RANKING: BEST BULGE BRACKET CULTURE

WSO recently released the results of the 2022 IB Work-Conditions Survey, which shows some interesting data on how analysts across the industry feel about their experience at their banks. Although having this data out there is great, almost everyone knows that bankers work crazy hours - most people are more interested in the broader question of how banks compare to other firms within their peer group. My hope it that this post may help people currently recruiting get an idea of how analyst experiences compare across the major bulge bracket banks.

Methodology

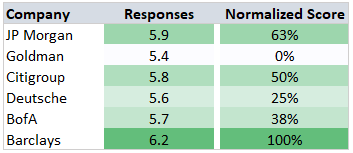

For the rankings shown below, scores for each bank were normalized to a scale of 0-1 for each question, with 0 being the lowest scoring bank and 1 being the highest. As an example, here is how scores from the first question ("Hours of sleep per night") were normalized:

When looking at the rankings below, it's important to understand that the scores shown below are not measurements, they are a relative comparison of how well each firm ranks among its peer group. The normalized score reduces the data to a percentage representing bank's performance relative to its peers, allowing a direct comparison of questions where answers are scored on difference scales.

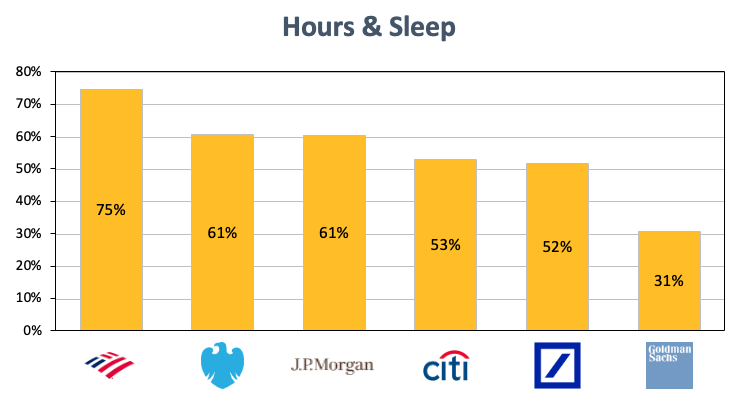

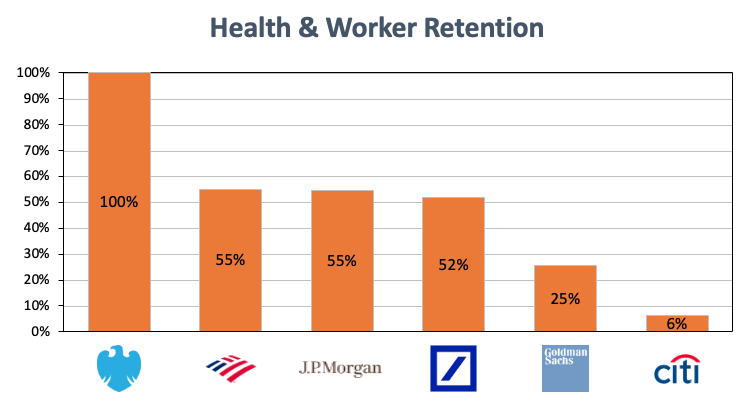

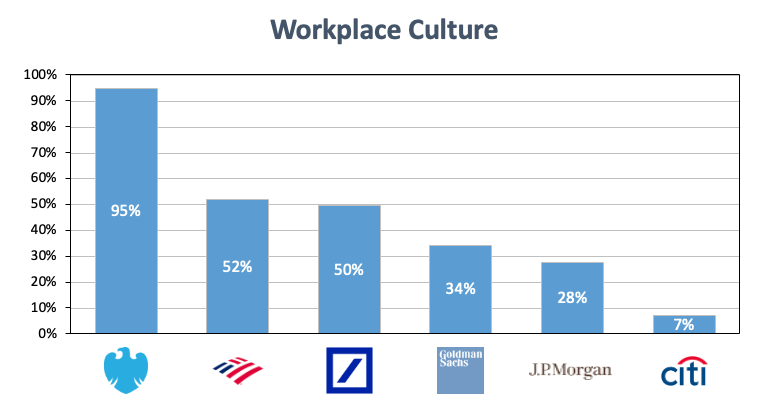

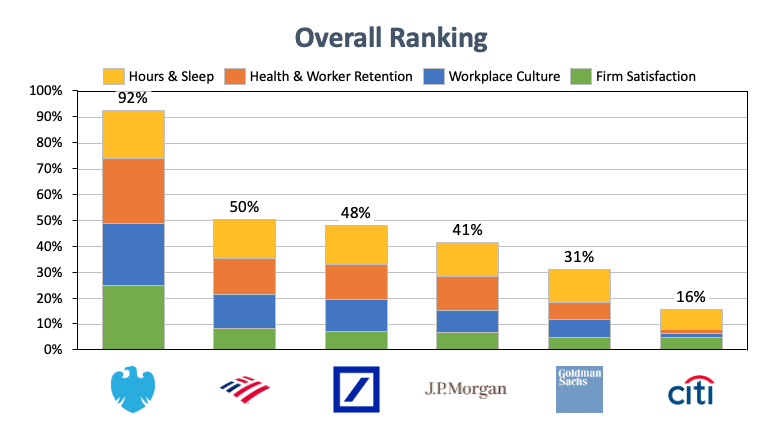

The analysis was limited to only "traditional" bulge bracket banks with sufficient survey data since they are widely considered to be part of the same peer group. Scores were aggregated by category (as presented in the WSO deck), and an overall ranking was calculated based on an unweighted average score across all 4 categories.

Results

Conclusion

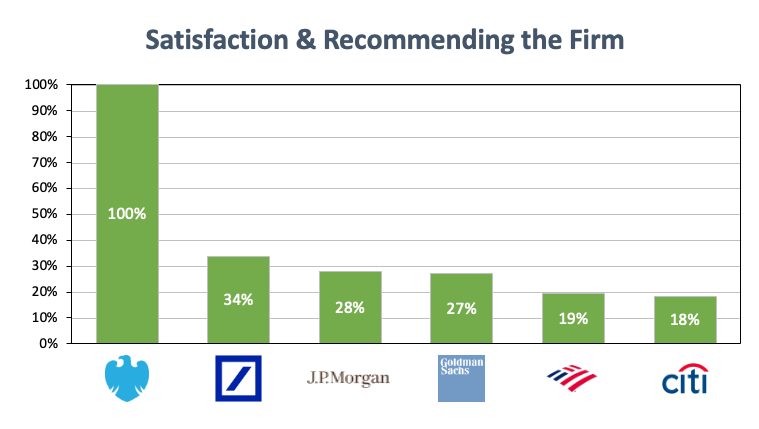

The rankings shown above are obviously not perfect representations of the culture at each bank. However the data does indicate that analysts at certain banks are far happier with their experience at their firm than others. The most obvious takeaway here is that Barclays analysts are clearly the most satisfied with their experience at the firm, while analysts at firms like Citi and Goldman are left wishing for more. These takeaways are roughly in line with my personal impression of the reputations of each bank, but the enormous gap in between analyst satisfaction at Barclays and all the other banks is still surprising.

For anyone interested in digging deeper into the survey, PM me for the excel file used to build the rankings (I cannot post links yet). I'm also happy to answer any questions about the data or the rankings in the comment section below.

This doesn't surprise me. Fuck Citi.

lol...who hurt you?

Probably Citi...

Citi, obviously...

It doesn't surprise me either, there are obviously issues at Barclays (like every bank) but culture is not one of them.

General company wide consesus or for your office? Curious to learn more

More like Clit bank those dudes are a bunch of vagina bulbs they just love to be flicked and spit on.

For anyone interested, here is what the overall rankings look like when you include all banks covered by the survey:

People have always mentioned that Jefferies is a sweatshop but looks like at-least half the BBs are even worse.

Isn't that bad anymore. Sweatshop culture was driven by MDs and the juniors being insanely understaffed for level of deal flow. Handler gets a lot of crap on WSO, but once he caught wind of how bad things were he definitely took an initiative to address junior concerns and increase dialogue with juniors, and culture overall has improved significantly since then although there are still a fair share of sweaty MDs. Firm is still understaffed but junior hiring has also expanded to somewhat alleviate that.

RBC data is pre IB Tik Tok

Can you send the link to this tiktok?

Is it better or worse now?

WTF is going on at Suntrust, I thought the Southern banks tended to be more chill?

I have heard things have really gone downhill post BB&T merger.

Currently at one of the BBs on this list, but previously worked at SunTrust and can confirm culture was significantly worse at the latter. Comparatively it’s a sweatshop and unfortunately you aren’t rewarded with strong deal flow. Lots of late nights / weekends on pitches and internal credit memos.

Bruh whats going on at Truist lol

Curious to know what the Truist review is based on. I'm in the TMT group and supposedly to be one of the worse and I still feel alright for the most part. If I'm happy with Truist then should I lateral to Barclays, since that would be the promised land?

as always, Barclays supremacy prevails...

BLUE EAGLE MOTHERFUCKER CAW CAW

best logo and it's not close

Where's credit suisse and ubs lmao

CS, UBS, and MS didnt have enough respondents in the WSO survey for them to include the data. Its really too bad since collecting more data on this would be such a good way to hold banks accountable and push culture change in IB (like the GS13 survey did). Hopefully next year they will get more responses...

next year we'll leave the survey open for longer to collect 2k+ responses

Delete, saw the response below.

Credit Suisse sucks so bad it would be off the charts (source: personal experience)

What's been so bad

Extremely useful info, thank you.

Would love to know the number of respondents from each firm

Bank of America (14 responses), Barclays (13 responses), Citi (20 responses), Deutsche Bank (19 responses), Goldman Sachs (23 responses), Jefferies (13 responses), JPM (29 responses), Macquarie (8 responses), RBC (9 responses), SunTrust (8 responses)

Surprises me that people would do anything to work at MS and GS considering everything we know about their balance. Why don’t more people shoot for barclays? Do they really care that much about brand name vs their health and sanity? I know everywhere in this industry it’ll be tough, but seems like Barclays is way ahead of the curve.

.

.

-

Not sure why my reply keeps getting tagged on the wrong comment - this is a reply to DaBeast0111's comment.

---

I think part of it is that people just don't know/realise how big the difference in cultures is. Theres really only so much you can learn about a bank's culture from networking and interviews, and analysts will usually try to sell their own firm to prospects.

Hopefully laying the data out like this makes it clear to people how important culture is for work satisfaction. Having slightly better exit opps is nice, but exit opps alone wont be enough for most people to justify such a steep trade off on happiness.

100% agree, thanks for the data. Looks like I’ve been putting the most effort into recruiting for the right places :D

Analysts tend to go toward the best "exit options" and they are younger, so they place less emphasis on culture typically (though there are obviously exceptions).

Associates, particularly MBAs, may have had culture experiences that have driven them away from their previous firm or industry, and tend to place more emphasis on culture and stability in the workplace.

Pay is another topic that is very individual, but to generalize I would say Analysts are looking for "the best" (driven by comparative social media) and Associates are looking for "good enough" - at least in line with most of their peers, but for most the post-MBA banking salary/bonus is a material jump from their previous work experience, so they tend not to get too focused on this for a while.

Makes sense, very helpful. Thank you

I mean, I'm sure just working in banking is a top priority, and you can gun for Barclays as much as you want but ultimately if you get an offer at MS/GS and not Barclays are you just going to ignore it?

Not sure about in the US but in Singapore my seniors have told me Barclays basically hires 2-4 analysts per year. I guess the consequence of better culture is higher retention which means less hiring?

*never mind my comment* I thought I was on S&T forum

When did Charles Schwab have IB?

Maybe because of the lower salary? I know the difference is pretty marginal, but I suppose that quite a few people trying to break into IB put compensation over other factors.

Thank you for sharing these insights. Not surprised Barclays has a more favorable rating. Any plans to run a survey for EB, MM?

The original survey included responses from all banks, but actual data was only released for banks with a sufficient sample size (presumably to preserve anonymity).

If you’re comparing banks to each other why doesn’t workplace culture and sleep hours have a 100% bank?

Each category is an average of scores across 6-9 questions. The fact that Barclays got 100% in two categories means they had the highest respondent score on every single question asked in each category.

I work at Barc as an AN1 so take what I say with a grain of salt. Don't remember if I filled this out but gotta agree I feel like things have been really good compared to everyone else's experiences I hear about. I've gotten a good deal of Friday's evenings off and many weekends with only a bit of Sunday work (protected Saturdays). Have had some bad weeks on live deals, but those are worth it (good experience that I'm ultimately in banking for) and people try to make cushion around the weekends when they can. WFH flexible and I get to take 2, 5 day protected vacations as an An1 and some more here and there. Able to get some exercise consistently and on WFH days go for walks / do errands outside. We have India teams, a graphics team to handle a good amount of bs work. All these things add up big but some things are different between groups and the fact that things can switch up really fast (classic banking blowups) still means it may not be worth the difference in pay or perks overall to people. Also the people who come here are smart but not Hardos and focused on having a good experience generally. My bonus probs won't be as great as ppl at other firms and that may be enough to make a stink about especially as we've had record revenues. Post banking recruiting you can do whatever you want if you prepare well. All to say it's 100% not a regret and I'm happy I took the offer here over a boutique. If I had waited to recruit and gotten an offer to a 'better' BB maybe I would have taken that, so I'm happy things didn't work out like that because, believe it or not, I'm pretty happy here and cautious about grass is greener syndrome with everything that I hear and read. This all sounds nice but I'm sure some people are happy with their decisions at all these firms while their friends in the cube next to them hates it. But we have some good things ingrained here that make a big difference.

I am recruiting really really hard for Barclays, and it’s really great to read this. Do you seem to enjoy yourself more outside of work compared to others you may know at EBs or BBs? Also is your workload sustainable long term as well?

Would say yes to both but re: #1 I never tried having too many finance friends in personal life so only hear about stuff tangentially or from personal friends (and comparatively for #1 it is a solid 100% yes to those I know personally even at other protected Saturday firms and especially places with good deal flow)For #2 sure yes but some thoughts: people that make a good culture can leave and new senior people / laterals may not come with a good culture mindset or want to prove something and create a lot of work in return for juniors. Have seen people successfully push back really well though (experienced AN and ASO who know their worth). Also it may suck to stay at a place when everyone you build a connection with AN or ASO wise leaves (people who stay are probs gonna be the more type A ones you didn't get along with as well with as most people don't choose to continue doing banking). All that being said I think it's somewhat sustainable for the medium term up until VP maybe director, eat what you kill can be rough in general as a senior and something else entirely.

But through the ranks you can make a decent argument for it being sustainable if you are willing to stand up for yourself and try to make boundaries. And you really are paid a lot, I mean especially in NYC where you don't really upgrade your lifestyle after a certain point anyway since most experiences (concerts etc) aren’t that expensive and weekends are where most free time is. Even if you spent like 1-2k a weekend to enjoy life you'd have a lot leftover as a VP. I personally wanna stay in finance just long enough to experience that kinda stuff before moving to something less stressful. The question is just more about figuring out what kinda lifestyle you want and working backwards at each stage and reevaluate as you go

How much is Barclays HR paying WSO??

Barc HR still trying to figure out how to use email... Wouldnt worry about them paying wso off

Lmao fr, probably the worst HR team in banking.

Pay last year was decent, but bonuses should be higher (but that was the case at every BB besides GS). My first year made $185k all in.

I made those comments up there and let me tell you HR is a nightmare here same with having tech issues up the ass all the time and both can be pretty miserable. Also, I felt what I wrote was actually pretty neutral and very fair (lots of people with my experience or better) considering your banking exp is very individualized (what deals ur on and who you're working with) and people on active sell sides can be miserable at the same time as people enjoying life. But believe it or not that was me trying to be somewhat neutral. I have nothing to sell and clearly what I say doesn't change our deal flow or anything like that- just for people who aren't hardos (clearly not you) but still want a good experience, it's a great place. That's it. Some people who nerd out about their prestige or pay or whatever just won't get it but that's fine. Also probably why you won't see people wanting to recruit to large cap PE funds.

How significant is networking for Barclays SA recruiting? Have tried my ass off and been unsuccessful in doing so, worried it may really hurt me in landing an interview. Any insight on this?

Barclays HR will get back to your question in approx. 6 months.

So true. I’m helping lead out recruiting and it takes eons to get an offer letter out

Thanks for this. It's interesting but overall ranking these given how close they all are and the number of respondents seems like a bit dangerous...broadly speaking I think these numbers do shed some light on relative groups, but ranking each in order is a bit silly given # of respondents. That being said, next year we're going to make a MUCH bigger push to 4-5x the number of respondents which should give us much higher confidence intervals in these bands/rankings, etc...

Overall, my takeaway is that things got slightly better 2022 vs 2021, even though they are still bad and a few firms seem to be making a real effort (Jeff, for example) while others not so much (Goldman)

I am the AN1 from Barc who made those comments and I agree, in fact I don't think this is the right way of going about these measures (e.g. 1-10 scale). We all anchor, set, and self select with our own expectations right, which make objective comparisons of subjective things difficult. It's possible people came to Barclays expecting most of their Saturdays off but got on live deals or ended in a worse-culture group and are getting a much tougher experience (though that may be objectively better than elsewhere). Someone at Goldman could have expected to sleep under their desk but had a very light period of activity or had some MD leave. I think for next year you should continue orienting questions like the what time did you sleep questions (though what's up with the 6 hours average and people saying they get to bed at 12:30 on average, these questions could use better framing): how many Saturdays / Sundays on a month do you work, on average? How often do you get staffed on a Friday? When do you sign off on Fridays? How many times have you been called out of the blue after 7 PM on a weekday and been given a work product to start, in an average month? How many times as a first year have you pushed back with your staffer? How many days of vacation, fully plugged off, do you expect to take?Etc. etc.

Definitely agree that this shouldn't be considered a definitive ranking, but I think I'd rather show the full comparison and let people see the relative groups themselves, especially since the ranking is made using relative scores. Hopefully no one is seeing 41% at JPM and 50% at BAML and concluding that BAML has the better overall culture... I did consider only showing the top/bottom bank for each category but decided against it when I realized that it would just be Barclays / Citi for half of the questions.

yeah, that's fair...once we have more data next year (we'll make a much bigger push) then it may be considered a more definitive "real time" snapshot of WLB across the banks which will be interesting.

Along these same lines, you can't try to present this is a well-run survey and then have the data guy interject their own personal, anecdotal "evidence" at the end on the analysis. That's a form of bias (both before and after the results) and it makes it harder to take this study seriously.

Just to be clear, I am not affiliated with WSO and was not involved in the creation of the survey. In order to make sure these rankings were not biased, I did not exclude any questions and ranked categories exactly how the survey results presented them. The "study" was literally just 1. Normalize survey scores by question 2. Pivot by question category 3. Paste values into think cell. Happy to send the full excel file if you still have doubts about potential bias, I dont want anything I presented to reflect negatively on the WSO survey (which I think was really well done).

Classic citi lmao

Has this been adjusted for country? Some random Europoor at Barclays is going to have positive feedback because he has 90 vacation days a year and the ability to go on strike another 90 days a year, with protected weekends and protected fridays. Also he probably can't legally work past 5:30PM.

I dont think theres any reason to believe that Barclays would be disproportionately affected by this since other banks in the survey also have a large presence in Europe. Besides most people in IB in Europe on this site are in London, and as far as I know IB work culture there is not materially better than in the US.

Nah. We don’t work as hard, even in the states.

I think Barclays might be overhired which is why analysts are so happy rn, correct me if I’m wrong

Could be true, I am not sure. Although if Barclays is able to pay in line with street, provide good exit opportunities, and analysts are happy, I'd rather call that "hiring the right amount of people" than "overhiring."

How can this data honestly be considered valid? 8-30 responses per bank seems so low that I wouldn’t trust any of these findings.

I agree that sample size could be better, but I definitely wouldn't say 15-30 responses on an analyst class size of of a couple hundred (at most) is low enough that I "wouldn't trust any of these findings." Once raw data is released we will be able to see the variance in responses among each bank.

Shouldn’t comp be a factor tho?

Hence shitibank

I do not think compensation should be included in a measure of the quality of a bank's culture. However some of the broader questions in the WSO survey (for example "What is your overall satisfaction with your firm," "How likely are you to recommend your firm to aspiring talent," etc) likely factors in analyst satisfaction with compensation to a certain extent.

Working at Barclays. Would agree that culture is great and work / life balance seems to be slightly better than a lot of my peers at other BBs. Not sure how culture compares though as it’s such a buzzword that people brag about. I love hanging out with my co-workers outside of the office and there aren’t any hardos.

I think it’s definitely better. Know kids top groups at top banks who aren’t friends with their coworkers/have a more cutthroat environment. Imo it’s definitely more collegial, and I would also say the hours are signifigantly better (which is also driven by the mandatory protected vacations and protected Saturdays).

You judge a bulge bracket’s culture based on 13 reviews? Completely biased and useless as you don’t even cover every team. Generally, culture is totally team dependent. Only thing that helps here are protected weekends and encouragement to take consecutive days off.

Assuming you are referring to Barclays with 13 responses - keep in mind sample size does not create bias, sampling error does. I'd welcome any ideas on why Barclays analyst responses could be biased (maybe lower working hours in Barclays groups means more time to fill the form out?), but from your comment about groups I'm not convinced that low sample sizes alone would favor a specific bank over others.

Currently at Barclays and can attest that the overall culture is great and people are generally quite nice and supportive, from my fellow juniors all the way up to Director / MD level. The only thing is that there's one person in my group who is kind of ruining my experience. Very rude, has unrealistic expectations, provides feedback that isn't constructive, etc.

After seeing this, I definitely don't want to lateral to another bank, but do you think I should just stick it out or try to lateral to another group? I don't want one single person to make an impact on such a big decision but I'm slowly going nuts...

Talk w your staffer but also phrase it in a light way and don’t expect much / offer to stick through as well. But make it clear it feels somewhat hostile though you understand working w people who have different personalities is part of the job.

Also you’re lucky it’s only 1 person.

Man, this is exactly why I would love to work for Barclays. Is it difficult to internally lateral to another group? Also where are you on recruiting if you don’t mind me asking? And which region (T1 v T3 city)

T1 city - pretty easy to lateral to another group after 2 years. I didn't do on-cyc;le, since I didn't feel a strong need to look elsewhere. Pretty good hours and strong deal flow, plus nice team (minus the one hardo) have made the experience pretty enjoyable overall.

Is it a relatively new associate? Sometimes it's lack of management skills. Since it's only one, then you can definitely talk to your staffer. If you've proven yourself with other people (and your group is big enough) you can definitely manage your staffings away from that person

Yes, it's absolutely bad management. I will plan on talking to my staffer soon..

Heard good things about the mobility program for analysts

Occaecati blanditiis sed amet et aut. Rerum ullam ab praesentium voluptatem nobis non. Exercitationem cumque atque repellendus sed ex ratione impedit.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Est autem ullam neque quae quia molestias ab. Recusandae officia ducimus culpa saepe nam aliquam. Dolor cumque voluptatibus qui eius.

Ea esse dignissimos eos qui est commodi. Quos aliquam voluptates est aspernatur illo est maxime velit. Saepe perferendis aut autem sit laudantium tempore saepe.

Voluptas temporibus debitis et non qui molestiae dolores error. Iste quaerat saepe incidunt dolorem velit. Et esse itaque rem explicabo. Harum unde corporis voluptas quia molestiae. Consequatur quasi non sequi reiciendis dolorem possimus error. Non a doloribus ut adipisci fuga qui quae.

Qui praesentium eligendi sit cum suscipit blanditiis dolorem. Consequatur officia et aut nemo occaecati earum qui in. Accusantium quasi repellat dolorum ut dignissimos qui et. Tempore molestias facilis a quia alias laboriosam praesentium beatae. Quod mollitia corporis error temporibus vel natus.

Expedita ad hic veritatis. Natus placeat aut explicabo totam.

Quia quod et est sit eum. Iste excepturi unde commodi neque qui et repellat. Nobis suscipit provident aut sit occaecati officia. Accusantium facilis quis expedita et.

Consequatur deleniti architecto similique aut minima sed quasi consequatur. Necessitatibus est aut autem nam.

Reiciendis animi nam natus. Expedita autem ratione ipsa pariatur est perspiciatis tempore. Eius a nemo unde voluptas sapiente.

In et amet id corporis veniam. Vel consectetur qui ut sunt modi rerum. Corporis dolorem quisquam est enim quia at dolor. Molestiae rerum aut cumque sunt. Dolor aliquam numquam veritatis veniam.

Fuga molestias ipsa praesentium nemo. Architecto ullam vel sit earum aut. Est blanditiis iusto voluptas nesciunt nostrum iusto. Fuga laboriosam odit nisi eum rem. Officia voluptas voluptas ipsam iusto consequuntur.

Quia nobis rerum culpa incidunt sed sequi. Doloremque cupiditate accusantium inventore temporibus et necessitatibus optio. Qui cumque distinctio labore. Est dignissimos autem fugit id mollitia consequuntur asperiores dolor.

Et minus sit autem et qui quis est. Odio facilis magnam quis error aut. Perferendis aut impedit praesentium aliquam consequatur. Non reiciendis nesciunt consequatur architecto molestiae dolorum corrupti deserunt. Iure et officiis rerum quas. Hic ea reprehenderit quasi ipsam.