Bloomberg Terminal

A computer software system that allows individuals to monitor and analyze real-time financial market data and place trades on their electronic trading platform

What Is a Bloomberg Terminal?

The Bloomberg Terminal is a computer software system that allows individuals to monitor and analyze real-time financial market data and place trades on their electronic trading platform.

The Terminal is provided by Bloomberg L.P., a financial software, data, and media company headquartered in New York City.

Michael Bloomberg founded Bloomberg L.P. in 1981, and the Bloomberg Terminal was introduced in 1983. Today, Bloomberg L.P. is a global company operating in over 170 countries and employs over 20,000 people.

The Bloomberg Terminal gives users access to financial data and tools, including but not limited to

- Real-time pricing and trading information for securities: stocks, bonds, currencies, and commodities.

- News and analysis of financial markets and instruments: economic indicators, company earnings, and industry trends.

- Proprietary data and tools: the Bloomberg Professional service offers a range of analytics and risk management tools.

- Messaging and collaboration tools: users can communicate with each other and clients through the Terminal.

- Other applications: tools for portfolio management, risk analysis, and compliance.

Key Takeaways

- The Bloomberg Terminal is a comprehensive computer software system providing real-time financial market data, analytics, and trading capabilities.

- Primarily utilized by financial services professionals, the Terminal's user base extends to journalists, researchers, and others needing high-quality financial information.

- Users can subscribe directly or access the Terminal through public facilities like libraries and universities.

- The Terminal comprises four panels with a toolbar, command line, and function area, facilitating multitasking and efficient work.

- The Terminal's low churn rate is attributed to its exclusive user base, with around 325,000 elite users who consider it a valuable tool worth more than its annual subscription cost.

Who Uses Bloomberg Terminal?

The Terminal is used primarily by professionals in the financial services industry - investment banks, asset management firms, hedge funds, and other financial firms. However, government agencies, consulting firms, and other organizations also use it.

Besides financial professionals, the Terminal is also used by journalists, researchers, and other individuals who need financial information.

Hence, anyone who needs to access high-quality financial data, news, and analysis can - and is using - the Terminal.

The cost of the Terminal subscription varies depending on the level of service and the specific features and tools an individual wants.

According to Bloomberg, the standard Terminal subscription includes real-time market data, news and analytics, access to the Bloomberg Professional service, messaging and collaboration tools, and extras.

Bloomberg does not publicly disclose the specific cost of the Terminal subscription, but many people share that it’s very expensive, estimated at around $24,000 annually.

How to Use The Bloomberg Terminal

Let’s go over the installation, basics, and navigation of the Bloomberg Terminal. Users must first subscribe to the service and install the Terminal software on their computer or terminal device to use the Terminal.

There are two ways to subscribe to the Bloomberg service:

1. Subscribe directly

You can do so by contacting Bloomberg, which has a representative to communicate with you about your needs. You will then be transferred to the sales team, who will work with you to change the pricing and terms of the contract according to your needs.

2. Accessing through the public facility

Many large public libraries and universities have access to the Terminal. So if you are close to such libraries or a student at a large university, you use the Terminal for free (or at a low cost). However, the downside is you cannot customize the system like you can if you subscribed directly.

Once a user gains access to the Terminal, they can log in using a unique username and password.

Typically, the outline for using the Terminal is as follows:

- Familiarize yourself with the Terminal interface and navigation:

The Terminal has a menu-driven interface, with various tools and features organized into different categories. - Access financial market data and news:

You can use specific "ticker symbols" to look up specific securities or use the Terminal's search function to find information on specific companies or markets. - Use the Terminal's analytics and risk management tools:

The Terminal provides various tools for analyzing financial data, such as charting and technical analysis tools, and tools for managing risk, such as portfolio analysis and stress testing tools. - Place trades on the trading platform:

The Terminal includes a fully integrated electronic trading platform that allows users to place trades on various financial instruments. - Customize the Terminal:

You can customize the Terminal by setting up alerts, creating custom workspaces and dashboards, and integrating the Terminal with other systems and tools.

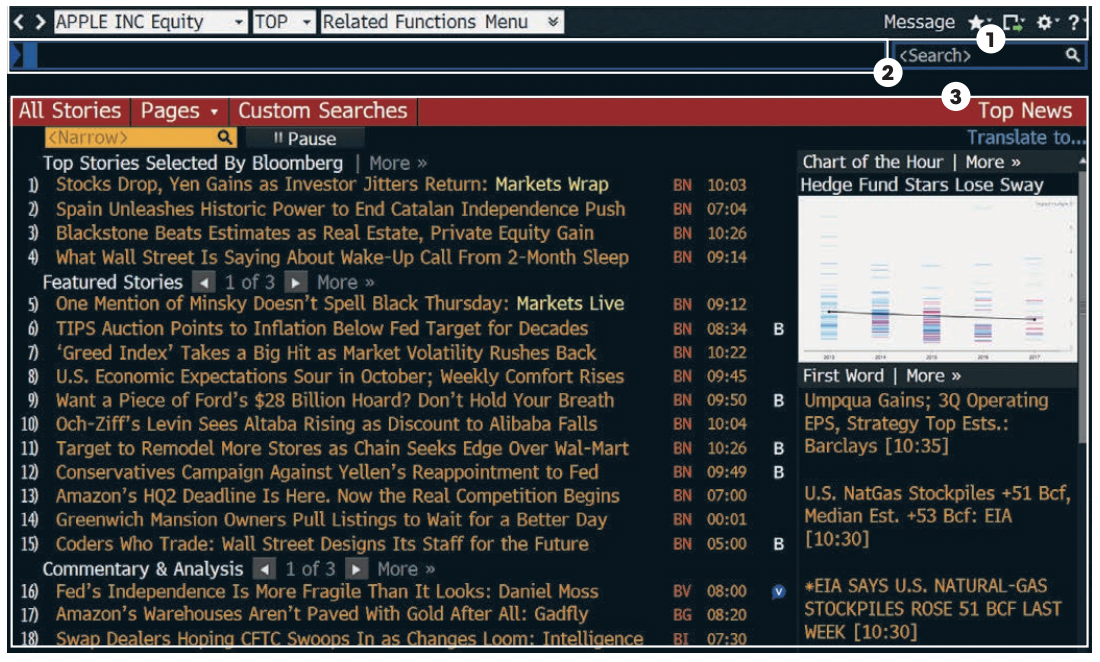

Bloomberg Panels and Functions

When you first log into the Terminal, four panels will appear. These panels are independent “workspaces” that allow you to multitask with the Terminal system, enabling you to work with multiple functions simultaneously.

Each panel is divided into three main sections:

1. Toolbar

The toolbar is the horizontal section at the very top of the panel. The toolbar's left side includes the following:

- A menu tab

- A recent tab (list of recently loaded securities)

- A current tab (list of currently loaded securities).

The right side includes tabs that perform key tasks, such as exporting data, viewing favorite places, accessing the Help menu, and adjusting defaults.

2. Command line

Right under the toolbar, you can enter commands for functions and securities. The command line acts as a search bar where you can perform keyword searches for securities and functions.

3. Function area

The rest of the panel is where you see the actual function content.

Navigating Content

Now that you know what the Terminal roughly looks like, let’s talk about its functions.

In this context, functions simply mean Bloomberg applications that provide analysis and information. You can access these functions by entering each function’s unique mnemonic.

NOTE

A Mnemonic is a device (letters, idea, associations, etc.) that assist one in remembering something. In the Terminal, Mnemonic is a short name for the function.

The Terminal has two functions:

- Non-security: functions that provide information and analyze the entire market sector.

- Security-specific: functions that analyze a chosen security

To run a function, enter the function mnemonic into the command line. The function will then show up on the Bloomberg panel.

If you don’t know the mnemonic, enter the keyword for the information or functionality you want. The command line will autocomplete the keyword with a list of suggested functions.

Once you get a hold of Bloomberg’s autocomplete search, you have the foundation of the Terminal.

Let’s move on to content you’ll likely see during your navigation journey.

Real-time data is crucial to the financial industry because it can easily change how people behave and therefore change how they do business.

This makes the Terminal a very popular and efficient tool because it can collect a substantial amount of real-time data and organize it into one place, allowing users to conduct research more easily.

When you think of real-time financial information, you probably think of stocks or securities. That is true! This portion of real-time data offered in the Terminal is very crucial. However, there are other real-time data crucial to know for a good financial professional.

So besides monitoring individual stocks, securities, etc., common screens users will see are

- News

You can view the top news stories of the day, which are constantly being updated. Users also have the option to filter news stories by asset class, demographics, or topics. - Market Monitor

You can access several market monitors covering various asset classes and market sectors. - Economics forecasts and releases

You have a list of upcoming economic data releases and consensus forecasts of what economists of major banks and brokerages are predicting, including economic data from countries in addition to the United States. - Equities

You can search for publicly traded equity by name, exchange location, country, and other filters. You can compare and contrast equities, producing a comparative analysis including the fundamentals, historical ratios, and charting. - Foreign Exchange

You can view current exchange rates for various currencies in real-time, compare curves for most currency pairs, and rate details for specific currencies. So, you never know what surprise you’ll see out of your country.

The Bloomberg Keyboard

The Bloomberg Keyboard is a physical keyboard designed specifically to be used with the Bloomberg Terminal.

The Keyboard looks exactly like an everyday keyboard, except it has additional buttons and functions specific to the Terminal - like shortcuts.

The buttons have shortcuts like jumping to the real-time market data and news page or navigating through different screens and/or terminals. It also includes a numeric keypad and a set of function keys that can access additional Terminal features and tools.

The goal of the Keyboard is to make it easier for users to access and navigate the Terminal.

NOTE

However, owning the Keyboard is not required, but it makes your life a lot easier since it’s more convenient and efficient to use the Terminal's various features and functions.

For example, if you want to look up Tesla’s stock, you can click on a key on the Keyboard instead of navigating through the interface - saving you time and energy.

This is why many professionals choose to use the Keyboard because there's so much content in the Terminal, so having a gadget would make it easier to navigate.

In conclusion, professionals consider the Bloomberg keyboard convenient because

- Customized functions

The Keyboard includes buttons for accessing common Terminal functions, such as real-time market data and news, and navigating through different screens and menus within the Terminal. - Efficiency

Having a range of buttons and functions specific to the Terminal can make it more efficient for users to access and use the Terminal's various features and functions. - Enhanced productivity

By streamlining access to common Terminal functions and making it easier to navigate the Terminal, the Keyboard can help users be more productive when using it.

Why the Bloomberg Terminal is Successful

The Terminal provides quality real-time data to its users, but what makes the Bloomberg Terminal stay at the top and out-compete everyone trying to do the same?

Bloomberg is one of the best software companies, providing exceptional customer service that allows them to keep their customers loyal. The Terminal as a product is great, as it provides professionals with a unique service.

Another reason the Terminal is a great product for Bloomberg is that the Terminal has low churn.

It has low churn because the Terminal’s messaging function (which allows communication among users) transforms it into an elite group of about 325,000 users whose employers think they are worth more than $25,000 plus their yearly salary.

NOTE

Churn is a rate of the percentage of accounts that choose not to renew their subscriptions.

Bloomberg knows their target market. They want to be an important product to a small number of people rather than a handy extra for many people.

So instead of making the Terminal an accessible application for all people to access for a lower price, Bloomberg made the Terminal a very luxurious application for an exclusive number of people.

By doing so, Bloomberg can focus on retaining those users, which allows them to identify and develop areas of improvement more easily. Moreover, once those users are used to the application, Bloomberg won’t have to worry about losing those customers.

or Want to Sign up with your social account?