Free Cash Flow (FCF)

Optimizing Cash Beyond Capital Expenditure and Working Capital

What Is Free Cash Flow (FCF)?

Free cash flow (FCF) is the cash flow a firm has remaining from its operating cash flows after accounting for its capital expenditure and working capital requirements. It is calculated by subtracting the cash used for Capital Expenditure (CapEx) and working capital requirements from Cash Flow from Operations (CFO).

The unlevered free cash flow (UFCF) does not account for the payment to debt holders whereas levered free cash flow (LFCF) considers all debt-related financial commitments (i.e. interest and principal payment on bonds).

Therefore, UFCF measures the cash flow available to both equity and debt holders while LFCF measures FCF available only to the shareholders of the firm.

A firm could use the FCF in 2 different ways; retain it in the business or pay it out to the shareholders.

The decisions on whether to retain or pay out the FCF is known as payout policy in corporate finance. Some of the reasons that a firm would want to retain FCF include:

- Having the opportunity to invest in potential positive net present value (NPV) project in the near future

- Build up their cash reserves for times of financial slack when they need to make sure that they are able to meet their payment obligations

Therefore, firms that retain FCF are likely firms that have a high return on investment (ROI) or unstable cash flows.

A firm may pay out its FCF in two different ways, namely stock buybacks and dividend payments.

In the US stock market, stock buybacks have been the dominant way of returning shareholder wealth by a mile since the introduction of Rule 10B-18 in 1983 which legalized stock buybacks. This is because stock buyback is a more tax-efficient way of returning shareholder wealth compared to dividend payments.

Key Takeaways

- Free cash flow (FCF) is the company's remaining cash after accounting for capital expenditures and working capital requirements.

- Firms can use FCF to reinvest in the business or pay it out to shareholders through dividends or stock buybacks.

- Unlevered free cash flow (UFCF) does not account for debt payments, while levered free cash flow (LFCF) considers all debt-related commitments.

- FCF yield is a measure of a company's performance, considering cash flow over earnings per share, and can indicate the attractiveness of a company's valuation.

- Free Cash Flow to Equity (FCFE) is the cash flow available to shareholders after all expenses and financing activities, used in leveraged DCF valuation methods. Negative FCF can signal growth or financial challenges.

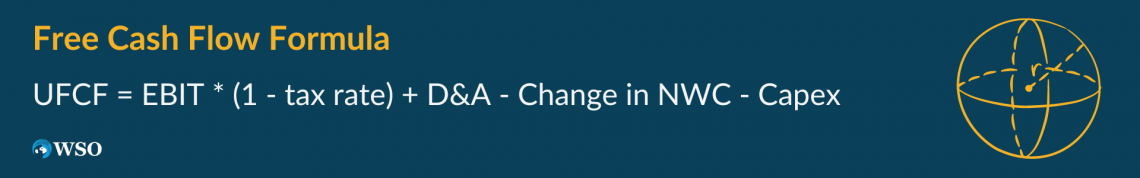

Free Cash Flow formula

There are multiple methods to derive the FCF (UFCF & LFCF) of a company. These methods are related to one another and can be derived from the 3 statements (income statement, balance sheet & cash flow statement).

The most common way to calculate the UFCF of a company is as follow:

UFCF = EBIT * (1 - tax rate) + D&A - Change in NWC - Capex

where:

- EBIT = Earnings before Interest and Taxes,

- D&A = Depreciation and Amortisation expenses

- Changes in NWC = Changes in net working capital

- Capex = Capital expenditure

EBIT, D&A and Taxes can be found in the income statement while changes in NWC and Capex can be found in the current & prior period’s balance sheet.

The most common way to calculate the LFCF of a company is:

LFCF = Net Income + D&A - Change in NWC - Net investment in operating capital

Free Cash Flow yield (FCF yield)

FCF yield is a financial solvency ratio of a company. It has been touted by some investors to be a better measure of company performance than earnings per share due to the emphasis on the cash flow statement over the income statement in this metric.

FCF yield can be defined in two ways:

- FCF yield = FCF per share / Market Value per share

- FCF yield = FCF / Market Capitalization

The latter is usually employed as FCF can be found on the cash flow statement and market capitalization can be easily found using databases such as Bloomberg or FactSet.

On the contrary, the former method requires the discovery of the shares outstanding of a company and information regarding shares outstanding may be dated or inaccurate if the company is thinly traded or has buyback schemes.

Some investors may view FCF yield as a better measure of company performance because they believe it is a more accurate representation than earnings per share.

This is because FCF yield, unlike earnings per share, considers the financial health of the company (i.e. liquidity) and gives an idea of the accessibility to cash from operations in cases of unexpected obligations. Further, the ability to yield cash flow is a better indicator of long-term value than paper profitability.

The lower the yield, the less attractive a company is to investors as this suggests that the shares are trading at a higher market value per share despite not generating a superior cash flow to justify it.

On the contrary, a high FCF yield would suggest the valuation of the company is attractive as the company is generating enough cash flow to satisfy debt obligations and possible increases in dividend payments or buyback schemes.

This would lead to an increase in return for the investors should the valuation multiples for the shares increase.

Free cash flow to equity (FCFE)

The FCFE is a measure of how much free cash flow is attributed to the shareholders after all expenses, including those related to CapEx, and financing activities. It is another word for Levered Free Cash Flow (LFCF).

LFCF is usually compared directly to the market value of equity as it considers cash available only to the equity holders of a firm. For example, it is used in the levered DCF method of valuation.

In a levered DCF, the appropriate discount rate would be the cost of equity, which is the rate of return required by the shareholders for the level of risk they are undertaking.

Given this, comparing a highly levered firm to one with lower leverage but with identical cash flows, we would observe that the market value of equity would be lower compared to the firm with lower leverage as the cost of equity would be higher, following the assumptions proposed by the Modigliani-Miller proposition II.

Negative FCF

Further, a levered FCF has a higher probability to be in the negative as compared to the unlevered FCF in the same period. This is possible in years where debt repayment obligations amount to more than the unlevered FCF generated by the business.

If the unlevered FCF is negative, the firm has a high growth rate requiring heavy capital expenditure or is making a loss from its ordinary course of business.

This would suggest that the firm would need capital injections sooner or later from investors to make up for the negative cash flow, and in cases where it is not due to high growth, it may make sense to sell or restructure the business.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?