Equity

The amount of money that the firm's shareholders would receive if all the firm's assets were sold in the open market and all the firm's debts were paid off in the event of liquidation.

Equity, also known as shareholder's equity, refers to the amount of money that the firm's shareholders would receive if all the firm's assets were sold in the open market and all the firm's debts were paid off in the event of liquidation.

In accounting, the firm's valuation can also be defined as the difference between the value of total assets and liabilities. The difference between the two is known as shareholders' equity. This value, at times, helps to determine the book value of the organization.

It can also be regarded as a degree of residual ownership in an organization after deducting the liabilities from the value of the assets. Thus, it helps to represent the stake of an individual shareholder as identified on the company's balance sheet.

Analysts use two valuations to make investment decisions, namely book value and market value. The book value refers to the difference between the assets and liabilities of the organization.

On the other hand, the market value is based on the prevailing share price in the market if the company is a public company or a market value determined by analysts and other professionals.

The balance sheet, its section consists of different components. Sources of funding, retained earnings, and other general or revaluation reserves constitute the organization's capital.

Types

The two different valuations used by the analysts are the following:

1. Book Value

It is always recorded at book value in accounting. This value is calculated by accountants while preparing detailed financial statements.

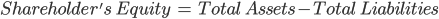

According to the financial statements, the book value refers to the difference between the firm's total assets and total liabilities, and the equation is given as follows:

The assets, in this case, comprise the firm's current and non-current assets. Existing assets include short-term assets like receivables, cash, and prepaid expenses, whereas fixed assets include long-term assets like machinery and equipment.

On the other hand, the liabilities comprise current and non-current liabilities. Current liabilities include accounts payable and short-term loans, whereas non-current penalties include long-term loans or capital leases.

Moreover, it consists of a few different components: share capital, retained earnings, net profit or loss of the year, reserves and surplus, and dividends.

Accountants of an organization continuously need to track changes in all components, for example, changes in share capital, throughout the financial year to achieve an accurate book value.

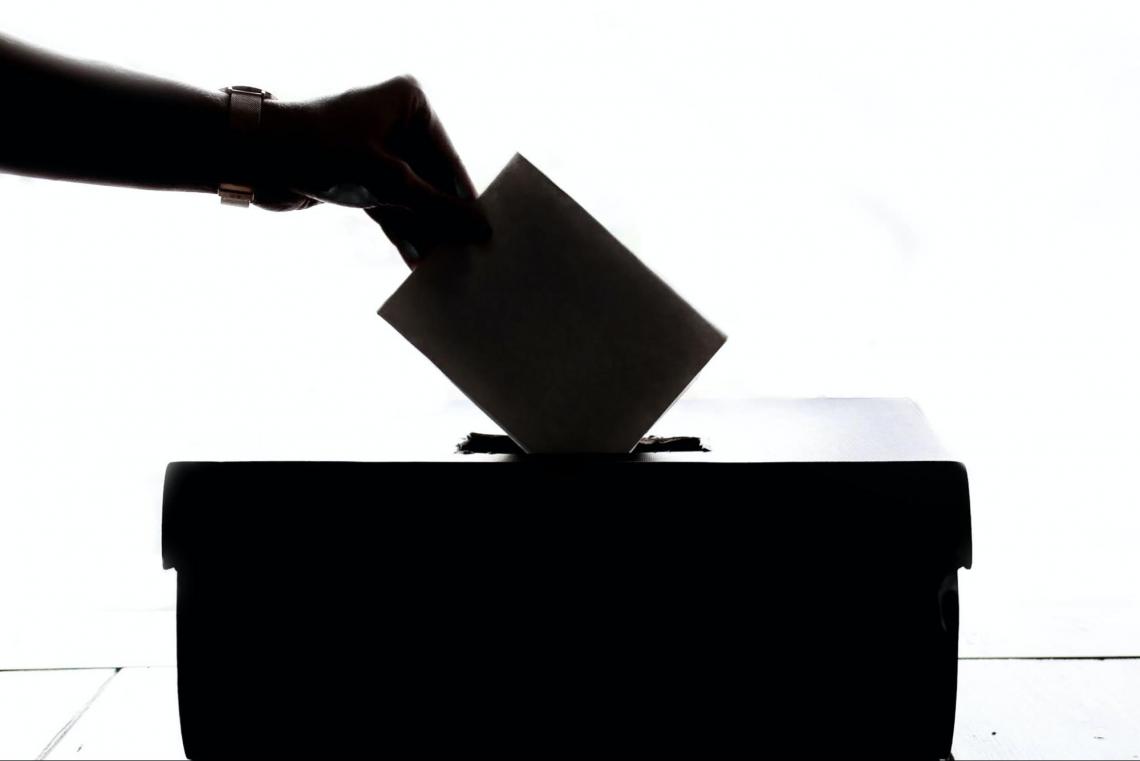

2. Market Value

Equity, in the field of finance, is always represented at its market value, which can be both higher or lower than the book value.

The difference in value exists due to the differences in approach as the accountants use a backward-looking method as accounting results are based on historical costs. In contrast, finance analysts are forward-looking as they try to predict future trends.

The market value of a publicly listed firm is easy to calculate as the deal is simply the prevailing share price multiplied by the number of outstanding shares.

However, it is tough to estimate the market value of a private firm. Thus, these firms hire professionals such as investment bankers, accountants, or valuation professionals to conduct their valuation analysis.

Features

The characteristics can be explained as follows:

1. Voting Rights

Individual investors become shareholders of an organization after purchasing the common shares of the organization. This gives the investors the right to participate in company shareholder meetings at regular intervals.

The investors, upon purchasing shares, are entitled to a vote in the organization, which will enable them to elect the company's board of directors and let the investors raise opinions and participate in the decision-making process.

2. Limited Liability

Although common shareholders are considered to be owners of the organization, these shareholders enjoy the benefit of limited liability, which implies that their weaknesses are limited to their investment in the organization.

This means that the personal assets of these shareholders cannot be used to repay the debts of the organization in the case the firm's assets are insufficient to fulfill all of its debt obligations.

3. Claim on Assets

Every common shareholder of an organization has a right to claim the residual assets of the organization in the event of liquidation.

However, when a firm is being liquidated, debt providers and creditors have the highest claim on the firm's assets, followed by preference shareholders. This is because the assets remaining after paying the first two categories are proportionally distributed among common shareholders.

4. Highly Liquid

The common shares issued by organizations, which comprise the share capital, are highly liquid assets, which implies that these assets can easily be converted into cash. In addition, shares of public companies are traded on the stock exchanges.

The shares are highly liquid instruments as these financial instruments can easily be bought or sold during trading hours due to a highly liquid and regulated stock market.

5. Regular Income Stream

An individual who invests money in a firm in common shares receives a right to the company's disposable income through periodic dividends.

The shareholders receive no dividends if a company incurs a loss in a given financial year or does not earn enough profit. Still, there is always scope for making higher income due to capital appreciation.

Types

The different types of instruments being traded in the financial markets are explained as follows:

1. Common Shares

Shares refer to small units of ownership in the organization. These units are often traded on a public stock exchange that investors can buy from.

Such instruments tend to provide voting rights to the shareholders and make them eligible to receive annual dividends based on the number of shares held by them. Returns from such instruments can be high, but they also bear high risk.

2. Mutual Funds

Mutual funds refer to a pool of funds where individuals invest different amounts, and the fund manager invests the pooled money in other financial instruments.

Equity mutual funds are those types of mutual funds where at least 60% of the funds are invested in common shares. These funds can be classified into the following categories:

- Large-cap funds – These funds typically invest most of their resources in large, well-established companies that tend to provide stable returns with lower risk.

- Mid-cap funds – Such funds invest in mid-cap firms with a balance in their risk-to-return ratio. They are considered riskier than large-cap funds.

- Small-cap funds – Small-cap funds invest money in small, growing firms that tend to offer higher returns but also bear high risks.

- Multi-cap funds – These funds invest money in firms operating in different sectors of the economy. Multi-cap funds invest in all the markets above depending upon the market conditions.

3. Future Contracts

Equity futures are those financial instruments that obligate an investor to purchase the underlying asset at a predetermined price and at a future decided date.

Trading these instruments is a lot more dynamic when compared to the cash market. The reason for this active market is that it facilitates the traders with the option to buy and sell short.

Arbitrage activities refer to buying and selling financial instruments in different stock exchanges that profit from different prices across different businesses.

5. Alternative Investment Schemes

Investors can also aim to invest in firms through venture capital, private equity, and hedge funds. These are typically return-seeking and active strategies, having risk features.

Components of Equity in Accounting

The different components that makeup equity on the balance sheet of an organization are explained as follows:

1. Share capital

Share capital refers to the money received by the firm in the form of funding from its common shareholders. The firm gets this money after the firm issues shares to the public.

Investors who buy these shares become the shareholders of the organization, and the firm receives money for the issued shares. The share capital of an organization is generally calculated as the price of one share multiplied by the number of shares issued by the firm.

2. Retained Earnings

Retained earnings refer to the cumulative net income of an organization over the years after deducting the dividend payments. In simple terms, retained earnings refer to the accumulated profits of the organization.

The balance of retained earnings fluctuates every year. The balance tends to increase if the firm makes a profit and does not pay out dividends, and the credit reduces if the firm incurs a loss. As a result, changes in the balance of retained earnings fluctuate the valuation.

3. Reserves and Surplus

At the end of every financial year, firms transfer a certain amount of money to different types of reserves on the balance sheet. These funds are used for specific purposes, such as purchasing fixed assets.

General reserve, capital reserve, and revaluation reserve are common reserves firms create. Firms use the money in these reserves for specific reasons.

4. Dividends

Dividends refer to the periodic payments the firm expects to pay its common shareholders. These payments can be made annually or multiple times a year.

Payment of dividends reduces the value of retained earnings as dividends are paid out of the current year's profit. However, the firm doesn't need to pay dividends to its shareholders, which entirely depends on company policy.

Calculation

Accountants have been using the accounting equation for several years to calculate the organization's capital value. The formula can be expressed as follows:

All the data for these values can be found in the company's annual reports (balance sheet). The steps to follow while calculating the deal are as follows:

- Look for the value of total assets on the balance sheet.

- After the value of assets is identified, look out for the value of total liabilities.

- As both values are established, the next and final step is to calculate the value by subtracting the value of liabilities from the value of total assets.

Another method of calculating the value was subtracting the value of treasury shares from the sum of share capital and retained earnings. However, this method is not commonly used by accountants.

Moreover, the value computed by the accounting equation reflects the entire value of equity in the organization and not just the values of its components, such as share capital or reserves and surplus.

Although both methods will yield the same value, the way that uses the value of assets and liabilities is more reliable as it helps to indicate a clearer picture of the firm's financial health, both short-term and long-term.

Calculation of Market Value of Equity

The concept of market value is most common in private companies as these companies do not have extensive data, such as detailed financial reports, that can be used to estimate the value.

Calculating the market value for a private firm is a very subjective process and two different professionals using market valuation can arrive at different values for the same business organization.

The different methods for market valuation are as follows:

- Discounted Cash Flow Approach

- Valuation Based on Comparable Companies

- Valuation based on past transactions

The discounted cash flow method (DCF) discounts all future cash flows to the present value using a specific discount rate. This valuation method is a highly detailed analysis and thus requires extensive information about the company.

Moreover, out of the three valuation methods listed above, the DCF approach is the most widely used method to calculate the market value as it takes into account all aspects of the business and is thus considered to be one of the most accurate approaches.

Venture capitalists most commonly use these methods in the initial stages of their investments in startup firms. This is because these methodologies yield values that these investors use to decide whether their startup investment will be profitable.

Researched and authored by Mehul Taparia | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?