Types of SEC Filings

Investors and financial professionals use these documents to gather information about the companies they are analyzing to make investment decisions

What Are SEC Filings?

SEC filings are formal documents that publicly traded companies in the United States must submit to the U.S. Securities and Exchange Commission (SEC).

These filings provide essential information about a company's financial performance, business activities, management discussions, risks, executive compensations, ownership structures, and other pertinent details that investors and analysts use to make informed decisions.

The Securities and Exchange Commission (SEC) requires Public corporations, Certain company insiders, and Broker-dealers to file periodic financial statements and other disclosures.

Investors and financial professionals use these documents to gather information about the companies they are analyzing to make investment decisions.

SEC filings are accessible on EDGAR, the SEC's internet database.

The Securities Exchange Act of 1934 (SEA) was enacted to regulate post-issuance securities trading in the secondary market and to increase financial transparency and accuracy while eliminating fraud and manipulation.

The Securities and Exchange Commission (SEC), SEA's regulatory arm, was established by the Securities Exchange Act.

The SEC oversees securities (stocks, bonds, and over-the-counter securities), as well as market conduct and financial professionals such as brokers, dealers, and investment advisers.

It is also in charge of overseeing the financial reports that public corporations are required to file.

The Securities and Exchange Commission (SEC) is a federal independent government body. The fundamental goal of the SEC is to ensure that the legislation against market manipulation is followed.

A) Registration Statements

The statement is divided into two parts:

1. Prospectus

- Anyone interested in purchasing the company's stocks must be given a copy of the prospectus.

- A firm's business operations, financial condition, results of operations, risk factors, management, and other relevant information must be clearly described in the prospectus.

2. Financial Statements

- Financial statements that have been audited must also be included in the prospectus.

- Corporations are not required to offer additional information and certification to investors but are required to submit a prospectus to the Securities and Exchange Commission.

B) Form S-1 is the most basic form for registration statements.

A registration statement can be prepared by any firm using Form S-1.

The SEC's Regulation S-K contains instructions for non-financial disclosures in a registration statement.

Regulation S-X contains information on the format and substance of the required financial statements.

The company must submit any additional information necessary to ensure that its disclosure is not misleading, in addition to the information expressly requested on Form S-1.

Certain smaller corporations and newly public companies are allowed to draft their disclosures under simplified guidelines aimed to make compliance easier under securities laws and SEC rules.

Key Takeaways

- SEC filings are formal documents that publicly traded companies in the United States must submit to the U.S. Securities and Exchange Commission (SEC).

- The Securities Exchange Act of 1934 regulates securities trading and transparency.

- Form S-1 and Form 10-K provide insights into a company's financial performance.

- Form 10-Q offers quarterly updates on a company's financial health.

- Form 8-K and Proxy Statements disclose significant events and shareholder information.

Form 10-K

The SEC requires an annual report that thoroughly reviews a company's financial performance.

Although the information in Form 10-K overlaps with that in the company's annual report, the two papers are not identical.

When a firm holds an annual meeting to elect directors, it must deliver an annual report to shareholders.

Form 10-K includes an overview of the following:

- The company's history

- Organizational structure

- CEO' 's salary

- Equity

- Subsidiaries

- Audited financial statements

Businesses must submit this document within 90 days of the conclusion of their fiscal year.

When a public firm files a Form 10-K, stockholders and potential investors use it once it has been submitted.

They can use the 10-K to learn more about how the company runs and generates revenue.

The document details the company's operations, hazards, and ongoing or pending lawsuits.

What are the components of Form 10-K?

The 10-K form is divided into various sections. These are some of them:

A) Business Overview: Describes the company's operations. It will cover business units, products and services, subsidiaries, markets, regulatory challenges, research and development, competition, and relevant people in great depth.

B) Management Discussion and Analysis: This section allows the corporation to explain its operating and financial results during the previous year.

The financial statements presented are the firm's balance sheet, income statement, and cash flow statement.

C) Add-ons: You can discuss the company's management team and legal actions in the add-ons section.

Why Should Investors Care About Form 10-K?

The SEC mandates all public firms to file 10-Ks annually to provide investors with a picture of the company's financial health and appropriate information before buying or selling the company's securities.

The 10-K may appear unnecessarily complicated, with its many tables of data and figures. However, investors must comprehend a company's finances and prospects precisely because the details are extensive.

Form 10-Q

SEC Form 10-Q is a detailed financial performance report that all public firms must file with the Securities and Exchange Commission every quarter.

Because it is filed quarterly, we can treat the 10-Q form as a shortened version of the 10-K form.

The table depicts the company's continued financial performance over the year.

A Form 10-Q must be filed during the first three quarters of a company's fiscal year. The form must be submitted within 40 days of the end of the quarter.

Unlike statements on Form 10-K, Form 10-Q financial statements are not audited and require less information.

What exactly does Form 10-Q do?

There are various sections to Form 10-Q. These are some of them:

The first section contains financial data. The company's financial statements for the quarter, including financial information. It is, in general, a discussion of management and economic analysis of the company's status.

The second part comprises all additional pertinent information, such as legal processes that occurred during the period, unregistered equity securities sales, and the use of the proceeds.

Why Should Investors Care About Form 10-Q?

The 10-Q is significant because it is updated quarterly, allowing investors to revise their valuation measurements and financial ratios quickly.

Even before the company submits its annual report, investors can utilize the 10-Q to monitor any changes occurring.

Changes in working capital or accounts receivable, variables affecting the firm's inventory, share repurchases, and even any legal threats the company confronts are all prominent investor interests in 10-Q reports.

Investors can also use the 10-Q to compare a company's performance to other companies they have invested in or plan to invest in.

It can help investors make comparisons, determine whether they are correct, and make different decisions based on that information.

This will give you a better understanding of whether your investments are suitable, their flaws, and how you may improve your portfolio.

Form 8-K

A report on an unanticipated major event or change in the firm that could have a material impact on shareholders or the Securities and Exchange Commission is known as an 8-K report (SEC)

Following a significant event such as bankruptcy or the departure of a CEO, public corporations are generally required to publish a current report on Form 8-K within four business days to give changes to previously filed quarterly and annual reports (Form 10-Q and Form 10-K).

Other events, requiring public notice are:

- Acquisitions

- Director resignations

- Fiscal year changes

What exactly does Form 8-K entail?

The name and description of the material event, as well as any relevant exhibits (materials), such as a financial statement, data table, and so on, are the only sections of an 8-K form.

Why is Form 8-K Important to Investors?

Form 8-K informs investors of substantial developments within the company promptly.

The SEC specifies many of these changes require an 8-K filing (such as mergers and acquisitions). In contrast, others are just occurrences the firm deems relevant enough for its shareholders to be notified (such as new product launches or upgrades).

The 8-K allows businesses to interact directly with investors without being filtered or influenced by media sources or sell-side analysts.

The information on Form 8-K is also helpful for financial research and analysis.

Analysts, for example, may wish to know how particular company events affect stock prices, and they can use the 8-K information as a guide.

Of course, we need accurate data when we employ statistical techniques like regression to quantify the influence of these occurrences.

8-K disclosures give a complete record and eliminate sample selection bias because they are legally standardized and must be honest and accurate.

Proxy Statement

The SEC mandates that corporations present shareholders with proxy statements to make informed decisions concerning topics raised at annual or special shareholder meetings.

Before the decision can be put to a shareholder vote for directors and approved by other corporations, the proxy statement must be prepared before the shareholder meeting and lodged with the SEC.

Investors can examine the wages of corporate leaders and any benefits to which they are entitled in the proxy statement.

Proposals for new board members, wage information, bonus information, directors' option plans, and any statements made by the company's management are all contained in the proxy.

What are the components of a Proxy Statement?

The Proxy Statement consists of several sections. These include the following:

- Voting procedures and information.

- Background information on the company's nominated directors, including relevant history in the company or industry, positions on the boards of other companies, and potential conflicts of interest.

- Board compensation.

- Salary, bonus, non-equity compensation, stock options, and deferred compensation are all examples of executive compensation.

This category includes benefits such as personal use of corporate aircraft, travel, and tax totals. In addition, many will also have pre-determined severance packages for executives.

Who are the audit committee members, and a breakdown of audit and non-audit fees paid to the auditors?

Why is a Proxy Statement Important to Investors?

Public corporations hold a general meeting of shareholders once a year, at which shareholders vote on various company actions or elect new board members.

You get one vote if you own common stock in a corporation (usually one vote per share). A proxy statement enables you to vote with a selected person who will collate the votes and cast your vote on your behalf.

These individuals are known as proxies, and they will vote as stated in the proxy statement.

Before the deadline, proxy votes can be cast by mail, phone, or online. The deadline for submissions is typically 24 hours before the shareholders' meeting. "Yes," "no," "abstention," or "no vote" are standard poll replies.

As a result, the proxy statement identifies the topics to be voted on and allows you to send a form to the corporation instructing your proxy on how to vote.

Forms 3, 4, and 5

Specific individuals are required by federal securities laws to report purchases, sales, and holdings of a company's securities by completing Forms 3, 4, and 5.

What is the difference between Form 3, Form 4, and Form 5?

A) Form 3

The amount of ownership is disclosed on Form 3, which is a preliminary filing.

When a person is hired as an officer or director of a company, they must file Form 3 with an initial disclosure of their ownership of the company's stocks.

This person must file Form 3 within ten days of becoming an insider.

B) Form 4

When an insider makes a trade, they must usually submit Form 4.

Thanks to this reporting, the public can view numerous insider transactions in corporate securities, including the quantity purchased or sold and the price per share. Within two working days of the transaction date, Form 4 must be completed.

The form records transactions involving the company's common stock, derivative securities, options, warrants, and convertible securities.

C) Form 5

Form 5 is an annual summary of Form 4 that includes any information that was supposed to be reported but wasn't.

Before the 45th day following the end of the fiscal year, Form 5 is typically filed with the SEC.

Due to a prior exemption or failure to make a report, the company's fiscal year concludes with at least one transaction unreported during the year.

Why Should Investors Care About Forms 3, 4, and 5?

If you're an investor, you should know what the company's owners and significant shareholders (or insiders) are up to.

It's easy to tell whether a stock's prospects are excellent or terrible by looking at the trading activity of corporate insiders and large institutional investors.

While insider or institutional ownership isn't a buy or sell indication in and of itself, it can undoubtedly aid investors in their search for valuable assets.

Insider ownership and trading can affect stock prices; therefore, Forms 3, 4, and 5 are valuable disclosures.

Intelligent investors can presume that insiders know more about the firm's future than the rest of us by paying close attention to what they do with their stock.

If insiders buy stock in their own company, they may be privy to information that ordinary investors are unaware of.

Insiders may acquire shares because they believe their claims are inexpensive or see significant potential for future mergers or acquisitions.

As a result, analyzing these forms is hugely beneficial to investors.

Schedule 13D

A takeover statement-like document contains specifics about what happened. A Schedule 13D must be filed with the SEC if an individual or group owns more than 5% of a voting class of a firm within ten days after an acquisition event.

To put it another way, Schedule 13D must be submitted ten days after the 5 percent shareholding is submitted.

Schedule 13D filings must be updated on time to reflect any significant changes in the stated facts, such as the acquisition or disposition of 1% or more of the class of securities subject to the filing. A "Beneficial Ownership Report" is also known as Schedule 13D.

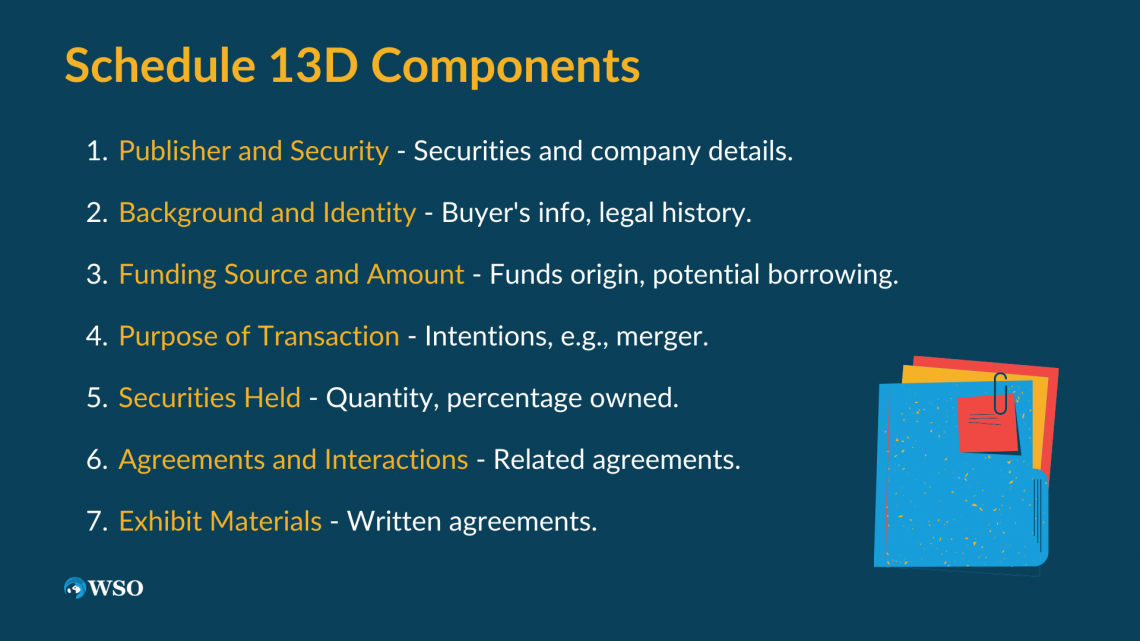

What are the components of Schedule 13D?

The different components of the Schedule 13D are:

- Item 1: Publisher and security. The sort of securities purchased and the company's name and address.

- Item 2: Background and identity Buyers must provide information such as their business type, citizenship status, and if they have been convicted of a crime or involved in a civil action in the previous five years.

- Item 3: Funding source, amount, and other factors. The origin of the funds, including whether or not they were borrowed.

- Item 4: The fourth point to consider is the purpose of the transaction.

- Beneficial owners must disclose whether they intend to merge, reorganize, or liquidate the issuer or any of its subsidiaries, among other things.

- Item 5: Securities held by the issuer. The beneficial owner states the number of shares purchased and the percentage of the company's outstanding shares that the transaction represents.

- Contracts, agreements, understandings, or connections relating to the issuer's securities are covered under the next item.

- Item 6: Beneficial owners must detail any agreements or interactions with anyone about the acquired company's securities.

- Item 7: Materials that have been archived as exhibits. A copy of any written agreement entered into by the beneficial owner of the securities is included in this list.

Why is Schedule 13D Important to Investors?

Plan 13D is designed to notify individual investors about changes in corporate control that may impact the company's future, such as voting rights mergers by corporate acquirers.

Investors utilize the information on Schedule 13D to spot red flags in insider mergers that could harm individual shareholders but could also suggest a firm takeover or buyout that would benefit shareholders.

Types of SEC Filings FAQs

The Securities and Exchange Commission (SEC) requires public corporations, certain company insiders, and broker-dealers to file periodic financial statements and other disclosures.

The 10-K and 10-Q are the most routinely filed SEC filings.

Your company must regularly file annual reports on Form 10-K and quarterly reports on Form 10-Q with the SEC, according to SEC guidelines.

The primary mechanism for businesses and other parties submitting papers under the Securities Act of 1933, the Securities Exchange Act of 1934, the Trust Indenture Act of 1939, and the Investment Company Act of 1940 is called EDGAR.

EDGAR stands for Electronic Data Gathering, Analysis, and Retrieval. The database is accessible to the public.

A partnership, corporation, limited liability company, or tax-exempt charity having assets worth more than $5 million.

A general partner of the company selling the shares; or any general partner of a general partner of that company; or any director, executive officer, or general partner of such company.

Electronic submission of registration statements and other paperwork is required for all businesses, domestic and international.

Then, investors can view registrations and other corporate papers via EDGAR. However, not every security issue is required to be registered with the SEC.

or Want to Sign up with your social account?