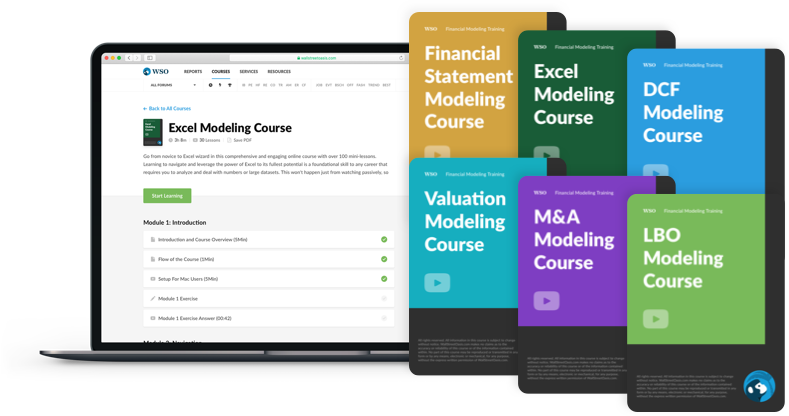

NEW Financial Modeling Training Courses

We are super excited to announce 6 new WSO courses to help you develop the most critical skills to succeed in your finance career! We are offering a major package discount with lifetime access for all 6 courses.

New WSO Courses:

- Excel Modeling Course (available now)

- Financial Statement Modeling Course (available now)

- LBO Modeling Course (available now)

- Valuation Modeling Course (available now)

- M&A Modeling Course (available now)

- DCF Modeling Course (available now)

WSO Elite Modeling Package (6 courses above) - Learn More

For over a decade, we have partnered with two great training providers and we endorsed their courses as a great way to help anyone looking to gain an edge and improve these critical skills…so the obvious question is...

For over a decade, we have partnered with two great training providers and we endorsed their courses as a great way to help anyone looking to gain an edge and improve these critical skills…so the obvious question is...

Why create -- yet another-- Financial Modeling Training package?

It really came down to three primary reasons:

- Access to Elite Pros. Given 1 million+ visits each month, the 750,000 registered members, and the 700+ mentors already working with WSO, we knew we could cherry-pick the best rock-star pros to develop and teach each course. ---- For example, instead of one person trying to teach all of the courses, we selected a megafund private equity pro to teach LBO modeling and a bulge bracket M&A investment banker to develop the M&A course and an M&A Director from an elite boutique to deliver the content. ---This allows our instructors to always give real-world context to the modules and lessons. On top of that, we lean on WSO’s network to also surround each instructor with a team of 3 co-instructors (other rock-star professionals in that niche) to help vet each lesson. These pros come from Morgan Stanley, Goldman, MDP, Barclays, Moelis, KKR, Evercore (+ more) with direct relevant experience to the course material.

- Better learning experience. - No more long boring lessons -- all microlessons, each with its own distinct learning outcome (well researched to help with retention) - Gamification (bananas!) to work toward real-life rewards (real incentive). - High-quality post-production on every video to help you focus on critical concepts and stay alert - Max the monkey! Alongside our expert instructors, Max will make the lessons a lot more fun.

- Community and Mission. At the core, WSO is and always will be a community -- what better place to learn than in a community of like-minded students and professionals? One of the 3 missions we highlighted 14 years ago for WSO was...

To help every student and professional around the world, regardless of their background, develop superior career skills and access the same opportunities as those with the most privilege.

We truly believe that these courses are a critical step so that we can meet this final mission with more purpose. Our first announcement on this front was the launch of the WSO Financial Aid Program just a few weeks ago!

If you have any questions, we are happy to answer them in the comments or feel free to click through to the course descriptions below to get a better feel of what’s included.

New WSO Courses:

- Excel Modeling Course (available now)

- Financial Statement Modeling Course (available now)

- LBO Modeling Course (available now)

- Valuation Modeling Course (available now)

- M&A Modeling Course (available now)

- DCF Modeling Course (available now)

WSO Elite Modeling Package (6 courses above) - Learn More

As always, thank you to all of the WSO members that make this community so strong and we look forward to serving all of you in this next exciting chapter! The WSO Team

UPDATES [March 2021]: The team has been hard at work and we have the following updates...

- PowerPoint Course is done! (available here)

- Accounting Foundations Course is done! (available here)

- Venture Capital Course is done! (available here)

- Real Estate Modeling Course is done! (availabe here) ...beta pricing ending any day now

PACKAGE CHANGES: The WSO Foundations Package changed slightly. We replaced the Financial Statement Modeling Course ($197) with the Accounting Foundations Course ($97) so we also lowered that price by $50 to reflect a bundled discount. We felt like less overlap with the Elite modeling package made sense and Accounting truly is a foundational skill along with Excel and PPT, so it fit the package better.

ON DECK: An Advanced Accounting course is in the works, ETA July 2021

RELATED: Public Training Bootcamps are now LIVE (insanely discounted compared to what else is out there so they are selling out) and WSO is coming to a bank near you as we roll out more live corporate training. Interestedin helping your employees get more efficient? Book a Call

thank you! It has been a LOOOONG road, but I'm very happy with how they are coming out :-)

and thank you to all of the beta users that helped us improve the LMS over the past few months! We've made a ton of minor changes over the past 8 weeks... when combined actually make a big difference in the UX:

...those are only a few and more improvements coming.

-Patrick

UPDATE: All Courses in Elite Package are 100% Complete AND now offer Certificates for Students!

Update on courses [11/1/20]:

1. All 6 courses in the Elite package are 100% complete. M&A Modeling, Excel Modeling, Financial Statement Modeling, LBO Modeling, and Valuation Modeling DCF Modeling Course!

2. Professional Support from IB/PE pros - we've successfully scaled up this team and implemented a process so now that any technical comments about the course/material will quickly be answered by qualified pros that still work in the industry. We are super excited about this and think that it's a HUGE value add for students and one way we are leveraging our MASSIVE team of amazing WSO mentors (over 700 members now!)

5. Courses on the Docket ... We are currently pre-selling a PowerPoint for Finance course, a Real Estate Modeling Course (this already has 4 modeling tests/cases live and counting) and a Venture Capital Course I'm super excited about (better material than VC bootcamps that charge $6,000/head) ...we expect to have more announcements coming soon for those. Course development for a Basic Accounting and Advanced Accounting Course have also started and will be 2021 releases.

We are still on the hunt for several instructors to start development on a Bond Course - Fixed Income and a Restructuring Modeling Course...if you and/or anyone you know you think would be a great person to help develop these, please reach out!

Stay tuned!

Patrick

ps - we also aren't resting with our more famous older courses -- we have leveraged the WSO community reach to make the Private Equity Interview Course even more of a powerhouse. We just crowdsourced over 10 more modeling tests from top PE firms and we are in the process of scrubbing and uploading these to the course (some of them we'll walk through and add additional modules to help make sure students see the best way to approach them)...

That's correct, we partnered with WSP for almost a decade (and BIWS before that)! I think they both (and several others) offer a great program, we just thought there were ways to improve upon them. This is a separate package entirely.

It's probably first easier to say how we are similar:

What is different in the WSO package:

The instructors were selected based on specific niche expertise to make sure real world context was included across all of the lessons. In the other packages, often there is just 1 teacher (the CEO) across all (or most) of the courses -- LBO or M&A courses, for example, taught by somene that never worked in private equity or M&A and/or has been out of the industry for a while. We think this matters.

The delivery of the courses is very different. We thought we could significantly improve the way the courses were delivered to help increase student engagement/retention including:

No more long boring lessons = all microlessons, each with its own distinct learning outcome (well researched to help with retention)

Gamification (bananas!) to work toward real-life rewards (real incentive).

High-quality post-production on every video to help you focus on critical concepts and stay alert

Max the monkey! Alongside our expert instructors, Max will make the lessons a lot more fun

Hopefully that makes things more clear... Thank you for the questions! Patrick

Great question. The PE Interview Course has 9 LBO modeling tests and a long section on LBOs in the PDF textbook that comes along with the course, but it is much more focused on reps and acing these tests in an interview context rather than developing the full-blown LBO modeling skills needed for an associate at a top PE fund.

This is also why in the PE interview course we also have audio recordings we provide of actual PE pros walking through previous deals in the context of a PE interview (with cheat sheet templates we provided them and you can use).

While the LBO modeling tests are great for landing the job, they do not have detailed dives on 1) how to deal with 2017 Tax reform in a modeling context 2) how you would model in a dynamic dividend recap 3) how you would model a roll-up strategy dynamicly with add-on acquisitions... The LBO Modeling course does all of those (+more) and also goes into a lot more depth on LBOs from a *modeling* context (theory as well, of course) -- it is simply a badass course and one that covers more than any other LBO modeling course out there (the benefit of spending $$$ and hiring several top private equity professionals to help develop it :-)

Hopefully that helps! Thank you for the question.

Patrick

For those of you that have been trying to purchase today, of course because of Murphy's Law, Paypal limited our account earlier today (we really need to switch payment processors)...I think because of the higher volume of new purchases at a new price point. (so dumb)

Anyways, we are back OPEN FOR BUSINESS. :-)

-Patrick

Thanks for considering! Patrick

Congratulations on the new addition to the platform. My uni ends in the beginning of July and starts again in September. I was hoping to smash out a modeling course over the summer. Do you perhaps know when in August the M&A and DCF modeling course are released? (Beginning, mid or end.)

I don't want to promise early Aug because I think it's a bit optimistic (even though we're aiming for that we don't want to rush the process). It is more likely mid or late Aug, although we may end up releasing version 1 of the videos for Valuation, M&A and DCF (before a lot of the animation and post production work is finished) into the LMS to help with timelines.

This way, students in a rush can start those as the final editing and details are added over the following 2-3 weeks. Valuation will definitely be the next one released since its being recorded now (I think early-mid July release), but the exact timing of M&A and DCF (as well as PPT and Real Estate) are a bit harder to predict.

Thanks for the question! Patrick

Hi SmallEyedMonkey -- Our course bundle includes a very foundational Excel course so I would think that if you have less experience (in M&A or modeling in general), ours might be a good fit for you.

In my response to LDNFinance above, I outlined how we are similar and how we are different to other financial modeling packages out there so you can get a better feel of what we tried to improve upon compared to what is out there already.

I hope that is helpful. Whatever you choose, good luck! Patrick

If you are looking for specific guidance on how to land a job in IB, you are better off likely purchasing the IB interview course. The financial modeling courses are great to also help prep you for interviews, but they are obviously more focused on the actual skill developement (when the function of whether or not you can land an internship is still really much more of who you know = networking and your performance in the interviews).

Yes, none of these "packages" include Accouting or Powerpoint as part of the modeling bundle, however, if you do decide to invest in one of these, I would push you to get one that has Excel as part of the main package since it is so foundational to make sure you are an expert in that program (no matter what finance career you follow). To be honest, given the IB/VC range of outcomes, I think you'd be much better served to try and figure out what you want because those two paths are VERY VERY different. While I think developing these skillsets is incredibly important to succeed on the job, given that you're coming from an MS Finance that I've never heard of, I'd say it's likely much more important you learn how to start meeting 10-20 people per week in these industries, now. If you're already aggressively networking then you can ignore the advice above and yes, I think we'd be a great option for developing your financial modeling skills (just an FYI, there tends to be much less modeling in VC and we will likely be releasing a VC course in the next ~3-4 months as well).Good luck with whatever you decide! Patrick

Hi Patrick, thank you a couple quick questions on the new lbo model being released. - does it include IPO as an exit? - does it include earnout optionality - are there lessons on how to merge balance sheets for add-ons with the platform acq - what about more idiosyncratic toggle features like convertible preferred debt, liquidation preference, warrants and equity co-invests. Will these be included in the model? Thank you

Thanks for the questions.

Does it include IPO as an exit?The assumptions of a sale at exit in functionally very similar...either way shareholders are cashing out, so I'm not sure what additional value that brings the student to assume it is an IPO.

does it include earnout optionality No, although we do plan on adding a discussion (and potetially modeling this out as part of our M&A Modeling course) with regard to earnouts. With other rare idiosnycracies, we had to balance length of the course with value. Adding a few additional hours to the course that can distract from the understandings of the core LBO we think could be detrimental. Students and IB professionals should understand earnouts and it may be something we add in as another bonus module, but for now given how long and how detailed the course already was, we decided it's a better fit for M&A.

are there lessons on how to merge balance sheets for add-ons with the platform acq The bonus module with the add on acquisition have flexible toggles based on year, size of acquisition and models out a representative acquisition target which flows into the model in a waterfall structure (based on timing). The balance sheet impact treats it as an asset acquisition as a simplifying assumption since it doesn't make a difference for calculating returns. If you had a specific acquisition with all of the specific balance sheet data, you could replicate the equity purchase price accounting that was done at entry for the LBO (the goal of the roll-up bonus module was more to be able to toggle add-ons and show the impact of buying down your multiple on returns)...

what about more idiosyncratic toggle features like convertible preferred debt, liquidation preference, warrants and equity co-invests. Will these be included in the model? Yes, we have a preferred stock + mezz stock structure (dilutive which we model out) with PIK toggles. There are endless numbers of other structures we could include...for example, we could we have a bonus modules showing the returns and sensitivities with a 2x liquidation preference on the senior debt or preferreds with a base/downside scenario-- I think this is great feedback and something we will strongly consider building out in additional bonus modules....that being said, the current course and what is included will really get you 99% of the knowledge base for a job in private equity.

Like all the WSO courses, we expect to continue investing to improve them over the years to help add more of these wrinkles. We will definitely keep everyone updated as more features are rolled out throughout the rest of this year!

Thanks, Patrick

Thanks for the question D.K.!

This is definitely on the product roadmap and will be released sometime in the next ~3-6 months. If we have a simple certificate of completion it is much easier to implement and something that we could add sooner (and may do that).

However, I think it is more valuable to have a respected certification alongside the financial modeling training packages that tests the students for modeling mastery with an actual proctor so that the "certification" is not just a simple multiple choice exam that someone can keep taking until they pass. (this is obviously a much bigger lift but one I think we can pull off with enough time and I think it's important enough to warrant the investment).

So short answer is yes, it's coming and will be part of the package.

Thanks! Patrick

Hi Aaron - thanks for the questions!

Yes, on top of having multiple "co-instructors" and many of the relevant professionals in our mentor network review the courses in detail, we also ran a very extensive pilot with ~30 beta users going through all of the courses and telling us anything/everything they liked and *, more importantly,* anything they felt was missing or could make the courses better (we plan on doing this for ALL courses).

The feedback was overwhelmingly positive -- many raved about the clarity of instruction and the context the instructors were able to deliver (how things were used on the job)...that being said, they definitely helped us get the platform to the next level before launch including:

1. Close captioning across all lessons to make them more accessible [done]

2. Improved navigation with countdown + autostart at the end of each lesson [done]

3. Speed with pre-load caching system so that the next lesson loads lightening fast after one finishes (this is out for Chrome, coming soon for Safari as well) [done for chrome, coming for Safari]

4. Better lesson labeling for easier navigation [done]

5. Scroll anchoring on left lesson bar for easier navigation within lesson views [done]

....among other small things (all put together they do add up to a major UX improvement)

They also helped us validate the benefits of a lot of interactive exercises and our product roadmap. One of our main priorities in the next few month is to add a lot more short quizzes throughout the courses to just reinforce the learning objectives of each module. (as mentioned above, this is also the precursor to adding a more robust certification that actually means something)

Thanks for listening!Patrick

**Update: All 6 courses in the Elite package are complete!**

Hi Mr. Rogers - thanks for the question. From my response above to FlyingKiwi...

We don't have an exact hour count because several are being recorded right now, but I would expect between ~45-55 hours across the 6 courses (so I'd budget ~70-100hrs to complete and review it properly unless you like watching at 1.5-2x speed which could bring it down).

I'd be careful just looking at total time though because (for example) our LBO modeling course is a similar length to the other courses out there but 1) some are very dated and 2) almost none of them are taught by a professional with private equity experience and thus you see there are some gaps (same issue with M&A course).

Some examples just for LBO include (but not limited to) 1. not showing how 2017 Tax reform should be modeled dynically into an LBO to account for the rule changes through 2023 (pretty major) 2. not showing how to model in dividend recaps dynamically so you can quickly toggle assumptions to different years 3. not including dynamic modeling lessons on add-on acquisitions or roll-up strategies which are fairly common nowadays to "buy down your multiple."... among others...

Also, the Valuation Modeling Course which is now ~90% uploaded into the LMS is by far the most robust Valuation modeling course on the market with a ton of comps spread and detailed discussions on very nuanced adjustments and the rationale behind each and every one (but I think it's not much longer time wise, even at 170+ lessons and counting!).

I hope that is helpful! Patrick

Hi Joshua! Thanks for the kind words.

No specific order, however, I think Excel and FSM would definitely be the first two, followed by Valuation + DCF since those are the more fundamental modeling and valuation courses. LBO and M&A are a bit more advanced so I'd do those last if possible.

ETA on M&A and DCF...I'd expect DCF+ M&A course to have videos in the LMS by end of August...That means final animations + post production work likely by mid/late Sept, but you should be able to dive in before end of August.

Valuation is up but we haven't announced it yet because there is still a lot of work going into it and the videos are still getting edited, coure materials still getting added, etc. No, you will not have to build your own -- specific to that, we'll make sure to get those course materials up by tomorrow EOD for the people that have started that one already.

Thanks, Patrick

I'm happy with the courses so far. They teach the no mouse method, which is nice, and its easy to understand.

Keep up the good work,

A customer

Patrick congratulations on the release. Seriously, you and Tim did an absolutely fantastic job and the quality of content is excellent.

The M&A model needs work, but I am certain you and your team will provide a top-tier M&A course in the near future.

Way to go WSO team.

Exciting new bonus announcement for the Elite package....

On top of the...

We've released and packaged an additional 18 mini-courses that automatically get added to your Courses when you purchase the Elite package ($486 value alone)

On top of this, over the next few months you can also expect:

That being said...pricing is going to bump soon with all of these extra bonuses.

Any questions, fire away!

Patrick