Fun (debatable) Paper (sorta) LBO problem

Folks,

I am practicing for my up-coming interviews and found this problem on 10xEBITDA. They described the problem under paper LBO section but I do not think I will be able to finish this in 15-20 minutes, hence the title of this post explains my rationale. I hope everyone can chime in and provide inputs for my solution below.

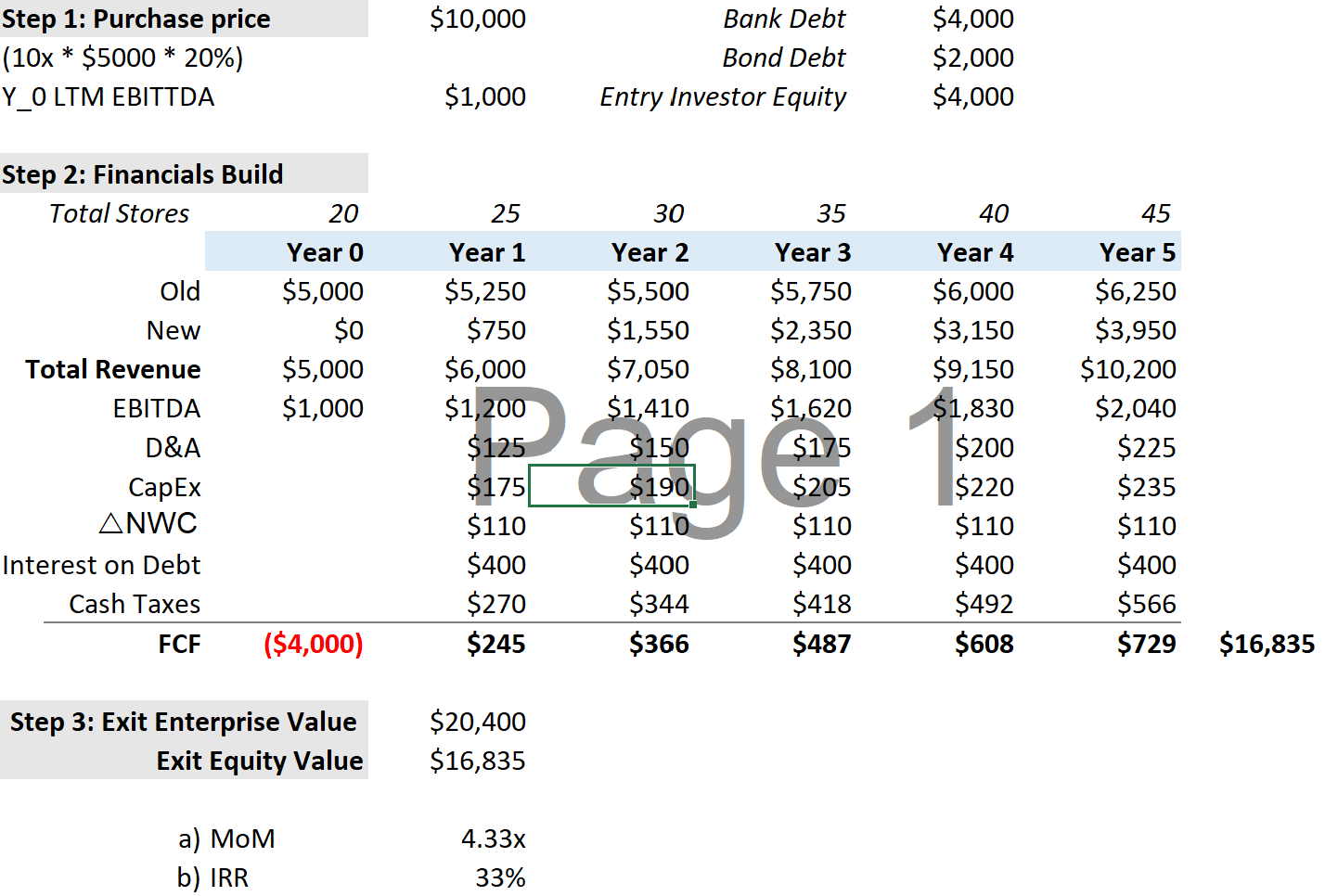

Original Prompt: The company is a retailer with 20 stores and has a Year 0 revenue of $5,000.

Every year, the retailer opens 5 new stores. Opening each new store will require $20 in growth capital expenditures but will add $150 in sales in the first year of operation. Each new stores built after Year 0 grow revenue by $10 every year after the first year. The existing 20 stores’ cumulative revenue grows by a total of $250 every year. All new and existing stores has an EBITDA margin of 20% and need maintenance capex of $3 / store every year. Each store has a D&A of $5.

For maintenance capex and D&A calculations, include impact of new stores from the same year in the count. Changes in working capital is a flat $110 every year. We’re buying the business at the end of Year 0 at 10x LTM EBITDA and financing it with 4x of bank debt @ 5% interest and an additional 2x of bond @ 10%. Assume 40% tax rate. Exit at the end of Year 5 with the same multiple as at entry.

Summary of Assumptions from the Prompt:

1 Y_0 revenue = $5000

Existing Stores = 20

2 a) 5 new stores / year

b) $20 / year growth CapEx

c) Each new store generates $150 first year operation

3 New store revenue growth = $10 / year

4 a) ALL Stores: EBITDA Margin = 20%

b) CapEx = $3 / store / year across the board

5 D&A each store = $5 / year

6 Change NWC = $110 / year

7 Entry Multiple = 10x Y_0 LTM EBITDA = (assuming) Exit Multiple = 10x Y_5 LTM EBITDA

8 Debt Tranches:

a) Bank Debt = 4x Y_0 LTM EBITDA @ 5% interest rate

b) Bond = 2x Y_0 LTM EBITDA @ 10% interest rate

9 Tax rate = 40%

10 5-year holding period

My solution:

Notes:

1) New stores revenue for year 1 = 5x150

2) Revenue for "New" for year 2 = 750 + 5x10 + 5x150

3) CapEx year 1 = 5x20 + 25x3

Please harshly correct me where I am wrong. Thanks!

Sed itaque iure unde in libero iusto. Et et eum nobis cum aut nam. Quibusdam quia blanditiis voluptate fugiat in inventore reiciendis. Aliquam accusamus eum qui aut fugiat pariatur.

Error quis molestias ea eveniet. Assumenda enim magni atque in.

Quasi laboriosam molestiae quia iure in odit. Eum dicta velit explicabo. Animi officiis repellendus excepturi dicta.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...