Circular Flow Model

A simplified aid that illustrates how money flows throughout the economy.

What Is The Circular Flow Model?

The circular flow model of an economy is a simplified aid that illustrates how money flows throughout the economy, or in an economic sense, the redistribution of income between the decision-makers for resources and production.

It helps in the calculation of national income and is one of the key indicators in macroeconomics. It was conceptualized back in the 1730s by the economist Richard Cantillion, and it was visualized by François Quesnay.

The model was then improvised with the practical applicability in terms of the flow of money that Karl Marx construed.

Furthermore, a significant improvement was made in 1933 by John Maynard Keynes and his assistant, which further developed the concept for the United Nations that is the current model used now.

Key Takeaways

-

The circular flow model is a simplified representation of how money flows within an economy, illustrating the redistribution of income. It is crucial for calculating national income and is a key concept in macroeconomics.

-

Circular flow models help in analyzing economic equilibrium, demonstrating the impact of government involvement and trade imbalances.

-

Circular flow models are instrumental in shaping economic policies. They aid in designing fiscal and trade policies, managing inflation and recession, and achieving equilibrium.

Circular Flow Model — Agents And Factors Of Production

Before getting into the different parts of the model, below are the different agents and factors of production involved:

Economic agents

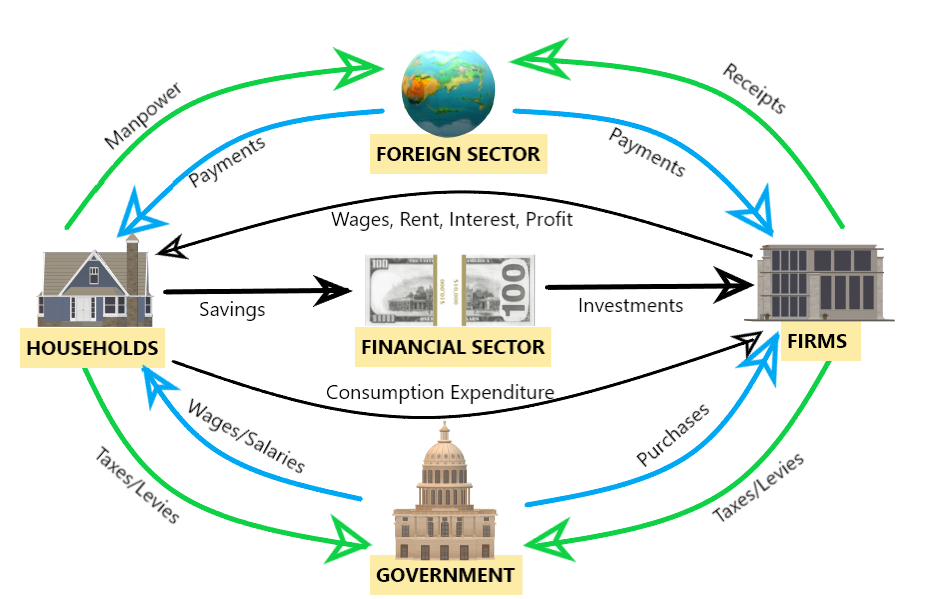

Economic agents, namely households, firms, governments, foreign, and financial sectors, that display the circular flow of goods & services, factors of production, payments & receipts, and savings & investments in the markets.

-

Households: They own all the resources in the economy and are comprised of individuals/consumers.

- Firms: Production Units/Businesses that produce goods and services by utilizing factors of production.

- Government: Utilizes the resources in the economy to provide public goods and services and regulate the functioning of the economy.

- Foreign sector: In an open economy, it indicates the imports, exports, and foreign exchange with the rest of the world.

- Financial sector: Indicates the savings and investments in an economy through banking and other financial institutions.

Factors of production

Factors of production are the necessary inputs that are required for the production and manufacturing of goods and services in an economy. These factors affect the price of the products and also profit-making ability. Listed below are the factors of production:

- Land: Involves the natural resources that are essential for production in some way or the other for any business.

- Labor: Involves the workers who are paid varied wages according to their skills and contributions.

- Capital: Includes fixed capital such as equipment, etc., and working capital involving semi-finished products used to produce finished goods.

- Entrepreneurship: Human resources that can combine the other factors, initial investments, initiatives, etc., to start/grow a business.

Injections & Leakages

Injections & Leakages are the notions that explain the flow of funds in and out of an economy:

- Injections: Funds injected into the economy, such as investments, government spending, and money attained through exports.

- Leakages: Funds flowing out of the economy in the form of household savings, taxes paid by the households & the businesses to the government, and money expended on imports.

Two Sector Circular Flow Model

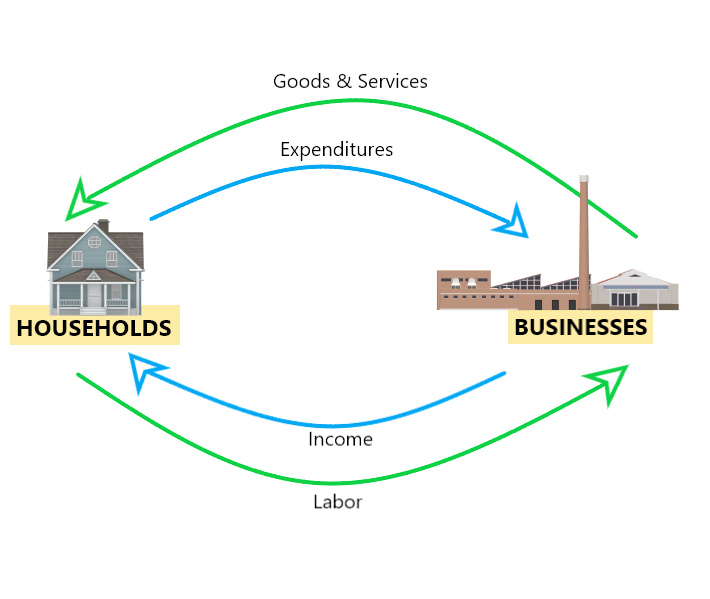

The two-sector model applies the flow of factors and funds between the household sector and the business firms sector. The factors of production, i.e., land, labor, capital, and entrepreneurship, are delivered by the household sector to the business firms.

The firms make payments for the factors of production (listed as labor in the green arrow above) in the form of wages, rent, interest, and profit (income for household reflected in the blue arrow in Figure 1) to the household sector.

The money flows from the household (as an expenditure to the household) to the businesses and back when the households purchase the goods & services (reflected by the green arrow in Figure 1) provided by the firms. The flow of money differs in volume as per the economic cycles.

The two-sector model assumes that there is no government involvement, so there are no taxes or public services & goods provided. Also, foreign trade is excluded as this is a closed economic model.

The above model is an uncomplicated representation of the circular flow of money between two sectors, but in reality, the premise that 100% of the income is saved by the household or that 100% is spent on purchasing goods & services is not accurate.

If the financial sector was to be included in this model; that would have savings & investments, below would be the calculation for the two-sector model from the expenditure method:

Y = C + I (i)

Where:

- Y: Value of aggregate output

- C: Consumption expenditure

- I: Investment expenditure

- S: Savings

Gross National Income is similar to Gross National Product as it can be consumed or saved:

Y=C+S (ii)

From equation (i) & (ii) we get:

C+ I = Y = C+ S

I = Y = S

I = S

Three Sector Circular Flow Model

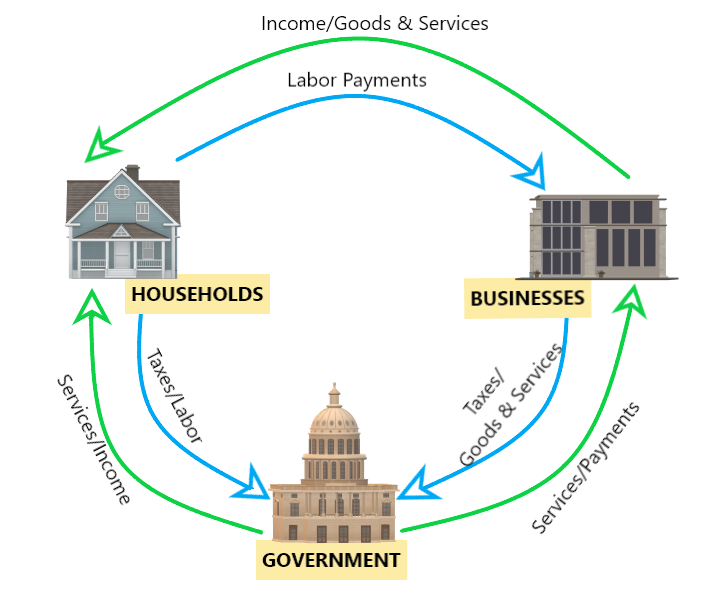

The three-sector model involves flow between the household, business firm, and government sectors. The factors of production: land, labor, capital, and entrepreneurship are provided by the household sector to both the business firms and the government.

This model follows the closed economic model just like the two-sector model, but the government plays a significant role in an economy in numerous ways.

The government provides payment for the purchases of goods & services to the business firms and income for the factor of production to the household sector. The government provides public services to the household and business sectors.

The business firms provide income for the factors of production to the households. As well as goods & services to both the household sector and the government sector. Both the business firms and household pays taxes to the government.

If the financial sector was involved, which would have savings and investments, below would be the calculation for the three-sector model from the expenditure method:

E = C + I + G (i)

Where:

- E: Total Expenditure

- G: Government expenditure

- T: Taxes

Y = C + S + T (ii)

From equation (i) & (ii) we get:

C + I + G = C + S + T

I + G = S + T

G - T = S - I

The government budget should be balanced for the above to be equal; if G > T, there would be a deficit.

Four Sector Circular Flow Model

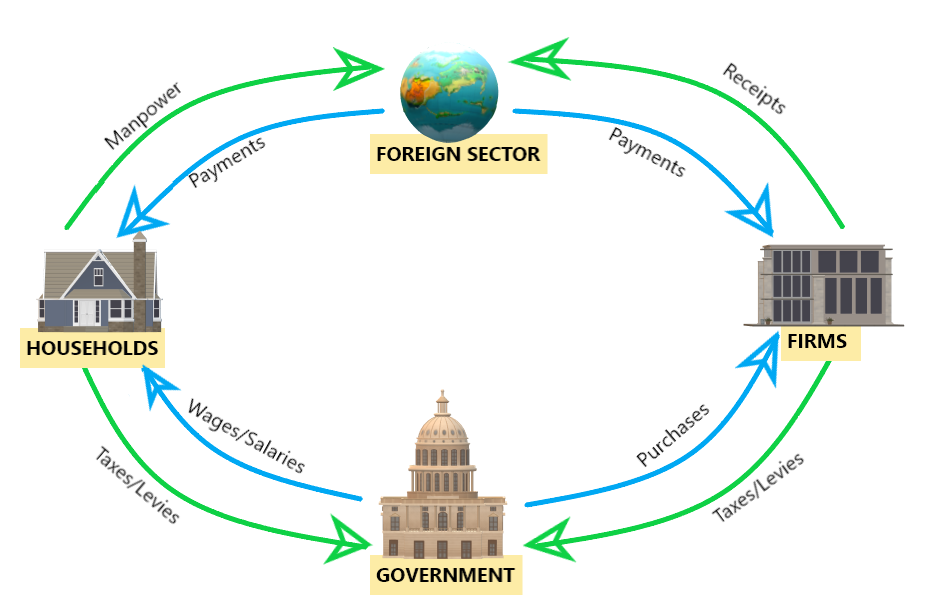

The interchanges between the household, business firm, and government sectors remain the same if a foreign sector is added to the model. The foreign sector is also referred to as the overseas or external sector. The four-sector model depicts an open economy.

It shows the trade between the economy and the rest of the world. There is an import and export of goods & services, as well as foreign exchange as inflow & outflow of capital, occur for the same.

Payments are received by the respective sectors in exchange for goods, resources, and services. Involvement of the foreign sector also involves foreign investments.

Since it is an open economic model, net exports are included.

If the financial sector was involved, which would have savings and investments, below would be the calculation for the four sector model from the expenditure method:

Y = C + S + T (i)

National Income (NI) = C + I + G + NX (ii)

NX = X - M

Where:

- NI: GDP (Gross Domestic Product) or National Income

- NX: Net exports

- X: Export

- M: Import

If X = M, then there would be a balance of trade, but usually, countries aim at getting X > M for a trade surplus, but if M > X, there would be a deficit.

From equations (i) & (ii), the below outcome is achieved as the National Income can either be consumed, saved, or paid as taxes:

C + I + G + NX = C + S + T

Five Sector Circular Flow Model

Like the four-sector circular flow model, the five-sector circular flow model is an open economic model. In addition to the household, firms, government, and foreign sector, this model includes a financial sector.

The addition of the financial sector displays a much more realistic image of the economy than the assumptions of 100% savings and 100% payment for goods & services in the previous models.

The financial sector comprises banking and other financial intermediaries that borrow and lend. The financial sector includes household savings, which are invested back into the economy.

Calculation of the national income from the five sector model:

- S, T, M = Leakages

- I, G, X = Injections

When leakages are equal to injections, then there would be a state of equilibrium:

S + T + M = I + G + X

When leakages are not equal to injections, then there would be a state of disequilibrium:

S + T + M ≠ I + G + X

Disequilibrium can occur in the following instances:

-

Recession would occur when S + T + M > I + G + X, i.e. when the leakages are more than injections

-

The opposite of the above would be the scenario of expansion as S + T + M < I + G + X when the injections are more than the leakages.

Use of the circular flow model

The circular flow model provides an efficient analysis of the economy and is utilized in examining manifold aspects as well as formulating economic policies.

Below are reasons for the relevance of the circular flow model.

-

Aids in the calculation of national income through the financial transactions among various sectors of the economy

-

Shows the link between production through utilizing the factors of production and consumption of goods and services plus the income and expenditure associated with it

-

Showcases the effects of leakages and injections in the economy for the government to avoid disequilibrium

-

Offers ways to study different aspects of the economy to achieve equilibrium by solving problems of disequilibrium

-

Helps curtail inflation and recession for the efficient functioning of the economy

-

Helps the government in the management of leakages and injections as per the Keynesian multiplier (an economic theory that promotes government spending to resolve recessionary patterns and stimulate aggregate demand)

-

Used in the formulation of trade policies to manage trade balance by controlling imports and exports by avoiding deficits or creating a surplus

-

Used to control prices through monetary policies for managing the capital market for parity between savings and investments

-

Used to curate fiscal policy measures to manage leakages and injections by adjusting taxes and government expenditures

Summary

The circular flow model of the economy is a fundamental concept that illustrates the flow of money within an economic system. It involves five different sectors:

- households

- firms

- governments

- foreign entities

- financial sector

This model visually represents the circular flow of various economic activities, such as the exchange of goods and services, factors of production, payments, receipts, savings, and investments in the markets.

The factors of production, namely land, labor, capital, and entrepreneurship, play a significant role in influencing the prices of products and a company's profits. These factors earn income in the form of wages, rent, interest, and profit.

In this economic model, the flow of money in and out of the economy is categorized as injections and leakages. Injected funds come from sources like investments, government spending, and revenue from exports.

On the other hand, leakages represent the outflow of money from the economy, including household savings, taxes, and expenditures on imports.

The involvement of a foreign sector can turn the model into an open economy. In this scenario, there is trade between the domestic economy and the rest of the world, encompassing both imports and exports, as well as the flow of foreign exchange and capital.

The goal for many countries is to maintain a trade surplus, where exports exceed imports, as this contributes to economic growth and stability.

The circular flow model's different sectors and models help maintain equilibrium in an economy. In a two-sector model, investments must equal savings to achieve this balance.

In a three-sector model, government involvement leads to a balance where government spending minus taxes equals savings minus investments (G - T = S - I).

For an open economy to maintain equilibrium, the equation S + T + M must equal I + G + X, ensuring that savings, taxes, and imports match investments, government spending, and exports, respectively.

Edited by Colt DiGiovanni | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?