|

Oprah’s Job Market Continues

Headline: “Stocks fall on US economy performing better than expected.” That pretty much sums up Friday’s decline.

What’s old is new again. For a minute there (more like for the month of January), it seemed that bad news was bad news again, and good news was good news.

This was not the case following Friday’s jobs report, which showed that nearly 3x more Americans started a new job than expected.

Guesstimates for the month pegged non-farm payroll additions at 187k. Turns out that January actually gave us roughly 517k more jobs, bringing the unemployment rate to 3.4%, a low not seen since a few months before the moon landing (May 1969).

Now, the unemployment rate posting a low not seen since your grandparents were tripping on acid at Woodstock sounds like a good thing, right? Well, apparently not, at least according to Mr. Market.

It’s the same old story we’ve been hearing for months. Higher non-farm payroll additions indicate that the job market isn’t nearly as tight as JPow wants it to be, suggesting demand for labor still far outstrips supply. In theory, this imbalance leads to wage-push inflation, necessitating further rate hikes.

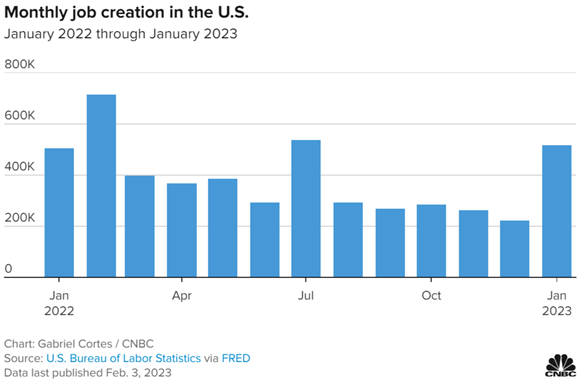

The new problem, however, is this is a sharp reversal of the trend we thought was occurring. Look at the chart below. From February to December, monthly payroll additions were pretty much chilling on a steady downtrend, with a few obvious exceptions.

That’s not supposed to happen. Job growth and falling inflation pair about as nicely as Skittles and red wine. Both are great, but you’re not supposed to have them together.

Whether this is a fluke or an early sign of inflation following in the footsteps of Big Sean by deciding to Bounce Back, we can’t know for sure until the next CPI report, dropping on Feb 14th. Yes, that also happens to be Valentine’s Day, meaning you’ll have the chance to ruin both your love and financial life on the very same day!

January’s report also showed an increase in the labor participation rate to 62.4%, something the Fed has been waiting on for a while. On the other hand, wages continued to storm higher, gaining 4.4% for the year (beating expectations) and 0.3% for the month (in-line).

One piece or set of data isn’t gonna tell you anything on its own, but this jobs report does suggest a reversal in the recent disinflation narrative, hence stocks throwing up on Friday. Still, the yield curve is pricing in rate cuts in the latter half of 2023, while CME gives a rate increase in late March with about 83% likelihood.

One last thing to point out: Look at the above chart again. All of those trend reversals in job additions occurred in months when the market was starting to rebound (July, October, and now January). Despite all those tech layoffs, it seems like employers said, “yo, our stock is higher,” or “yo, my portfolio is higher, can we hire more people?”

As usual, I don’t have any answers for you. I’m just here to point sh*t out. The only thing that’s clear is that while in physics, a “theory” is something like gravity or evolution, in economics, it’s more like the Tooth Fairy and Santa Claus.

|

Molestiae quos in sed. Et delectus maiores iste quia laudantium labore ex. Veritatis eaque vitae explicabo. Quo et hic voluptas et.

Qui nobis quae ex deserunt veniam. Aperiam aliquam similique non sapiente. Illo voluptatem nisi aperiam dolore harum corrupti adipisci. Qui dolorem sit facere. Et non molestiae delectus non animi laborum.

Consequatur nobis fuga sit laborum. Id fugit ut consequatur ab omnis cumque hic.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...