IB sucks compared to SWE if you are smart

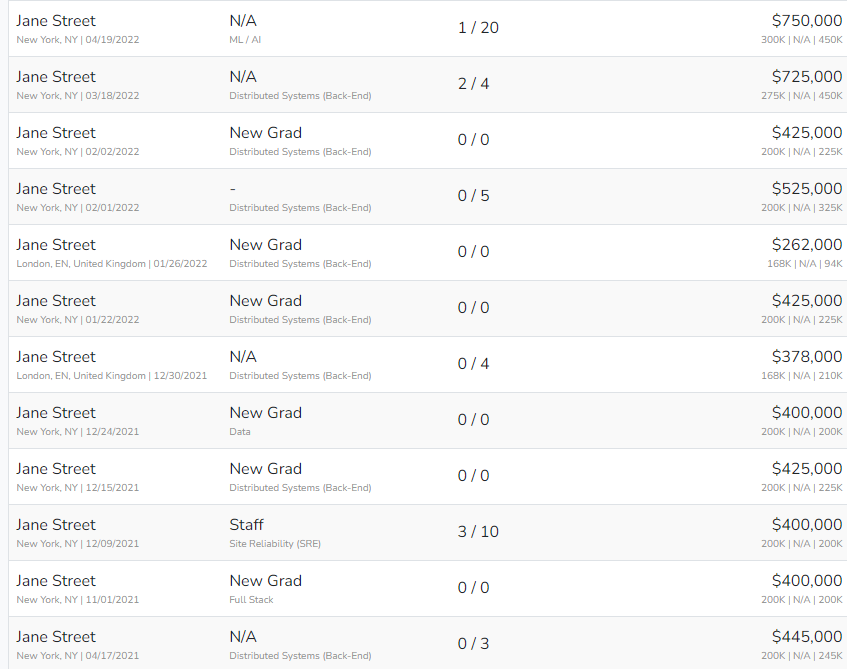

Software engineers at Jane Street make 400k starting, working 40 hrs a week. So over double the pay for half the hours lmao.

Pay goes up to a million by age 30 lol. I also heard Citadel/HRT pay even more...

EDIT: for people saying "you need to be insane at math," no you don't. For QUANT TRADING, yea, you'd need to be Putnam/USAMO level smart. But for SWE, all they care abt is LeetCode/GPA. Everyone from my Semi-Target school got interviews if they had 3.7+ gpa in CS. Yall are overestimating how hard it is. QUANT TRADING is insanely hard to get, but SWE is doable.

WOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOW

I Dont think I've ever seen anything like this ever before(football fans know)

This deserves attention. Bump

SWE is a completely different career path than finance, you're implying a typical banker will be happy working in that field which is untrue... also your average SWE does not make a million at age 30. That is absolute top of street pay and a VERY small number of spots, not the norm for the career.

Both finance and SWE pay extraordinarily well, people should focus more on which they will enjoy/be able to do long-term instead of straight $ comparison.

you think anyone enjoys working 80-100 hours formatting logos?

You think anyone can get into Jane Street?

Obviously not, banking sucks at a junior level, but doing your 2 years is a tried and true way into PE, corp dev, even HF... all of which pay quite well

Also no 23 year old is staffed with solving world hunger, I don't know SWE at all but I'm guessing they do the entry-level equivalent to formatting logos

I am always baffled by how this kind of comment doesnt get more MS.

Aligning logos (and similar menial formatting tasks) has been 5% of my time when I was an intern 12 years ago and maybe 0.01% since then.

Investment banking is not about making ppt presentations

SWE sucks compared to IB, look at these fresh out of school Tiger Global employees making 750k! You should never go into SWE because everyone makes that out of school in finance and goes to a top hedge fund!

no one is making 750k out of college at a tiger club lmfao.

On the other hand, SWE at a HFT firm is quite doable. I go to a semi-target school and everyone with above a 3.7ish GPA in CS got an interview. The kids that got Jane Street from my school didnt make USAMO. In fact, they didn't even have AIME on their resume. They were very smart (3.9+ GPA as a CS major), but they werent USAMO level. You are mistaking Quant Trading with SWE.

ok prospect, you must be fun at parties!

You can make a milli at 32 in s&t… Jane street takes 0.000001% of the top swe grads

Bro, banks hire thousands of new people every year. Jane street hires less than a single bank does.

actually Jane Street/Citadel/HRT etc hires a few people per target school, so its not that different, than say an EB

fuck you bro

even if you add their class sizes, it’s significantly smaller than the cumulative BB/EB classes

Why is it always a prospect spouting BS like this

It’s the same Redditlorian posting tech v. IB comparisons since the dawn of time. Never seen one of these threads that wasn’t authored by some anonymous or brand-piping new account.

Not everyone can get into Jane street bro we’re not that smart

I'd rather not be a nerd thanks

Bro are you like a sophomore in college lmao? These jobs per class take literally maybe 3-5 kids a year and the kids who get them are 4.0 at MIT/Stanford/Caltech who all have been winning math competitions since 6th grade. What kind of comparison is this? Lmao why do IB when you can start off at NFL/NBA making $1M a year! What a joke of a post.

Not true at all, Jane Street takes 20+ people which is the same as an EB. Also, I know you dont know what you are talking about because Jane Street (along with most tech firms) are much more likely to accept a non-target than IB

NBA takes 20+ each year. Why don’t you go play in the NBA?

EBs take way more than 20 fyi. If you look up Jane Street there are very few non-targets... IB is chock full of non targets...

Also you're a prospect using Reddit to prove a point against people who are actually in the industry and know people at Jane Street/Citadel/et al. The people I know at these firms are the creme de la creme of their graduating class - yes, slightly more accessible these days, but IB has like 1000-1500+ spots across the big-name firms and you're talking 50-60 TOTAL SWE spots. It's just not even a worthwhile comparison.

Jane street swe class is actually pretty big. 20-30 students. The background you just described is the type that gets quant trading at jane street. Swe is very different and much easier with objectively worse candidates than quant. Even then jane street takes a lot more then 3-5 quant traders per year.

So what you are saying is the that some of the SWE are almost more back office-y and that OP might be quoting Quant traders which are hard to get.

Lol imagine doing software engineering for like 10 years. Probably you will die from the mundane nature of SWE.

Source: my brother got offers from FB and Apple SWE and absolutely hates coding. Almost everybody wants out of SWE to less coding roles like Product or Ops.

whats your bros end goal

I heard top NBA draft lottery pics are pulling a few mil a year on a 5 year contract though. Maybe SWE and Finance both aren't the move... should be working on your jump shot

no one on this sub can make the NBA lol. I am sure there are a ton of people in IB who can make SWE at HFT firms tho, ppl are really overestimating how hard it is. I'd say it is easier to get an interview at a HFT firm than it is a top EB. They interview a ton of people

I'm on the fundamental L/S side ,so may this is inaccurate, but I highly doubt that Jane Street SWEs are working 40 hours a week. They are either very efficient which is awesome or will eventually be kicked out if they aren't updating their skills and competing with the rest of the pack.

Why are you so horny for Jane street buddy

Jane Street SWE is very different because you are essentially implementing trading algorithms based on quant research.

Needless to say it requires top tier math + CS skills. We’re talking USAMO qualifier and/or USACO plat. The NBA analogy used above is 100% accurate. You have to have that level of talent in math + CS to get a seat at JS.

It’s an extremely poor example to use in a tech vs finance debate and if you’re trying to claim its “easy to get in” you’re flat out lying and being arrogant by intentionally diminishing the difficulty to put down finance people on this site and try to make them feel bad over something they shouldn’t feel bad for as that type of comp is understandably reserved for rockstars.

Definitely dont need USAMO to make Jane Street SWE.

For trading, yea you'd need those skills/qualifications. But for SWE, you dont even need to make AIME.

I know a few people in these seats. I know what I’m talking about. They are all USAMO qualifiers and all had distinguished performance in USACO as well, regardless of role (trader/SWE). JS actually uses your USAMO/USACO/IMO performance as a resume filter criteria (on top of GPA). If you don’t have anything your resume is probably going in the trash. I’m not here to debate with you on how much math goes into efficiently implementing trading algorithms (I have no idea) but I will say that most CS majors I know in school doubled in math + CS or stat + CS. JS and for that reason any reputable trading shop has absolutely no reason to even consider a candidate who didn’t make AIME for an SWE role because they have hundreds of applicants who are skilled in both who went to MIT tier schools.

Gonna agree with the other poster. Swe is not quant trading.

Ive received interviews from jane street level firms for swe (five rings, hrt, jump included) with pretty subpar gpa. My resume is good sure but I also have absolutely 0 math competition or usaco experience. HRT especially hands out so many interviews Just look on linkedin. They hire a lot of students who are at schools ranked below t30.

Have you interviewed for swe before? There is very little math involved even for hft. My experience interviewing with firms like the ones I've mentioned above plus some top ones in chicago is that there is 0 math involved in interviews. Note I made it to the final round for 1 of the firms I mentioned above and received offers from top chicago shops.

Not to jump into rankings here but I would argue JS is in a tier almost all of the other shops. Getting an offer at a “top Chicago shop” isn’t the same because I know for a fact CHI shops are far less competitive than the top or even semi-good NYC shops (and the pay also differs). There are only so many people at the level of ability I mentioned earlier, so yes it’s not impossible to find SWE roles downstream even if you weren’t doing it in high school but grinded in college. Regarding the math in interviews that depends on the difficulty of the interview. Just look at LC hards which often times reach even Olympiad difficulty. I’m not claiming that’s the norm but when you are talking about $400k starting salary at JS, expect to get those type of questions. Also, I previously applied to JS just for fun and in their general application they wanted previous USACO, USAMO, and even IMO scores.

TLDR: My arguments applied solely to the $400k starting salary at the best of the best shops like JS. I never said that ~$200k SWE roles downmarket required that level of intelligence or talent.

Oh so we are talking about extremes? Cool I know an IB group that’s paid it’s analysts 400k+ their first year and atleast one VP2 (at the age of 29, they joined out of undergrad) 1.9 million so that blows the SWE comp out of the water lol.

If you think Jane Street / SWE is the place to be then good for you please go get a job there and let us know how your experience has been.

If everyone looked at just the pay scale at the top end of the street then we would all be trying out for NBA / NFL but most of us have our head on our shoulder and thus look at the probability adjusted earning potential - and there’s nothing like IB when it comes to that.

1st of all, doubt that's true. What firm?

2nd of all, you are vastly overestimating how hard it is to get SWE at HFT firms.

I know the kids that got Jane Street from my school and they didnt have USAMO. In fact, they didn't even have AIME on their resume. They were very smart (3.9+ GPA as a CS major), but they werent USAMO level. You are mistaking Quant Trading with SWE.

“Getting an interview” means nothing. Most of these shops have 5 or 6 rounds and the last 2-3 is where people get weeded out like crazy.

Also you can’t make this thread on JS, and then use “HFT” firms broadly. That’s like talking about how easy Goldman IB is to get into when in reality your friends got an interview for an MO role at an MM. The competitiveness (and compensation) drops heavily outside of the top one or two dozen firms in the space. You’re not making $400k as an SWE at most trading desks. JS and some of the others are known for being crazy selective and having very high comp.

EDIT: Reddit is your source for this. Dude, your arguing with people who know people in these seats…

For your first question, specialized boutique firms may *potentially* pay $300K+ all-in (this would be Dyal, Ducera, Qatalyst, etc.), but the real killing is made after analyst years in which associates would likely pull at least $500K+ their first year, especially with firms that have profit sharing.

The only downside would be terrible, terrible hours.

Is the firm Ducera?

Nope

You also underestimate two things

1) The amount of people that even work at those firms

2) Even at the threshold of those who get interviews, the ones that get accepted are literal prodigies...

HFT is selective yea, but Google hires more than the entire EB/BB class combined. On a pure numbers basis, getting FAANG (which also has very good pay) is easier than getting BB/EB IB.

Finance isn’t like tech where only the best firms pay top salary. Pretty much every MM and even regional offices will be paying ~$150k+ all-in.

Sorry bud but you’re not getting an offer at Jane Street

If I'm being candid here, why would anyone ever choose Jane street or HRT over a more respectable, name-brand firm like Ernst & Young or Accenture? It just seems mind-boggling to me that a college graduate would willingly pass on having the B4 name on their resume. Different strokes for different folks I guess...

Idk, I was making 300k out of college at the hedge fund I joined, pay rose way beyond what swe typically pays

SM or MM fund?

MM

IB also "sucks" compared to joining the NFL if you're Aaron Rodgers. The reality is that 99.9% of CS majors will not end up at the companies you listed in your post. Want the math? 65 thousand graduates/year and rising, 20-30 new grads/class --> 0.1% of US-based CS graduates joining JS/Citadel/HRT every year.

Why rest your hopes on recruiting for a company that takes barely 0.1% of new grads nationwide when you could just do banking and make multiplicatively more? Seems pretty simple to me.

can also say the same thing about Finance/econ majors and spots for SA. Dont BBs have an acceptance rate of like 1%?

Those stats are global, and there are something like 30-40+ names across BB/EB/MM/etc that have very solid IB groups all of which pay well, versus just 1 Jane Street. There are thousands of IB spots overall.

If your average non-target networks, has a decent GPA, and spends a few weeks on technicals, they will more than likely land IB somewhere (50%+). The acceptance rate for 1 bank is not indicative of the average person's chances. Can't say the same for these top 3 SWE jobs you keep mentioning.

If it's so easy to get into Jane Street tho, why even post here - just go take your SWE spot and be rich working 40 hours

GS IB SA class size is 70-80/year. Multiply that by 40. If you are incapable of performing this basic level of reasoning, I'm not sure how you can even fathom having a chance at landing JS/HRT.

citadel alone hires around 250-300 new grad swes......there are also many other firms that pay 400-600k (sign on included ) like de shaw, pdt, five rings, jump, old mission, radix. Jane Street actually has one of the larger new grad swe classes. They alone account for your "20-30 new grads/class" number. Two Sigma is also around 350k this year all in with sign on but obviously they also hire a massive amount of new grad swes comparable to ctiadel. The amount of seats available for top of the line hft swe is similar to the amount of seats available for top BB/EB

What I wrote above is just swe. That doesn't even account for quant yet but of course quant is a completely different game from swe.

If you say Jane Street one more time...

Bro, these two field are too different... like, I may not like programming or deep-computer stuff over analyzing and valuating a mulit-billion company

SWE employees at these firms get tied to very dirty noncompetes. They also do not get treated well in general.

Getting an interview vs an offer is different thing.

If you think these are stress free jobs not sure what to tell you. They are for a very specific personality.

what type of personality? stereotypical arrogant nerd?

I will preface by saying that I don’t have a lot of data points for friends who work in prop trading / tech whether SWE or other roles. Also, am a FT analyst not intern.But I do know the following

i have a buddy who makes 103k in a LCOL city as a SWE working (according to him) max 30 hours a week fully remote with very little stress. Said it doesn’t even feel like he’s working. This is for a large non FAANG role. He also had about a 3.4 at a large state school not ranked T30.

I’ve also been told by a friend who does quant trading (not SWE) at one of the reputable Chicago prop shops that more people don’t go for these roles just because they overestimate how hard it is. He actually said he doesn’t even know how to code well enough to do it for his job so he doesn’t code despite CS/Econ undergrad.

Seems like a whole lot of cope in this thread.

$103k is a far cry from $400k. Nobody is denying that tech has better WLB and pays well, but OP is talking in extremes ($400k) where your friend is much closer to reality. Also 3.4 for CS is actually pretty good.

103k for his location plugged into a CoL calculator shows 289k for Manhattan. Even if we didn’t adjust for CoL it’s still only 7% away from IB salary. No bonus of course tho but adjusted for CoL and hours worked comes out way ahead of banking.

I guess my point is we’re being tricked if we think we get paid well in banking when SWE at non FAANG pays the same salary for half the hours and in LCoL

Says Prospect in IB

Some one skipped stats and does not understand percentiles

You need talent, genuine interest and 100% commitment to become very good in SWE and get a job at a firm that pays better than BB/EB IBD or PE. Finance is for everyone who is able to learn slides by heart for ~3 years und memorize interview questions for IB internships.

Ok but a tech bro will never get laid

What happened to “do what you like?” Some people like coding and building apps. Others are more interested in learning how to grow and finance a company. Both paths lead to a lot of money. It’s not just about the money to hours ratio. As much as ~some~ Jane street guys make millions, ~some~ IB/trading/MBB guys make a ton of money. Many people in both the CS and business career paths end up in mediocre middle management positions making 200k. Just do what you like because if you take a SWE job because you want to make 180k at 22 while working less hours but hate coding you will be miserable and be walked all over by the guys who actually like their job.

Quo optio ut tenetur rerum asperiores corporis dolorum. Aut ut deleniti nisi in illum non est aut. Eum et ipsam dolor voluptatibus id voluptatem molestiae. Quisquam quod ea commodi necessitatibus recusandae quisquam culpa. Consequuntur doloremque similique accusantium sapiente aut facere vel.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Omnis ea similique quam alias id. Autem quia placeat eius. Inventore eligendi cupiditate quo ut rerum voluptatibus pariatur. Corrupti eos quis culpa facere quas sit sit. Neque velit commodi esse fugiat commodi alias eos accusamus.

Rem tenetur quaerat fuga voluptas. Animi iusto sit sint suscipit. Ea nostrum nobis et nisi et assumenda ut.

Veritatis nostrum fugiat tempora maxime ut repellendus. Voluptatibus consectetur exercitationem optio veniam soluta ut sint officiis.

Quam inventore quo et et deleniti architecto qui. Debitis ut tenetur repellat aut amet id. Sed commodi in eaque repellat. Maiores occaecati ipsum expedita minus. Accusamus qui vel iure quasi tenetur unde.

Esse occaecati molestiae voluptas temporibus. Nostrum explicabo quibusdam consequatur error similique.

Eum fugit sit qui nisi tenetur atque. Quis quam eum autem corporis ullam quo voluptatem sapiente. Voluptatum accusamus voluptatibus cupiditate voluptatem natus.

Ab odit ut dolorum sed corporis aut ipsum. Sint voluptatibus illo tenetur molestiae ut aut dicta. Ut possimus magnam et. Aspernatur illo impedit et libero nulla vitae eveniet.