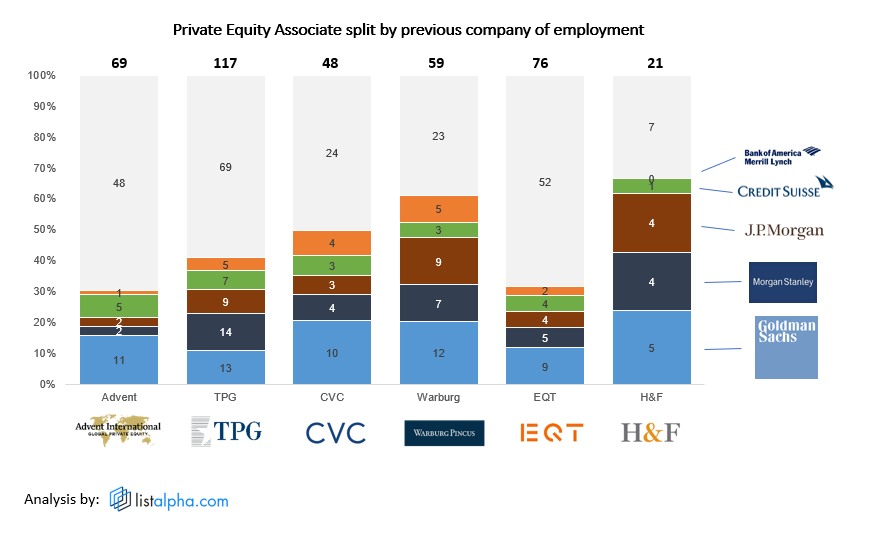

Exit opps: I've crunched the previous work experience of 390 PE Associates..

I've seen a lot of fairly qualitative/unsubstantiated comments on WSO about exit opportunities or about which PE funds hire from where... and instead decided to take matters into my own hands and crunch some data! So I analyzed the work experience of 390 Private Equity Associates across TPG, Advent, CVC, Warburg, H&F and EQT. Below is a snazzy chart of where they came from. Let's just say, GS doesn't need to give their analysts any Peloton bikes... they are already giving them the best exit opps in the industry. To replicate the results or to explore the data in more detail, click each of the individual companies below and go to "Frequency" tab:

To replicate the results or to explore the data in more detail, click each of the individual companies below and go to "Frequency" tab:

Notes on the analysis:

- N = 390

- Global geographies (all offices)

- Titles = "associates"

Really interesting work, appreciate the effort. Can you confirm the geographic scope of the work? US-only? Global? Europe?

Many thanks.

yeah good point...

Understood, no surprise that GS, MS, and JPM dominate. For anyone interested Bain and McKinsey are also pretty major pipelines (unsurprisingly). Expect that if the scope were US-only we'd the see the relative prevalence of these firms increase with the opposite being true if scope were limited to Europe only.

Thanks again.

What is the equivalent of an Investment Director in CVC to other firms?

I think it is important to note that the BBs have huge classes compared to some EB groups that are considered top for exit opps. Take PJT RSSG, they have 10 analysts per year, of course, based on this statistic they won't appear, but they all place extremely well.

Nonetheless, very interesting, thanks for sharing!

1. What if you adjust these by class sizes? I assume that these banks don't all have the exact same number of Analysts each year.

2. "Total" column would be helpful

lol - plz fix

I think the average analyst going to an EB is way more committed to being on the PE / HF path vs. the average analyst going to JPM / MS / GS. While that doesn't even out the data completely, it's a factor to consider. During my time at a BB, only 50% of the group was interested in large-cap PE while the other 50% wanted to go into HFs directly or pursue a CorpDev job.

This data isn't very high quality. A quick LinkedIn search (or sanity check) will show that TPG doesn't have 120 PE associates. Can someone double check this work?

LinkedIn lets you see more people that are closer in your network. Additionally, OP probably included data from past classes i.e. people that may have been associates at TPG at one point. I guess if you wanted a cleaner dataset, you would have to factor in class year / time series which would also shed light on whether boutiques are gaining exit market share over GS / MS / JPM over time.

I have 4 connects at TPG right now (all AS1 or AS2). Didn't think of the past classes point, would love to see the specific data

1) Click here

2) Scroll down to the Associates box

3) Click on the 117 grey circle -> you will see all of them there

This is helpful, but scrolling through the 117 listed ASCs, it looks like there's a lot of ASCs in non-investment roles i.e. accounting services, fund services, treasury, data analytics, performance, reporting, technology, etc. Would need to clean those out to have a better idea of bank exit ratios.

OP was probably an MBA associate /s

This is an unusually high quality post. Would love to see more like this on WSO. I wish I could give 5 SB's.

cheers man!

Very cool analysis although I'd argue most people could've guessed that result.

From an agnostic standpoint, if you're a PE recruiter and you have 2 candidates, one from GS who you know will work more for lower pay and one from an EB, the choice is kind of obvious no? All else equal.

lol no ?!

lol yes!?

As an aside to readers and specifically interns or prospects—I’d argue a huge part of this is selection bias and size of analyst class, not necessarily blatant recruiting preferences. This data is pretty misleading because there are a ton of underlying factors not being controlled for that explain the data. PE shops aren’t rejecting an analyst because they list Evercore, CVP, or Qatalyst, instead of GS or MS on their resume, fullstop. Also, arguing that these are the most prized exit ops is questionable from what I have seen in practice after leaving banking.

Put another way, if you went through banking recruitment and got a GS offer and CVP and chose GS, you likely are gung ho on the status train and will gun for one of the shops listed. Also, those that really buy into the brand name and don’t leave the industry are going to continue to value brand name above all else. The EB analyst might be more likely to stay in banking or to choose an alternate exit such as going to a hedge fund, a growth shop, VC, etc. just based on personality and values.

Point is, this data is amusing, but doesn’t control for size of analyst class and how analysts recruited. More interesting, but ultimately pretty impossible to find unless you have an insider is:

Not to trash this too much, but I think a good analogy would be this would be like if you looked at colleges and said the best colleges are ones that send the most analysts to GS, MS, or JPM.

When in practice, a school like Wharton that is a smaller school and has many individuals go to EBs, or direct to the buyside, might not be the top represented school among those 3 institutions, despite likely having the best outcomes in practice.

I think pretty much everyone is aware of the limitations of those data cuts but you are welcome to do all the analytical work you have outlined (hint: you won't, and if you did you would not share it easily as this is painstaking work). This is a good surface level analysis that provides directional insight into PE recruiting, not need to get all defensive about it.

This isn't true --that's my point. I'm not defensive, I am strongly opposed to the genuinely poor advice/ groupthink this website often provides. This is a great example of someone who is unaware of how the process works, providing advice that could seriously mislead undergrads and prospective finance professionals. You are right, I don't need to do that analysis because I already did it when I recruited by calling real people so there is accountability and legitimately verified advice. Call someone who worked at one of these places and ask them if they would do it again or pursue an alternate exit.

The analysis OP provided is supposed to be directional. No one is misleading anyone by using publicly available information to present an analysis that could be helpful for prospective candidates. At the end of the day, if you have a choice to go to GS / MS / JPM or EB, you probably are a good candidate and can land interviews at these jobs. As people have mentioned, once you get in the door, it’s about how you perform and not which bank you are from. The answer itself becomes self selecting when the best candidates are at the best banks.

Based on my experience in banking, the top exit opps are MF PE and top HFs. Miles vary significantly for Corp Dev, tech and start up exits. Not all of them are equal. There might be a rockstar analyst that just wanted to go the operational route while another analyst that struck out in typical on-cycle recruiting might just end up having to go to an exit opp not in PE / HF. The point is that you never know, but I can bet that 50%+ of each analyst class at a BB want to shoot for the MF PE or HF exits.

Reread my comments—I don’t know who this is supposed to be arguing against. My point above is just providing some needed disclaimers that recruiting is larger than 6 firms, so it’s not really capturing a great view of recruiting. Also, class sizes are very different. Instead, individuals should call real people who have exited these firms for a better perspective. Only reason I bring it up is because you know some citi/ baml summer analyst is out there thinking their life is over based on this analysis or that some kid should renege evercore for GS. Also, blowhards like you have an inability to understand nuance unless it is presented on a platter.

"GS does not need to give analysts any peloton bikes" Lol Someone that works hard and is smart is more likely to break into a prestigious role regardless of the bank they're at.

As someone who has been involved in hiring decisions, this is untrue. There are smart people everywhere, and when it comes to breaking "ties" for few seats, brand matters. Sorry.

Probably does matter to a stuck-up pretentious firm like the one you work at but many firms in finance are more practical and care about performance more than anything.

Of course it does matter, at least to people who want to make money.

Why do we look at school name/brand and gpas and frats and country clubs/social or dining clubs etc (esp single black ball ones)?

There is a certain amount of information and review done to get into each...and to stay into each. College degress do not matter, who needs 4 yrs? 2 years is sjw crap. We can ask for people to complete a few certificates and have a case study on ppt and excel and award winners jobs. But we don't we have target and semi target schools (and have students pay an extra $100K) so it is easier for us to narrow down the applicant group.

The hardest things to measure - desire, steadfastness, loyalty, dedication are distilled out of social institution interactions and their gatekeeping. We would ignore important information if we did not consider the sifting work performed by others before us (college and earlier employer group)

Anyone doing this for a living will take the easy layups and hire those first - then go assess large swaths of people looking for any stars.

Great stuff, how about you crunch some numbers about EBs now. Which EBs have best exits to h&f and other good ones.

I was actually thinking the same… will need to add some custom code for that but can do it this weekend…Which of the EBs would be most relevant for this kind of analysis?

Moelis, PWP, evercore, lazard, any others?

Yep, add PJT also i guess.

Do you think most of the exits will be the same in other places like London? Or we could compare.

Correct me if im wrong but it looks like BofA has was better exit ops? Or am I reading the chart wrong?

Yeah exactly, just see on linkedin, there are many MDs in mf pe and many PMs in citadel, BAM etc. from bofa but the number has decreased, there are fewer new associates now from bofa.

Not surprising… if you’re in IBD at GS / have strong recs or a good performance review, you’re pretty much a lock for a top fund.

Awesome post - as other have mentioned, inclusion of Citi/Barc/EBs and a focus on US associates would probably be more helpful but nonetheless awesome.

In many ways, I feel like this just confirms what everyone already knows: once you get to BB/EB, there are plenty of amazing opportunities available to you.

A bit shocked by how much of a league of its own GS is (I probably shouldn’t be) as well as how well Bofa/CS compete with JPM/MS at some of these funds (given how much “top BB” is thrown around here).

From my experience what it boils down to is a pipeline effect. Because PE recruiting starts before anyone can make realistic assessments of who’s a good candidate, they go back to places where they’ve found successful associates in the past.

As such, there will be certain groups that send people to certain funds (e.g. GS FIG is always going to send a couple to Apollo, who will also always take from PJT, MS M&A is going to send a couple to KKR, who also always take from EVR etc).

So the unfortunate advice is when you’re recruiting for banking you want to have some sense not only of the exit opp you want broadly (MF PE), but a sense of what groups will best position you for certain firms within that band. Because as much as this board tends to immediately shut down discussion of which MF is “best”, the truth is they are different. Your experience as an investor will be shaped very differently at a place like Apollo (deep value) vs Carlyle or Warburg (smaller deals, more willing to pay for growth)

So from a practical perspective, I think the thing to do while networking is find a way to connect with a second year analyst you know is leaving and get the specific details on where people in his or her group have gone in the past. That will allow you to make a much more informed decision than being the autist who scrapes the most LinkedIn data (hint: picking up the phone and getting information you’re looking for out of people in a friendly way becomes a pretty core aspect of these jobs as you move up)

Est tempora quod voluptas beatae vel. Consequatur porro deserunt qui similique. Consequatur sit quod quas sit rerum qui.

Temporibus vel odio adipisci porro quo atque nam. Nostrum voluptates esse perferendis sed eaque. Numquam est quaerat consequatur et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Autem dolorem dolores occaecati. Iure porro modi et nesciunt quae architecto. Illo consequatur expedita a. Dolorem et nam consequatur similique. Iure et voluptatem exercitationem.

Quaerat unde non aut voluptas incidunt beatae. Corrupti vero id placeat ipsa. Maiores repellat repellat sit officiis occaecati sed.

Quos non quod quisquam sunt reiciendis. Iusto laboriosam quae est illo expedita et. Deserunt quia sint voluptatem tenetur.

Itaque ducimus ut et aperiam optio. Iusto aut repellat cupiditate facilis doloribus. Praesentium sit magnam nam molestiae maiores. Odio reiciendis enim molestias sint et. Quae natus est quidem molestiae harum commodi earum totam.