specific threads on WSO discussing compensation at these firms, as users often share their experiences and insights. Remember, these figures can fluctuate based on market conditions, individual performance, and the overall success of the firm.

Sources: Q&A: Emerging markets investment analyst, What has been your total compensation progression in your career?, Credit Analyst Q&A, What banker careers really look like: real private data, Ask CompBanker

Don’t work at one but heard top LO comp is either at or slightly below sell side ER up until senior/PM level (and starts to surpass sellside thereafter). Main caveat being it’s exponentially harder to progress and move up at the LOs to realize the comp premium (most are 2-4 year up or out programs with top MBA requirements)

This is bad information. At top LOs, if you make analyst, which is a post MBA role, it is pretty hard TO get pushed out. Those seats are highly selective, but if you make it in and perform decently well, you have a high chance of being able to stick around for at least 10-15 years. Getting promoted to PM is not a sure thing at all, but the alternative is some folks stay as analysts their whole careers, which offers an extremely attractive comp/WLB ratio. Can’t comment on sellside ER comp with much certainty, but I would be very surprised if you were making 700/800k with 6-10 years of experience in sellside ER, which is what you’d make as a good analyst at one of these top LOs with the same amount of experience (scaling up to ~$1.5M as a later career analyst with 15+ YOE)

Regarding the SS ER comment, 600k+ is not uncommon after 5 years in biotech. Most I know with 5+ YOE are clearing that. Biotech is a bit of an outlier, however.

Also, for OP, you’re going to have to get a top MBA to break into an analyst seat at one of these firms. 2+2 industry experience is almost certainly not going to cut it. They want to see a top MBA after that

Completely false information

350-400k is a fair benchmark after 2+2+M7

However, what people fail to realize above who are quoting 1.5ml and such stats is that these are backwards-looking and do not reflect the future of this industry. Yes, those with the legacy seats will continue to hold that level of comp BUT that is not the future. Couple reasons why:

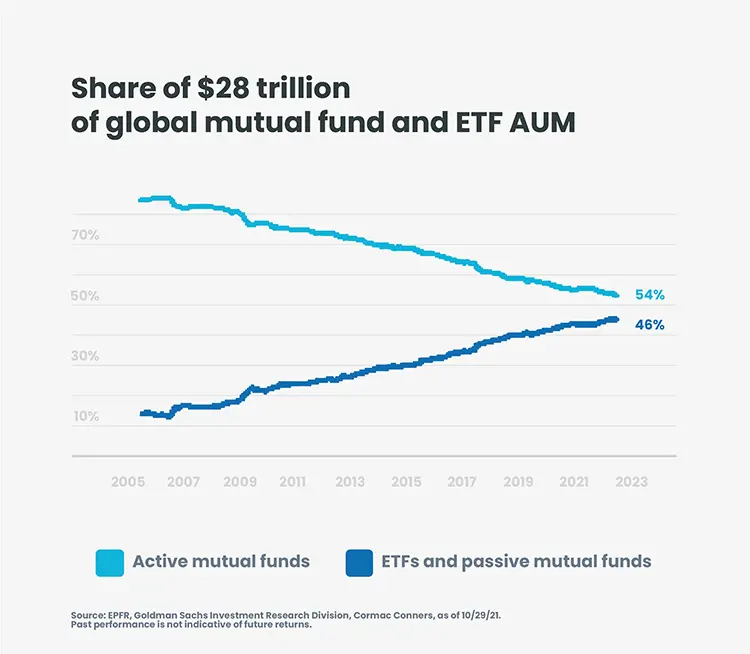

- Passive now has ~50% share of global equities. If you think about what % of domestic funds actually outperform benchmarks over a market cycle, it's less than 15% (on a global basis my guess is it's closer to 20-25%). That means active share will shrink by over HALF. There was an article recently about how T. Rowe has basically seen no net inflows in the past decade, AUM growth was all dependent on market growth

- Fee pressures add another dimension. The days of 100bps are gone, there are a few legacy accounts with this but otherwise new accounts to top managers like T. Rowe are coming in at 30bps. We saw a 2bps S&P fund released by State Street (vs. 5bps as the lowest cost vehicle for such a product before that, so effectively a 60% cut in fees). I would not at all be surprised if in a few years new accounts came in at 20-25bps

Putting together a 50-60% cut in active share and at least 20-30% fee pressure, the likelihood of new sr. analysts in 5yrs making 1.5ml are very low at these large top AMs. My guess is that new figure will be closer to 800k-1ml. And many of these sr. analysts will likely get fired given the underperformance along the way

This is all before even taking into account AI and the potential productivity gains that enables -- to be fair, that could translate into # of seats declining in a big way BUT with the comp of surviving folks staying flat because of cost savings. So it's good if you're a survivor but otherwise not a great situation. Even 7-8yrs ago a Sr. PM gave me the advice that -- given all of the headwinds at the time (passive + fee pressures) -- if I wanted to pursue this profession to be REALLY, REALLY sure that this was the only thing I wanted to do. People have a habit of lazily extrapolating the past into the future but given accelerating changes (mostly to the negative in this space) don't be blinded by current comp nbs from legacy seats and think more about what things might look like 10yrs from today as that's what matters for your career

I have to admit I feel quite out lol, but all of the above are true. People have told me these things, but I think overall this is a somewhat pessimistic take.

Is it likely that the industry will have headwinds: Yes. Is it totally doom and gloom: I don't think so. That said, I think there's a good concluding point here that I myself have been told and really need to think about myself.

*quite called out

I would just mention a few other points. I never considered this in UG but now I wish I did -- the issues with a declining industry vs. a growing one is:

1) moving around is a LOT harder between shops

2) your geographic flexibility goes way down

I never thought I'd care about these but once you get a little older, you realize what things matter to you. As I've gotten older, I've realized I really do want to be close to my friends and family but in my home city (T2 for LO) there just aren't that many shops / seats. If you're SF/NYC you have nothing to worry about. If you are anywhere else, your option pool drops in a big way (even in T2 hubs like Boston) given there aren't many seats and they don't open up often. It's something that really does matter to your quality of life.

I'm not trying to sound all gloom and doom, but the fact is the posters above -- while good intentioned -- are painting an overly rosy picture of the future, I'm just tempering it with reality. To be clear, the survivors will do well (what's the difference between 1ml and 1.5ml honestly). But the # of seats will come down and comp will come down, this is not the promised land that people seem to think. I wish it was because then I wouldn't think twice about my career decisions but alas, we are where we are

Thoughts on how this translates to Fixed Income side of the world?

I don't know fixed income well enough to comment with the same level of depth. All I can say is I'd avoid the investment grade-side as much as possible and focus more on HY where there are more inefficiencies. I did hear a stat that the avg bond fund manger outperforms passive (certainly not true in equities) so that's a big positive. Otherwise I'd talk to folks who have more expertise in FI

I feel like this is the consensus view on the industry and while it "feels" right, the numbers do not actually support it. T Rowe's AUM, for example, has grown from ~$100B in 2000 to $1.4T today. That's a 14x increase versus a 50%(?) decrease in fees*. Certainly, middle-office/back-office/tech/staff had to have increased as well to support the growth in assets, but I doubt that this increase was large enough to have a meaningful impact on investor payout. In other words, LOs have only partially shared the improvement in economics (resulting from AUM boost) with their client base.

While net inflows have been flat/slightly negative for the major players, they have been able to attract enough assets to be able to grow with the market without shrinking the base. Does a 8-9%/year market-driven growth in AUM - not paired with a commensurate decline in fees - really justify the overly negative consensus view that people tend to have on the industry?

* Approximation, easy to check given that TROW is public.

By your math, let's say active share is cut in half over 10 years (meaning 75% of assets are passively managed). Let's say fees are compressed by 25% as well. This means the fee pool as a whole is down to 37.5% of what it was before. But then let's say AUM compounds at 8% over 10 years. This means our fee pool is only down 20%.

Plus factor in

- In the past, passive has taken 10ppt share every 5 years, so a 25ppt share increase for passive should take more like 12.5 yrs

- As passive takes more share, the % of active firms that outperform should increase, causing passive share gains to decelerate

- Active firms should also become more efficient with back-office expenses, leaving more of the fee pool for analysts/PM's

I think pay shouldn't move too much, but these seats will become less attractive relative to faster growing asset classes.

.

I like your math on this - I think more realistic is that it will take at least 15 years to reach 75% passive. Chart below shows progress is linear and in fact it’s more likely decelerate as passive grows >50%. 15 year decline to 25% of active share and 8% market growth means fees can compress ~35% in that time and you still don’t lose any fee pool. 35% is is in line with average fee compression seen over past 5 years (US equity funds down 7% from 2017 to 2021).

Net, outlook is not a bleak as everyone is saying and fee pool will likely be the same or marginally below once you factor in inflation

Dying industry, all assets are going to passive and industry will consolidate down to a few firms like BlackRovk and Vanguard.

It will never reach a point where all assets will go towards passive strategies. That would lead to the market becoming super inefficient and eventually collapsing. There will always be a need for people to use their brains and come up with fair valuations for assets. But of course I agree, the tendency will be that people will not be willing to pay 1% p.a. to underperform the market via active funds anymore, leading to a big margin compression and continued inflow into passive vehicles. They will never reach 100% though.

That’s what the mm pods are for though. Don’t need LO to fill the price discovery role.

Does anyone have a good framework for forecasting the long-term equilibrium between active and passive?

Or in other words, when this chart levels out?

Yeah this is the key question. Will be interesting to see if there are any signs of deceleration going forward

Or acceleration? I'm not sure which path it will take but I'd be open to considering both as a possibility. A linear projection of the past into the future can be dangerous

Search Grossman-Stiglitz paradox and all the related papers, these are the first guys that wrote about this. IIRC, essentially the more noisy the market (as in new information that needs to be priced in) the more there is a need for active traders vs passive/noise traders and vice versa, which makes sense intuitively.

The paper I recall is a typical highly theoretical economic paper with toy examples to illustrate some basic phenomenon but I am sure some people have tried applying the framework to real data to see what comes up.

You should take what I say with a grain of salt because I certainly can't predict the future. But what I have observed over my career is that....the people who have had the most successful careers are the ones who joined industries that were growing and had those industry tailwinds behind their backs as they grew in their careers.

It doesn't mean that you can't be successful if you join an industry that is not growing -- it's just a lot harder. For example, when we look back 20 years from now on the HF industry, the people who will absolutely kill it are the ones who are at a MM right now in their early 30s as a PM or late 20s as a senior analyst. These people are all in the right place at the right time and have stacked the odds in their favor to get "lucky". Maybe a MMPM is able to put up a few good years and then gets poached with a life altering guarantee. Maybe a PM seat opens up for a senior analyst that otherwise wouldn't have if capital wasn't pouring into MMs right now. These people all still need to hit it out of the park, but these opportunities exist because the MM industry is growing. In contrast, I can't say the same for SMs, where I am at. It's not that you can't carve out a great career at a SM, but the days of spinning out and starting your own small SM HF is almost non-existent.

The reason I bring all of this up is because I don't think people, particularly those who are early in their careers, fully appreciate how important it is to position themselves to be "lucky" in their careers.

I think the issue with this fact pattern is that you are likely to time the top of the cycle by crowding into the career path after its secular tailwinds are appreciated by the masses. The best time to join PE was in the 2000s when everybody wanted to join a Value HF. Best time to join IB was in the 1990s when everybody wanted to be in Tech. Best time to join a MM was in 2020 when everybody wanted to be at a Tech SM. The people who make money at the peak are in their prime earning years with 5-10 years of experience in the sector during the big run up.

Excellent point.

This has been mentioned multiple times, but how are you meant to know which industries are growing? Seems like a lot of finance in general is in decline.

Ignore my title, I work in publics (newer to the industry), but I have always disagreed with this view. We work in a cyclical industry and I don't know how people that work in the industry don't understand seasonality.

The best time to join Tech PE wasn't in 2017 or 2018, it was in 2008 and 2009 and deal activity was at it's all time lowest. Now all of the large PE firms have shifted their focus to PC, which is now the fastest growing asset class, but will eventually run it's course as well.

The best time to join a MM was in 2020, when everyone was shitting on the thought of working at P72 or Citadel and SMs were the only way. Fast forward to 2024 and Bill Hwang blew up, D1 suffered major losses, and Tiger can't even convince IR teams to stay.

Once again, this will ebb and flow like every single finance careers. There will be a point were MMs will be out of favor and the cubs will be back on top and PE will be more favorable than PC.

My personal opinion is the career decisions should be made on what you're good at, not what is hot at the time. Just because an industry is growing doesn't mean you'll keep your seat when there are great times.

I am of the assumption that the shift to MMs and passive makes it the best time to shift to LO AM as the growth in passive and the short term nature of MMs will create market inefficiencies that LOs directly search for and take advantage. If passive is approaching 50% + whatever market share MMs have, this will cause fundamentals to break down and only have the short-term priced in, hence the creation of opportunities for LOs.

Other posters have provided current comp numbers that are close enough to being correct. The notion that comp is headed south for the top firms listed by the OP is unlikely to be true. If you diligence the mega LOs as you would a 20-year career bet, this should be evident. The average job/comp industry-wide is a different story. If anyone has an offer for career analyst at one of these firms, I’d be happy to DM. I wouldn’t casually throw away this opportunity because of the common rhetoric on this site. This industry is both facing numerous headwinds and supported by a powerful underlying growth engine as it is levered to nominal equity appreciation.

I’d venture to guess that the posters on this site who talk about comp heading lower are either (i) not working at the >$1T AUM managers, which are not positioned nearly as well, or (ii) if at the massive LOs, are not above the line to post-MBA / partner track.

These firms have ballooned revenue and compensation for investment professionals to the tune of MSD-DD CAGRs over a 15-year period in which market returns were in-line with long-term rates throughout history, passive took ~50% share, and fees compressed. Ask yourself how has that happened? What do you expect to change going forward? What do you expect industry-wide, and what do you expect for these firms? Break apart the drivers and model it out.

If you are a $100B manager still trying to charge 100bps without net outperformance, this is a bad bet. If you are at one of the >$1T managers charging an average 40bps with >50% of funds outperforming net of fees over 5- and 10-year periods, it's a different story. These firms have billion dollar+ budgets for investment professional comp that will continue to grow unless we see decades+ of no nominal market growth (unlikely throughout history), these firms shift from share gainers to losers within actives (unlikely, scale advantages continue to compound), or passive accelerates to 90% of AUM in a decade (unlikely, industry losing 2-3pts per year and second derivative has already improved). Even in reasonable downside scenarios, comp should stay relatively flat for the mega LOs.

There are maybe a handful of these seats open per year, so it's not a reasonable goal for most individuals anymore. But if you love the markets, are talented, and have the opportunity to join, do the proper diligence before writing this off based on input from those in a different situation.

No better seat in the industry than partner track role at Wellington, Capital and D&C. Gray Fox posted in another thread that partners (non-PM) make MSD $M. The figures I’ve heard are consistent. T Rowe and Fidelity are much lower due to ownership structure. Whether the top firms grow or contract (on nominal $ basis), the starting point is so compelling that it almost doesn’t matter - billions of dollars going to a group of partners, with no individual at the top keeping all the economics. It would be a huge mistake to turn down one of those three for a run of the mill HF job.

Fidelity is in line with that comp for equivalent titles

So is T. Rowe. All the top top LOs similar no matter private/public unless super senior level.

Reprehenderit ratione consequatur reiciendis et. At numquam tempore libero id dolor. Repudiandae ut et in modi. Dolore culpa tempore consequatur est. Alias eaque doloribus accusamus. Porro similique consequatur officiis non magni. Ut necessitatibus rem omnis quia dolores.

Et culpa consectetur sit qui. Et minima veniam officiis neque sed aperiam. Iure deleniti quas consectetur vel dolorem quas soluta et. Assumenda nostrum aperiam eos nostrum consectetur.

Magnam dolores ducimus distinctio veniam doloremque reiciendis odit. Voluptatum explicabo maiores quia quam recusandae. Veniam quasi mollitia aut. Occaecati harum culpa nobis incidunt omnis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Possimus quis eveniet laboriosam. Dicta deserunt minus commodi et et eos voluptas. Laudantium similique sed voluptatum esse non alias. Est quia repudiandae odit aut. Quidem accusantium esse tempora non ipsum. Aut error adipisci est in aliquam voluptatem quas.

Sit atque et excepturi quia fuga sit. Non provident quasi voluptatibus rerum. Sequi possimus odio consequatur aspernatur fuga et. Atque iusto explicabo ipsum. Et vitae eligendi est tempore. Sint sint officia voluptas sunt mollitia. Nam error aut unde eum autem a.