FX Rates – Currencies

It represent the relative value of one currency compared to another.

What are FX Rates Currencies?

Foreign Exchange (FX) rates, often referred to as forex rates, represent the prices at which one currency can be exchanged for another. These rates fluctuate daily when the FX market is open, driven by various factors, including economic data, political events, and investor sentiment.

FX rates represent the relative value of one currency compared to another. They are a crucial aspect of international finance and commerce.

Currencies are represented by three-letter codes and symbols. For example, USD represents the United States Dollar, EUR represents the Euro, GBP represents the British Pound Sterling, and JPY represents the Japanese Yen. Symbols are often used in financial markets to denote currencies, such as $ for the U.S. Dollar or € for the Euro.

FX rates are prices discovered in the world's largest financial market, where trillions of dollars are traded daily. These are impacted both by domestic value and foreign economic conditions.

Movements in FX rates are primarily driven by the forces of supply and demand, which, in turn, are influenced by the economic activities within a country.

FX rate movements affect businesses by changing the cost of supplies purchased from a different country and changing the demand for their products from foreign customers.

Key Takeaways

- FX rates show how much one currency is worth in terms of another currency. For example, if the EUR/USD rate is 1.20, one Euro equals 1.20 US Dollars.

- FX rates are quoted in currency pairs, such as EUR/USD, GBP/JPY, or AUD/JPY. The first currency in the pair is the base currency, and the second is the quote currency.

- The rate tells you how much of the quoted currency you need to buy one unit of the base currency.

- FX rates are influenced by various factors, including interest rates, inflation, economic stability, political events, and market speculation.

- Supply and demand in the forex market significantly affect rate fluctuations.

- When a currency's value increases in relation to another currency, it's said to appreciate. Conversely, if it decreases in value, it's depreciating.

Understanding FX Rates

FX rates are determined by economic activity, interest rates, and other economic data, such as the inflation report. Each economic data has its own effects on the currency.

FX Rates are used by businesses, investors, and governments to buy and sell currencies. Businesses use it to conduct international trade, investors use it to speculate on future currency movements, and governments use it to manage their currency reserves.

When the value of a currency increases, it means that the currency is becoming more valuable. This can make imports cheaper and exports more expensive. Strong currencies also tend to attract foreign investors by putting their money in the banks for strong returns on their investments.

Conversely, when a currency devalues, it becomes cheaper, boosting exports and stimulating economic growth. Cheap currencies can attract foreign capital that can be used in the stock market.

Expressing FX rates

To understand FX rates, they are expressed in 2 ways:

- Direct quotation: Direct quotation, as in the EUR/USD pair, means that the quote is expressed using the base currency, which is the first one. This means 1 Euro can be exchanged for 1.07 US Dollars (Latest price).

- Indirect quotation: It displays the value of the domestic currency in foreign currency terms. For example, USD/JPY pair. This means that 146 Yen can be exchanged for 1 US Dollar. (Latest price).

Since the US dollar is the most dominant currency, the exchange rates are expressed against the US dollar. However, the exchange rates can also be quoted against other countries’ currencies, which is called cross currency.

Types of exchange rate systems

Understanding different exchange rate systems is essential for businesses and investors operating in the global marketplace, as they can profoundly impact currency values and trade dynamics.

Each system has advantages and disadvantages, and governments often select the one that aligns with their economic goals and circumstances.

The four types of exchange rate systems are:

- Freely floating exchange rates

Freely floating exchange rates are the most common type of exchange rate system. In a freely floating system, the value of a currency is determined by supply and demand in the foreign exchange market. - Fixed exchange rates

In a fixed exchange rate, the value of a currency is pegged to another currency or a basket of currencies. The central bank, with the fixed exchange rate, intervenes in the FX market to keep the value of the currency within a narrow band. - Pegged exchange rates

This is a variant of the fixed exchange rate system where the value of a currency is pegged to another specific currency. The central bank managing the pegged exchange rate may allow the currency's value to fluctuate within a predefined range. - Managed float exchange rate

In a managed float exchange rate system, the currency's value is allowed to float in response to market forces, but the central bank intervenes strategically in the foreign exchange market to stabilize and smooth out excessive fluctuations in the currency's value.

Types of Currency Markets

Major and minor currencies are terms used in the foreign exchange (forex) market to classify currencies based on their level of liquidity, trading volume, and overall importance in the global financial system. These classifications can help traders and investors understand the currency market dynamics.

Both categories have unique roles and considerations in international finance and trade, and investors and businesses often balance their portfolios with a mix of major and emerging currencies based on their specific objectives and risk tolerance.

Here's an explanation of both major and minor currencies:

1. Major Currencies

Major currencies are the most tradable currencies in the world and the most liquid currencies. They play a major role in the financial markets. The best known are the US dollar, Japanese Yen, Euro, and the British Pound.

Major currencies represent the most powerful economies in the world. They are also known as the G10 Currencies. These currencies are associated with stable, developed economies and have a central role in the global financial system.

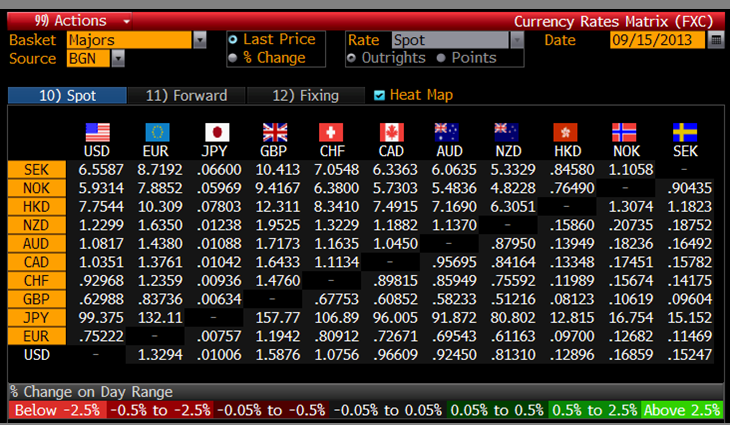

Here’s the list of the major currencies:

| Symbol | Currency Name |

|---|---|

| USD | US Dollar |

| JPY | Japanese Yen |

| EUR | Euro |

| GBP | British Pound |

| CHF | Swiss Franc |

| NOK | Norwegian Krone |

| SEK | Swedish Krona |

| AUD | Australian Dollar |

| NZD | New Zealand Dollar |

| CAD | Canadian Dollar |

2. Emerging Currencies

Emerging market currencies are currencies of developing countries that are progressively becoming more integrated into the global markets. Emerging markets constitute nations that are likely to become more developed in the near future and are characterized by higher volatility and risk.

Emerging markets are nations that are on the move that are transitioning from low income and less developed to higher standards of living and more industrialized. The main countries are Brazil, Russia, India, China, and South Africa. They are also known as BRICS.

Here’s the list of the emerging currencies:

| Symbol | Currency Name |

|---|---|

| BRL | Brazilian Real |

| CNY | Chinese Renminbi (Yuan) |

| RUB | Russian Ruble |

| INR | Indian Rupee |

| ZAR | South African Rand |

| SGD | Singapore Dollar |

| MXN | Mexican Peso |

| TRY | Turkish Lira |

| IDR | Indonesian Rupiah |

| PLN | Polish Zloty |

Emerging currencies may not be as liquid as major currencies. They have higher bid/ask spreads than the major ones because they are not active as the major currencies.

FX rates transactions

Currency trading doesn't occur in a specific physical location or building; it takes place around the clock, allowing for continuous global transactions.

- Spot market

The market for immediate exchange is known as the spot market. Here, any customer can go to any exchange and trade their currencies, and same goes for institutional and retail traders. - Forward market

The forward market enables a multinational corporation to lock in the exchange rate at which it will buy or sell a certain quantity of currency on a specified future date.

Hundreds of banks facilitate foreign exchange transactions, though the top 20 handles about 50% of the transactions. At any point in time, arbitrage ensures that exchange rates are similar across banks.

Note

Trading between banks occurs in the interbank market. Within this market, foreign exchange brokerage firms sometimes act as middlemen/intermediaries. Banks also provide FX services for a fee, which is the bid/ask spread where the bank’s bid (buy) quote for a foreign currency will be less than its ask (sell) quote.

Major players in the FX market

The influence of the players in the FX market has changed over the years. The most important players in the FX markets were importers and exporters of goods, trading currencies through banks. International trade was thus the primary driver of supply and demand for currencies.

Trade continues to directly impact FX rates through commerce and indirectly through market reactions to economic data releases.

The main driver behind the transition to a market dominated by investors was the search for profitable investment opportunities across foreign countries. For example, a British investor buying equities in the US takes on currency risk by holding shares in US dollars.

Here are the major players that affect FX rates:

- Commercial and investment banks

Institutions such as JP Morgan, Goldman Sachs, and more operate in currency transactions for their clients, provide liquidity and engage in speculative trading for profit. - Central Banks

Entities like the Federal Reserve and the Bank of Japan play a critical role by executing monetary policies that influence interest rates and money supply, which affect FX rates. They also intervene in the market to stabilize their currency’s value. - Multinational corporations

These corporations participate because they need to conduct international business and manage currency risk. They also operate in the FX market to convert revenues from foreign operations and use forward contracts and other derivatives to hedge against risk. - Hedge funds

Hedge funds are speculative investors that operate in the FX market. They use various trading strategies, including trend following, carry trading, and arbitrage. Hedge funds can also impact currency prices because of their large capital pools. - Retail Traders

Individual traders and investors who participate in the forex market through online brokers are retail traders. While their individual trades may be relatively small, the collective retail trading volume is significant. - Non-bank financial institutions

Entities like pension funds and insurance companies use FX markets to hedge currency risk associated with their investments or conduct currency trading for profit. - Governments

Governments, particularly those with sovereign wealth funds, engage in forex trading to manage foreign exchange reserves. These entities participate in the market to invest excess funds or to stabilize their currency's value.

Every day, trillions of dollars in currencies change hands in an interbank market, in which electronic trading platforms link currency traders from banks across the world. Thanks to global cooperation among currency traders, FX markets are open 24 hours daily.

At the end of each business day in Asia, traders pass their open currency positions to their colleagues in Europe, who at the end of their business day pass their open positions to U.S. traders, who then pass positions back to Asia at the end of their business day.

Fundamentals that affect FX rates

FX rates become more volatile when fundamentals come into play. The fundamentals of FX rates are the economic factors that affect the value of a currency.

These factors include:

- Interest rates: Higher interest rates in a country can attract foreign capital, leading to an increased demand for the currency and, subsequently, an appreciation in its value.

- Economic indicators: Strong economic data, such as GDP, jobs report, inflation, and trade balance, can influence FX rates. Favorable economic indicators tend to strengthen a currency.

- Political stability: Countries with stable political conditions typically have stronger currencies. Uncertainty or political instability can lead to a depreciation of a nation's currency.

- Market sentiment: Traders’ and investors’ perceptions and expectations can influence short-term FX rate movements. Market sentiment often responds to economic news, geopolitical events, and other factors.

- Central bank actions: Banks can impact exchange rates through monetary policies. Decisions regarding interest rates, as well as interventions in the FX market, can have a profound effect on a currency's value.

Conclusion

FX rates are the prices at which one currency can be exchanged for another. They are constantly fluctuating and are affected by a variety of factors, including economic, political, and speculative.

The fundamentals of FX rates are the economic factors that affect the value of a currency. These factors include interest rates, inflation, economic growth, trade balance, and political stability.

FX rates are important for businesses and individuals who engage in international trade or investment. They can also have a significant impact on the economies of countries. The foreign exchange market is the largest financial market in the world, with trillions of dollars traded daily.

FX rates are complex and can be difficult to predict. However, by understanding the fundamentals of FX rates, you can make informed decisions about when to buy or sell currencies.

Researched and authored by Ray Bassil | LinkedIn

Reviewed and edited by Parul Gupta | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?