Marginal Revenue Product (MRP)

Demonstrates the adjustment or change in total production brought about by utilizing an extra asset

What Is Marginal Revenue Product (MRP)?

Marginal revenue product (MRP) demonstrates the adjustment or change in total production brought about by utilizing an additional asset, assuming that the costs of different variables stay unaltered. It is essential in determining the optimal level of resources to use.

Organizations utilize the marginal revenue product analysis to settle on choices for production and advance the ideal degree of production factors.

A production input with a higher MRP will draw in a greater cost than an input with a lower one.

MRP depicts the extra income created by expanding an additional unit of production resource, known as marginal revenue product. It is a significant idea for distinguishing or looking at the interest in contributions to production and the optimal nature of a resource.

It is generally used to settle on the basic choices of business production and inspect the optimal level of an asset. Assessing expenses and incomes is troublesome, yet organizations that can estimate it precisely will often make more than their competitors.

It is predicated on the marginal analysis, or how people choose on edge. So, for example, a customer buys a jug of water for $1.20, but that doesn't mean the customer believes every jug of water is worth exactly $1.20.

Considering all the factors implies that the purchaser abstractly esteems one extra container of more than $1.20 at the time of sale. Therefore, the marginal analysis gradually looks at expenses and advantages, not as an objective entirely.

It is significant for understanding the compensation rates in the market. It only makes sense to employ extra labor at $20 per hour if the labor's MRP is higher than $20 per hour. The company will be at a loss if extra labor cannot generate an extra $20 per hour in revenue.

-

Marginal revenue product (MRP) measures the impact of additional resources on total production, aiding optimal decision-making in production and resource allocation.

-

It is calculated by multiplying the marginal physical product (MPP) by its marginal revenue (MR), showing the added revenue from employing one more unit of a production resource.

-

MRP analysis aids companies in gaining a competitive edge by accurately estimating costs and revenues and ultimately, better budgeting.

-

The MRP curve highlights diminishing returns as more units of a variable input are employed and is crucial for understanding labor demand and wage rate decisions.

-

Balancing MRP with marginal cost through careful planning and cost considerations is crucial for maximizing profits.

understanding Marginal Revenue Product (MRP)

American financial expert John Bates Clark (1847-1938) and Swedish business analyst Knut Wicksell (1851-1926) first showed that income relies upon the peripheral efficiency of extra factors of production.

Business owners or Entrepreneurs frequently use this analysis to make critical production choices. For example, a farmer wants to determine whether to buy one more specific tractor to seed and harvest wheat.

Suppose the additional tractor can ultimately deliver 4,000 extra bushels of wheat, and each extra bushel sells at the market for $10 marginal revenue cost). In that case, the MRP of the tractor is $20,000.

By considering all these different factors, the farmer is able to pay less than or equal to $20,000 for the farm truck.

A few basic monetary bits of knowledge outgrew marginalism, including marginal productivity, marginal costs, marginal utility, and the law of diminishing marginal returns.

It is vital to understand wage rates in the market. It just checks out to utilize an extra worker, working at $20 each hour if the laborer's or worker's MRP exceeds $20. The organization loses money if the extra laborer can't produce an extra $20 each hour in revenue.

It can be obtained by taking out the contrast between the two progressive total incomes. The distinction in the two progressive total incomes occurs because of the work of an additional unit of a component.

Strictly speaking, laborers are not paid as per their MRP, even in balance or equilibrium.

Rather, the tendency is for wages to approach discounted marginal revenue product (DMRP), similar to the discounted cash flow (DCF) valuation for stocks.

Assuming that the wages exceed DMRP, the business might reduce the wages or replace a worker. This is the procedure by which the Supply and Demand Markets for workers inch nearer to balance or equilibrium.

The formula for calculating Marginal revenue (MR)

The marginal revenue formula includes multiplying the marginal physical product (MPP) by the marginal revenue (MR) and is shown in the below formula:

The formula for calculating the marginal revenue of any product is given:

MR = TR / Q

Where MR= marginal revenue, TR= total revenue, and Q= amount of goods.

Calculation of (MRP)

The formula for calculating is as follows:

[ MRP = MPP * MR ]

Where MRP is the Marginal Revenue Product, MPP is the Marginal physical Product, and MR is the Marginal Revenue earned or gained.

Let us consider an example to show the working of MRP:

Assuming that Robert is the manager of a footwear fabricating plant, he is considering recruiting one more worker to satisfy the rising need.

Marginal revenue is determined by separating the adjustment of all income by the adjustment of the amount. The Greek image Δ, articulated delta, addresses the adjustment of a value. Duplicating the marginal revenue with the peripheral item gives the MRP.

He estimates that every unit sells for $15, and Robert realizes that another worker will produce an extra 150 sets of footwear consistently; the MRP is determined as follows:

MRP = 150 * $15 = $2,250

Subsequently, If Robert recruits another worker, the representative will produce an extra $2,250 in week-by-week income for the assembling plant.

Calculating marginal revenue product (MRP)

The marginal revenue formula is a financial ratio that determines the change in overall revenue from the sale of extra products or units.

Organizations utilize MRP analysis to pursue key production choices. Then they apply the idea of MRP in assessing the expenses and incomes by utilizing the data to acquire an upper hand against their opponents and competitors.

Value of Marginal product (VMP): the value of the Marginal product is a calculation determined by multiplying the marginal physical product by the average revenue or the product's price. More specifically, the formula for calculating the value of the marginal product (VMP) is given below:

VMP = physical product * sales price of the product

The value of the marginal product (VMP) calculates the amount of a company's revenue that a unit of productive output contributes. VMP also helps to prevent labor exploitation in the organization.

Some of the essential terms that are used in MRP are as follows:

-

Marginal Revenue: This is an increase in the total revenue created by the increase in production.

-

Marginal Product: This refers to the change in the result because of the additional or extra labor or units.

-

Value of Marginal Product (VMP): This is the marginal product or output multiplied by the product cost.

Marginal revenue product curve

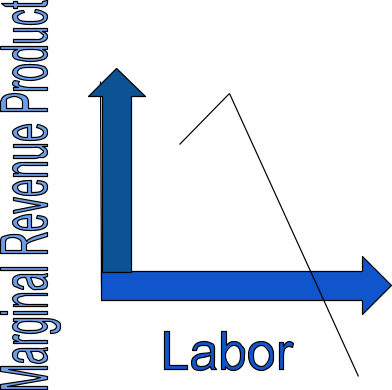

The MRP curve is a curve that graphically outlines the relation between MRP and the quantity of the variable input, holding all other inputs fixed.

This curve shows the gradual change in the total revenue for incremental changes in the real variable input. The diagram graphically shows the relationship between the MRP and the variable input.

In the above curve, the number of laborers is measured on the horizontal axis, and the revenue generated from the marginal production is measured on the vertical axis.

The shape of this curve is generally significant. As displayed in the above curve, the declining segment of the marginal revenue product curve reflects The Law of Diminishing Marginal Returns.

This curve is the critical element for determining the component "demand curve."

What does the MRP curve show? The demand for workers is a company's MRP curve. The above graph indicates the relationship between the wage rate and the amount of labor that a company demands. The curve slopes downward as a result of the diminishing marginal product.

As per the law of variable proportions, the marginal product of input increases initially; after a positive level (degree) of employment, it begins diminishing. Hence, the curve looks like a reverse U-shaped curve in the average and marginal product curves.

Marginal revenue product of labor (MRPL)

The marginal revenue product of labor (MRPL) shows an increment in the total production output when extra labor is hired while keeping all other factors of production fixed,

The MRPL is determined by multiplying the marginal product of labor by the marginal revenue.

MRPL = MPL x MR.

Organizations utilize MRPs to decide the labor demand based on the demand for their results.

In a competitive market, the profit-maximizing recruiting choice is to recruit new laborers up to where the marginal revenue result of the last labor rises to the market wage rate, which is also the marginal cost of the last employee.

Assuming that the marginal revenue of the last employee is not precisely their wage rate, recruiting that labor will set off a reduction in benefits. The marginal revenue result of labor addresses the additional income acquired by recruiting an additional worker.

This demonstrates the actual wage the organization is willing to pay for each new laborer they recruit. The organization pays the market wage rate derived from the forces of supply and demand.

This is due to the fact that when there is perfect competition, the firm is a price-taker, and it does not need to lower or reduce the price to sell extra units of output. The market wage rate represents the marginal cost of labor that the firm must pay each additional worker it recruits.

Example for MRPL

A firm is recruiting work in a competitive work market. If the marginal revenue result of a worker is more or higher than the wage rate, what should the firm do?

Solution: A firm must recruit more workers. ( A profit-maximizing firm will recruit more workers until the marginal revenue of workers is higher than the wage rate).

MRP and optimal input level

When a firm uses inputs to their optimal level, the marginal revenue product of additional product information is equivalent to the marginal cost of an extra resource or asset.

In this manner, if the MRP outpasses the marginal cost of input, the firm will maximize its profits by recruiting more inputs, which will, in turn, increase the volume of outputs.

However, assuming that the marginal cost exceeds the marginal revenue product, the firm will be forced to reduce the number of inputs in production, which will subsequently cause a reduction in the number of units produced.

When marginal revenue is less than the cost of production, this indicates that a firm is producing too much, and it should reduce its quantity supplied until the marginal revenue equals the marginal cost of production.

Marginal revenue (MR) and marginal cost of production

The marginal cost of production means the costs incurred for each extra output produced. Significantly, the marginal cost of production tends to rise as the quantity being produced rises up.

The marginal cost of production and marginal revenue are financial measures used to identify the amount of output and the price per unit of a product that will maximize the profits.

An organization can expand its benefits by delivering where marginal cost (MC) rises to marginal revenue (MR).

A rational organization always tries to crush out as much profit as possible, and the relationship between marginal revenue and the marginal cost of production helps determine the point at which this occurs. The objective, in this case, is for marginal revenue to equal MC.

The marginal cost (MC) is calculated by dividing the total cost change by the quantity change. It is given by the formula below:

[MC = C/Q]

Where MC = marginal costs, C is the total cost, and Q is the change in the quantity.

The marginal costs of production may change as production capacity changes.

For example, let us assume that a company increases its production of an "XYZ" product by 200 units and receives revenue of $400. Then calculate the marginal revenue.

Change in revenue = $200

Change in the quantity (marginal revenue) = $2.

A lower marginal cost of production means that the firm is operating with lower fixed costs at a particular production volume. Conversely, if the marginal cost of production is higher, the cost of increasing production volume is also high, and increasing production may not be in the firm's best interests.

Reaching optimum production

Organizations should be aware that expanding production brings about steep costs because of changes in significant reach (for example, extra apparatus or space required).

Eventually, the organization arrives at its optimum production level, at which additional producing units would increase the per-unit production cost. Additional production causes fixed and variable costs to increase.

For instance, increased production beyond a certain level might include paying workers prohibitively high amounts of overtime. But on the other hand, the maintenance costs for machinery may significantly increase.

The marginal cost of production estimates the change in the total cost of a good that emerges from producing one additional or extra unit of that good.

Reaching the optimum production level is the point at which the firm reaches its optimum production by producing more units which usually increases the per-unit production cost. In other words, additional or extra production leads to an increase in fixed and variable costs.

When the production is increased beyond a certain level, it may involve paying prohibitively high amounts of overtime pay to the laborers.

Benefits Of Marginal Revenue Product (MRP)

There are many advantages to using MRP. Some of these advantages are as follows:

1. Inputs and Outputs

For simplicity, economists decrease organizations into "inputs" and "outputs." Inputs are the things you use to produce goods and services, such as hours of labor and tons of raw materials. Outputs are the things you produce. Every input has a cost, including the workers, that must be paid.

2. Paying for inputs

It is "the key impact" on how much a firm should be willing to pay for inputs. So, for example, if labor has a marginal revenue product of $400 daily, then that is the maximum wage firms should be willing to pay.

3. Inputs in isolation

The idea of an MRP assumes "all other things being equal." In other words, If you add a worker but change absolutely nothing else, and your revenue grows to $400 daily, then the worker's MRP is truly $400.

4. Proper planning and reliable production schedule

The MRP system assists production managers in properly planning production and putting together a reliable production schedule.

5. Administrative demand for traceability and transparency

The MRP System assists in meeting the regulatory demand and enforcing quality and audibility.

But if adding a worker to the production line means you will go through an additional $40 worth of raw materials daily, then that additional cost must be considered. It then makes sense to recruit the worker only if you can pay $360 or less. That is the real marginal product of your worker.

Limitations Of Marginal Revenue Product (MRP)

One of the difficulties in comparing marginal revenue product to the marginal cost of input is that the increase in any single input is usually not enough to create more output units.

In many organizations, estimating every worker's productivity level is troublesome. In this way, organizations need to make the best assessment of the efficiency and utility of every worker.

For instance, public area occupations are not simply impacted by the current factors but rather by public authority strategies and government policies.

Despite its major contribution to factor pricing, MRP suffers from some limitations or disadvantages, which are as follows:

1. Unrealistic assumptions: Marginal productivity theory stands true only under specific circumstances, such as homogeneity of production, perfect competition, and perfect mobility of factors of production.

Besides, this theory is applicable only in a static economy, while the real world economy is dynamic.

2. Difficulty in estimation: It implies that the marginal productivity of a factor of production cannot be estimated accurately or exactly.

This is because while determining the marginal productivity of a factor, other factors are kept constant, which is not possible in the real scenario.

or Want to Sign up with your social account?