2014 WSO Rankings for Investment Banks: Career (Part 2 of 10)

Not all investment banks are created equal. Some of them will leave you with no exit opportunities, work you to the bone and then leave you out to dry. After all that work, you may still be a long shot to get into a good MBA program... The other end of the spectrum are investment banks that launch your career, help you prosper and pave the way to the coveted land of milk & honey (the buyside and/or one of the MBA business schools<br /> ">M7 MBA programs). What if you have two internship offers and you're not sure which one to take? We thought ranking the banks based on the % of interns receiving full time offers would also be helpful. Without further ado...

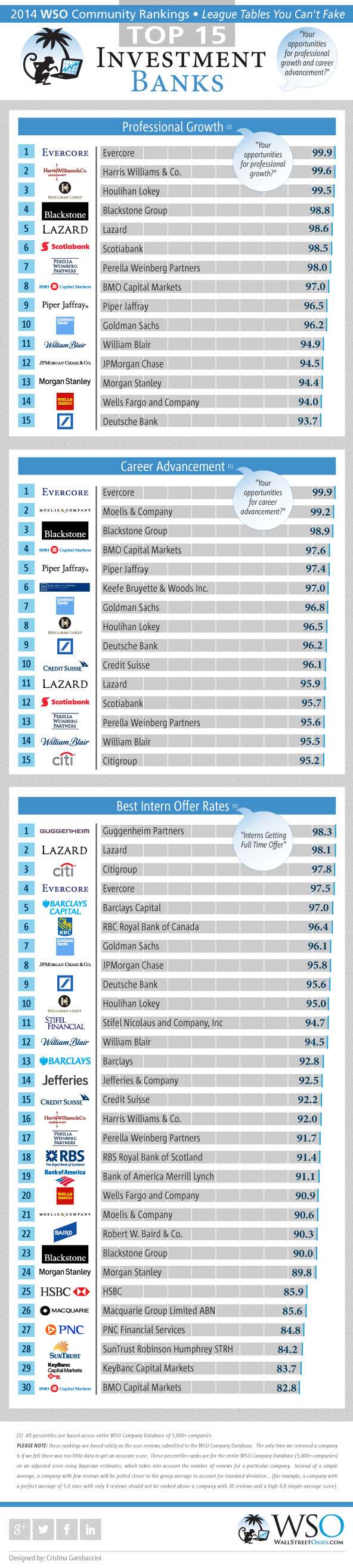

Below you will find the following rankings:

1. Top 15 Investment Banks for PROFESSIONAL GROWTH

2. Top 15 Investment Banks for CAREER OPPORTUNITIES

3. Top 30 Investment Banks for % of INTERNSHIPS CONVERTING TO FULL TIME OFFERS

These firms are all ranked on a PERCENTILE basis across all 5,000 companies in the WSO Company Database based on thousands of WSO member rankings. Feel free to share the rankings below on your site by copying the html code below the graphic. Stay tuned because next Tuesday we are going to be announcing the investment banks with the hardest interviews, those with the easiest and those with the best overall interview experience!

Share this Image On Your Site

Missed an earlier part of the 2014 WSO Community Rankings - Investment Banks? Click below:

Hi Patrick, could you explain a bit re. the difference between career advancement and professional advancement?

Judging by the fact that Moelis is #2 on career advancement, I assume career advancement = exit opp while professional advancement = how you are treated by seniors/junior workers at the firm and their support of you

BMO, KBW before GS and Laz?

Interns getting full time offers rates seem very high. Probably selection bias. GS does not offer 96%, that's for sure.

...these are percentile rankings, not actual % of interns offered FT spots. If you want that breakdown, you can look at the companies in the WSO Company Database :-)

@"KslayerK", the difference is I see career advancement as "how well does this company set you up for the future roles" and professional growth as "how well does this company help you improve and develop skills as a professional?" but that is only my interpretation.

Remember, this is based off of user submissions to the WSO Company Database.

Thanks, Patrick

Thanks Patrick, somehow these two are interrelated though

This list is such a joke.

was waiting for the first negative comment...surprised it took this long, but not surprised that it lacked any substance :-)

I think knowing what employees think about their career advancement and professional growth opportunities at each firm is relevant to many potential employees in this community, no?

I also think a person deciding between two internship offers from a firm on this list and one off of it would find this data pretty useful. Should you take that internship offer from Evercore or Moelis? This chart might push you to favor Evercore... just another datapoint to consider in an industry that is tough to get accurate #s on.

care to elaborate more on why you think it's a joke?

Harnessing the data out there makes sense but I think there's a few factors which make this list not very useful. First, the rating scale used in answering the questions is very subjective, and would require a large sample size to be meaningful (in a huge sample of people ranking career advancement 1-10, things may even out to get a good number, but if you ask only a few people the result doesn't mean much). While there are a ton of reports in the WSO database, there aren't very many for each individual firm. Second, lumping all ~5000 firms into the percentile ranking mutes the quality difference between the top firms; and I think most WSO users would be most interested in looking at rankings that consider, say, only the top 50 firms in a given category (i.e. top 50 investment banks). The relative rankings would then mean more.

And ultimately when the list shows Piper Jaffray ahead of Goldman in terms of career advancement, the gut test says the data is not very reliable.

Just wondering, does this only apply to IBD? Or does it lump in S&T and ER as well?

this lumps in S&T and ER, although the majority of the data is for IBD.

Looks like Evercore is an epic win :-)

Why are Barclays and Barclays Capital listed? I presume you just mean Barclays, since Barcap dropped the capital a few years back. Still not sure why it pops up twice though, should be the same...right?

yup, we are fixing that...those results should be combined.

This is a refreshing perspective compared to the league tables banks show. Consider this a different kind of fairness opinion... Good for undergrads to get a perspective on the changing landscapes.

Not too happy about the BBs being knocked out... but robust data doesn't lie.

I wouldn't call it being "knocked out"...many of the BBs made this list which is not easy when you consider all the banks out there.

duplicate post

Robust data do not lie (data = plural for future reference) followed by can someone shed more light on the data sources? Do you even think before you post?

Take your useless dogmatic comments somewhere else. No value being added here.

regarding your grammatical inquisition, for someone who always pointlessly comments on posts to do a Google search, take your own advice and stop wasting everyone's with your attempts to gain approval.

Can someone shed more light on the data sources. Thanks.

I know these percentile/rankings are based off of WSO database submissions, but when you don't include Centerview and Greenhill. Centerview is known for its 3 year program where they try to cultivate analysts into becoming Associates and Vice Presidents. Greenhill allows analysts significant amount of face time with higher ups.

It's a good effort. However, I think there's not enough data points to fully capture the true percentile/rankings. Then again it'd be damn near impossible to capture the true percentile/rankings. I expect these percentile/rankings to become more and more trusted in the future.

Do you guys remove outliers? For example someone can go shit on Evercore right now.

You are 100% correct, the rankings are by no means perfect and there are biases.

To be fair, Centerview and Greenhill were both removed from these rankings due to lack of submissions (as we state in the footnotes)...they both would have ranked quite well here with just a few more datapoints and I'm sure they will show up next year.

A lot of problems with this list....I dont know how you don't have BAML in the top 15 for career advancement or professional growth...Look at their placement (Carlyle, Warburg, Kelso, T.H. Lee, KKR, Apollo, etc...) All in one year btw. Also second in the M&A league tables...I understand the list is data driven but consider that your data has some serious biases. No chance GS has a 90+ percentile offer rate when it's well known they take 40% of their S&T class and maybe 70% of their IBD class. No chance that puts them in the top percentile.

again, as I told mmbanker above:

...these are PERCENTILE rankings, not ACTUAL % of interns offered FT spots. If you want that detailed breakdown, you can look at the main company pages in the WSO Company Database. We have that too...

I love all of the unnecessary butthurt about this list.

I'm a little surprised they left out the brothers lehman

Interesting to see how the focus are now shifted away from BB.

What's your sample size?

This is a very interesting set of rankings. I concur with others who have asked how 'Professional Growth' and 'Career Advancement' are being defined for this purpose.

In my experience 'Professional Growth' means the opportunity to enhance and broaden your skill set - the opportunity to become a well-rounded banker capable of speaking to clients about a wide range of investment banking services with expertise - (and those are the best bankers - ones who can talk with as much knowledge about M&A and strategic alternatives as they can about equity-linked financing, liability management, hedging and debt products, for example).

'Career Advancement' (in my view) - which institutions provide you with the best track for promotion or the best routes to the most elite buy-side firms.

I do take issue with these lists (its certainly not how I would rank them) but if this is based on member rankings, as indicated above then obviously I am in the minority.

Let's take a look at peer perspectives (interns at BMO ranking JPM, for ex) as well as sample size per firm before taking this list too seriously.

This stuff obviously only applies to the US.

Anyone can fill in any WSO surveys. They are not validated (vs. Most employee surveys come from company emails, etc.). Major integrity issue. Also believe responses are collected over the years, not a smaller timeframe snapshot? This will change things, especially for banks that were not doing so hot few years ago, but recovered.

Lies, damned lies and statistics.

First: The evaluating criteria succumb to being dubious and ill-defined. When submitting a company review, there's really not much clarity on what "professional development" means to someone.

Second: People report on the context of their relative experience, not absolute, or vis-a-vis other firms. This is why many of the small boutiques/MM firms here claim to have great opportunities for career advancement when I doubt they're putting more analysts into PE shops or into good associate positions at the same or other banks. A quick LinkedIn search backs up that inclination.

Third: I'm not sure, but how far back is your timeline on your data? As any good finance monkey knows, old data is stale data is bad data.

No butthurt here, just trying to be objective as many kids ascribe more value to this website than maybe they should. At the end of the day, is any kid with opportunities at KBW and Goldman going to choose the former?

I would also echo the data integrity issue. If you could create a specialty report with opinions of verified users / email address from the firm, etc, the higher quality output would be more well worth it.

As another user mentioned, a relative ranking would be a really fun report to read (asking verified users to rank their top 20 investment banks on various dimensions) and would have a higher quality to it. Could also be updated regularly.

Similarly, the salary report could be cleaned up in this similar manner (U.S. IBD only, higher quality reporting). We all know the BB's pay a standardized rate for Analysts and Associates, so make the compensation report similar in that you're getting higher quality data points.

Magnam et non numquam ipsa repellat. Necessitatibus architecto aliquam excepturi provident. Repudiandae cumque ut ea omnis sit cupiditate magnam incidunt. Vel similique quia animi culpa. Commodi autem facilis aliquam impedit voluptatem.

Numquam sed ut ea. Autem nisi autem tenetur eveniet rerum cupiditate vero enim. Aut consequatur voluptas accusantium repellat in.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Modi nihil eaque quia eos dolorum enim. Quaerat assumenda maxime et placeat reprehenderit modi. Dignissimos provident culpa delectus impedit quam dolores laudantium. Est provident tempora facilis tempora.

Voluptatem omnis iure sed sit. Harum explicabo cupiditate et. Officia perferendis et sed suscipit in et sed. Sint sint corporis harum saepe esse ad ipsa.