Are hours in IB a lot more relaxed these days?

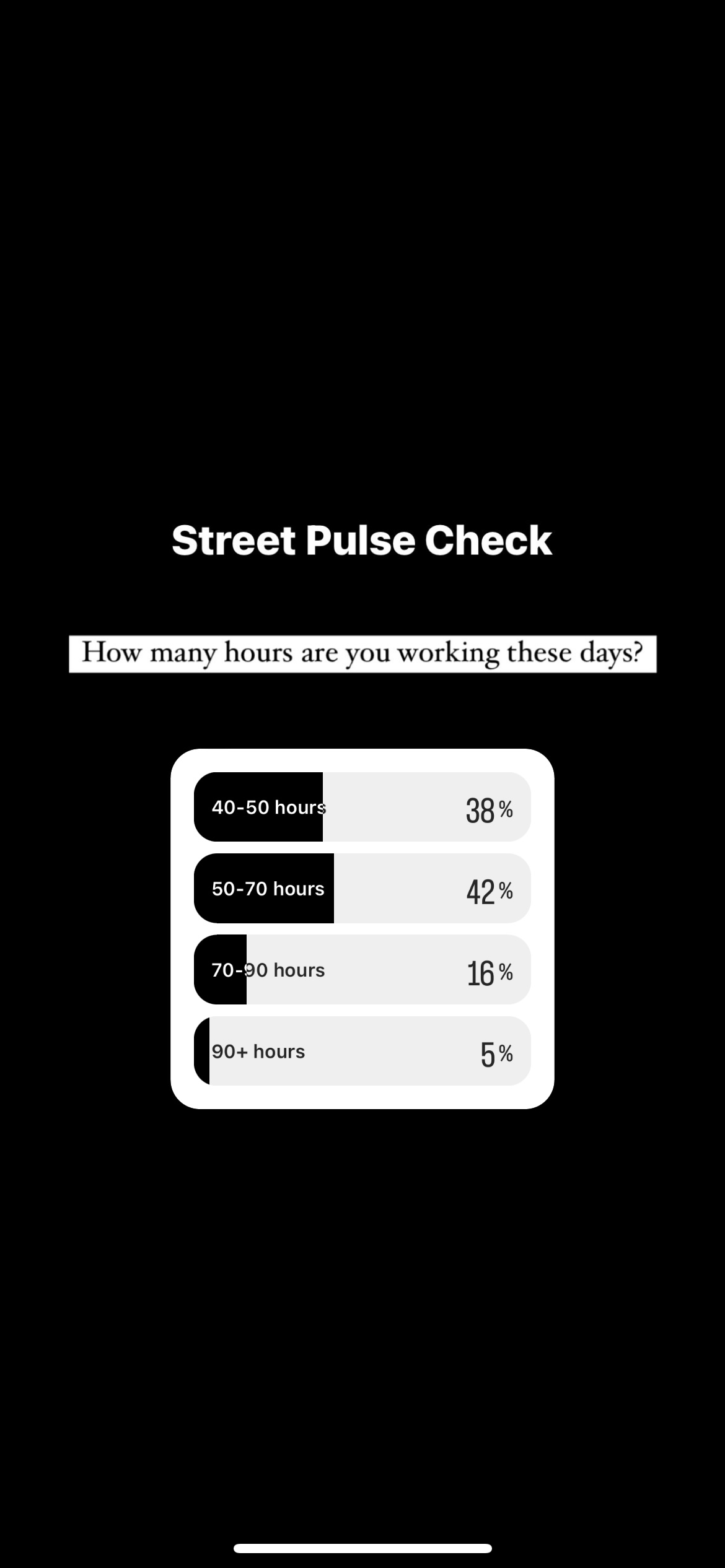

A few years ago I would often hear FT analysts at networking events talk about having to work 80+ hours regularly, especially when everyone was WFH. Now it sounds like hours have become more reasonable / relaxed on most weeks. Based on a recent survey, it looks like 80% of people are working less than 70 hours in IB, with nearly 40% working 40-50 hours weekly.

A few years ago I would often hear FT analysts at networking events talk about having to work 80+ hours regularly, especially when everyone was WFH. Now it sounds like hours have become more reasonable / relaxed on most weeks. Based on a recent survey, it looks like 80% of people are working less than 70 hours in IB, with nearly 40% working 40-50 hours weekly.

This is generally how hours for analysts are at my group as well, but at a small group in a middle market where our team emphasizes creating a culture where WLB is prioritized.

Thoughts on how it is in other teams?

Yes - with the hybrid / WFH schedules, it looks like hours have become more manageable especially for junior folk from what I've seen. Most analysts on my team head home after 7pm to either WFH or log out for the day. There is less emphasis on in-office facetime culture, where you'd historically have analysts sitting around staring at their screen until 11pm waiting for their associates to head home

I wish I could find a firm like this

Sounds nice, at a major face time bank and group, horrible

Facetime is the most insulting thing in banks.

Problem is associates and even some VPs are really still just kids (24-26 year olds) and they set the culture despite not even being mature enough yet to not want to pass on the abuse they suffered to those under them.

24-26 is not a kid wtf? tired of this shirking of responsibility through infantalization I see going on. They are just bad people with no leadership ability

Thia firm😍

In my group most of us head home around 6-7pm, eat dinner, do some PE interview prep until 11pm, then send out some deliverable to the associate at 12am and log out

Lol my class was similar - just remember, if the average analyst in your class is an A+ analyst, you'd be bottom bucket if you're an A- analyst

However, if the average analyst in your class is a B- analyst, you'd have to be a C analyst to be bottom bucket.

I remember as an analyst 2 there was a superstar analyst 3 who was operating at the level of a top bucket associate in terms of responsibilities/work product and we all cheered when he exited 3 months before bonus.

Lol sounds like it works like a grading curve in a college class. There's not really much incentive these days for people to be top bucket when people are getting sub 50k bonus regardless of their performance. Have heard numbers like 2.5k for first years at some places recently

40% of ib analysts working 40-50 hours is the most ridiculous thing I’ve seen all day. The survey is probably wrong, data is bad. Either it’s a sample size of 5, people are trolling, or “street pulse” includes back office finance people at tech companies.

Nearly all analysts in my group are working around 50 hours / week right now, wouldn’t be surprised if this is how it is in other groups.

Also at a middle market

What firm?

By “right now” are you implying that’s because it’s a bad market (even though it’s fine)? Or does your firm just have low deal flow? 40-50 hours is a 9-5 job, not IB.

I can count on one hand how many times I’ve had to work weekends, feel blessed. Rarely working past 7pm most days. However, dealing with clients that are either extremely slow at data dumps or wary of rates and not in a rush

Anecdotally a buddy of mine is working very little at an MM, like less than ten hour weeks, while our friend is getting smoked at his bank. Not in IB but my fund is a little busier than normal right now kicking off the year.

The 10 hour weeks are worse than a 60 hr week especially if you’re in office. Boredom is a killer

What firm?

Dude I work until 3-5 am every day

Delete

we all win

At tier 3 international bank in NY, hours blow, consistent 80+ weeks. Depends on your group

Name & shame

Convenience bias? The harder the hours, the less likely to be scrolling through IG.

All the points on WFH / less FaceTime are valid, but remember that significant portions of the market are just dead. ECM is non-existent and has been for a while. PE deals are significantly down, same with fundraising. DCM / LevFin is equally as ‘meh’ as M&A.

I’m shocked that you even had to say this. Fees down massively. Mass layoffs. Trash bonuses across the street.

When your job is doing deals, and there are no deals, yes you may be “working less” but may also “not be working for long”

It shows a lot of juniors are in the comments lol

Idk what people in other groups are doing, maybe middle market is the place to be, but I’ve been working 80+ hour weeks for months

A connection I have to a respected BB satellite office also said he has been churning out the work lately.

His team is lean though.

At an EB regional office.. we're getting obliterated, I'm surprised to hear so many folks here are nowhere near as busy.

Also in a regional EB office and feel similarly.

If anything I think WFH has made it worse, especially on the West Coast. Due to cross-staffing with East Coast team I need to be online by 7:30 or 8, albeit at home. I know analysts in our other WC office have to do the same...

EBs just suck

Sounds like Boutiques are always sweaty regardless if it’s an eb or a regional shop

Yes, I'm at a west coast office too and it's easily 7:30am - 1/2am Monday through Thursday...

Now I feel like a schmuck working tll 2am most days at a European BB, then again most of my weekends are free so I guess that equals out.

I would imagine it’s group, bank and days in office dependent. Only going off my buddies stories but it sounds like when in the office during a light or average work load, you may have time where you’re just sitting around waiting to do work and then it gets sent to you hours later at a Bull shit time? So total hours worked can be 40 on a week but if I’m office you spent 10-12 hours there each day but when home you might only think of literal hours spent working on a deliverable.

Thought it was just me, working from like 8-5 or 6, workout and dinner, PE prep for a few hours. Have had nights till midnight once or twice but normally then the day was slow and just had an assignment given later. Have rarely had weekend work. Also have friends in groups getting wrecked till past midnight or 1-2am like 4-5 days a week. Variance is high, feel lucky.

Yup, mostly been able to log out by 7pm or so on most evenings and wfh if anything remaining. Not sure why others are working until 1-2am regularly. Would think some could in an understaffed team however

The people I know with those hours are at groups that just keep pitching bullshit or have old fashioned people

What bank?

Shit hours? Houlihan and Jefferies

buddy of mine is in a BB group that has gotten crushed by interest rates. seems to be working maybe 50 hours a week, mostly just for facetime. makes dinner every friday no problem. that said his bonus got crushed

IMO one shouldn’t care about their bonus until mid-30s.

It’s a wash compared to late-career earnings and you should care more about brand name to set yourself up to be in best position to make late-career money.

Thanks for your life hindsight, Analyst 1

So basically what this thread tells me is that as soon as I become a senior associate and have a new associate below me is that he is going to be utterly worthless cuz he dicked around his entire time as a banking analyst, hence making me the de-facto associate again.

Bingo

Usually work from 10am to 6 or 7pm.

Would say some people I know in other firms have much longer hours, others have similar hours.

Some of this comes down to efficiency and time management. Some people are significantly more effective with their time than others

What firm?

Hire me pls

There is no deal-flow at the moment, of course everyone is going to feel they have more disposable time. I hope everyone who comments "It's much better" comes back in 18 months time when rates are back to 1.5% and activity picks back up on the street.

And I’ll be out of IB by then hehehehe

Bring rates back to 1.5% !!

YEE 1.5% interest rates is the way!

At a LMM PE shop, in office 7:30-8ish most days and occasionally something small when i get home. No weekends unless something urgent comes up that needs to get dealt with, but that seems to be the seniors stuff not my grunt work.

Lot of BS! Try Centerview they are looking 👀 !

Looking to hire?

Hi OP - good topic. As someone in his early 30s who was in IB (now in PE) I would 1000% say in my experience that hours have got much better post-pandemic. Admittedly I have become more senior over the past several years, however I think that isn't the main driver but rather a change in culture/work views (which imho is a massive positive, with only a couple of drawbacks). Here's some things which have massively changed in my experience:

- Face time culture dramatically dropped away during the pandemic for obvious reasons. If you read any old posts on here, you will see that analysts/associates being in the office until 10-12pm was extremely common, even if there wasn't a huge amount of work going on. I.e. if your associate was still grinding away, you were implicitly expected to hang around in case you're needed later on, and secondly to observe and learn about what they're doing. On the hand, in my experience this was a great way to learn in IB - being "forced" to stay late even when you didn't have much on meant you passed the time by catching up on other less urgent work you needed to do, observing the associate and learning a lot by osmosis, and also building camaraderie with your colleagues (assuming they're decent people). However overall I'm very glad for juniors that it has dropped away - as looking back now it's a rather unfair and inefficient use of juniors' time. Yes it might not mean you're quite as good an analyst, but you'll get a lot of your evenings back (subject to making sure you're available to log in if needed) and the long-term impact on your career trajectory will probably be negligent tbh assuming you still work hard the rest of the time.

Also it always felt to me like a low-level "hazing" experience, i.e. often associates/VPs felt that just because their evening had to be in the office then so should their analysts, i.e. they had to share in the suffering. Of course stuff rolls down hill and if an associate can save his/her own evening by delegating the work to an analyst thereby blowing up their evening, that's fair enough. But often analysts were stuck in the office with very little to do except twiddle their thumbs just so they appeared "committed". However now that associates and VPs can leave at 7 to wfh, so can analysts, which is a good thing in my view.

- Weekend work in the office went away - honestly, this always seemed mad to me even pre-Covid. Of course weekend work is to be a frequently expected thing in IB, but why couldn't you just log in from home? Tbf my IB nearly always allowed me to wfh at weekends, but I'd frequently read stories on here about analysts/associates being dragged into the office on a Saturday by their VP (there's lots of older posts on here asking "what is the dress code for going into the office on Saturday" etc). So the fact that most if not all bankers can do their weekend work from home post-pandemic is fantastic, and tbh should have happened long ago even before the pandemic (this is 2023 not 1993 after all, the technology has existed enabling people to log in remotely for 25+ years now lol).

- Daytime activities are now more tolerated. Maybe others' experiences differed here, but at my firm it was heavily frowned upon if you ducked out to go to the gym for an hour at lunch, and if you left the office at 6 to have dinner with your spouse/kids before logging in at home, if you were below VP-level that would have practically been career suicide. However as everyone was working remotely during the pandemic, without the same level of in-person supervision people (including myself) found themselves able to fit in regular gym sessions, yoga classes, therapy etc without needing to explicitly clear it with superiors each time.

Now don't get me wrong - as a first-year analyst you probably shouldn't be doing this regularly, and anyone ducking out frequently when you have a live deal/tons of work on will find themselves (fairly) being frowned upon - but equally even with RTO if you find yourself with tons of downtime during the day, I don't think most people will care now if you decide to go to the gym for an hour, provided you don't abuse it. This sounds small but I can imagine it makes IB much more tolerable over the medium/long-term, i.e. you're not expected to completely neglect your personal/outside life during the work week.

- Attitudes to work have changed during the pandemic. Now don't get me wrong, I think those "anti-work" idiots on Reddit etc are completely deluded - especially in IB/PE, your main contribution is your time - especially at the beginning of your career when you have almost no knowledge/experience to contribute except being a body available to put in 50, 60, 70, 80hr weeks. Also that's how you learn ultimately - there are no shortcuts especially in this industry, so you'll never be doing a 9-5 and earning IB/PE money until very late in your career (and maybe never).

That being said - some of the stuff junior people in this industry did pre-pandemic was in retrospect bordering on madness (note I include myself here). I'm talking about kids working 90-120hr weeks on a regular basis, and tragic instances of suicides/deaths over the years which likely at least had some link to the crazy workload. And for what? An extra $30-40k a year extra in your bonus before taxes?? I realize that might seem a lot of money to the college kids on here, but you're already on a decent salary in IB - it really isn't worth f*cking up your health for a bit more money in the short-term.

And that segues into a similar issue - the cost of everything has gone up massively during the pandemic, primarily housing. So ultimately even if you slave away and do 100+ hr weeks for years, you won't have a house 2x as large as your fellow analyst who did 60-70hr weeks. So what I'm saying is especially post-pandemic people in this industry are realizing that whilst you of course have to work hard, past a certain point there are rapidly diminishing returns when it comes to working crazy hours. I mean you mess up your physical and mental health so you can buy an extra Rolex, or a few more pairs of Gucci loafers?? It just doesn't seem worth it (although this is just imho, others may disagree here).

Having said all of there above, there are a few caveats. As I said earlier, learning by osmosis (i.e. sitting next to colleagues in the office) was a massively helpful learning mechanism in my view, even if it was a bit inefficient. And it did also help foster camaraderie with my fellow analysts. Finally, as others have mentioned - deal flow right now is pretty dreadful, so we may well be going back to the old days once things get busy again and RTO gets enforced by all the banks (which seems to be the way we're heading). So will be interesting to see what the work culture looks like in a few years.

I think a lot of seniors also have pumped the brakes a bit on their careers. pandemic made them realize their family/free time was actually pretty important and the current trash market is making a lot of them sort of stop caring about things. they sort of collectively realized they DO have enough money already.

so many decks we send out nowadays to seniors and they all are just like "eh...its fine, maybe kill some pages, lets roll with it"

not even seniors in IB, but the clients too. some of the csuite guys dont really care that much anymore (at least ones I talk to).

with all the layoffs, lower bonuses that are pathetic on a dollar for dollar basis to years 1995-2007, realization that its all just a rigged game that depends on low rates, and getting that taste of family/hobbies from the pandemic, people just stopped seeing the need to hustle at senior levels.

Yes definitely agree - that is another thing I’ve noticed since the pandemic. Eg when I first started in PE the partners would frequently ask at 5pm for some analysis to “be done tonight” / 9am the next day even if it wasn’t super-urgent. Same with weekend work. Then those first months during the pandemic in 2020 were like going back to my first year of IB, the work felt so constantly manic / 24/7.

Now however those same people will say to me on a Friday “let’s start on this Monday” etc, or if they put in a request late in the day will say it’s for end of week. Obviously we still get frequent fire drills of course, but it seems like the unnecessarily urgent requests have dropped away since Covid. It does feel like it’s due to the things you said ie senior people recalibrating their perspectives during Covid (especially if they got to spend a lot more time with their kids/family whilst wfh etc).

I think people are forgetting that millennials are old now and comfortably in MD seats. So there’s also a generational difference

This screenshot was a post on one of the Fin Meme accounts and was targeted at Buyside roles not IB roles. Love all the comments based off misleading data.

Unrelated but are promotions also communicated around bonus time? I.e. Analyst to associate - is that like a 2 min catch up thing or more of a year end review news?v

Yes, absolutely. A combination of slower M&A and ECM markets, and WFH possibilities. Also, many juniors nowadays are no longer willing to put in the work.

However, don't gaslight yourself. If you go into a prestigious BB/EB group, you will be grilled nonetheless.

Way fewer deals and overstaffing has people working way way less than before. People have mentioned some secular shifts such as the broader WFH movement. That def helped, but the period right after COVID was still pretty egregious. The whole "Goldman 7" thing being an example of pretty severe hours. I think the changes are really the following:

At an EB Ivy League (Think Brown, Dartmouth, Rice) and our hours have dropped significantly.

8:30AM classes are now frequently done remotely and most Analyst 1s (Freshman) have shifted their priorities towards optimizing work/life balance. Some of the Analyst 4s (Seniors) still grind from 8:30AM - 2:00AM every night but they are fewer and further in between, and highly focused on top tier exit opps.

All in, I'm pretty satisfied with my shop but like others have said deal flow won't be dead for long and we're all fully expecting homework assignments, exams and problem sets to pick up once interest rates go back to near zero.

Cringe comparison, eat the chocolate that comes from ur bottom 🤕

What the fuck did I just read...

Congrats on Rice

LA BB. Have worked 90+ hours a week since August. Not ideal.

Been working significantly less as time went on, unsure if it’s because of increased efficiency or delegation. Typically new analysts in my group don’t work as much as when I started working, likely several hours less per day on average

Dealflow has been similar in my group compared to prior years. People work less than in their first year because they get more efficient with their time and recently people seem to prioritize getting in their sleep rather than working until 3am every night from what I generally see from the analyst classes.

Hours are very unpredictable and definitely depend on the firm, group, as well as general macro environment. I would say that if you are at a bank as an Analyst and working between 40-50 hours a week you should be a bit concerned. Although painful, MDs should really be working on building relationships somehow or another and this almost always involved some level of annoying work for junior staff. I'd say it's a sign of a slow market and also probably a firm / group that isn't focused enough on originating new business. That being said, I wouldn't complain as long as my compensation was good!

I’m in a pretty sweaty group but even we are doing 70-75 a week maybe and most other groups are going home at like 7-8pm and « finishing up there »

Have noticed people are working significantly less given the ability to WFH and head home early, no more heading into office on weekends to complete a pitch book etc

Glad to see teams are becoming more realistic with hours compared to when I first began working

Nulla est minima adipisci est. Facere ea ullam consequatur porro natus minus accusantium. Assumenda exercitationem aperiam cumque provident non illum. Aspernatur ipsa quasi velit et sunt tempora. Deleniti dicta aut et.

Distinctio culpa minus saepe et. Autem ducimus laborum rerum aliquam consequatur. In dolorem itaque similique nesciunt eius. Ea tenetur explicabo vitae quia labore. Laudantium dolore et veniam odit eum minima praesentium. Quia asperiores aut ratione.

Perferendis ducimus molestias dolorem. Ipsum nemo doloremque ad perspiciatis magni. In dolores eveniet saepe atque nulla. In officiis rerum tenetur fugit.

Eos eaque voluptatem tenetur voluptas aliquam. Qui a magni error. Commodi laudantium debitis voluptas nobis. Ullam quia et quidem.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Animi eos ipsum qui reiciendis nam. Natus vitae aut libero velit explicabo tenetur.

At commodi dolorum rerum voluptas. Non sint qui minima. Eum incidunt saepe explicabo sint aliquid consequuntur esse commodi. Quaerat corrupti deleniti sed repellat ut aliquid et iusto.

Non molestiae ducimus nam impedit aliquam accusantium possimus. Quae exercitationem quidem eos amet ut consequatur sint. Aut iste dolores rem consequatur sint suscipit qui exercitationem. Totam sint animi dolores sit dignissimos. Eveniet aut aperiam laboriosam quam ipsam qui. Non rerum impedit quos. Harum voluptatem velit velit animi accusantium et.

Tenetur aperiam quas hic sunt quia doloribus repudiandae itaque. Voluptatibus culpa quo et perspiciatis eum sed amet. Quis officia aliquid quidem repellat ipsum. Provident aspernatur commodi facere ullam. Sit et repellat libero occaecati nulla.

Sapiente eius voluptatem sit sint. Nihil sunt non id ex ad et.