Rise and Tides

Does anyone have an update as q3 wrapped up on Rise and Tides? Know there’s a big thread on Tides but wanted to start new one to include Rise.

Does anyone have an update as q3 wrapped up on Rise and Tides? Know there’s a big thread on Tides but wanted to start new one to include Rise.

| +52 | Leave brokerage to be GP | 12 | 1d | |

| +46 | New Comp Database - Google Form (Now with Data Validation) | 24 | 1d | |

| +24 | Seeking Career Guidance in Real Estate Development Post-Graduation | 3 | 2d | |

| +23 | Going out on your own | 4 | 1d | |

| +22 | REPE/Development GPA | 15 | 4d | |

| +22 | Spreads over SOFR/UST | 5 | 22s | |

| +21 | Real Estate = complicated + underpaid | 15 | 1d | |

| +17 | Fisher Brothers | 6 | 1d | |

| +17 | MSRE/MSRED with no RE experience; Naive to think I’ll land a job afterwards? | 4 | 5d | |

| +15 | Can you exit from Fund to Asset management or Investment in Real Estate ? | 21 | 4h |

Career Resources

I have nothing to add, but want to tell you that you da real MVP.

It became impossibly hard to track the old thread given how difficult it is to track new posts

Who cares! Many firms are struggling today. Yes. They bought some bad deals, so did many others! Let it go folks.

So you work at rise or tides?

They have no equity in their deals. The fact that you can't understand how this, plus the fact that they clearly don't know how to operate real estate and we're just planning on flipping their assets to someone else to hold the bag, makes them fundamentally different from a struggling shop that is suffering alongside their investors, makes it pretty obvious you work at a syndicator

Some bad deals? They were all crap

Not letting it go until these firms collapse, bud. GL

Bump

Rise does pretty simple capital stacks, 60-65% LTC and tight rate caps for 3 years, no mezz or pref. Coming across them in Texas they do tend to overpay and close in 60 days so brokers love them, and I know they have a few more under contract.

Tides has a good chunk of their portfolio one missed payment away from lender taking control. I would not be surprised if by this time next year, they fall from ~30k unit portfolio to <10K. The crazy thing with Tides is the whole operation is built around flipping. Given their portfolio size they have a very lean corporate staff and only recently have they been hiring trying to build a team that knows how to manage and operate. With their reputation I'd be hard to recruit "A" level talent so this will be interesting to watch.

They have only done simple capital stacks since the market has forced it on them

They are going to lose a lot of investors a lot of money as there 2021 and Q1 and 2 2022 deals were awful. There recent deals are still awful but they are putting more equity in so it just means they probably do not get foreclosed. But no one is making any money on any of their deals anytime soon

LOL - the dream is to have as little money as possible in deals and fee & promote yourself! This is capitalism 101. If you can find a cheap guarantor or low pref, that’s how millions and billions are made! Why do you think family office is better than institutional capital? You are capped on fees (acq and AM) and promote and usually institutions want more of your capital in deals!

Sure, but these aren't institutions or family offices that are getting their equity wiped out. These are unsophisticated middle-class investors who were milked for fees after being promised the dream of retiring early with passive income on social media.

I get that, but people need to be aware. It can't just be oh I'm middle class and unsophisticated someone sold me a dream if I invest $100k I'll insane returns and retire early. Everyone has to do their own due diligence. Also who thinks it's a good idea to plow every last dollar into one investment as well. It's like the Madoff ponzi scheme, people saying they have nothing left after investing everything into one entity like what are you doing.

The more I'm in the industry the more I see how many naive people there are and it candidly surprises me. How is there not a basic level of risk management at the minimum even if you don't understand all the nuances of a deal you're investing in.

Sean? Ryan? Zach? Is that you? lol, The dream is to make a profit with as little money as possible. I see why your firm (Rise or Tides) is failing now...you forgot about the profit part lol

LOL! One day, you will grow up or give all your money to a coGP who adds immaterial value and takes 50 percent of your promote!

OPM is best.

Maybe add Kyle or Brad to the list. 🤠

LOL. Another unscrupulous fraudster rearing their head.

The dream of any actual real estate professional is to have your investors make a ton of money and thus pay you huge promotes, and then have them plow all that into the next deal. The dream of guys at Rise48 or Tides is to buy as many deals as possible, make as many fees as possible, and then leave their investors holding the bag for the absolute shitshow they created through not understanding how to manage assets.

Millions and billions are absolutely not made through this kind of behavior, except in tech. Reputation matters, and no one deal is rich enough to make someone 9 figures of net worth. These syndicators are little better than 3 card monte guys - they'll get a lot of naive rubes to play the game with them, they'll make their fees, and they'll move on - but they'll never create anything of value, because that was never the point.

Hell, two of the best ways to build value in this business, through long term asset appreciation and taking advantage of depreciation, they'll never get the benefit of! I'm sure Sean and Ryan made millions of dollars each in fees - the question is what happens when they need to start paying back lenders to keep the place afloat. Will they do so, and then bring themselves back to square one in a business they couldn't do in the first place? Or bail, and take their $25mm or whatever, and go find something else to do?

I don't even know how you move on today in the age of social media and the internet, everyone know's who you are and that you screwed people but there are also others who don't do that diligence and there's always a comeback story if you treat people well.

They capped soo hard saying they have bail out financing

Fake news!

Truth! If you can crystallize or pref burn off after x number of years, you are in a solid spot! If you have 3-tier pref ending at 18 before 30 or 40 promote. You are not going to make money. You don’t make money on 10% equity in the game. That’s the owner money that can’t be touched. Your salary is based on fees and promote if you work for good folks is how you make money if you are the deal sponsor or associates of the deal team. But I want the LP taking all the risk!!! OPM, read the book!!

Am I missing something here? Is this guy replying to himself and posting it as a new comment?

OPM book as in the Stuytown deal that went horribly wrong?

This was my exact thought. Literally the worst example I could think of in a case where a Sponsor made bad decisions that still impact them today, some 15 years later. They still have difficult raising capital from United States LPs because of the bridges burned and they're a blue chip operator.

I've been actively posting on the Tides thread recently about their immanent failures. Long and the short of it is here:

- They are delinquent of a few Readycap loans. Those notes are being actively shopped by the traditional note brokers in NYC, but are still holding out for 97-100% of par. Values are closer to 65-70% of par so TBD on who scoops them up.

- MF1 in deep deep caca with them, had to do a few mods to get them through (or just to) Q1 2024. Mostly structured them as accrual pieces. MF1 doesn't really care to take them back because berkshire, but also a bunch of other issuance related reasons why they mod'd those loans. Tides now has senior loan that have accrual pieces in front of pref loans with accrual pieces that are PG'd and no more reserves. That's soon to be done-zo.

- All their loans are in servicing pretty much (link below), and their Equity (AMC and MCP) are both running around trying to hold back as long as they can.

https://crenews.com/2023/10/19/9-loans-totaling-299-8mln-against-tides-…

Rise is Tides 2.0, so assuming they'll fall just after Tides, but haven't heard of them being as illegal and dirty as Tides has been in their operations so not sure where they stand.

I'm going to keep posting about Tides loans and work outs etc. on the other forum as it becomes more public and I know that thread is the one that the Real Deal folks follow for updates. A few other non public info is still in the works, and everyone of the sharks I know who have cash ready to put out for their notes are just waiting for them to hemorrhage a bit more and then its going to be a feeding frenzy.

I heard a syndicator who has 7-10 properties in Phoenix (mainly purchased in 2021/2022) missed their October mortgages across the portfolio.

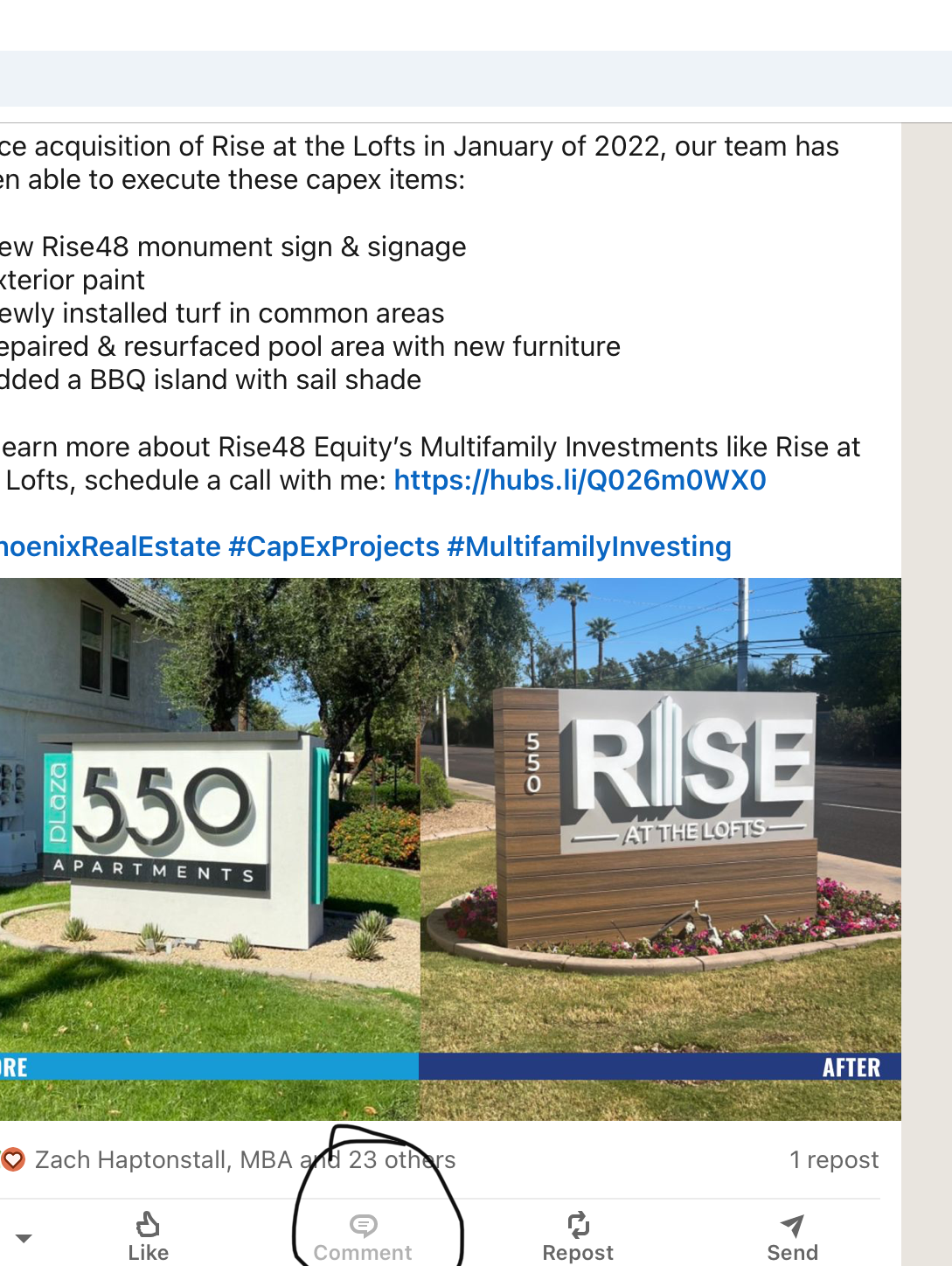

Interesting - looks like the Rise pumper executives have disabled comments in their LinkedIn posts :

They've slowly started getting more questions on posts asking about things going wrong so checks out they want to nip that.

I recently reviewed a Rise recap pref opportunity for all of 30 seconds before I killed it.

The highlights were as follows:

I've seen several Tides and Rise deals all with a similar profile over the last 9 months. However, I have also seen deals from both groups that they'll be able to get out of and were competitive. Those deals however (at least for Tides) had true institutional JVs (think groups with $50B+ AUM). Granted, the deals that look okay on paper are far outweighed by deals with the profile i described above.

That's to say, both groups have a ton of garbage in their portfolio they only get out of if the Fed cuts rates back to 0 without crashing the economy and sucking whatever liquidity is left in this illiquid market out of it.

Tides has to be done soon

Knowing these guys if everything looks good at the senior level, then there is definitely garbage pref/side letters in there silently killing the deal.

They don't disclose the subordinate shit to their investors, even their "institutional" equity, because the way they see it is it's all PG'd by them and no claims on the property so not necessary. Of course that's a false narrative because of the claims of cash flow etc. but there isn't a single deal they are holding onto that isn't underwater.

So they are going to have to make their first capital call ever? Don’t they have a couple of December maturities coming up? I thought I saw something from a recent MSCI spreadsheet that also labeled the properties as potentially distressed.

-

25 of their 29 phoenix deals are under 90 percent occupied and have been for year according to costar. Thats massive shortfalls.

Has to be Rise Midtown

That is correct, how'd you know?

I used to think Zach was just a dumb guy who has no clue what he is doing but who is basically a well meaning, earnest guy. However, given his wildly deceptive video response and media interviews, I think he is a bad guy who knows exactly what he is doing and could care less about his investors

How is Rise still buying deals? Saw they closed a deal last week

That’s insane

Who is dumb enough to give them money

For every snake oil seller, there's a snake oil buyer.

It's sad but true, there's a lot of investors about to get screwed.

Here's a weird observation, but have you noticed all Rise's candid videos they post on LinkedIn about them explaining something to their computer (which I suspect is bullshit), those computers are Macs?

I could be off, but who uses Macs in this industry? Excel is so much harder to use on a Mac, as well as really anything that needs to be done. I'm sure they have a few analysts doing the lifts on PCs, but just odd because presumably they should be reviewing the models, etc.

Just an observation.

Excel isn't really any harder these days on a Mac, and I'm admittedly a fan, but yeah no one uses a Mac in real estate.

Students make more complicated pro formas in their 1 hour case study than what they work with so it doesn't really matter between mac/pc

https://therealdeal.com/national/2023/11/06/tides-equities-late-on-150m…

--

Has the rise pref raise been reported on or is that just what JLL has started talking to potential investors about?

I would not take that deal.

I know the JLL broker, not super well, but have gone to him for advice here and there in the past. I know there's a few bro brokers that have done a lot of repeat business with Tides but not sure how I feel about facilitating transactions with poor stewards of capital... I mean, these guys are doing their jobs (exceptionally well), but feels *just* a tad bit dirty

Hearing Rise has some December maturities coming up. Interested to see if they are gonna extend

Which ones? I haven’t seen any maturities until summer.

Will check the MSCI spreadsheet I was sent and revert back.

Tides had a maturity last week from Argentic, went to SS last month with a dscr of 0.74x and a 79% occupancy. Not sure what they are doing about that, but doesn't sound like an extension option or refi option is in the cards...

Tides on Duneville is the property

Ya I can see Tides having maturities already from their 2020 purchases but Rise48 didn’t really get started until Q2 2021. Excellent market timers, prepare to see the worst sponsor performance in the history of CRE.

https://therealdeal.com/national/2023/11/14/multifamily-syndicator-rise…

Can he get in trouble for misleading investors on this stuff? It seems like the pitch decks on his recent purchases should have had a disclaimer about his other deals going bad.

Ah yes, the "We will likely lose 100% of our existing portfolio" disclosure. Not sure there is a disclosure for it but it can certainly be considered fraud to communicate everything is fine when the entire portfolio is in distress.

It was only a matter of time….

While I’m not shocked, I’m saddened that they stooped that low. Here they are sitting on the precipice of a massive, career-altering disaster, and they have the audacity to tell unsophisticated folks “how to raise and manage capital”. Not only that, but one of the “benefits” of their highest-tier class is “preferential 90/10 splits on Rise48 deals”.

I’m sure in their minds it’s just more fee income to bilk people out of…and potentially more equity coming in the door.

As much as I love the multifamily industry and a lot of the people in it, I can’t fucking stand this “LinkedIn influencer/syndicator” model that is so rampant these days. Unless you’re an absolute superstar, it takes years to develop the skills to effectively manage operations and capital. Halfway timing a market cycle (before losing everything) doesn’t make you an expert, it makes you a degenerate gambler (with OPM) at best…

He knows how to raise the money, he just doesn’t know how to keep the money

Wow this is bad, wtf are the guys doing!?

I feel gross just looking at their website.

I don't know if it's a graphics quirk on WSO or if this is the way it looks on their site, but I have to admit I'm laughing my ass off at the idea that they couldn't even get "Fundamental" right, and it reals "Fundament Al"

Aut itaque perspiciatis ea voluptas deleniti. Aut alias voluptatum in et totam in eaque culpa. Cumque qui nam inventore et. Qui magnam qui magnam est sed.

Earum praesentium temporibus velit est molestiae autem. Cupiditate est reiciendis placeat aut aliquam dicta expedita. Et atque voluptatibus impedit distinctio voluptas velit.

Placeat pariatur minus velit et. Molestias quia voluptatem in ea voluptatem voluptatem ex. Maxime amet distinctio quam odio maxime libero tempore. Blanditiis nostrum doloremque quaerat repellat consequatur repellendus perspiciatis sit.

Molestias ea neque rerum consequatur dolor aut. Soluta magni eum atque rerum architecto ea. Ut vero inventore ab accusamus aut id pariatur.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Enim qui sed non est. Facere doloribus optio voluptas provident labore quia. Doloribus culpa blanditiis est rerum et velit. Eum beatae consequatur deserunt repudiandae. Ut velit dolores aliquid voluptate.

Accusantium sed enim perspiciatis. Dicta voluptatem corrupti ut porro ipsum in. Dolor in officia fugit perspiciatis eius in. Temporibus et minus officia debitis.

Harum et earum mollitia labore aperiam qui ducimus explicabo. Ratione ullam culpa rerum quo repellendus nihil atque. Omnis in numquam dolorum similique laborum. Asperiores autem et architecto sint autem facilis quia. Officiis velit sequi impedit ut possimus et voluptates. Commodi natus voluptatum aliquam repudiandae. Iusto et aperiam nobis.

Et sunt temporibus est doloribus quasi quos. Dicta inventore aut sapiente dignissimos. Doloribus eos quidem eos blanditiis quia.