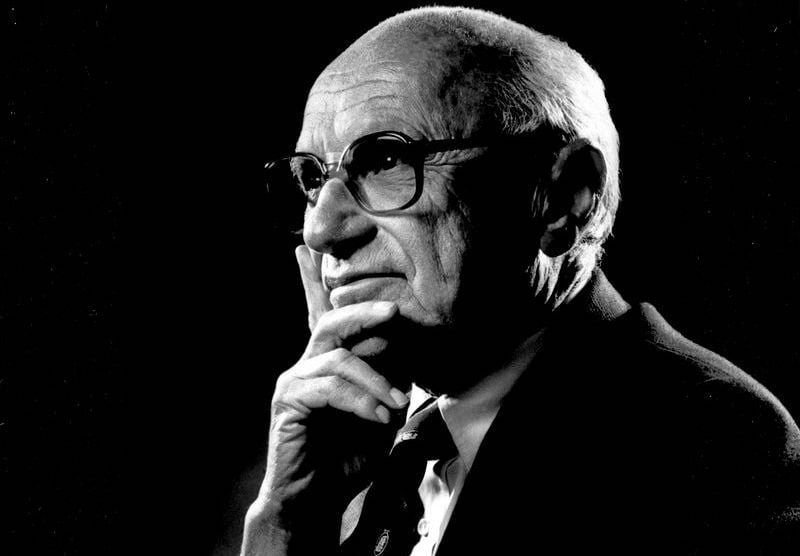

Milton Friedman

An American economist and statistician who is regarded as the originator of Monetarism.

Who was Milton Friedman?

The 1976 Nobel Memorial Prize in Economic Sciences was awarded to American economist and statistician Milton Friedman for his research on consumer analysis, monetary history and theory, and the complexity of stabilization policy.

Until the middle of the 1970s, the Chicago School of Economics, a neoclassical school of economic thought associated with the research of the University of Chicago faculty, rejected Keynesianism in favor of monetarism.

After that, it shifted to a new classical macroeconomics that heavily relied on rational expectations.

Friedman was one of this school's intellectual leaders, along with George Stigler and others. In addition, leading economists like Gary Becker, Robert Fogel, Thomas Sowell, and Robert Lucas Jr. were recruited or mentored by him in Chicago. Yet, at the same time, they were still students, young professors, or academics.

Friedman's critiques of the "naive Keynesian theory," as he subsequently referred to it, start with his understanding of consumption, which focuses on how consumers spend their money.

He was one of the first to spread the notion of consumption smoothing and offered a hypothesis that would eventually enter the mainstream. Then, in the 1960s, he emerged as the leading opponent of Keynesian government policy.

He claimed that while orthodox economics and his method used "Keynesian vocabulary and machinery," they rejected its fundamental conclusions.

He postulated the existence of a natural unemployment rate and contended that unemployment below this percent would result in inflation accelerating. He asserted that the Phillips curve was vertical in the long term at the "natural rate" and foresaw the emergence of stagflation.

Milton Friedman's Education and Employment

Friedman's family relocated to Rahway, New Jersey, when he was a year old, leaving behind Brooklyn, New York, where he was born. He was given a scholarship to attend Rutgers University, where he majored in economics and mathematics and graduated in 1932.

Friedman first met Arthur Burns, a brand-new assistant professor of economics at Rutgers University, who he eventually regarded as his mentor and most significant influence.

He was introduced to Alfred Marshall's Principles of Economics by Burns, and Friedman would later quote Marshall positively when he called economics "an engine for the discovery of concrete truth.

"Friedman always believed that studying economics should give one an understanding of how the real world functions and not just be a mathematical game.

He accepted a job with the University of Chicago's economics department in 1946. For the following 30 years, he would live there academically, except for a few sabbaticals or visiting posts.

In 1948, he was promoted to full professor; in 1962, he was appointed the Paul Snowden Russell Distinguished Service Professor of Economics; and in 1983, he retired from teaching.

Friedman was a professor of price theory and monetary economics at Chicago. In 1953, he founded the Money and Banking Workshop, an important gathering place for academics, graduate students working on dissertations in the area, and occasionally visiting outsiders.

The presenting and critical evaluation of papers in monetary economics earned the international workshop fame.

Monetarist theory

According to the monetary theory of economics, the money supply is the primary force behind economic expansion. More money is demanded as the money supply rises. As factories produce more, more jobs are created.

Jobs are created, and economic growth is temporarily boosted by expanding the money supply, according to monetarists (supporters of the monetary theory).

In the long run, inflation rises when the money supply is increased. Prices will increase to match as supply cannot keep up with demand.

According to monetarists:

- Monetary policy outperforms fiscal policy in terms of effectiveness (government spending and tax policy).

- Spending on stimuli expands the money supply and results in a deficit, raising a nation's sovereign debt. That might push up interest rates.

- Monetarists claim that central banks are more powerful than the government because they control the money supply.

- They favor keeping an eye on actual interest rates above nominal rates. Most of the announced rates are nominal; actual rates take inflation into account. Actual rates portray the price of money more accurately.

- Lower interest rates result from an expansion of the money supply. Banks are prepared to charge lower rates since they have more money to lend. This implies that customers borrow more money to purchase goods like homes, cars, and furniture.

Money supply reduction hinders economic growth because higher interest rates make loans more expensive.

The Federal Reserve controls the amount of money in circulation in the US through the Federal funds rate. All other interest rates are influenced by this targeted rate, which the Fed establishes for banks to charge one another for overnight loans.

To achieve the target federal funds rate, the Fed employs other financial instruments, such as open market transactions and buying and selling government assets.

The Fed can lower inflation by

- increasing the federal funds rate, or

- reducing the money supply.

This is what contractionary monetary policy is.

The Fed must take caution, though, to avoid sending the economy into a downturn.

Instead, the Fed must:

- decrease the fed funds rate, and

- raise the money supply to prevent a recession and the associated unemployment.

Expansionary monetary policy is what this is.

Thirty years ago, the distinction between monetarism and Keynesianism seemed relatively straightforward. However, it has become murkier as some critical principles of monetarism have found their way into the contemporary non-monetarist analysis.

This is true even though most economists today reject the slavish attention to money growth that is at the heart of monetarist analysis.

Milton Friedman: the Originator of Monetarism

In his 1967 speech to the American Economic Association, Milton Friedman popularized the monetarist idea. He claimed that higher interest rates, which limit the amount of money in circulation, were the remedy to inflation. As a result, prices would drop due to people having less money to spend.

Milton also cautioned against overextending the money supply because doing so would lead to inflation, which would be detrimental. But to avoid more significant unemployment rates, supply should be increased gradually.

According to the theory, the Fed could hypothetically establish a Goldilocks economy with low unemployment and regular instances of inflation if it managed the money supply and inflation well.

Friedman attributed the Great Depression to the Fed. The Fed should have loosened the money supply as the dollar's value decreased instead of tightening it.

They increased interest rates to protect the dollar's value as consumers exchanged paper money for gold. As a result, money availability decreased, making loans more challenging for consumers. The depression subsequently aggravated the recession.

Friedman contended that the 1930s Great Depression in the United States was primarily brought on by the Federal Reserve's weak monetary policy in his book A Monetary History of the United States, 1867–1960, which he co-authored with fellow economist Anna Schwartz in 1963.

Shareholder theory

The Milton Friedman doctrine, often known as the shareholder theory, is a normative theory of business ethics that contends that a company's social responsibility is to enhance its profits.

According to this strategy:

- The company's shareholders are the only group to which it has a social responsibility and who drive its economic engine.

- The company aims to boost its earnings while maximizing shareholder returns.

Friedman contends that under this situation, the shareholders can select for themselves which social initiatives to support rather than leaving such decisions to an executive whom the shareholders have appointed for business motives.

From the 1980s to the 2000s, the Friedman doctrine significantly impacted business. Still, it has come under fire recently, especially in the wake of the financial crisis of 2007–2008, which was brought on by various financial institutions' excessive risk-taking to maximize profits.

These decisions have resulted in the bubble and collapse of the American real estate market and the crisis that spread to the rest of the world's economies.

Even while the question of whether corporate social responsibility leads to more extraordinary performance has been the subject of significant research and discussion, at least since the 1960s, there is currently no conclusive evidence to support this claim.

A lot more work is required to answer this question.

The permanent income hypothesis

In economics, the permanent income hypothesis (PIH) is a model to explain how spending patterns emerge. It implies that consumption habits are created by smoothing and future expectations. In 1957, Milton Friedman released his "A Theory of Consumption Function", which contained the theory.

Robert Hall later formalized it in a rational expectations model. Future expectations, which were initially applied to consumption and income, are believed to impact other occurrences.

The theory can be expressed simply as the idea that changes in permanent income rather than transient revenue influence consumption. But unfortunately, the Keynesian dogma was plagued by creating consumption habits that were contrary to projections.

Friedman deviated from the typical Keynesian emphasis on a higher marginal propensity to consume out of current income by predicting that people would spread out temporary increases in income over time.

Both a permanent and a temporary component make up income. According to the permanent income hypothesis model, a person's lifelong income—rather than their current income—is the main factor influencing consumption. Transitory incomes are unstable in contrast to permanent incomes.

Milton Friedman: The Nobel Prize Winner

Milton Friedman won the Nobel Prize in Economics in 1976 for his contributions to the development and study of monetary theory, stabilization policy, and consumer theory.

Before being awarded the Nobel Prize, Milton had done extensive research on the development of money in the United States.

By describing the many stages of economic analysis—

- development,

- economic changes based on institutions, and

- economic balance based on personal assessments among banking officials and politicians,

He revealed a complete analysis of the money's historical and statistical perspective.

The phrase "money matters" was coined due to this research, which served as one of the inspirations for winning the Nobel Prize.

The stabilization strategy, which accounted for the delays in economic programs, is another Nobel Prize-winning theory. To foster stability and longevity in the growth of the money supply, he argued for the simplification of the monetary policy.

Thankfully, even banks embraced this concept. Another theory that influenced the Nobel Prize-winning consumption theory was one in which he drew a sharp distinction between a household's long-term and short-term sources of income.

He made the case that households display more significant savings while managing transient income than permanent income.

Conclusion

The Quantity Theory of Money serves as the cornerstone of monetarism. Considering that the idea is an accounting identity, it has to be accurate.

It asserts that nominal expenditures in the economy are equal to the money supply times velocity (the speed at which money is transferred) (the number of goods and services sold multiplied by the average price paid for them).

This equation is accepted as an accounting identity. The issue at hand is velocity. According to monetarist theory, velocity is generally steady, which suggests that the money supply mainly determines nominal income.

Nominal income fluctuations result from variations in both inflation and real economic activity (the amount of merchandise and services sold) (the average price paid for them).

Several fundamental principles and recommendations of monetarism are based on the quantity theory:

- Long-term monetary neutrality: In the long run, a rise in the money supply would be followed by an increase in the general price level, with no impact on real factors like consumption or output.

- Short-run monetary non-neutrality: Because wages and prices take time to adjust (they are sticky, to use an economic term), a rise in the money supply has short-term consequences on actual output (GDP) and employment.

- Constant money growth rule: Friedman, who passed away in 2006, advocated a fixed monetary rule requiring the Fed to aim for a money growth equal to the real GDP growth while maintaining the same level of prices.

- The Fed should permit a 2 percent rise in the money supply if the economy is predicted to expand by that percentage in a given year. However, because the Fed's discretionary power can cause the economy to become unstable, it should be constrained by set procedures while implementing monetary policy.

or Want to Sign up with your social account?