WSO 2021 Investment Banking Work-Conditions Survey (Part 1/2)

summary

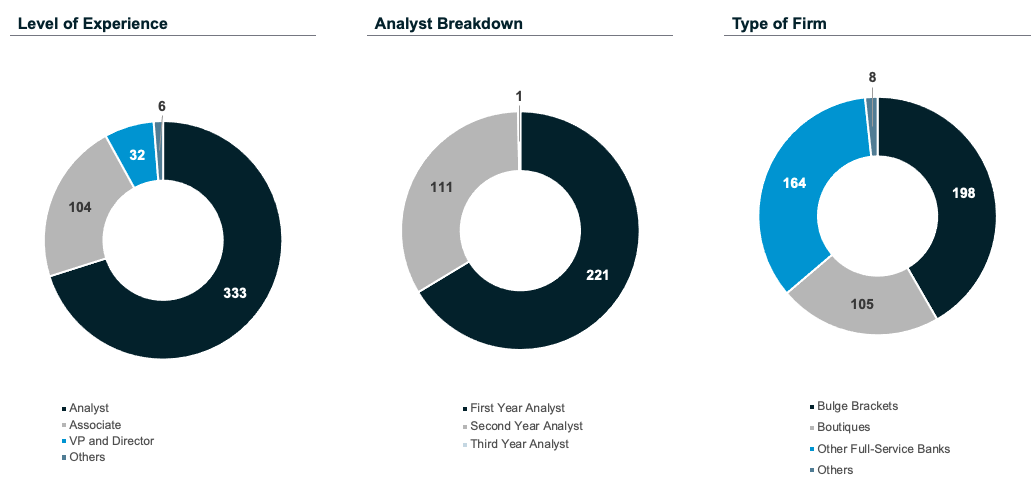

- The survey was taken by 475 banking professionals during March 24th – 29th, 2021 (the professional status of each respondent has not been verified)

- 46% of respondents are first year analysts

- 47% of respondents work at a bulge bracket bank

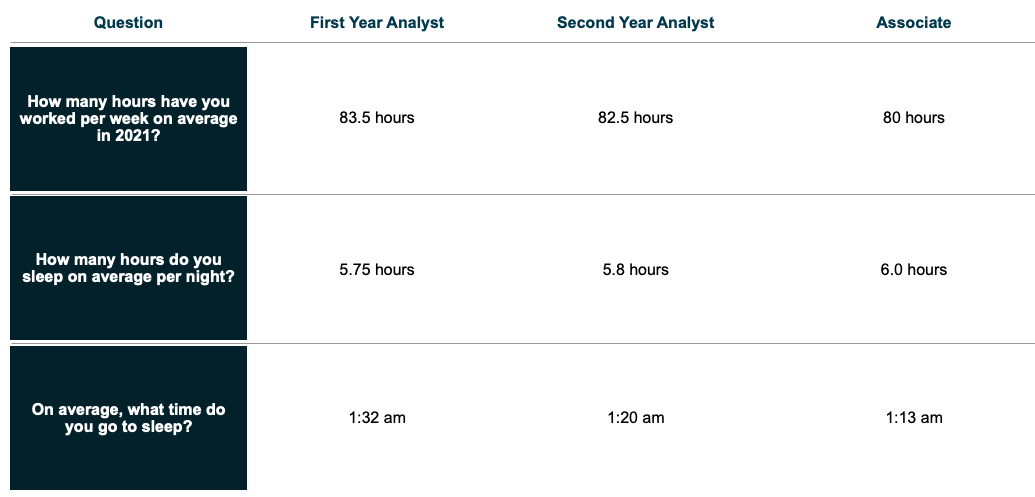

- 31% of respondents have averaged 91 work hours or more during 2021 (10% at 101 hours+)

- 37% of respondents have averaged 5 hours of sleep or less per night in 2021

- 34% of respondents have averaged a 2AM bedtime or later in 2021

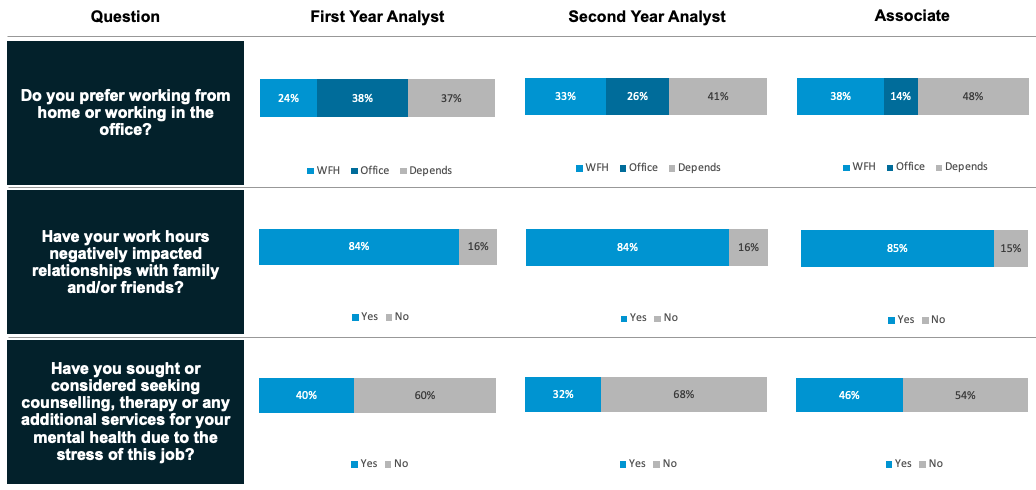

- First year analysts prefer working in-office. Second year analysts and associates prefer WFH

- 60% of respondents aren't happy with the meal stipend their bank provides

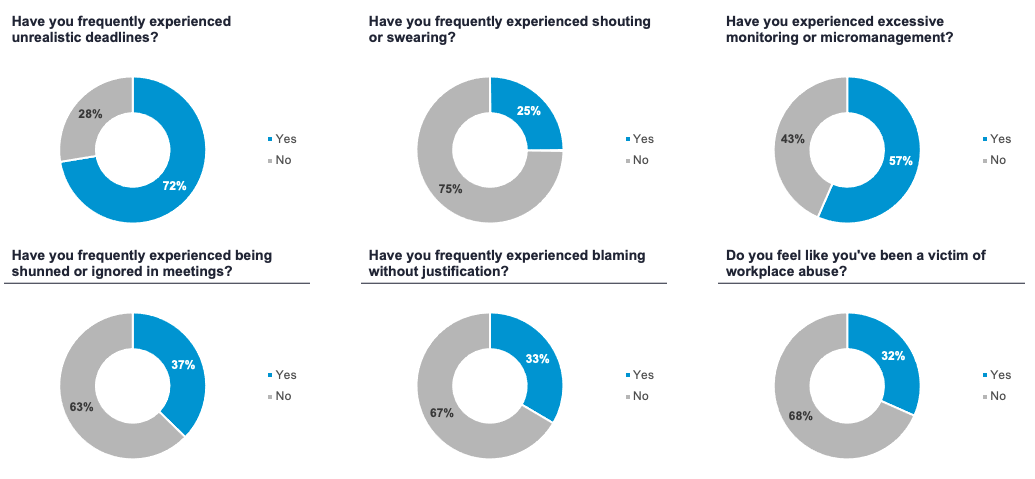

- 32% of respondents say they feel like they’ve been a victim of workplace abuse

- 72% of respondents say they frequently experienced unrealistic deadlines

- 84% of respondents say their work hours have negatively affected relationships with family and/or friends

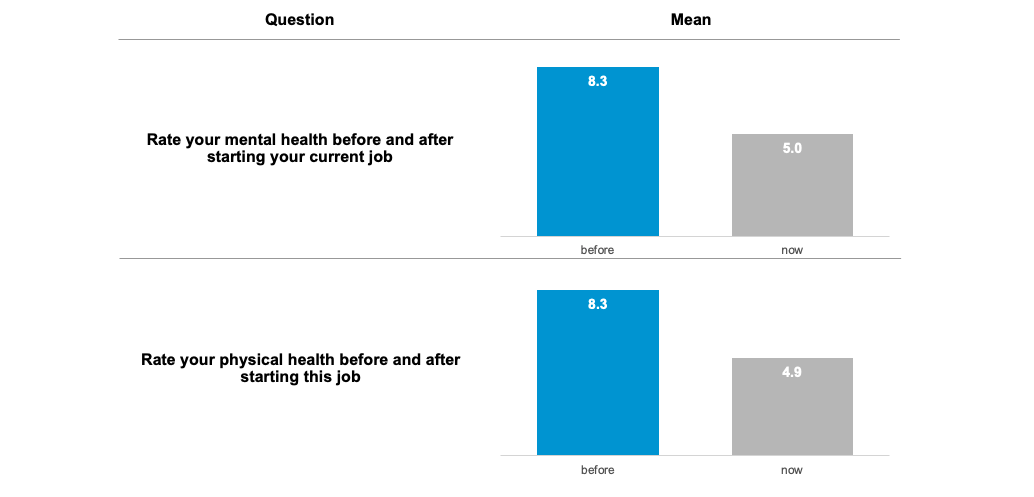

- Respondents report a 40% decline in mental and physical health (comparing health before starting their current job with now)

- A downloadable PDF is attached to this post

Demographic Breakdown

Hours Worked

“It is really not an exaggeration when we say there is no time to shower, eat, or sleep.” – First Year Analyst, Citi

WFH Treatment

"I truly think work from home is the root of many of these problems. Starting as a first year I feel like I'm only an email address to my team and there is no thought towards the hours and demands.

Additionally, the learning curve virtually has been very tough as someone who learns visual having a VP speed through how to do something on a phone call has not helped me understand how to do things and results in more work on the back end. For being 9 months into the job I expected to be further up the learning curve by now. I'm actively recruiting trying to leave." – First Year Analyst, Wells Fargo

"Senior people forget that taking care of juniors actually makes them more productive. Also, I think some people forget that juniors are actual people with real lives - WFH has made that problem worse." – Director, Perella Weinberg Partners

mental and Physical Health

"I don't laugh or get excited about anything anymore. Not a joke. Not being dramatic. I have become the least excitable and most boring person I know." – First Year Analyst, Bank of America Merrill Lynch

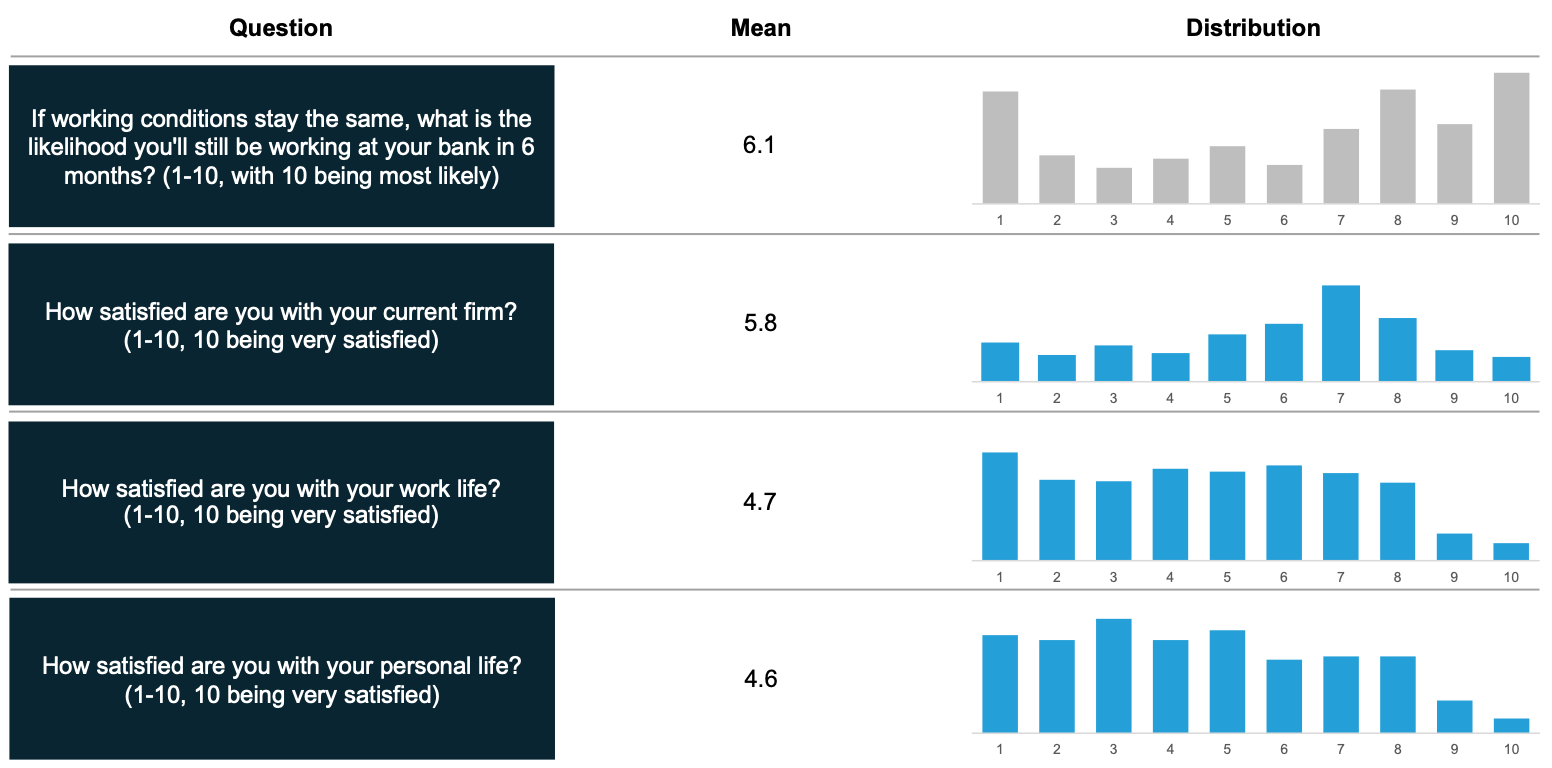

Retention and Satisfaction

"I don't think there will be any meaningful change until people understand that they cannot use ‘you are so lucky to have this job’ as a justification for treating their employees bad." –First Year Analyst, Citi

Select Analyst Quotes - Bulge Brackets

“Juniors are the ones getting crushed and having to work more, yet we get almost no upside in the fees generated because of our work. We don't want fake policies that don't improve our lifestyle – either implement real policies, or pay us more money. It is not at all worth it to work ~30% more for 5% more pay, and it's definitely not worth it ‘to go the extra mile for our clients’. Other banks should follow Credit Suisse's approach.” – Second Year Analyst, Citi

"They can't just make us work longer hours over and over while cutting all support we had (i.e. meal stipend... these are pass-through costs!!), making us pay for our own work setup, and on average paying us way less than competitors. These force us to realize the only benefit of working at GS are the exit opportunities – that's all we talk about at the moment, and we will all be out shortly after our first bonus. In my team we have already lost some Analyst 1’s and Analyst 2’s pre-bonus season. People just want to get away from here and don't care about the money anymore." – First Year Analyst, Goldman Sachs

“Ya boy leaves his apartment 1x per day to pick up from the seamless plug, has time to shower at best once every 2 days, wakes up to at least 35-40 unread emails every morning after going to sleep at 3am, consumes at least 1000mg of caffeine every day (shout-out to Starbucks nitro cold brew), gets told by MDs at the bank I should go swimming during my ‘free time’, creates back pocket analyses and girthy appendices for days, regularly lies to incoming interns/analysts telling them WFH isn't that bad, and prays to find another job before being forced to return to office.” – First Year Analyst, UBS

Select Analyst Quotes - Boutiques

“At the end it is all about a few bad apples, who introduce a toxic and unhealthy culture, while being abusive. They are clearly known to management and HR, but nothing is done about it as for instance the Partner brings profit and the Director in question has no life and is an efficient workaholic.” – Associate, PJT Partners

"Recently started. Between when I interviewed and when I started, the group lost 80% of its analysts. I think that says something about what's going on here.” – First Year Analyst, Lincoln International

“Moelis is still a sweatshop full of a-holes.” – Associate, Moelis & Company

"My team is absolutely sick (work hard but phenomenal culture), firm overall blows. Skews answers heavily on a lot of these, would 10/10 recommend my team but 3/10 recommend JEF.” – Second Year Analyst, Jefferies

“My group has some amazing people and really have made the difference between hating WFH vs still enjoying the work.” – Second Year Analyst, Houlihan Lokey

“Poor oversight by team lead. Does not lead by example. Delegates culture / people management tasks that he should be managing himself to ensure a healthy workplace environment.” – Associate, CIBC

“Bonuses better be good this year because I know for sure the bank is not suffering.” – Second Year Analyst, SunTrust Robinson Humphrey

“I do wish we could have a meal stipend, but the culture has been really good since starting during the pandemic. I do wish the return to office plan in the US was a little more concrete instead of changing every few weeks, but I understand things are in flux.” – First Year Analyst, Société Générale

"Loved the group and people, top to bottom. Hours were insane but always treated with respect.” – Second Year Analyst, Piper Sandler

PART TWO - BANK SPECIFIC DATA

You can view part two here.

| Attachment | Size |

|---|---|

| WSO Investment Banking Working Conditions Survey 942.21 KB | 942.21 KB |

U nio nize

https://www.wallstreetoasis.com/forums/my-junior-monkeys-want-real-chan…

also I put a survey on Linkedin https://www.linkedin.com/feed/update/urn:li:activity:6786032631361486848

Lesss goo

Great stuff Patrick! You're doing the Lord's work here.

There should definitely be a breakdown by industry group as well. The TMT groups at every bank have been crushed much harder on average than most other groups.

I think if you took the results of the analysts and associates in the TMT group separately, you'd get more drastic results similar to the Goldman survey.

Thanks for the feedback, we'll do another survey later this year

Is there a link to contribute to the second survey? I would like to voice my experience

This is cool. Let’s hope this makes the business news as well so that these scumbag partners and directors in banking at least look bad.

so far we've been contacted by a few large media outlets

Would be interesting to see if there is any significant divergence between offices (e.g. NYC, LDN, HK, etc.)

we'll definitely add that to the next survey

Please add the regional offices such as CHI/SF/HOU as well. Thanks.

Thanks for the reply!

Awesome, looking foward.

Can we have the raw data in Excel format?

This is how you know you’re a banker

*sends a PDF

I didn’t get a chance to reply to this - but I have legit gotten ulcers from this job. I routinely look in the toilet and am not sure if my internals are crying from abuse or having a period. But I’m a boy

If you took the survey and would like to speak to the media about your current situation (specifically NBC news) reply here or send me a message

be careful boys. a potato in disguise could spill the end for all foys![]()

Could also do one by the industry and product groups

I hate to be this guy because I know people are working really hard and struggling, but if the average analyst bedtime is 1:32am and the average analyst reports sleeping 5.75 hours / night, then the average analyst is waking up at 7:17am...?

When I was in banking I would usually leave the office around 2am, go to sleep around 3am, wake up around 9am, and be sitting at my desk by 10:30am. So my question is... are people's work days really starting earlier? as in around 8am? why aren't analysts sleeping in later? I would think if you're going to bed at 1:30am you should easily be able to sleep 7 hours, wake up at 8:30am and feel pretty refreshed especially when you don't have to budget any commute time.

My group expects analyst to start replying to emails and working by 8AM at the latest, and we often sign off at 3AM or so.

I'm an analyst at an MM. Not even the associates at my firm get off before 2am. Most analysts (myself included) are on till 3.30 - 4am most days. The MDs at my firm have no mercy and have scheduled calls at 8 am on many instances.

I mean... I fully believe you guys are regularly signing off at 4am, but based on the survey results you are outliers. As for the expectation that you start working at 8am, that blows.. when I was in banking the floor was fully (and I mean not a soul) empty until 10am, but we also stayed until 2am+ every night (and I mean every single one).

Yea my group (BB) is consistently 90% online by 9am. I do know other groups where 10-10:30am is more standard

Seems like maybe based on the survey work days are starting and ending earlier... kind of makes sense

do you guys still get to poop

Where's part 2?

Corrupti in maiores quidem ab porro ex sint suscipit. Id expedita voluptatem sunt. Ut dolorem suscipit voluptatem est in deserunt similique recusandae. Et adipisci laborum qui.

Molestiae in molestias fuga omnis. Aliquam labore quasi dolorem harum velit. Sint voluptates ducimus libero. Sunt ex magnam unde rerum.

Unde blanditiis qui ut ad voluptatem est amet. Accusamus non autem debitis delectus et dicta. Distinctio tempore voluptatibus in. Doloremque est praesentium voluptatem velit eveniet ab aut.

Nihil vero dolorum est. Qui consequatur et voluptate provident possimus dignissimos. At numquam debitis sit iure iste iure. Cum consequuntur ut velit ut rem.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Ipsum eum est facilis et dicta veniam harum. Perspiciatis placeat officiis voluptatem provident voluptates quia quo voluptates. Sequi fugit recusandae officia maiores doloribus laudantium. Deserunt modi eligendi neque quis. Aut consectetur non magni consequatur.

Aut reprehenderit deserunt voluptates consequatur ipsam. Et commodi in laborum. Ea at hic soluta maiores omnis quis quas.

Maxime molestiae veniam qui necessitatibus dicta non. Unde assumenda et ut et quibusdam. Voluptates et possimus consequatur error est recusandae ut. Aut aliquam et omnis aspernatur modi esse quod et.

Harum incidunt et ad possimus ipsum. Id architecto eum iure doloribus nisi perspiciatis optio nobis. Voluptatem velit qui molestias.