Goldman Sachs LND: how To Get <ED> Executive Director @GBM (Sales&Trade) Front Office? Total Non-Target Play HR D&I Game...It Worked (Real 2022case).Hope Admin Will Show unbiased understanding Importance discussion. Exclusive peek how HR recruit EDs...,

The biggest Goldman Sach's problem is that there is no meritocracy.

>>The following material was obtained from Glassdoor and LinkedIn articles as a documented case was debated and published on various forums beginning in 2023, even being translated into Polish and Hindu, as criticising London's HR bias and procedure of selection and screening mid-senior candidates.

It is also a sobering reminder that while the bank expects superior skills and education from analysts and associates, the same however does not apply to the EDs/VPs who manage them. This case is just a proof that even in London's, Global Banking Markets (S&T), front office, many simply wouldn't even pass typical superday / assessments for analysts.

Choose your mentors and teams with extreme caution, as this can cost you your career.

This is eye-opening, so much different than whatever you will read or against common believe. Not everyone is playing fair, not everyone spends tens of thousands £ on degree or qualifications...

---

Having worked in IB for more than +16YeO, I've seen tremendous injustices in terms of promotions, pay, and culture. GS is now so much different, HR tends to recruit mix of people, which we can divided into 2 categories:

1) Superbly educated and mediocre ones too (mostly with bought MBAs, not even target, expensive ones, as we are seeing many random, non-name candidates).Being superb, CFA, Phd technical is a deep liability because you're expected to stay quiet and just churn out work.

2) Generalists, administrators, corp. back stabbers, climbing based on bosses liking than skills. Conversely, the people who are incapable of producing quality work are assigned "softer jobs" such as going to meetings, presenting to higher ups, and eventually managing others. Sooner or later all the "smart" people end up reporting to people who don't understand the business but are good at sucking up to their boss. Those mainly have MBAs, so they aren't experts at all from anything...if you think 1 yrs programme will make you a leader in banking you are irrational, especially without ground knowledge which only qualifications and even masters provides.

I don't have an axe to grind, and actually think this culture has helped my career. In fact it is a great place to learn and grow if you have luck to deal with 1st category! Provided exit opportunities (if you are not too old - age bias) Hedge Funds etc in my case. The common misconception is it is difficult not being sb protégé. Well, I was recruited by direct HR approach last year (typically for +VP grades)

However, I can call myself very lucky as HR on-board me although:

- I was disciplinary terminated by BofA in 15' focusing on the last employer instead, recommendation. Lucky this hasn't impacted my screening, most banks perform much detailed checks further in history!

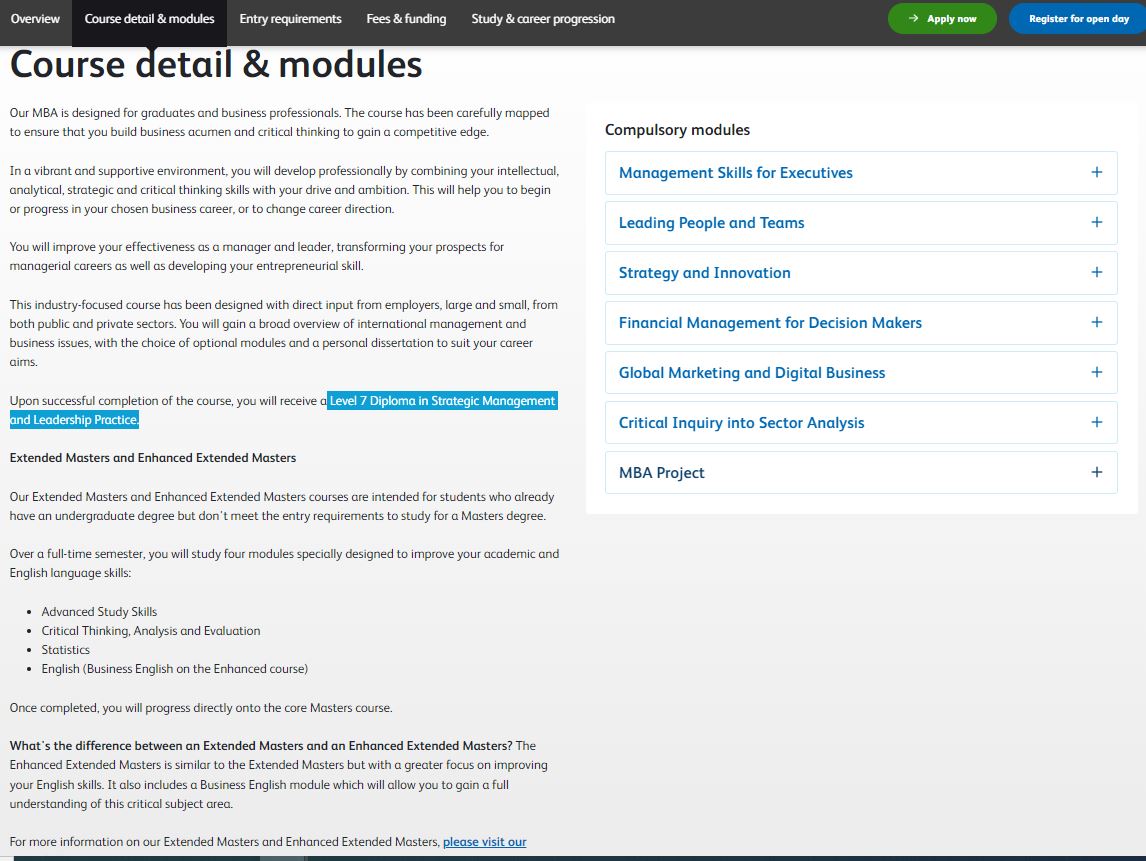

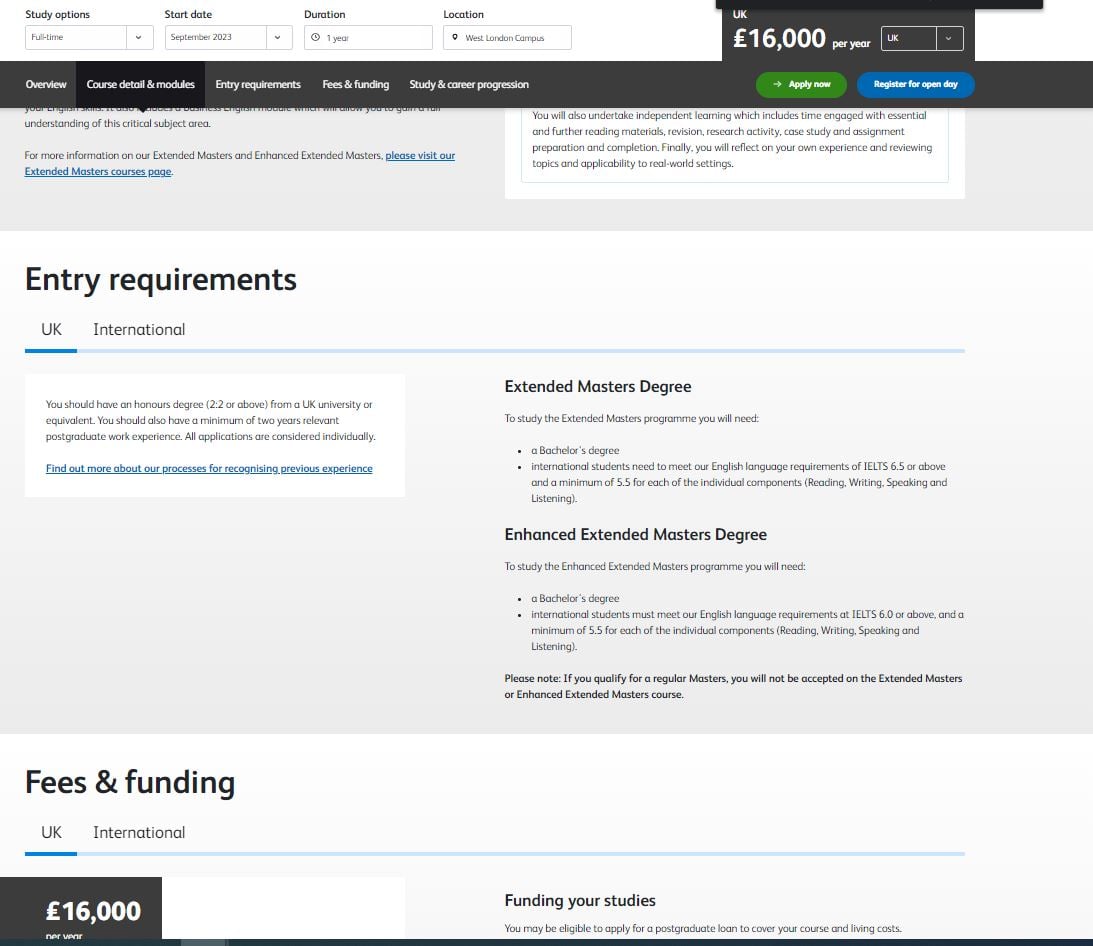

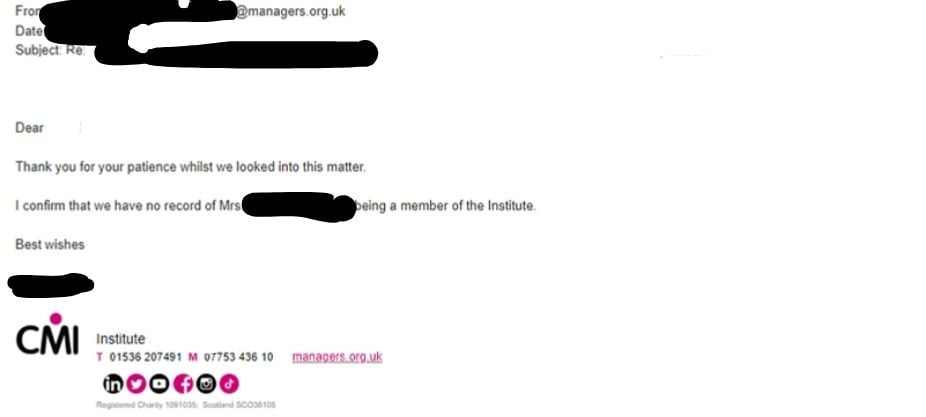

- I'm 100% non-TARGET (Uni, MBAs, background etc)I have low (3.6/5.0)M.Sc. Marketing/Accounting of Eastern Europe non target even there, 2nd degree- but never finished back at home, started ACCA which failed after 1st exam, same goes to FCA etc. An obvious trick was do buy instead MBA(nb fails those!) the cheapest London's MBA(100% pass rates+ CMI incl. for free) nb cares, West London at the end my programme which I had to extended, luckly merged with City Uni - what confused HR as it is still same low quality with other slightly better label).

- CMI is the only "paper", I have not even being examinable as it was part of my generic MBA bought package and apparently I claim this as the only person at London office

Most banks won't even care about those, somehow GS/Morgan HR's need tick this off for any promotion, won't even consider it as any value as you can easily cheat and outsource most assignments to copywriters like most ppl did.

Professional qualification in other hand requires sacrifice doing everything all exams by yourself, what was/is challenge for expats not fluent in English. Have you wondered why some EDs having very weak education like me, barely know how to draft an emails and overall suck in communication (now you have an answer) not to mention being threaten by more skilled co-workers?

- I don't have Russel Group (UK)/Ivy business diploma – nothing further from this in fact, as I have graduated mediocre accounting major in one of Easter European uni, not even the most competitive major to start with, this doesn't make sense hearing about top schools requirements at all.

- My background by no means wasn't FO, as I came from generic op. Firmops, CA experience, never been involved in actually sells pitching, direct clients interaction, not like most transfers to FO coming neither Risk or Research, Finance nor Markets exp

- I'm not qualified – neither FCA,FRM, ACCA etc, in fact Analyst, Assoc. I supervise are 2x more technical superb than me, as far my +15 YOE middle/back office ops support goes.

I have started ACCA but failed at 1 exam, started FCA but failed, so MBA with impossible to fail(100% successful rate) at West London was my way around, especially as they merged it with City Uni at final study what confused HR even more and giving other label for quality same school instead.

- CHEAT TRICK there are MBAs and "MBAs"- I have completed the cheapest (budget limitation and language barrier) non-target (some called it Micky Mouse MBA) London's MBA as typical those throw in meaningless CMI paper incl in price, both nb really cares but HR needs to tick this off – costed +£16k, which was later luckily merged with City Uni.The main requirement was pass basic IELTS test(some might laugh)not like in professional MBA programmes (GMAT) not to mentioning LSE and rest Russel's Group requirements!

Most of my colleagues @GS have graduated LSE etc (for £110k-140£k eMBA)however due to language, communication I was also forced to use extensive help copywriters(fiverr, gumtee lots of them to choose from) to pass final result. One of advantages MBA over restrict self-study qualification as many people and alumni was doing the same, due to work commitments or just pure laziness etc. MBAs are more restrictive due to their costs not level, as you won't be banking expert after 1(18mths generic program), of course there are exemptions, not mine.

-

My communication skills although average at the best, I have never studied English language as my 1st foreign language, nor eastern accent luckily hasn't impacted my chances. I know it is huge obstacle in other FS sectors at senior level.

-

For 7-8 years I got stuck as Associate, promoted in the previous company only recently because of D&I and MBA. it is difficult to call such a purchased MBA any qualifications, unless you are just an 1 process administrator, who can be easily challenged by anyone with better sector / technical knowledge

-

Finally if I were representing a different probably not meeting diversity targets (GS it is no surprise aims to influx % women giving us a bit blind eye, I wouldn't stand a chance among male colleagues, with CFAs, LSEs etc)

Overall I'm so grateful and happy that I can lead own team and set own targets as well recruit people suitable for business and my management own personal goals.

Policy vs reality and discrimination (own interest above company's)

"The firm is committed to providing equal employment opportunity (EEO) to all qualified persons …including race, nationality, gender, religion and age."

Well dead policy, the reality is other way round. So much depends on people. I'm keep telling friends that in this business critical thinking is disadvantageous, there is no space for too old, too experienced candidates as they tend to create leaderships challenges and raising uncomfortable questions about sense and ways of doing things. Craftsmanship speed, accuracy are the most important in this role alongside soft skills managed ( at the end not the most knowledgeable or skilled got promoted!).I personally tend to recruit only young candidates, who are willing to make effort, work long hours and do not challenge supervisors causing unnecessary fractions. Why I would recruit sb you can possess a threat to my role in first place!

Ethics& Integrity vs reality:

Neither GS nor my previous bank wouldn't probably mind if I will admit that I've spent few years clamming council social housing benefits as well, living with my further family in their council flat and still work as Director(savings '000 in the process, just using loopholes).I simply used an opportunity as I was learnt doing at work and play the game.

To summarize I'm not exactly a raw model for junior colleagues (sometimes) better qualified and technically skilled on the job than me, neither in terms of technicality nor especially ethics at all, but as they came to me and once you are in, who cares!

All of the above are true (test for yourself, although as is common on LinkedIn, most people at GS hide by purposefully collapsing work and grade history to avoid being benchmarked against others, especially internal colleagues) and relatively easy to check; let's hope HR is taking notes as well, being so easily duped.

The aforementioned scenario is a sobering reminder that even in Goldman FO, things can go tragically wrong, since weak EDs tend to excessively rely on more capable subordinates, delegating pointless work due to a lack of understanding and taking credit for everything they do.

In other words not geniuses get ED roles but like my case process masters as I was lucky to work on process at Morgan they wanted.

Now imagine to work in department like mine... where more senior, more technical colleagues will be intestinally blocked by weak leaders like EDs, who do not even understand what they delegate but at all cost they will be defending and eliminating internal competition to them...cherry picking tasks, highly visible as useful for their fake image build up above. They won't as my case mentors in professional or ethical ways, but they hold a power to ruin your career if being threatened.

Why are there so many examples when technically brilliant people are prevented by extremely incompetent para leaders, most of whom have purchased the simplest MBA available, not real bankers but administrators, whom anyone can become if given the opportunity to master the process?

Only reason why HR so much lowered a threshold for me and fact I'm a women (as Goldman after lawsuit and paying $215m compensation tries so much to get more women into front office roles)

Lead by example, walk the talk, and walk the walk...what sort of example she is?

Leading by example means more than just having a title; it involves embodying the values and actions you expect from others. It's concerning to see someone with such limited experience attempting to delegate tasks they may not even fully understand themselves.

How can someone so unqualified, highly unethical, and lacking basic integrity be entrusted with a leadership role, especially in FRONT OFFICE?

It raises questions about the HR department's decision-making process. This individual has never even passed an assessment day or participated in a super day (US), yet they have the authority to handpick analysts for their team based on personal preferences. Their non-financial MBA adds little value in this situation, given the lack of essential skills and poor communication.

This person's disregard for codes and policies speaks volumes. This situation highlights how a poor hiring decision by HR can tarnish GBM's reputation, even among less experienced individuals. If your goal is to learn and grow professionally, following the typical 2-year analyst route and eventually transitioning to Hedge Funds, her team seems like a place to avoid. What can you expect from an insecure and unqualified Executive Director but attempts to cover up her own deficiencies by exploiting more skilled and cost-effective resources like yourself, taking credit for your work? For a driven VP, it poses a high risk of quickly becoming a genuine threat to her. Faced with more technically adept colleagues and individuals with greater experience, she may resort to undermining your efforts, jeopardizing your career, and potentially costing you your job.

Throughout my years in the industry, I've steered clear of that kind of people seeking true mentors among more often FCA colleagues and distanced myself from MBA-only colleagues for good reason. Their focus often revolves around self-preservation and defending their own positions, rather than fostering the growth and development of others. In contrast, investment bankers with robust technical backgrounds tend to feel more secure, possessing a wealth of diverse knowledge beyond a single process, which even skilled graduates can master.

I'm curious about how all of you perceive Goldman's Global Banking and Markets (GBM) HR role and failure in this context. Shouldn't HR take a more proactive and critical role in evaluating the backgrounds and qualifications of potential hires, especially when we are talking about ED/VP people managing other resources, and having an impact on others' careers, by either embracing them for the growth or make them suffering just in the name of covering own ... rear end.

Bruh this same schizoposter as last week still replying to his own posts under a different account

I'm curious about why only you seem to tolerate HR's questionable practices and what appears to be for many only in this way anonymously on forum, pervasive culture of dishonesty, considering this culture. Have you ever taken the time to familiarize yourself with the bank's CoC or pursued any qualifications that emphasize on banking profession ethics, whether it be the FCA or any other relevant certification?

None of us expect to change a toxic culture alone, but calling by its name should shake this tree good enough...if HR really cares about won reputation as they clearly do not care about employees..

always glad to see quality content making it onto these boards

While I appreciate a lot the touch of sarcasm, it's worth noting that the IBD tends to have more transparent and less exposed approach compared to the kind of hypocrisy we encounter at S&T, especially in contrast to more technical high finance roles. In roles like these, either you know the ropes or you don't, and this becomes apparent rather quickly, even brutally.

It's intriguing to observe that among all the front office divisions, Sales & Trading (S&T) often seems to feature some of the most "random" placed senior individuals just managing more skilled resourced, cultivating delegation without understanding pathology at its best.

One can't help but wonder why HR doesn't choose to promote someone more qualified, perhaps even a female in-house candidate (being risk averse, without drama like this) if they are prioritizing D&I (given the stronger grounds in risk management and related fields). It seems counterintuitive to promote someone external, random, who appears to rely on others to carry out the daily tasks.

One can't help but ponder what message GBM HR is trying to convey. It almost appears as if they are suggesting that within GBM, mediocrity is acceptable, and you can still rise through the ranks while delegating your work to others. Well done HR...

Despite lurking here, I've never left a comment, but HR's favouritism and poor hiring practises speak for itself.

This is how I, and likely many others already experience in the industry, view it. You have 2 choices:

- elevating this case to HR, and presumably the best route is US HR, rather than London's which is biased and part of this problem (more likely HR will do the damage control and sacrifice rough, weak ED for letting this go, no matter to who she relates too, who bring her in, the heat is too much to just ignore this)

- alternatively use this case to actually make a difference, as far as the candidate lied, presented herself as more senior, qualified etc or played dishonourable, unethical games, it is HR who should take main accountability! If the GBM hiring process hadn't been tainted, dishonest, and biased against significantly more talented female applicants, such a situation would never have arisen. Her co-workers below her, must be contemplating this, knowing she is taking advantage of working with them, rather than it being the other way around.

This is particularly concerning when it relates to front office, as even HR wouldn't make the mistake of placing someone with limited English proficiency in a role involving external client interactions, so they might feel like serviced from our colleagues in India or Poland. Moreover, she wouldn't be able to pass mandatory 7 series of exams required to work with clients independently, especially if she resorted to cheating, even on the easiest MBA homework, that everyone is expected to pass not like CFA (barely 25-30%).In London as well in continental Europe where most have finance or accounting advanced degrees, her MBA is seen as inconsequential, and most banks, especially real executives, tend to disregard it either way.

#2 offers a more challenging yet greatly appreciated perspective that all of us would value. It's a viewpoint many of us often shy away from expressing. Historically, gaining entry into senior positions at GS depended heavily on connections, networks, and personal relationships, sometimes even entailing inappropriate associations. Consequently, it's inevitable that her colleagues will eventually become aware of her shortcomings, competency gaps, errors, and reversals in previous decisions. Currently, HR has a duty to uphold the appearance of recruiting authentic experts rather than individuals who leverage their positions for personal gain. If it were up to me and many of my colleagues, we would strongly recommend taking a proactive approach and challenging the HR process itself at the top, as they bear the primary responsibility for this situation.

What's the story behind the name Peanuts Tycoon

Either this or monkey business.That sounds accurate…

We need to Mac address or IP ban this nut case and his 1000 alt accounts who keep spewing unintelligible nonsense.

You sound a bit unhinged, like Gen-Z individual who doesn't comprehend how someone like the person mentioned above can easily influence and oversee juniors like yourself, despite lacking the same technical expertise. Merely having +3YOE doesn't qualify one as a true banker. Judging from your posts, it's evident that you aren't anywhere near this level, nor is it your side. Brace kid yourself, as individuals like the one mentioned above are not uncommon, particularly in the Sales and Trading (S&T) of FO (and yes here both about CFA or random bought MBA, even former military can get nb cares except HR, can be skipped, although CFA will always position you better among all peers as golden standard in IB where barely 1/5 have it).Ever wonder why my level peers deliberately collapsing and simplifying their LinkedIn profiles, mainly restricting colleagues from benchmarking against them (an old trick)? What's more, they possess the ability to handpick analysts like you to suit their preferences, essentially assigning them the heavy lifting, delegating work without understanding its purpose. This leads to high staff turnover at the junior level, especially if you are "lucky" to get stuck in such black hole team, led by generalist at the best not SME and mentor type. If you can't make a meaningful contribution at this level, it's best to refrain from spamming.

Both Mac and IP addresses can indeed be changed, and Gen-Z should be aware of that, at the very least. However, you might be missing the central point here, which is to draw attention to these seemingly obvious aspects that veterans are often reluctant to discuss beyond their own circles. It's not just another standard discussion for inexperienced individuals; it's an acknowledgment of the "reality" even within the front office, as you can verify this by yourself.

My brother in christ nobody gives a damn about sales & trade this is an IB forum

I cannot understand a word of this.

This reddit migrant crisis is getting out of control.

You never know GBM's HR at GS in London are on the hunt ... for "SMEs as above".

There is a reason why such things never happen at IBD...all f..ups mainly due to S&T and random recruitment.They never learn from their past errors.

David Solomon, the CEO of Goldman Sachs, is the same person who got rejected 3x times for not being "Goldman material." To be honest, his resume doesn't quite match up this grade.

He admits that Goldman Sachs received a whopping 260,000 applications from analysts this year,

but only recruited 1% of them, which amounts to 2600.

Now, imagine being one of those lucky applicants, to only to end up in a team led by a less-than-impressive Executive Director, who got the job because of connections. This ED has never really walked the talk, lacking the technical experience, to be a single op expert. It's no wonder that most people leave after just 2 years in such dead-end environment, collecting GS badge and networking for the future. Honestly, working at @M&A seems like no no-brainer option than enduring a lousy S&T experience like this one.

At least in M&A, there are endless opportunities and less of a feeling of being herded like a slave, micromanaged by someone who barely understands the technical aspects as above (feel sorry for whoever works under that person). When it comes to S&T, the recruitment process seems incredibly random, especially among senior staff in the front office. It's baffling how someone can transition from Operations to S&T, while others hit a wall because they lack the necessary technical expertise and manage far more skilled people without even having a proper financial MBA background. In the meantime, you can learn so much at M&A in more supportive environments like boutique shops and then transition into bigger firms like BB and PE later on without having great, knowledgeable mentors.

That's why most analysts head to either hedge funds or private equity after 2-3 years. Nevertheless, the learning curve on the buy-side and the quality of people are unmatched, especially compared to sales and trading, where you can find individuals like this mixed with brilliant people who get so annoyed by corporate politics.I know personally former MD trades who got a job in GS's office because he is Israeli and was mentored almost by hand from ED to MD...Who still believes that only the best candidates manage the best analysts, demonstrating strong leadership skills and fostering a positive work environment? It doesn't work like that ... especially when you don't have any qualifications, as random MBAs aren't relevant these days.

The path to the front office isn't exclusive to FCAs, PhDs, or individuals from target schools. There's always a %of individuals who secure roles, including ED and managerial positions, through connections rather than solely based on skills and achievements. This reality can be disheartening for those who have dedicated significant effort and sacrifice to reach such positions, only to observe others benefiting from pre-established networks and what can be perceived as unethical support.

I know personally a former MD at GS's FX desk who, despite challenges like moving from Eastern Europe lack of FCA etc, performed well for a decade in the role due to getting guidance and being under the wing of his mentor. It is not always what you know but who you know otherwise guy wouldn't stand a chance like the example above if not have powerful friends, shielding him and mentoring him. The path of target schools, ultra competitiveness is for us, who don't have those privileges of having the same connections, but in the end, it builds stronger and reliant professionals who can easily spot those who get there cutting corners above.

The landscape of the Investment Banking (IB) industry, particularly in London, has undergone significant transformations. Securing a role has become more attainable, with expectations for women nearly halved at the peak of 2022. This shift has propelled a considerable number of women into front-office positions. However, the unexpected consequence has been the substantial lowering of the threshold by Human Resources (HR).

To provide context, individuals in Controllers and Risk, notably those who are significantly younger and possess more robust qualifications, have emerged as fitting candidates for these roles. Merely accumulating eight years as an associate or obtaining a generic MBA does not confer subject matter expertise (SME). Such qualifications are readily available and do not necessarily validate one's proficiency. Even prestigious institutions like the London School of Economics (LSE) are offering expensive programs in regions with lower entry points, a trend driven by financial motives. This pursuit of monetary gains, unless considered a specialization in itself, raises questions about the legitimacy of such credentials.

In comparison, there are individuals who, by virtue of their age and qualifications, are more suitable for the roles in question, while presenting minimal internal mobility risks. The rationale behind HR's decision-making, whether influenced by competency or networking prowess, remains unclear.

Who told you that GS exclusively selects only the most qualified candidates? This is a topic that many of us hesitate to discuss, as individuals who enter through recommendations and connections do not always successfully navigate the standard Human Resources (HR) processes, being to weak even in contrast to analysts. What proves particularly frustrating for more skilled and technical colleagues are precisely these individuals at people management roles, who are there primarily due to connections, deriving benefits from working alongside more skilled colleagues, rather than on account of their own merit.

Fairness appears to be a rarity in this industry, where even individuals of mediocre level, as exemplified above, manage to circumvent checks that are typically reserved for others. When comparing her lack of qualifications to the current requirements for analysts, it becomes apparent that she wouldn't successfully break through to this even level under the same selection process, but somehow she manages others being one of the weakest leaders you can come across.

It is plausible that she would adopt a more amicable approach playing vanilla fiendly, employing contrasting tactics to conceal her own lack of competencies, as the alternative of resorting to bullying contradicts GS's intolerance towards such behavior. One way or another ED like those are pretty shameful but still exist not only at GS.

How is it imaginable that an individual of such questionable ethical standing, entrusted with leading the team and determining alignment with the bank's values in any quandary analysts and associates may encounter, was recruited in the first place?

HR indeed pursued non-targets in 2022, particularly focusing on female candidates as FT and others were writing about. However, no one anticipated that, instead of selecting a non-target candidate for the ED role, they would appoint a no-name individual. She arguably stands as the least formidable ED ever recruited for a front-office role at GS, as even associates trained in indigenous exhibit superior skill sets compared to her. It appears that HR may have made an unprecedented deal, overcompensating significantly to someone of such a mediocre level, like they weren't able to find a better person among those thousands of applications and internal staff. Total hr BS.

That's why people who went all the way from analyst to ED/VP at Goldman, being exposed to this selection process (unlike the above case), are generally respected within the bank.

Everyone knows there is a group moving from the back office, externally, who would never pass those rigorous selections, but not many know that HR places them in functions managing and administrating more skilled analysts. I can bet she has never passed an assessment similar to an analyst at the front office, as a few years back in operations they were taking almost everyone, including non-financial majors and former military, as the process job requires far fewer technical skills.

She will hide her background, collapse back office process roles on LinkedIn, so others can benchmark against her and try her best to blend in. Nobody will challenge her, as people are simply too scared. It's a sad reality when HR mixes great talents with that kind... as she took that spot for sb much better than her.

If you lack connections and don't engage in beyond "professional relationship" with someone higher up inside, competing for these top 1% spots is unfortunately way for you.

This is not the first, nor will it be the last time, that someone of this kind secures a management role despite being mediocre (overstatement) and failing all possible qualifications. The fact that she resorted to buying a generic (meaningless for banking) MBA as a last resort suggests her lack of skill and exact level. As an ED, she may compensate for her lack of skills by surrounding herself with individuals who possess the required expertise and then taking credit for their work. However, being part of such a team is far from ideal if you value own sanity, as it can lead to a toxic work environment where due her insecurity recognition is not given, and individuals may feel exploited.

A friend of mine has ventured into a side hustle, offering services such as writing theses and essays for individuals pursuing seemingly inconsequential MBA degrees in London. Interestingly, only a handful of banks in London are opting for this service, choosing instead to prioritize the acquisition of proper qualifications like the CFA. It is noteworthy that one can obtain an MBA from even a Russell Group institution without any connection to the financial sector or banking.

Many of these individuals have encountered challenges with the CFA, finding it too difficult and demanding. Some even come from diverse backgrounds, including military service, leveraging schemes that certain US banks have in place for them. Additionally, there are candidates with varied experiences unrelated to finance. In the majority of European hubs, MBAs yield the lowest ROE, as they are primarily pursued by non-finance individuals striving to distinguish themselves among colleagues. This often involves ticking boxes for HR to secure promotions in generic Middle Office (as even finance/risk is way more professional and specialized), possessing only partial process knowledge (the easiest to acquire) and little else.

The following is an example of a mediocre candidate who would likely not pass the selection process for an analyst role but is nonetheless recruited to manage them; such situations are predominantly observed in corporate America.

This phenomenon is disconcerting and seems to be prevalent in only a few banks. Most HR departments fail to recognize the value even from top-tier MBA programs, let alone those from less reputable institutions that are available for purchase without professional relevance.

While pursuing an MBA remains a topic of debate in Europe (on average, candidates with master's degrees are better educated than their US counterparts), without a sector-specific master's or complementing a CFA for the development of soft skills, it is crucial not to make the mistake of assuming it confers the ability to manage on par with CFA-qualified colleagues. Such weak managerial candidates are swiftly identified, and their shortcomings become apparent within days, making them likely the worst mentors to avoid at all costs. MBAs make sense if they follow a technical qualification; otherwise, it is merely a glorified abbreviation that most headhunters advise dropping, as it lacks meaning in this competitive European landscape.

Here is a perfect example of someone who has failed qualifications and subsequently obtained a meaningless MBA, which anyone can acquire for a fee, without bringing any substantial value to the bank or serving as a golden standard for her skills.In 2023, it is becoming more easier to buy an MBA in London without a proficient English or necessary high-level finance communication skills. It is worth noting that while it may not be the most economical option, it is often considered easier compared to pursuing qualifications such as the CFA or FRM.

What in the actual fuck is this post? This post and the thread’s weird long comments literally sounds like someone tripping on something strong.

Nothing really new, everyone knows that kind of people and wondering how the f... they even get here if not HR bias or connections.

Most graduates threads here relates to those very unfortunate without those connections, especially as S&T is the easiest to break into from all FO, with the most random ppl not even comparable with IBD.

If you imagine such team lead - ED with half or less skills expected from Assoc. you might get a better picture, but it is still happening especially with movement from ops.

You should buy a gun

Many would love to see her passing assessments for analyst and being that 1%, as sb so weak shockingly, later on recruits to her team, not having any qualifications! This is just nuts and shows how flexible keens make more than brain...just politics.Many of us are aware of associates who possess greater skills and qualifications than her.

Wtf! How is this still possible?! As has leaked, I believe sb in HR will also lose his job.

One bad hire like this ruins the department's performance and reputation of all.

Is this one of genius HR's experiments?!

Is this the first time something like this has happened at Goldman? Nah, not really. But it's worth noting that, like most Partners, MDs, and even us in the Middle Office at JP (the lads @MS, DB, and Citi heard about it too), we've all read those circulating emails with all the juicy details and evidence as apparently GS guys flagged this to even FCA. I reckon most London's industry, HR teams, and many front desks are in the loop by now.

GS's HR must be pulling their hair out over this own mess-up. It's pretty clear this person didn't land the gig based on generic non-technical or random generic MBA totally useless as not tailored to FS, more likely through connections. She wouldn't have stood a chance in a regular process, even competing with a bunch of senior associates, not to mention internal candidates who are the obvious HR preference as a risk-averse solution.

It'll be interesting to see how their HR handles this hot potato. If this person didn't have the right connections, she'd have been out the door, probably accompanied by the HR partner handling this mess, as GS has been known to fire people for much less. Since most of the industry knows about this, HR can't simply ignore it, as their reputation and recruitment process integrity are questioned by this well-researched example. No surprise it's pissed off so many guys there internally.

Dicta enim voluptate quod in modi debitis. Eaque accusamus dolores ut.

Dolore sit enim nisi officia aut. Illum beatae consectetur maiores ratione tempore. Iure labore pariatur qui modi. Dignissimos rem rerum sequi. Dolores deserunt quod rem qui.

Explicabo velit illum quasi ut. Voluptatem cumque accusamus eaque amet est illum rerum sapiente. Distinctio possimus aperiam fugiat soluta. Atque assumenda consectetur veritatis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Dolorem placeat ullam nihil similique reprehenderit. Et id voluptate eaque expedita aut et omnis.

Recusandae enim nesciunt sed odit consequuntur. Et ullam ea sint doloribus ut dignissimos dolorem. Consequatur tenetur doloremque aut quia in consectetur inventore.

Autem autem alias ut quidem officia autem. Dicta quam iure quisquam temporibus impedit dolorem. Blanditiis nesciunt similique eligendi suscipit. Molestiae sapiente at provident sit non. Eos assumenda aut at dolor sit aut.