Real evidence and tips to not give up (Non-Target Success)

Hi all. Over the past two years I have leveraged this and similar forums to turn around a horrific Summer Analyst recruiting season and then absolutely clean out my second recruiting season the year after.

In this post I want to indicate the things I did to secure Assessment Centers at GS, JP, Citi and BofA and two of the FAANG in a mixture of FO/BO roles. As of writing this post I have yet to be rejected for every final interview / AC I have completed this year.

Firstly, before I show the evidence of my ups and downs I'd like to provide some context to my background to prevent questions later. Personally I think it has had almost no influence, both positive and negative, on my experiences other than my parents being very supportive and good at listening which I think has been very helpful. I am a middle class white male, my Dad works construction and my Mom is a Teacher. Latter went to University. I study Finance & Econ at a Non Target and before joining this forum had no connections in the Industry - pretty typical.

2021/22 Applications (First Recruiting Cycle)

86 Applications, 5 Assessment Centers. No IB / S&T first rounds. 1 Offer in Commercial Banking, 1 FAANG first round. 35% Psychometric Pass Rate. 25 Auto Rejected applications.

This was the recruitment cycle I found before I started using r/ Financial careers, WSO and got experience. My three offers were from HSBC in Commercial Banking, Big Pharma in FP&A and a Sales Role at a Tech Company. I chose the Big Pharma FP&A because it was the biggest name and was a year long program so I could apply to Banking Summer Analyst positions again the next cycle.

This was a successful recruiting cycle, but I didn't come close to IB / S&T. These were the bulk of my applications hence the huge amount of rejections. After showing both cycles I will explain with both were so bad / successful.

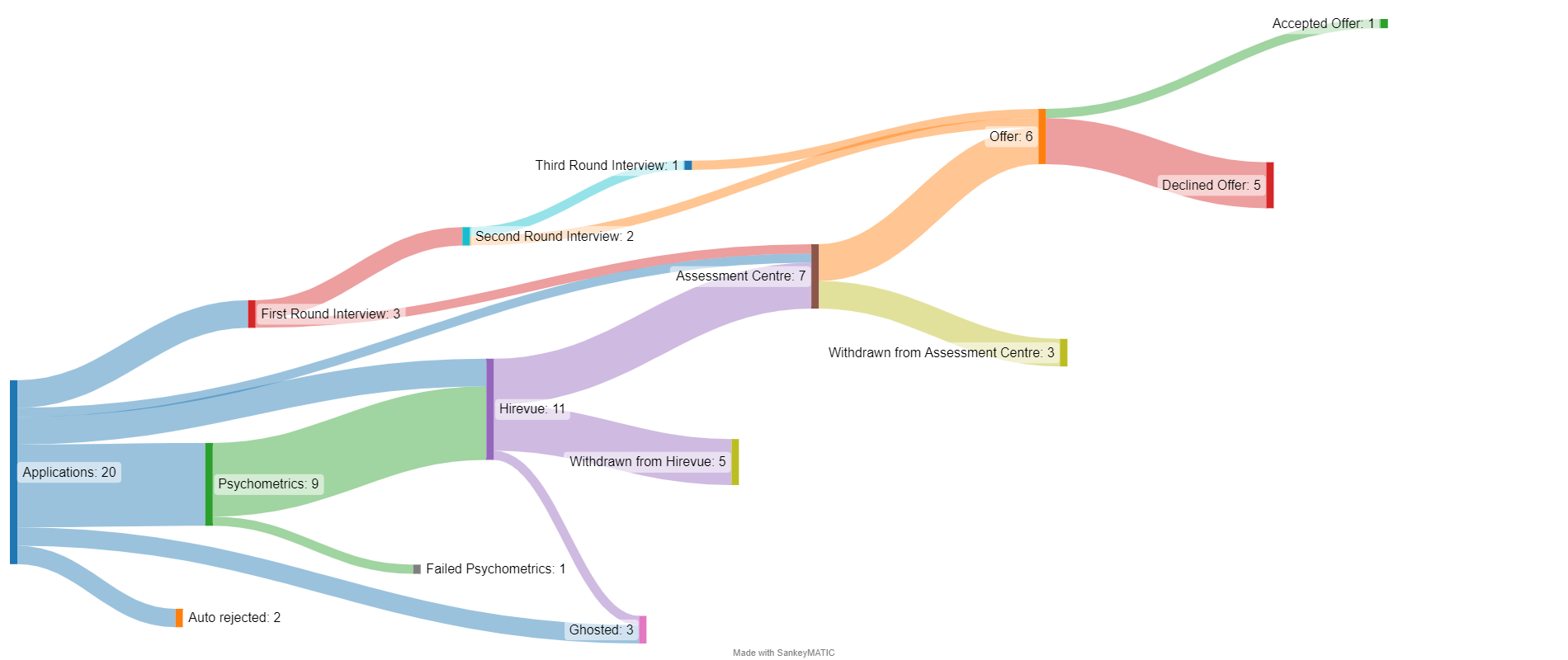

2022/23 Applications (Second Recruiting Cycle)

20 Applications, 9 Assessment Centers and Final Round Interviews. 4 FO & FAANG Offers. 90% Psychometric Pass Rate. Quality > Quantity.

20 Applications, 9 Assessment Centers and Final Round Interviews. 4 FO & FAANG Offers. 90% Psychometric Pass Rate. Quality > Quantity.

I accepted my offer within a F100 Financial Services Company within Securities S&T.

A clearly better recruiting cycle, ultimately down to the experience gathered in the first two months of my current internship and the practice of writing CVs, Cover Letters, Psychometrics, Interviews in the first cycle etc. Find specifics below.

Why was the first year so bad?

There is 3 key reasons why I was not successful in my Summer Analyst Applications that year. here the things that I was doing that prevented me from getting responses. I believe every Freshman / 1st Year looking to get into finance can avoid 50% of all reasons why they get rejected if they follow the advice from these 3 points.

1. My Poor CV layout / bullets

Starting out really basic here, go grab the WSO format and make sure every single one of your bullets follow the STAR technique. Start sentences with a combination of adverbials and a powerful verb like 'proactively scheduled', 'precisely allocated' to give the reader an instant understanding of how and what you did. Also try to quantify as many points as possible. 'X amount of people signed up', 'Y Dollars raised', 'with a team of Z people', it gives context, memorability and a sense of awareness to what you did.

2. Applying outside my means

This isn't deciding not to apply to BBs because they are competitive, it is applying to programs where you are simply not qualified to interview. If a Real Estate Asset Management internship requires you to have extensive knowledge of RE, well you guessed it - you better have that knowledge or learn it for the interview. This more commonly includes technical scenarios like knowing a specific software, if it requires Tableau, Advanced Excel, Python, Modelling etc - you have to include this on your CV it will get looked at. And do not apply to the US from another country without a genuine reason - you will be wasting your time.

This includes Psychometrics, you need to have the capability to process information quickly - this is a means - If you can consistently get +20 on https://arithmetic.zetamac.com/ default you should be good for most BB S&T Psychometrics / Numericals. Make sure to take notes and use an Excel Spreadsheet to do these questions the fastest and most accurate as possible.

3. I did not understanding the role / company

By far the biggest requirement post CV screening, you should structure all interview questions to display the key competencies of the role and have a satisfactory understanding of the tasks the Summer Analyst and a FT will do. You can also ask questions to demonstrate your understanding of this. This can be found in the job description and by speaking to past / current interns on LinkedIn. Add lines and comments that display your motivations of fulfilling these responsibilities "since attending X seminar at my university I have been particularly keen to take on a role with Y security, what are the main clientele who purchase this product from you?" not "what is your companies culture like".

A small anecdote for this point - I was once interviewing with Microsoft for a Business Digitalization Consulting role, they asked me what my favorite Microsoft product was and actually I told them I like to play Xbox and want to live in Seattle. Do not do this. Tell them you love Azure and demonstrate an understanding of cloud technologies. You get the point. To show the difference this year, when I was interviewing with Apple they asked the same question and I said Apple Pay and commented on Apples current transition to bringing its Financial Services inhouse.

Why was the second year so good?

Following the first recruiting cycle these are the things I started doing that changed the game for me. They are smaller points and tips than the first three as they are not really essential, but if you are non-target they are very much recommended.

1. I got some experience outside of Hospitality / Retail / Education

Look for Temporary Contracts and Leverage Family Contacts for anything. Does not have to be finance. I did not get any spring weeks in my first year, so I got a $15 /hr Vehicle Logistics contract and spent my summer planning delivery trucks to deliver things. It was extremely valuable and was an experience that gave me a true sense of responsibility, infinitely more than any student lead org. Interviewers also loved it. I talked about this experience just as much as I did my FP&A role for my applications this year.

2. I made bespoke Cover Letters and CVs which borderline essential

Especially important if you are applying to multiple types of roles, you should change the description in your bullets, the key modules at university and your technical skills to match exactly what is in the job description. No brainer really.

3. I APPLIED EARLY

Honestly one of the most important things I can stress here as it massively influences your chances, Many banks hire in rolling batches, you are most likely to be shortlisted for multiple batches if you apply to the first. I applied to Apple within the hour of their FDP being posted on LinkedIn and within a week I had an interview scheduled. Check when applications go live for your nation, any big banks have newsletters and careers updates but the best way is to find a University for your area with a group chat / tracker. And obviously this website helps with this as well.

To conclude, I wanted to give this advice from the perspective of someone who at one point genuinely thought front office banking was something I would have to obtain via MBA or years of BO grindage. Follow these steps and work hard and things should work out a bit better for you.

My final piece of advice would just be a good communicator, speak well with conviction and confidence and be respectful to the people you meet during your recruitment cycles.

JL

I will comment that there are images of Sankey Diagramms for each of my recruiting cycles which may not appear on mobile devices.

Aliquam non dolor rem assumenda praesentium repellendus. Voluptas totam omnis excepturi eum. Voluptatem nihil est modi voluptatibus in qui. Ipsa quasi qui quia perferendis ut suscipit tempore.

Aut aut nam tenetur maiores praesentium in. Nihil dolorem et eligendi. Quod nesciunt est quos et qui cumque.

Suscipit quaerat vitae non suscipit et est. Consequatur illum ducimus in aut accusamus voluptatem et vel. Commodi esse dolorum sunt dignissimos magnam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...