Non-Operating Expense

A cost that isn't tied to fundamental business activities is a non-operating expense.

What Is a Non-Operating Expense?

It is common to have expenses unrelated to a firm's daily operations. Therefore, as non-operating costs, they should be separately listed on the Company's income statement.

This makes it easy for financial managers, investors, and other stakeholders to understand the business's performance. A cost that isn't tied to fundamental business activities is a non-operating expense.

Interest payments on debt, restructuring charges, inventory write-offs, and payments to settle litigation are examples of non-operating expenditures.

Stakeholders can gain a clearer perspective of firm performance by documenting non-operating expenditures separately from operational expenses.

Understanding Non-Operating Expense

A cost from activities that aren't directly tied to core, day-to-day firm operations is a non-operating expenditure. Interest payments and one-time expenditures due to asset disposal or inventory write-downs are examples of non-operating expenses.

After operational expenditures, non-operating expenses are usually included near the bottom of a company's financial statement.

It's usually a good idea to separate costs and income sources that aren't directly tied to core business activities to get a clear view of a company's success.

A company may be profitable, but a one-time expenditure like a write-off of old inventory might result in a net loss.

On the other side, the corporation may sell a non-core business line, resulting in a profit that raises the Company's bottom line momentarily.

It's simpler to assess how the main business fared during any given accounting period when these non-operating costs and profits are kept separate on the Company's financial statements.

This also aids in the tracking of performance patterns and the more precise forecasting of future performance. Accounting software aids in essential financial monitoring, allowing for more accurate forecasting and budgeting.

Non-operating costs are included at the bottom of the income statement.

The goal is to make it easier for users of financial statements to evaluate the direct business operations that show at the top of the income statement on their own. Profit generation from core activities is crucial for a company's success.

Non-Operating Expense importance

Before learning about the importance of non-operating costs, it's essential to understand the advantages of appropriately reporting them.

To begin, company owners profit in the following ways by disclosing non-operating costs on financial statements:

- By transparently conducting business, we are creating a trusting relationship with current and future stakeholders.

- Declaring non-operating costs like employee perks, bonuses, loan interest, and so on adds to the financial reputation of a company.

- Including non-operating expenditures in a company's income statement provides for a more accurate and transparent financial report to be prepared. As a result, they will be able to forecast future earnings on a more realistic basis.

However, non-operating expenditures play a significant influence, as seen below:

- Non-operating costs help examine a company's performance and estimate its prospective profitability.

- Management can discover unjustified spending by keeping a complete record of non-operating costs. The control can successfully decrease unnecessary expenditures by making the required modifications.

- However, individuals must make it a point to appropriately categorize expenses to make the most of the information relevant to non-operating costs.

Understanding a company's earnings from core activities, net of direct operating expenditures is crucial when analyzing how it makes profits. Of course, unrelated costs influence the bottom line, but they may not reflect how well a firm is doing.

Operating expenditures are significant since they may assist in determining a company's cost and stock management efficiency.

It emphasizes the degree of expense t firm must incur to earn income, which is the primary purpose of a corporation.

If a corporation has more opex as a proportion of sales than its rivals, it may imply that they are less efficient at generating those sales. However, looking at a company's opex has the drawback of being an absolute figure rather than a ratio.

As a result, it is inappropriate to use it as a yardstick to compare businesses, even if they are in the same industry. However, they may be helpful in the horizontal analysis since they can represent the Company's prior success.

Non-Operating Expense Examples

Depending on the industry, a business may incur various non-operating charges.

Here are some examples of everyday non-operating expenses:

1. Interest charges

- An entity's interest expenditure is the cost of borrowing money. On the income statement, interest expense is a non-operating expense.

- It denotes the interest payable on all borrowings, including bonds, loans, convertible debt, and lines of credit. It is computed by multiplying the interest rate by the outstanding principal amount of the debt.

- On the income statement, interest expense represents interest accumulated during the period covered by the financial statements, not interest paid during that period.

- While interest expenditure is tax deductible for corporations, it depends on the individual's jurisdiction as well as the purpose of the loan.

2. Obsolete inventory charges

- Obsolete inventory is inventory that has reached the end of its product life cycle and must be written down or written off the Company's books.

- To write off old inventory, deduct expenditures, and credit a counter asset account, such as allowance for obsolete inventory.

- The current market value or book value is calculated by subtracting the contra asset account from the total inventory asset account.

- When outmoded inventory is disposed of, the associated amount in both the inventory asset account and the contra asset account is deducted from the disposal journal entry.

3. Derivatives expense

- Derivative expenses are the reasonable and necessary fees, costs, charges, or expenses incurred solely in response to a derivative demand by the Company, its board of directors, or any committee of its board of directors and do not include

- Any settlements, judgments, damages, compensation, or benefits of any Insured Persons or any overhead expenses of the Company.

- The insurer will refund derivative costs within sixty (60) days of the Company providing written notification to the insurer of its final decision to file or not launch a civil lawsuit against an executive.

Individuals must get familiar with the exclusions to grasp the components of non-operating expenditures and their magnitude.

In other words, charges incurred directly due to core operations are not included in the list of non-operating expenses.

4. Restructuring expense

It is the expense incurred by a corporation during a corporate reorganization. They are classified as non-recurring operating expenditures and appear as a line item on the income statement if a firm is undergoing restructuring.

5. Loss on disposition of assets

Gain or Loss on Disposition means the gain or loss from the sale, exchange, or other taxable disposition of all or a portion of the Partnership's property.

This excludes gains or losses from sales of services or property in the ordinary course of the Partnership's business), as determined following the Partnership's accounting methods for federal income tax purposes, regarding the property's adjusted book basis.

Operating vs. Non-Operating expense

Operating expenses are the costs incurred by a firm to carry out its primary revenue-generating operations. Non-operating expenses are costs incurred that were not directly related to those operations.

Operating expenses comprise a wide range of day-to-day expenses, such as administrative and sales costs. Here are several examples:

- Employee pay

- Office equipment

- Costs associated with sales, such as commissions, promotion, and advertising

- Costs of research and development

- Rent, utilities, and insurance costs

- Equipment maintenance on a daily basis Travel expenditures connected to typical business operations

Knowing the fundamental differences between operational and non-operating expenditures makes it easier to report them correctly.

Operating costs are defined as expenses that are considered necessary for the proper operation of a company enterprise.

Though such costs are not part of the fundamental manufacturing process, they are critical when selling products or services in the market.

Non-operating expenditures, on the other hand, are costs incurred as a result of a company's special financial commitments that are often unrelated to its primary business.

Such charges might now be either a regular occurrence or something out of the ordinary. It should be mentioned that both forms of costs are useful in determining a company's competency and act as a powerful signal.

Operating costs are often thought to be manageable and readily adjustable as needed. Non-operating expenses, on the other hand, are difficult to regulate due to their sporadic incidence and frequently do not make it to management's evaluation.

There is also a significant discrepancy in the categorization of the two costs in financial statements. In a profit and loss statement, for example, operating expenditures are recorded immediately under COGS.

Non-operating costs, on the other hand, are disclosed at the conclusion of the profit and loss statement and removed from operational costs.

Finally, it should be noted that some non-operational expenses may be classified as operating costs in some businesses. Business owners must investigate the likelihood and handle the expenditures properly.

Non-Operating Practical example

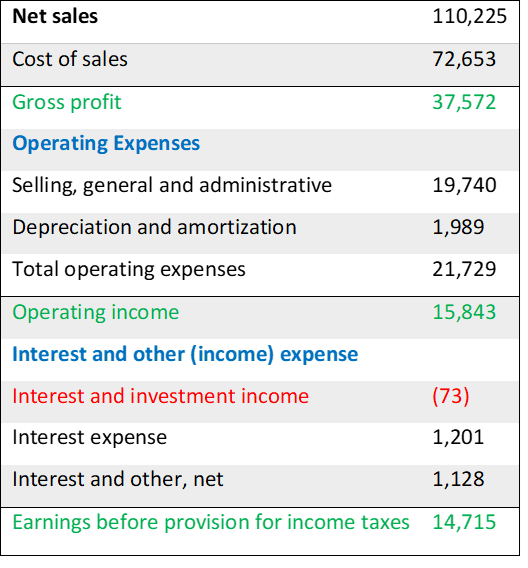

After subtracting operating expenditures (including depreciation and amortization) from net sales, Home Depot's income statement for the 2019 fiscal year shows an operating income of $15,843 million.

Non-operating expenditures (described as "interest and other (income) expense") of $1,201 million in interest expense were offset by non-operating revenue from interest and investments of $73 million.

Thus, the net non-operating expenditure was $1,128 million ($1,201 million - $73 million).

This sum was subtracted from operating income to arrive at $14,715 million in profits before taxes.

Non-operating expenditures such as interest, currency translation losses, and one-time legal/restructuring costs are expensed on the income statement since the transactions have a direct financial impact.

However, because there is no immediate cash effect, the accounting approach and reporting for losses on asset sales and asset write-downs vary somewhat.

The accounting treatment examples below are typical interview questions for corporate finance jobs.

Example 1: A $100 plant is sold for $80; the tax rate is 50%

The effect on the financial statement:

- A $20 loss is recorded on the income statement as other income and expenses.

- Net income is reduced by $10 when taxed at 50%.

- The $20 loss is non-cash and is reflected in cash flow from operations.

- CFO has increased by $10.

- A sale of $80 is reported under-investment activities. Thus cash at the bottom of the cash flow statement is up by $90.

- The balance statement shows that assets are down by $10 (plant is down by $100, and cash + A/R is up by $90), while retained profits are down by $10.

Example 2: $100 plant written down to $20; 50% tax rate

The effect on the financial statement:

- On the income statement, an $80 loss is expensed under other income and expenses.

- Net income is reduced by $40 when taxed at 50%.

- The $80 loss is non-cash and is reflected in cash flow from operations.

- Cash has increased by $40.

- The balance statement shows that assets are down by $40 (plant is down by $80, A/R is up by $40), and retained profits are down by $40.

Non-Operating Expense Pros

Some of the main pros are as follows:

- The disclosure of non-operating expenditures results in transparency, which is valued by all stakeholders, including investors and employees.

- Non-operating expenditures may be reduced more readily than core business expenses by businesses.

- The separation of non-operating and operating expenditures in the income statement allows analysts to more readily examine the performance of the primary business.

- Investors, shareholders, and even your workers want to deal with a firm that is open and honest; hiding expenses creates the sense that you are not fully trustworthy.

- When investors realize that someone is utilizing debt properly and prudently, they understand that he is thinking about their future and are willing to take some risks before going outside.

- Employees will consider the price of your services since it demonstrates how much you appreciate them.

- To evaluate the Company's performance and estimate its greatest potential profit, those who assess its financial condition often compute the Company's non-operating expenditures and remove these expenses from the Company's operational revenue.

- When non-operating costs are computed and reported separately in the firm's income statement, it gives all stakeholders a clear and thorough company profile that aids in assessing the Company's actual performance.

- What to do if there is an issue with such non-operating costs, which may also be seen in the display by the operation manager.

- Someone cannot reduce budgeted costs such as utility bills, rent, or salary, but anyone can reduce non-operating expenses if the situation gets tight.

- SIfhis non-commercial costs include perks and bonuses, investments in discovering and maintaining people, and enough loan interest to demonstrate your financial position., someone in excellent health.

- Display these data in someone's report rather than hiding them at the bottom of the worksheet.

Non-Operating Expense Cons

Some of the main cons are as follows:

- There is often the possibility of accountants misclassifying an operational expenditure as a non-operating expense to increase earnings from the primary business.

- Confusion occurs from the absence of any defined criterion for distinguishing between operational and non-operating expenditures.

- Some expenses sometimes create confusion in the mind of the person who divides the expenses into whether they should be treated as operating costs and non-operating costs.

- Therefore, the person apportioning the expenses should have proper knowledge about the running and non-running expenses for the Company; it is worth just apportioning them.

- An expense can be non-operating for one Company, while the same expense can be operating for another company.

- Therefore, there are no standard criteria for its bifurcation. It requires time and effort from the person for proper separation of expenses.

So, it can be seen that although non-operating expenses are captured separately in the income statement, these expenses are still important for managers, investors, and other stakeholders in the assessment of the future financial viability of a company.

Researched and authored by Fatemah Kamali | LinkedIn

Reviewed and Edited by Aditya Salunke I LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?