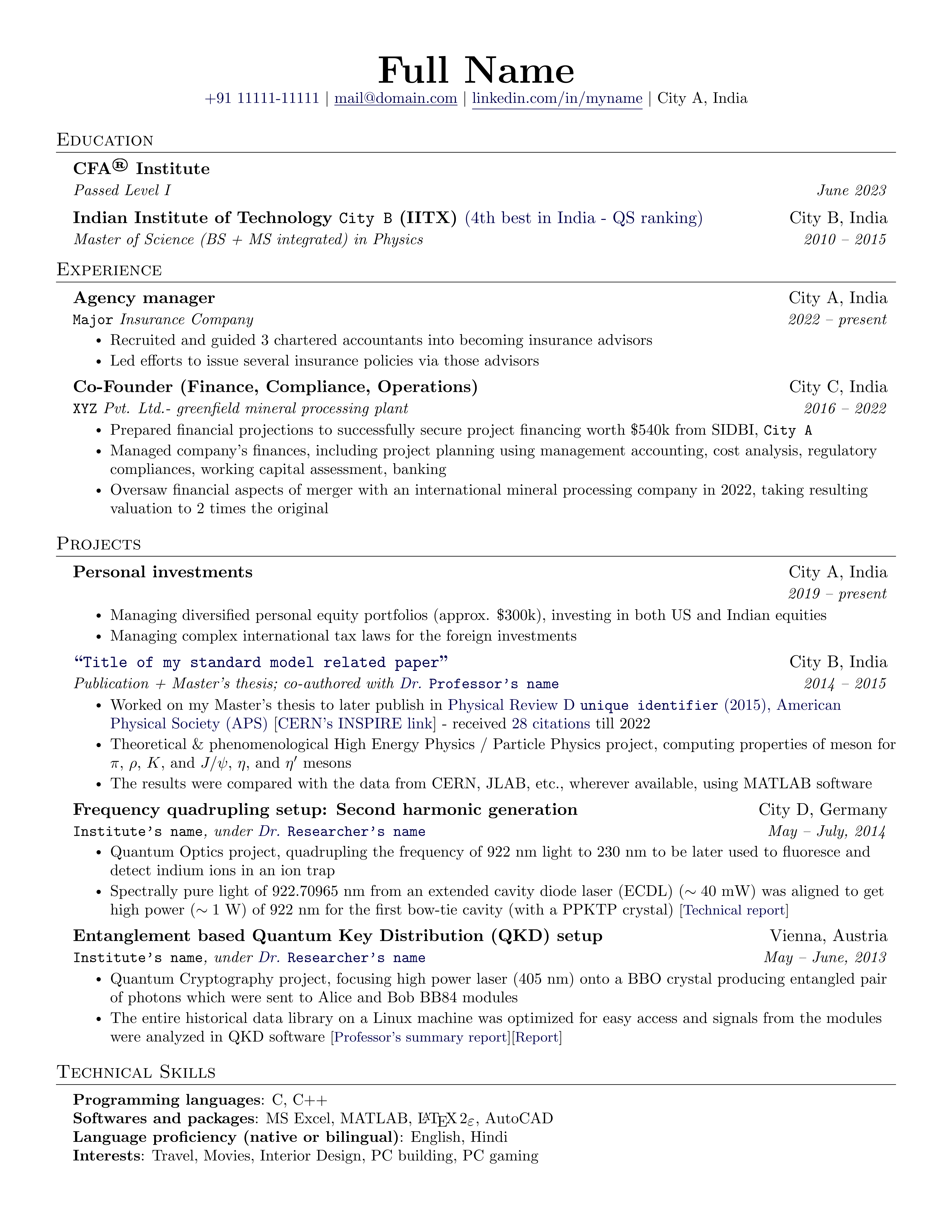

Here's a resume for you all to tear apart. Going to apply in a few days in preferably fundamental ER related jobs - mainly domestic, maybe some international too. What needs to be removed/modified/added? How much hope is there for me?

Besides whatever you think is wrong with it, I have a few specific queries, which I'll be happy to have addressed:

-

What kind of sectors and roles within them in finance would you suggest someone to look for who has this sort of resume? Esp. in equity research or PM or corp. finance, what kind of job descriptions/titles should be targeted, which can have a decent chance of getting an interview call? -

Are the dollar amounts - $300k/$540k - worth mentioning? Someone suggested me to be as specific as possible, so I wrote it. But aren't these way too small to be mentioned at all? -

Is not knowing VBA, Python, SQL a dealbreaker for a job these days? I am good at Excel, I think, but never needed to use VBA macros by far. I intend to learn it soon though. -

Should I keep the "Personal investments" project here or remove it? As people in my another post suggested, I have removed any info about the performance of my personal portfolio. It is wise to skip that, right? Considering returns have varied from +50% to -20% over the benchmarks. -

Any obvious keywords I should mention that can help recruiters' algorithms shortlist the resume for an interview? -

That bit about my university being 4th best in India - can it hurt to mention it, mainly for international positions (because everyone knows it here and I won't mention it for domestic applications)? -

This is a stupid ask, but in my conversations with my foreigner friends, I've been told that I have excellent American English accent and someone suggested to mention it in the resume (in language section), considering there are many client facing roles in finance where international companies may prefer someone with a more mainstream accent. I am uncomfortable writing it as it looks really weird & stupid. Any opinion on this?

A few notes:

- Due to apparent lack of relevant work experience in finance and to learn the theory better, I went for the CFA program. For now, I intend to continue studying for CFA exams, while gaining some relevant work experience simultaneously, if possible.

- Again due to abovementioned deficiency, I went on a little more detail on my research paper / internships than is likely warranted in a resume for a finance job. If I had anything better to write, I'd have cut down on all that.

- I'd want to get into ER roles, preferably related to US equities, but my resume being what it is, I will also try for middle office / investor relations roles in asset management, roles in corp. finance, in PE/VC companies. I also want (ideally) any work experience I will have going forward to be counted as "relevant work experience" as per the CFA charter's criteria.

- Texts in dark blue are hyperlinks.

- Texts in typewriter font are supposed to ensure anonymity.

At 30 years of age, I know it seems weird pivoting to a new field, where with such a resume I have incredibly slim probability of getting in, but I need a change and I have come to like the field a lot over the past 4 years.

Any criticisms/suggestions are appreciated.

Sed et qui quia temporibus dolor. Nisi ut est sit eum quidem consectetur aut. Neque quis voluptas molestiae non. Et et voluptatum quam quaerat. Aperiam nobis ipsam non eaque reiciendis incidunt recusandae velit.

Sunt architecto temporibus in consectetur. Voluptatem voluptatem assumenda temporibus. Suscipit et sint tenetur numquam dolores perspiciatis vitae.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...