Currency Crisis

A crisis when country's currency substantially decreases in value due to circumstances such as high inflation, bank failures, shifts in the financial markets, imbalance of payments deficit, conflict, etc.

What is A Currency Crisis?

A currency crisis is when a country's currency substantially decreases in value due to circumstances such as high inflation, bank failures, shifts in the financial markets, imbalance of payments deficit, conflict, etc.

The government can control it, which affects the economy greatly, by selling foreign reserves or by taking other suitable measures. A crisis of this kind could lead to more national debt, higher rates of unemployment, and perhaps hyperinflation.

A crisis may arise when abrupt currency fluctuation prompts speculation in the foreign exchange (forex) market. A crisis may result from currency pegs to other currencies collapsing.

Monetary policy actions by a central bank, such as abruptly raising or reducing interest rates, can also affect capital flows into and out of a nation, leading to extreme fluctuations in the value of a nation's currency and ultimately to a currency crisis.

Key Takeaways

- The abrupt and sharp decrease in a country's currency value, which has detrimental implications for the entire economy, is known as a currency crisis.

- The government controls currency crises, which significantly impact the economy, by selling foreign reserves or taking other necessary actions.

- The causes of currency crises include significant swings in the stock and foreign exchange markets, spikes in unemployment and inflation, economic downturns, and unfavorable monetary policy changes.

- Investment-friendly legislation, early problem detention, prevention, investments from several nations, and appropriate trade relations can all help to stop it.

Understanding Currency Crisis

A significant drop in a nation's currency's value is what triggers a currency crisis. One unit of one currency no longer buys as much as it once did due to exchange rate fluctuations brought on by this value reduction, which has a detrimental impact on an economy.

It is a situation in which inflation increases and the economy falters. People begin to have doubts about how the government and banking system are run and function in such a setting. There are significant swings in the foreign exchange market during this period.

Still, it takes time to exhibit weakness. There are multiple indicators that require constant monitoring. High unemployment, erratic stock markets, the banking system's collapse, inflation, and declining purchasing power are a few of them.

Since a balance of payments deficit triggers a fiscal crisis, circumstances arise from the situation of the balance of payments. The fiscal unrest slows down the economy, and since a deficit in the balance of payments might lead to a fiscal crisis, the balance of payments is liquidated.

Due to the economic slowdown caused by the fiscal crisis, there may be a decrease in foreign investments, and the stock and FX markets could face challenges.

Central banks and governments must raise interest rates, sell foreign reserves, and expand currency supply to avert such a crisis. The value of the national currency is stabilized through central bank intervention. The exchange rate issue also impacts international investors.

Causes of a Currency Crisis

Comprehending the elements that lead to currency crises is crucial for economists, investors, and policymakers alike. The following list of major reasons for currency crises sheds light on the complex interplay of political, financial, and economic variables that can lead to these unsettling occurrences.

- High Inflation: As the currency's purchasing value drops due to inflation, confidence is undermined.

- Large Fiscal Deficits: Concerns over the sustainability of the budget are raised by excessive government spending.

- Excessive Debt: Vulnerability is exacerbated by high debt levels, especially in foreign currency.

- Persistent Current Account Deficits: Foreign exchange reserves are strained due to imbalances between imports and exports.

- Market Speculation: It is possible for traders' activities, motivated by their expectations of currency depreciation, to become self-fulfilling.

- Political Instability: Instability is exacerbated by frequent changes in leadership, unclear policies, poor economic performance, and corruption.

- External Shocks: A nation's exports and overall economic health are impacted by abrupt changes in the world economy, and nations that depend on the sale of commodities are subject to pressure on their currencies because of price volatility.

- Banking Sector Issues: The banking industry's flaws, such as non-performing loans, are a factor in the decline in public trust.

- Lack of Foreign Exchange Reserves: A nation is left exposed if it has insufficient reserves to protect its currency or fulfill its obligations abroad

How to Prevent A Currency Crisis

Strategies for preventing currency crises are essential for averting or controlling their negative consequences. Typically, these tactics include cautious financial regulation, discipline in the budgetary process, solid monetary policy, and efficient international cooperation.

Here are some tips for preventing currency crises:

1. Monetary Policies

The goal of central banks should be to uphold a stable and adaptable exchange rate system and to guarantee price stability. Monetary policy must be tightened during a crisis to protect the currency and stop capital flight.

2. Fiscal Discipline

Governments must carefully handle the public debt and budgetary imbalances they face. Maintaining fiscal sustainability over the long run can support market confidence and avert a currency crisis.

3. Strict Financial Regulation

Effective financial sector regulation is important to lower vulnerabilities. Some possible actions are implementing sufficient capital buffers, reducing exposure to foreign exchange, and improving transparency.

4. Effective International Coordination

Collaborating with global financial organizations such as the IMF can offer crucial financial and technical assistance during a crisis.

The first step in averting a currency crisis is to identify early warning indicators. Carefully monitoring economic indicators, including current account balances, public debt levels, and inflation rates, is necessary to identify these possible threats.

Evaluating financial market indicators like asset prices and credit growth are also critical. It is necessary to take proactive measures to address vulnerabilities as soon as concerns are recognized.

Examples of Currency Crises

The currency crises that have been brought on by a confluence of political, financial, and economic variables are illustrated by the following cases, which also show their varied causes and effects.

Every crisis is different, but commonalities include a decline in trust in the nation's economic policies, which causes the currency to depreciate quickly.

Venezuela Hyperinflation

The currency instability that started in 2016 amid the nation's protracted socioeconomic and political turmoil is known as hyperinflation in Venezuela. In 1983, Venezuela experienced double-digit yearly inflation rates for the first time.

In 2014, inflation rose to all-time high levels in the world in Venezuela and continued to rise in the following years.

The Venezuelan government experienced a decline in oil revenue because of declining oil prices and production decreased. Government spending was cut as a result, which made the crisis worse.

Nicolas Maduro, who is the current president of Venezuela, has been denounced by many organizations, and protests erupted everywhere in the country. The government was considered a failed administration and was corrupted.

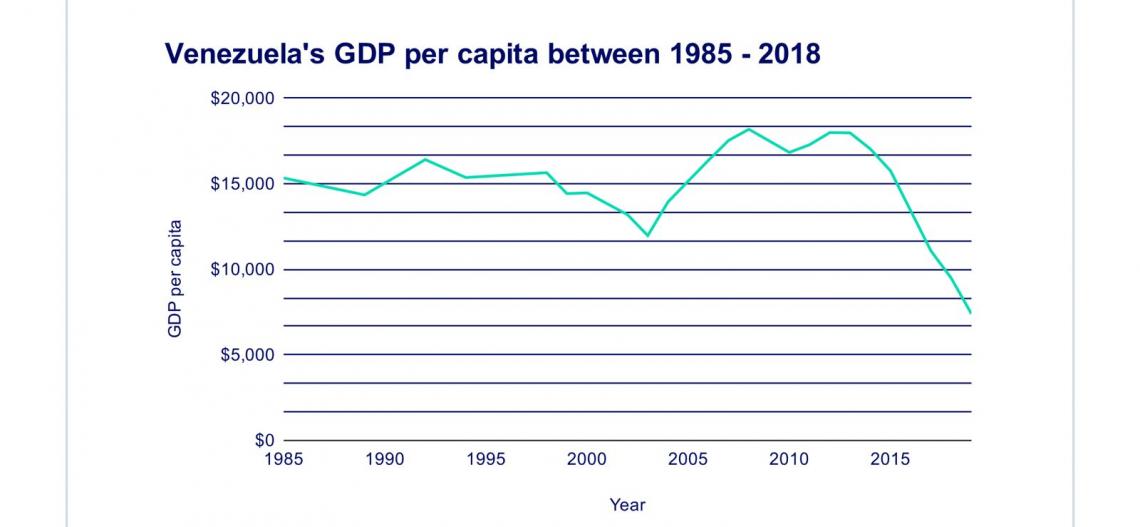

Venezuelan GDP shrank by 18.6% in 2016. This was the final economic data that the government of Venezuela generated. According to estimates from the International Monetary Fund (IMF), Venezuela's GDP shrank by 22.5% in 2019.

The image makes it evident that Venezuela's crisis has significantly negatively influenced GDP and shrunk the nation's economy.

Venezuela's inflation rate at the outset of the crisis was 28.19%. When the Venezuelan government stopped releasing data at the end of 2018, the country's inflation rate was 929%.

The Venezuelan Bolívar has lost value due to hyperinflation. As a result, the government unveiled the Petro, a brand-new cryptocurrency backed by the nation's mineral and oil assets.

Asian Financial Crisis

The "Asian Contagion," another name for the Asian financial crisis, was a series of events that started in July 1997 and extended throughout Asia, including currency devaluations.

South Korea, China, Singapore, and Malaysia are tiger economies that were hurt by the currency crisis the most. For years, foreign capital came flooding in. Undeveloped economies were expanding quickly and exporting a lot of goods.

Due to its heavy reliance on foreign debt, Thailand was always on the verge of going bankrupt. Although it was poorly managed, real estate dominated the investment market.

The private sector continued to maintain massive current account deficits and became increasingly dependent on foreign investment to survive. The nation was exposed to a substantial level of foreign exchange risk as a result.

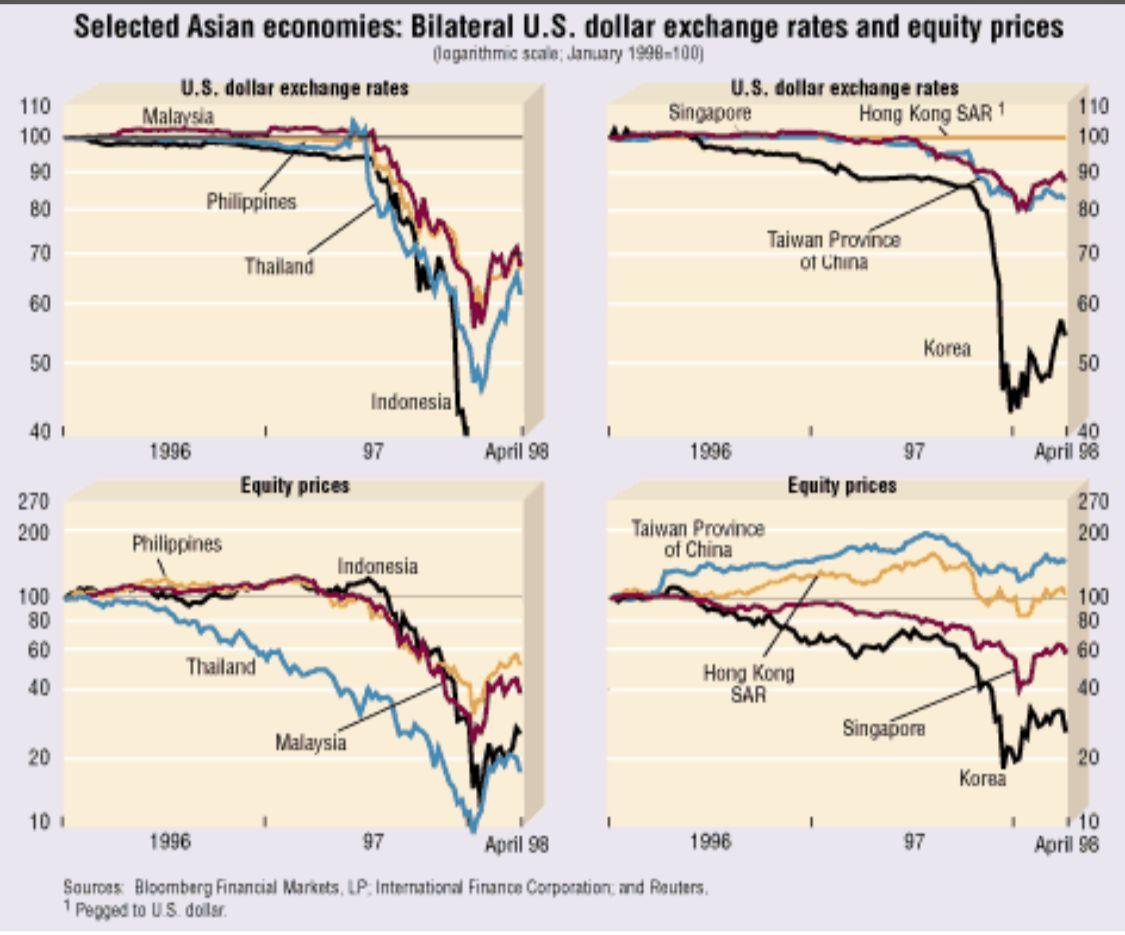

In an attempt to protect the national currency from months of speculative pressure, the Thai government depleted a large portion of the foreign exchange reserves before ending the de facto peg to the US dollar, which set off the crisis.

The risk escalated when the United States raised interest rates, eventually reducing foreign investment in Southeast Asian economies. The current account deficits suddenly became a major issue, and a financial crisis swiftly spread.

The IMF provided $36 billion to support reform programs in Indonesia, Korea, and Thailand. The impact of this support on the crisis is a subject of debate, with some arguing it may have contributed to challenges in currency value and stock markets.

The financial market overshooting exacerbated the panic and created more challenges for the business and banking sectors.

For instance, there was a notable increase in the foreign debt's worth in local currency. Although uncertainty lingered longer in Indonesia, stronger pledges to implement adjustment reforms were made elsewhere.

Lessons Learned from Currency Crises

Currency crises have taught important lessons that continue to affect economic policies and decision-making. One example of this is the Asian Financial Crisis of the late 1990s. The need to preserve strong economic fundamentals is one important lesson.

Strong monetary and fiscal policies enable nations to better handle economic difficulties and stay against the cascading repercussions frequently accompanying currency crises. The event emphasizes how important governments must put stability first by using sound economic policies.

Keeping the exchange rate stable does not guarantee that a central bank's policies will be effective.

Although declaring one's intention to keep the peg in place can be beneficial, investors will eventually consider the central bank's capacity to uphold the policy. To be believable, the central bank will need to depreciate sufficiently.

Currency crises can be avoided or at least lessened by finding the ideal balance and selecting an exchange rate regime that suits a nation's economic circumstances.

Even with initial financial stability, an economy might have a crisis. A low debt load is insufficient to maintain policy continuity or curb unfavorable investor sentiment.

In the near term, speculation limits options when there is financial contagion, but low inflation and trade surpluses can lessen the impact of a crisis on an economy.

Governments will frequently have to give private banks access to cash so they can invest in short-term debt with immediate repayment obligations. The government may soon deplete its foreign reserves if it also makes investments in short-term debt.

Conclusion

Although there are many different types of currency crises, they often arise when investor expectations and sentiment diverge from a nation's economic picture.

While growth in developing nations generally benefits the world economy, experience has shown that too fast growth can also lead to instability and an increased likelihood of capital flight and currency runs.

These crises highlight how crucial it is to preserve strong economic fundamentals and how strong fiscal and monetary policies are necessary to handle unforeseen difficulties.

One of the most important lessons for policymakers worldwide today is the need to carefully analyze exchange rate regimes and recognize the fine balance between stability and flexibility.

The financial sector's resilience has emerged as a key component of economic stability, leading nations to strengthen their banking infrastructure and regulatory frameworks.

Global financial markets are interrelated, emphasizing the need for international coordination and collaboration and the shared accountability of nations and international organizations in tackling financial instability.

Lessons from past currency crises offer a road map for constructing resilience, cultivating stability, and advancing sustainable economic growth as nations and economies continue to negotiate the intricacies of the global economic scene.

The dynamic and flexible nature of economic policymaking in a world where the interplay of elements necessitates ongoing vigilance, cooperation, and strategic planning is highlighted by the lessons' shifting nature.

Everything You Need To Master Financial Statement Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?