Permanent/Temporary Differences in Tax Accounting

It results from the difference between financial statements and tax returns.

What are Permanent/Temporary Differences in Tax Accounting?

Tax accounting is a branch of accounting specializing in taxes rather than the commonly seen financial statements that focus more on transactions and follow financial accounting standards.

The permanent and temporary differences in tax accounting result from the differences between financial statements and tax returns.

Specifically, the financial statements present tax expense amounts, calculated based on financial accounting standards, but the actual paid taxes depends on the tax returns which are prepared in accordance with tax accounting rules.

A permanent difference occurs when the items are treated differently in tax and financial accounting. Items creating permanent differences are part of pretax income under on financial statements but not a portion of the taxable income on tax returns.

Since the difference cannot be eliminated, it does not generate deferred taxes.

Sometimes, a permanent difference that results in the complete elimination of a tax liability is preferable for companies because companies reduce their tax liabilities in the long run.

Key Takeaways

- Tax accounting focuses on taxes instead of financial statements that focus on transactions.

- Permanent differences in tax accounting result from the difference between financial statements and tax returns.

- Permanent differences occur when items are treated differently in tax and financial accounting and cannot be eliminated.

- Temporary differences are also known as timing differences, as transactions are recognized at different times in financial and tax accounting.

Permanent/Temporary Differences in Tax Accounting Examples

One example of a permanent difference is meals and entertainment, as these are only partially recognized for tax reporting purposes.

Permanent differences for companies also relate to the purchase of life insurance for employees and their income derived from similar insurance.

It only causes a difference between the effective and statutory tax rates.

The effective tax rate represents the percentage a person or business pays in taxes after applicable deductions and credits. For example, a business pays $20,000 in taxes after earning $100,000. Its effective tax rate is 20%.

The statutory tax rate, in contrast, is the tax rate based on an income range. It represents the tax percentage that the law mandates to be paid for that specific range of income. For example, the current statutory tax rate for individuals earning between $40,126 and $85,525 is 22%.

On the other hand, temporary differences are the differences between the pretax book income and the taxable income that will eventually be eliminated. In other words, they are the differences in what the company can deduct for cash and book tax purposes.

They are also known as timing differences, as transactions are recognized at different times. This is because financial accounting is accrual-based, while tax accounting is cash-based.

To understand this concept in more detail, imagine purchasing a television.

Accrual accounting immediately records the transaction as revenue under the account receivable section on the balance sheet. Once the cash is deposited in the company’s bank account, the transaction will be “transferred” to the cash section on the balance sheet.

Contrarily, with cash accounting, television sales would not be recorded as revenue until the business charged the customer's credit card, got the go-ahead, and deposited the money in its bank account.

At this stage, the transaction would appear on the balance sheet as cash and the income statement as revenue. The same analogy applies to temporary differences. One example is the rent income.

In accrual accounting, the company can record rent income as revenue when it is earned. However, they must report the transaction under taxable income in the tax return form if they receive an advance payment.

This means the revenue will be recorded in the tax return, not the book income, creating a timing difference. In the future, when the rent revenue is earned, the company will report the payment under the book income rather than the tax return, reversing and eliminating the difference.

Since permanent differences cannot be reversed, it only have an impact during the time they occurred.

Primordially, the sole ramification is the actual tax rate applied to the book values; it could be greater or lesser than the tax rate applied to the tax return.

Temporary differences, however, have a more complex impact on the company’s accounting information. Deferred tax assets and liabilities can be created due to timing differences.

Classify permanent vs. temporary differences

This section will discuss some line items and whether they create permanent or temporary differences.

Specifically, we will talk about the following:

- Tax-exempt income

- Depreciation

- Amortization

Tax-exempt interest refers to the income that does not list into consideration when filing taxes. Therefore, it creates a permanent difference because it is included in the pretax income but excluded from calculating the taxable income.

On the other hand, depreciation creates a temporary difference. Depreciation occurs in long-term assets whose useful lifespan is over one year. Tax accounting usually uses accumulated depreciation instead of the commonly seen straight-line depreciation shown in the balance sheet.

It creates a difference because the depreciation amount in taxable income varies due to the different calculation methods. However, the depreciation amount will be equal in both tax and financial statements when the long-term asset reaches the end of its life span.

At that time, the depreciation number will be the same in the tax returns and the financial statements. The temporary difference is thus eliminated.

Similarly, amortization creates a temporary difference. Amortization is the depreciation of intangible assets. The reason is the same as the one for depreciation. Therefore, it establishes deferred taxes.

To gain a deeper perspective on differences in accounting, there are two types of temporary differences:

1. Taxable temporary differences

Taxable temporary differences occur when the taxable income in the current period for taxes is lower than the pretax income subject to taxes. This means the income tax payable is lower than the accrual income tax expense, creating a deferred tax liability.

2. Deductible temporary differences

Deductible temporary differences happen when the income tax payable exceeds the accrual income tax expense. This forms a deferred tax asset.

This is because when the income tax payable is higher, more money is available to pay taxes. However, the actual tax expense is lower than the individual’s capacity to pay. Thus, the extra tax money becomes part of the individual’s assets.

Tax accounting

The Internal Revenue Code dictates the regulations of tax accounting. We will delve into this with more specificity in the final segment of the article.

Tax accounting is the sub-sector of accounting that includes tax returns and tax payments. It is regulated by the Internal Revenue Service (IRS) in the United States.

Tax accounting is an additional facet of the operations of various entities, including corporations. Tax accounting aims to monitor financial resources associated with companies and individuals.

For businesses, more aspects of their daily operations are involved in tax accounting. Funds directed towards specific shareholders or business expenses must be included as part of tax returns.

Due to the complexity of tracking information and following the rules, most large organizations hire tax accountants to produce the necessary paperwork.

Generally Accepted Accounting Principles (GAAP)

GAAP stands for Generally Accepted Accounting Principles. It refers to a set of rules and standards used in financial accounting to guarantee that companies report their financial data in a standardized and dependable way.

The key topics that GAAP encompasses include the methods for recognizing revenue and expenses, evaluating assets and liabilities, and disclosing information in financial statements.

By adhering to GAAP, companies can provide trustworthy information to their investors and stakeholders. The information they can rely on while making decisions.

It is noteworthy that GAAP is not a law; nonetheless, it is widely acknowledged and followed by accounting professionals and companies in the US.

Different types of tax accounting

There are three types of tax accounting we are going to discuss in this section:

1. Tax accounting for individuals

Trade receivables are amounts owed to a business by its customers for sales made on credit. They are an asset on a company's balance sheet and represent a short-term claim against the customer.

The payment time frame can vary but is usually within 30-90 days from the date of sale. Proper trade receivables management, such as credit control measures, helps ensure customers pay their debts and minimizes the risk of bad debt.

Trade receivables are a valuable asset for businesses as they are easily convertible to cash but must be managed carefully to minimize the risk of bad debt.

2. Tax accounting for businesses

Tax accounting is the process of preparing financial information for tax purposes. It involves the application of tax laws, regulations, and rules to a business's economic activities to calculate tax liability and determine the amount of taxes owed.

Accurate record-keeping and utilization of tax incentives and deductions can help reduce the tax burden and maximize profitability.

NOTE

Proper tax accounting practices are important for compliance and minimizing the risk of penalties and fines.

3. Tax accounting for tax-exempt organizations

Tax-exempt organizations are exempt from paying federal and state income taxes for their specific purposes, such as charitable, educational, religious, or cooperative organizations.

They must still comply with tax laws and regulations and demonstrate their exempt purpose and not for private gain through specific tax returns and financial reports.

Tax-exempt organizations may be subject to other taxes and must provide annual financial reports to maintain their exempt status. Proper tax accounting is important for them to maintain their exempt status and avoid penalties and fines.

NOTE

Tax accounting for individuals is the least complex as it only entails a person's income, investment gains or losses, qualified deductions, and other transactions that may affect the tax burdens.

Moreover, tax-exempt organizations need to pay special attention to tax accounting because they must file annual returns even though they do not need to pay taxes.

The annual return is the return on investment given over a period of time in percentage. The annual return is usually measured against the initial investment through geometric means.

Filing annual returns means that tax-exempt organizations must provide information regarding grants, donations, or other coming funds. Reporting these monetary details helps organizations adhere to all laws and regulations.

NOTE

Tax accounting differs from financial accounting. The former is cash-based, while the latter is accrual-based, but there are more distinctions than this most obvious one.

Next, we will talk about financial accounting in relation to tax accounting.

Financial Accounting

Financial accounting follows the rules under GAAP.

Under GAAP, companies follow a set of principles, standards, and procedures to generate their financial statements that summarize the company's transactions over a period of time.

The purpose of financial accounting is to provide credible information to current and potential investors, lenders, and creditors when making decisions regarding the company.

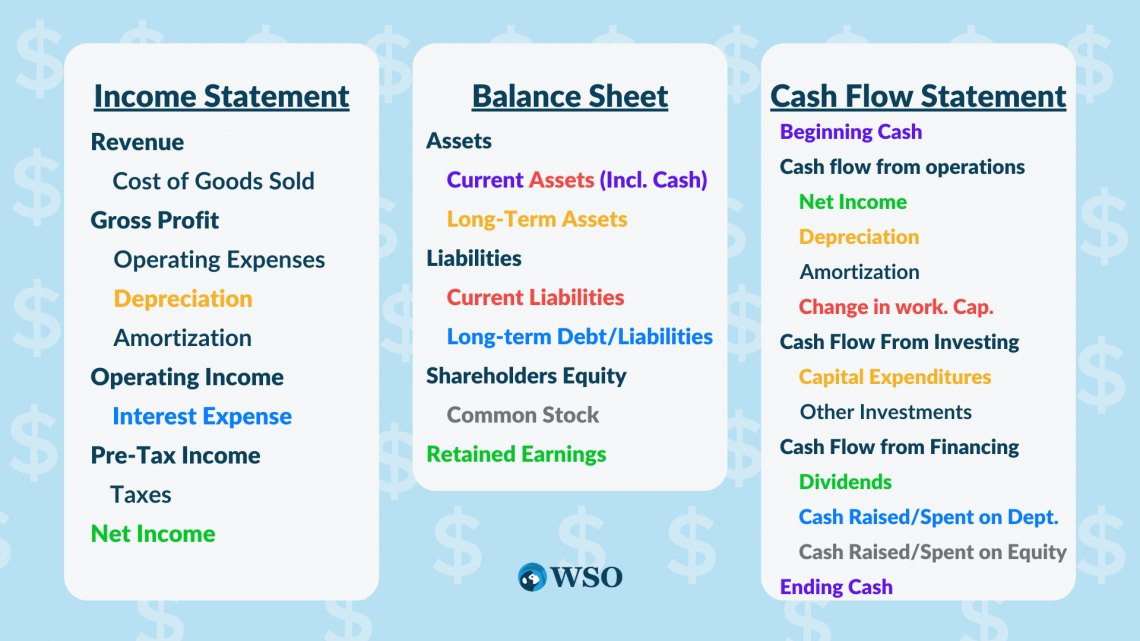

The three key components of financial accounting are the income statement, balance sheet, and statement of cash flows.

The income statement records the company's significant revenues and expenses. It starts from the company's gross revenue over a certain period, subtracting major costs and arriving at the bottom line called the net income.

Other major line items in the income statement, also known as the profit or loss statement, are:

- Cost of goods sold (COGS)

- Selling, general, and administrative (SGA) expenses

- Interest and tax expenses.

Depreciation and amortization charges are often incorporated into one of the major expense items listed above.

The balance sheet demonstrates the financial condition of a company and divides into three sections:

- Assets

- Liabilities

- Shareholders' equity

To demonstrate the relationship between these three, liabilities are the external claims to the company's assets, while shareholders' equity represents the internal claims to the company's assets.

Therefore,

Assets = Liabilities + Shareholders’ equity

Under GAAP, the balance sheet needs to list all assets and liabilities based on decreasing liquidity, with current assets/liabilities being the most liquid and long-term assets/liabilities being the least liquid.

For instance, cash and cash equivalents are current assets that are put at the top, and property, plant, and equipment (PP&E) are long-term assets placed towards the bottom. Additionally, balance sheet items can use different calculation methods when compiling financial statements and tax payables.

For example, the company can use the first-in-first-out method (FIFO) to record inventory under assets. At the same time, the company can also record the inventory using last-in-first-out (LIFO) for tax purposes.

Lastly, the statement of cash flows includes the inflows and outflows of cash within a company due to various transactions. The cash transactions are categorized into:

- Cash flow from operations

- Cash flow from financing

- Cash flow from investing

Financial accounting provides a more precise picture of a company's transactions, while tax accounting only focuses on transactions that influence the business's tax burden.

Internal Revenue Code (IRC)

The Internal Revenue Code is the domestic part of the tax law in the United States. It is crucial for tax accountants and other individuals to follow the regulations listed in this document carefully.

We are talking about the Internal Revenue Code, the revised version passed in 1986. There were two versions before the Internal Revenue Code of 1986:

1. Internal Revenue Code of 1939

The Internal Revenue Code of 1939 was the first comprehensive codification of federal tax laws in the US, enacted in 1939 and effective in 1940. It consolidated various pieces of tax legislation into a single code and established the Treasury Department's authority to administer the tax laws.

The Code imposed taxes on income, estates, and gifts, providing for collection through penalties and interest charges. It was eventually replaced by the Internal Revenue Code of 1954.

2. Internal Revenue Code of 1954

The Internal Revenue Code replaced the former Revenue Code of 1939. It simplified the tax system, Thus, making it simpler for taxpayers to understand and follow.

This Code set authority for the Treasury Department to enforce tax collection through penalties and interest charges. It covered taxes on businesses and individuals on income, estates, gifts, and certain excise taxes.

The Revenue Code of 1954 is the foundation of the federal tax system in the United States.

The Internal Revenue Code of 1939 was published in the United States at Large, an official record of Acts ratified by Congress, and title 26 in the United States Code.

Fifteen years later, the act was renamed the Internal Revenue Code of 1954 to depict its connection to the Internal Revenue Service. The 1954 version imposed a progressive tax with 24 income brackets.

A progressive tax is a taxation model where the tax percentage rises proportionally with an increase in the taxable income or amount. The 24 income brackets range from 20% to 91% Note that the tax rates are for unmarried individuals in the United States.

The Internal Revenue Code of 1986 was named in compliance with section 2 of the Tax Reform Act of 1986.

Part of section 2 of the Tax Reform Act of 1986 demands reference to the Internal Revenue Code of 1986 in the 1954 version and the connection to the Internal Revenue Code of 1954 in the 1986 version.

In the IRC, the sections that are mentioned most frequently are sections 1 and 11. Section 1 describes individual tax law, whereas section 11 discusses corporate income tax.

There are 11 subtitles in the IRC, ranging from income taxes, in sections 1 through 1564, to group health plan requirements, in sections 9801 through 9834.

The IRC is an integral part of tax regulation in the United States; Without it, the country may suffer from severe problems due to the lack of public funding.

For more tax and financial accounting information, please visit "Accounting Foundations" under the Wall Street Oasis course offering page.

Researched and authored by “Won S. Mejia Helfer” | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?