Pick Apart My IB Resume Like a Hostile Takeover - No Mercy

Hey everyone,

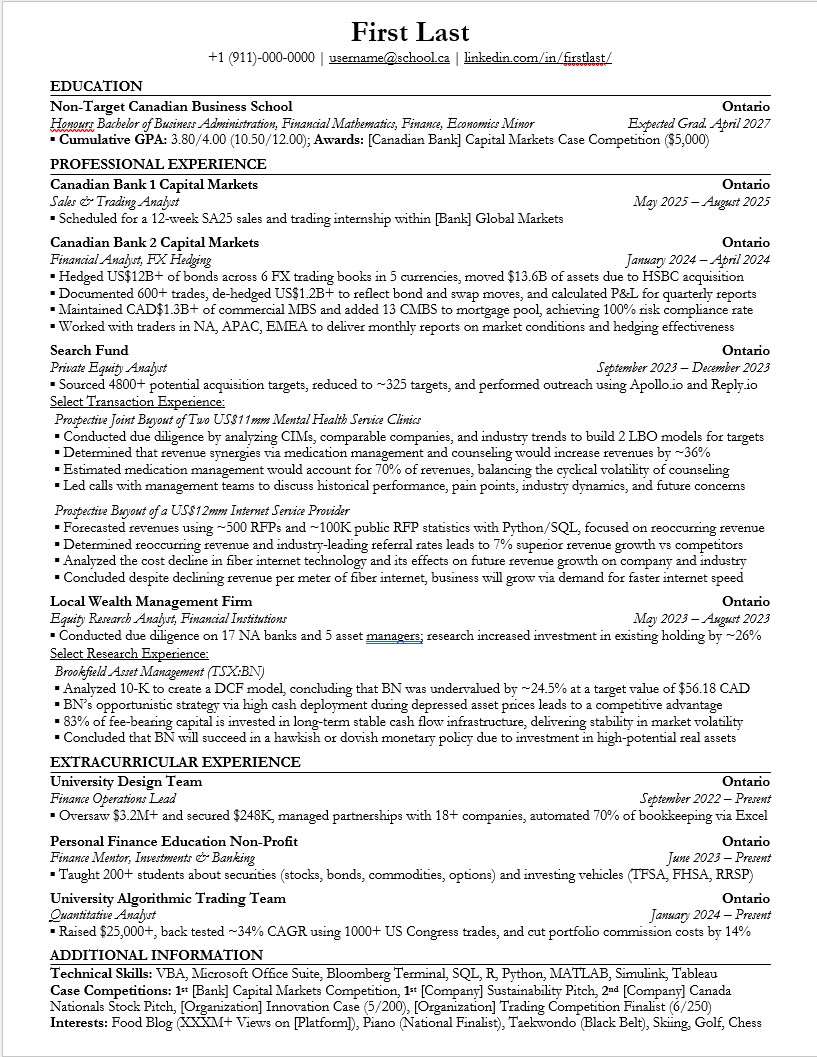

I’m heading into my second year at a non-target as a Finance/Math major in Canada. I'm aiming for an off-cycle IB role for this fall or winter term. I'm trying to make sure my resume is solid as possible before I go out and absolutely go ham on networking and crank out practice models and technicals.

Any slight visual ick, any formatting preferences, any feedback at all would be amazing. Any advice on how to go forward or what you would do in my situation would also be great and very much appreciated

Impressive experience if true…

Maybe add the word “incoming” to the top role just to be clear and it also sounds good

Yeah so long story but switched programs and got set back to first year sequence (grad 27), but credits for a math major- Hoping that having more experience will give me a better chance in recruiting- will put that in thank you!

You give away who canadian bank 2 is in the bullet points, just fyi if you’re really that worried about company anonymity

Yeah I realized that after posting lmao- I already mentioned the company in my post history so it’s fine, thanks for the heads up though

Looks like a strong resume, although take that with a grain of salt since I’m still trying to break in in Canada too… albeit with a less impressive resume.

I’d say just make sure to have a strong story of what led you to want to do IB since you did PE then trading and IB is probably more similar to the former.

got to be laurier

At aut doloremque excepturi ex nisi. Sit consequatur voluptatem numquam. Animi nihil atque dolores nihil. Molestiae commodi quo harum rem sed voluptatem. Nulla dolor ut deleniti rerum ab et. A aut necessitatibus error quis voluptates dolorem.

Nobis quia aut sed aut dolor. Unde aliquid id pariatur iure magnam qui quia explicabo. Animi quo quia atque aut nisi nam fugit. Et libero libero neque.

Accusantium tempore nesciunt mollitia perspiciatis sunt dolorem quos. Explicabo harum totam quas occaecati repellendus. Sit dolorum possimus earum minima velit debitis.

Id doloremque et ea id. Sunt est repudiandae non veritatis consequatur maxime.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...