Please Roast My Resume - Graduating Senior Not Getting Any Traction

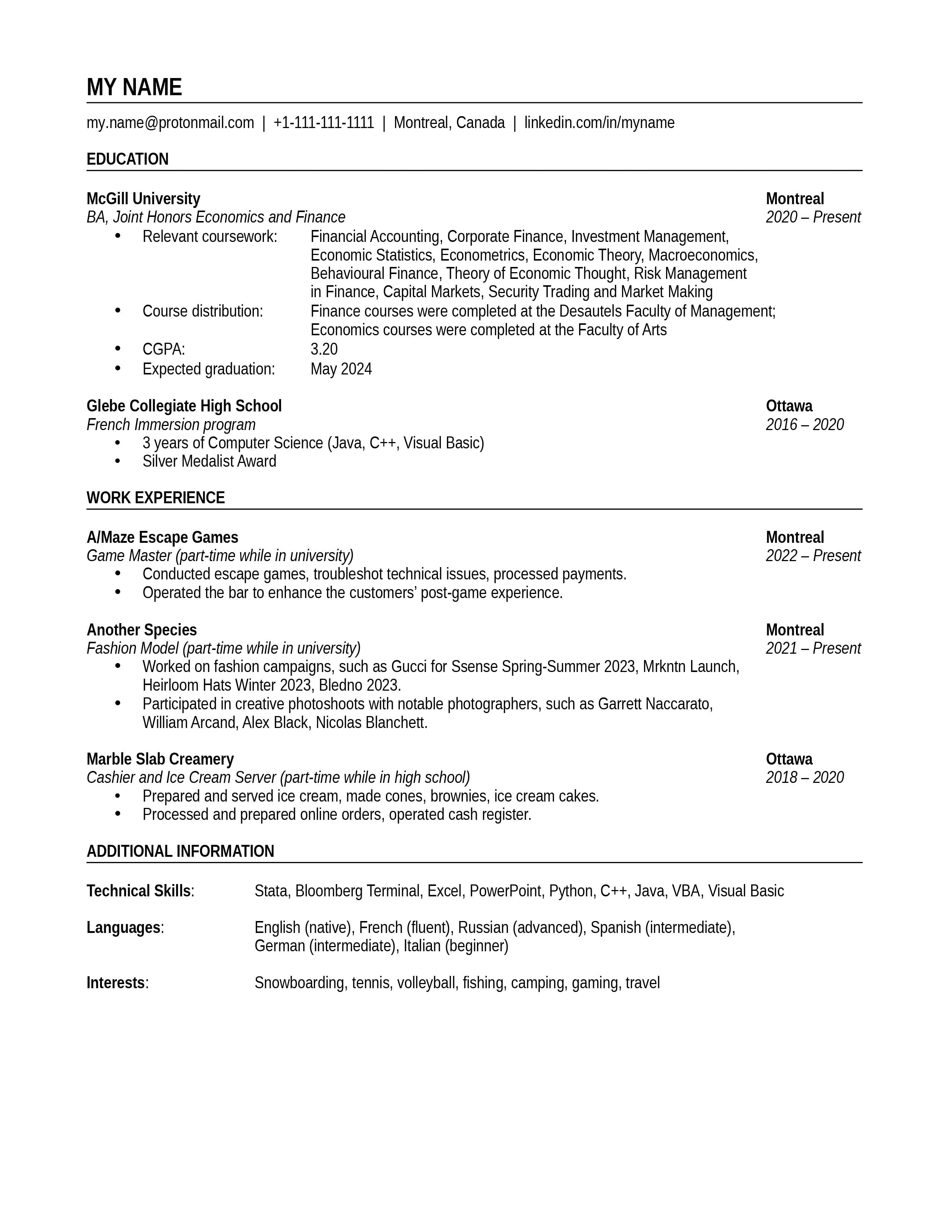

Graduating this spring from a decent Canadian university. Don't have any internships, mainly because I wanted to hold on to my year-round part-time jobs. My CGPA is 3.2. Started sending my resume to Canadian firms through LinkedIn a couple months ago, but not getting any reaction. Is there anything I can do to improve my chances of getting noticed?

Where are the bullet points for your work experience and why don’t you have your GPA on your resume?

Idk what the general consensus is around GPA in Canada but if it’s same as US then it’s recommended to leave GPA on resume unless less than 3.0.

Also, try to get a relevant internship sometime soon (even if it’s unpaid) and don’t expect to get any feedback from firms just by applying without networking, especially in your case.

Bro, did Desautels not give you their resume template or did you choose to not use it?

Tf is this??? Use that template, fill bullet points.

And I finished my master in finance from McGill two months ago. It is not just you, not many in Canada are hiring, even those that are, are hiring for laterals not freshly graduates. Had a few people who did not get returns after their internships.

And no one responds in LinkedIn anyway. Use email.

I'm using the WSO template. I'm not in Desautels. My program is a bit odd -- it's 30 honours econ credits from Arts and 30 honours finance credits from Desautels, but I'm getting a BA, not Bcom. I'm not even sure if I can use Desautels career services. I'll take a look at their template, thanks!

Updated the resume with the bullet lists. Still on the fence about the GPA.

Hey, I was heavily involved in hiring across my last two roles so here's a quick summary of some of my thoughts. It would be really helpful to know what kind of jobs you're targeting.

Some thoughts:

Finally, if you're just cold-applying to jobs on LinkedIn, it's normal to not expect a good hit-rate. You need to reach out to people in the field that interests you, (have coffees, zoom calls, etc. and network). The job market isn't super hot right now, so some more work than sending resumes in is definitely required.

Thank you so much for your feedback. I'll add the GPA (although I think it's too low) and will work on the resume based on your suggestions.

Hi, was wondering if you were based in Canada.

Saw you were in growth equity, would love to learn about funds based here.

I am a recent MFin grad from Desautels.

Yes, based in Canada. Can't go into too much detail on my exact location/role unfortunately as I want to maintain anonymity and the buy-side in Canada is a very small world, especially as you get to VP+ levels.

To get a pretty comprehensive list of the private capital landscape in Canada, you can check out the CVCA website which lists all its members and lets you search by type, geo, etc. Otherwise, happy to answer any specific questions if I feel I have the knowledge to do so.

I really appreciate your help, thank you.

I've just changed the resume, tried to address as many points as I could:

With regards to the rest, unfortunately I didn't join any clubs this year (had too much on my plate) and haven't obtained any certificates yet. Wrote a pretty good research paper on HFT for my Advanced Finance Seminar class and another paper on Keynes for my Theory of Economic Thought class. Maybe I should mention them.

I've just realized that I haven't answered your question about the type of jobs I'm targeting. Actually, I'm not entirely sure, pretty much anything non-accounting would do at this point, but I think I would enjoy HFT and trading in general (equities, commodities, forex), equity research, anything related to portfolio management.

Glad I could help.

1. I think mentioning course work that you're proud of and aligns with the job you're applying for is a good idea.

2. Unfortunately, I'm not very aware of how the job search looks like for trading so can't offer too much specific advice. I think messaging people on LinkedIn to network would be a great first step. Make sure you are concise and show interest/knowledge of what the person does and you should have a decent hit rate. There's probably a ton of good posts about how to do this on this site.

Provident dolores repellendus officia sit illo perspiciatis. Atque nihil cupiditate veniam in. Numquam qui natus quisquam fuga laboriosam. Culpa ipsam occaecati nulla cupiditate. Qui libero sunt numquam. Molestias ducimus ex laboriosam quis et.

Libero quae et quos quis rerum nulla. Amet eos asperiores iste inventore.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...