How To Kill a Bank - The Final Chapter

Mod Note (Andy): Best of Eddie, this was originally posted in October 2010. To see all of our top content from the past, click here.

Many of you remember a series I wrote earlier in the year entitled How To Kill a Bank (here's Part 1 and Part 2). It was supposed to be a 3-part series, but the first two parts generated so much hate mail that I never bothered to post the final part. You guys have been asking about it ever since.

For those who don't remember, I created a 10-step plan that enabled consumers to destroy one of the four major commercial/investment banks (Bank of America, Citigroup, Wells Fargo, or JP Morgan Chase). I posted the actual plan on the site for about a half hour and then took it down because it got such a violent response. I was literally accused of economic terrorism.

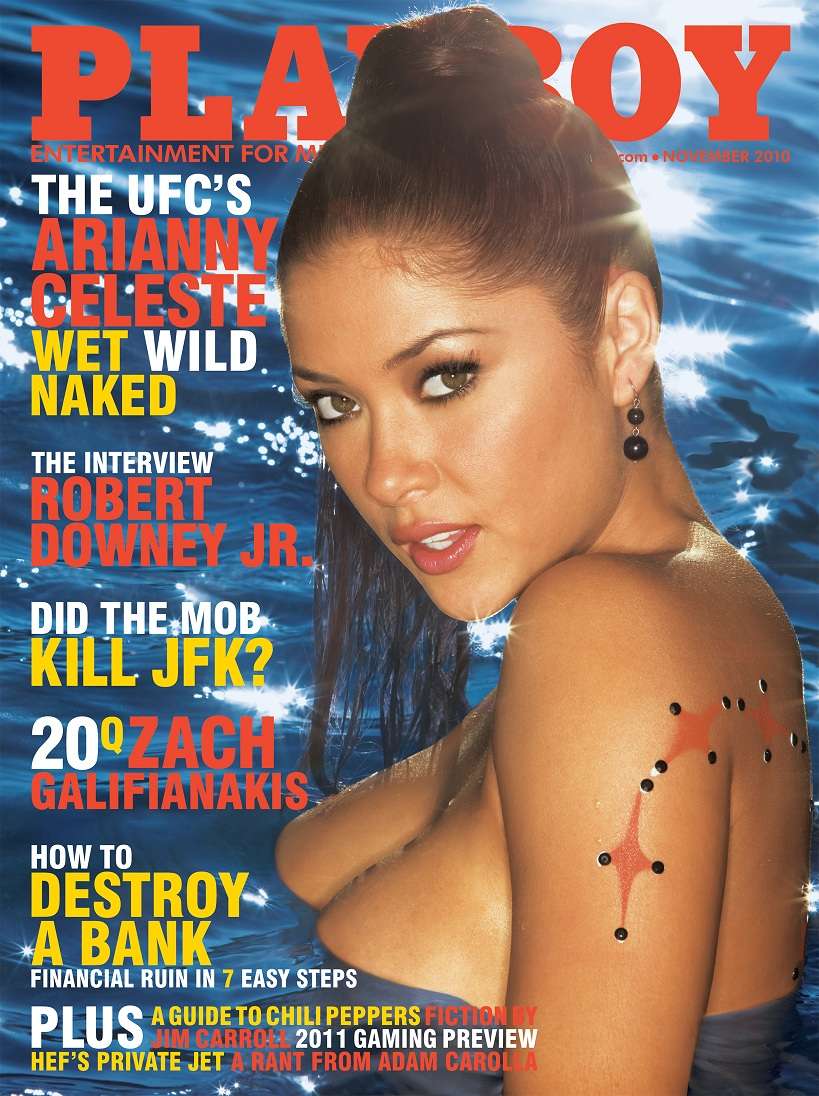

Unbeknownst to me, the post got a lot of attention outside the site as well, and it wasn't long before I was contacted by Tim Schultz, a freelance writer in Tokyo, who convinced Playboy Magazine that it could be their financial story of the year. I'm pleased to present you with the end result, available on newsstands Friday, October 15:

It's been a surreal process guys, and Patrick and I really appreciate your patience. While I haven't seen the article itself yet, I'm confident the author did a great job and that it will be both entertaining and enlightening. My plan was presented to a wide range of experts (St. Louis Fed President James Bullard, former S&L regulator and current UMKC Economics and Law professor

, and others) and I'm anxious to read their input.Not for nothing, but the November issue also boasts as cover girl MMA sweetheart Arianny Celeste and Playmate of the Month Shera Bechard(Safe for Work link). I have it on good authority that they might even be naked.

So get out there on Friday and pick up the November issue, or just go ahead and subscribe for a couple bucks more. I'm anxious to hear what you guys think.

By the way, 10 Silver Bananas to any monkey who submits a photo of himself (or herself) reading the November issue on their trading floor or any other readily identifiable area of their firm (you prospective monkeys can submit a photo of yourself with the magazine in a bank to qualify - extra banana if the photo includes a hot teller). You can cover your face with the magazine if you're worried about anonymity. Submit photos to [email protected]. We'll put together a monkey Wall of Shame.

Wow, congrats Eddie! Hopefully the guy will mention WSO so the site can get some publicity.

Thanks! The article is actually about WSO, and the power that financial blogs like us have today. I'm pretty sure Patrick's in the article too.

Congrats, well done EB!

That's awesome Ed, congrats! Haven't picked up a playboy in a loooong time but I'll be getting this one for sure.

Damn Ed...that's awesome, well worth the wait

Now I can really read Playboy for the articles!

Seriously though good work.

Win

You should have held out for Megan Fox being on the cover. But other than that, it's pretty fucking cool to say "Yeah, I had one of my articles published...in Playboy!"

That's actually been an area of confusion for the people who know about this. I didn't write the article, the article was written about me. As in, I'm the subject of the article. along with WSO (you guys) and the plan I wrote.

Just wanted to clear that up. Tim Schultz wrote the article (and had to spend some time in Paris's diviest bars to do it).

Congrats guys - should be some serious publicity for the site!

I would argue that being able to say there was an article ABOUT you in playboy is infinitely cooler than having an article you wrote in appear in Playboy.

Wait......so you get accused of economic terrorism and are forced to take it down from the site....so you go and let it be published in an international magazine.... :/

I'm not disagreeing with you but what made you think it was a good idea?

Playboy's legal department has much greater resources than WSO's.

Eddie, does this mean Schultz is going to reveal your real name!?

This feels like the episode of South Park where we finally see Kenny take his hood off.

Good job Ed.

Ha! Ha! When you do business with PB you need multiple pseudonyms.

Damn Eddie - well played sir. I apologize for giving you shit for holding out. As someone above me said "now I can actually read Playboy for the articles."

Having an piece about you in Playboy is an accomplishment - hopefully you kept all your clothes on, unlike many of the others featured in "articles". Can't wait to read it.

Congrats man, thats so awesome... just read the original posts now, interesting ideas.

Wow guys! I will go out and buy the issue when it hits newsstands.

Having worked on the retail side of JPM Chase, as well as currently working in commercial area of Wells Fargo this has definately peaked my interest. From experience and countless (useless) conference calls and "team meetings" I think JPM would still be a functioning entity out of the Big 4 Banks if a run was made on the community bank deposits. Their investment division had carried their profit line along with the mortgages until the most recent quarter when the retail bank actually posted a signifigant push in revenue lines. At the same time if there was a run on WF I could be eligible for a severence package. . .

I'm counting on you guys to let me know what's in it, because it's going to be mid-next week at the earliest before I get a copy. It will probably take even longer for Patrick to get it in Buenos Aires.

So let us know if they make us look like asshats, lol.

Major props Eddie!

email me your address and I will overnight you an issue marine

[email protected]

Thanks, Gene. I've already got them on the way. You guys will still have it before me, though. I'll bet Patrick will take you up on the offer, though.

you have been on this site longer then me. I still tip my hat where credit it due. Thanks for all the posts over the years

Wow, all playboy readers in the world with this kind of information. This could be dangerous haha..

I was very curious to see what the plan was way back when. Congrats man.

yeah, thanks to all of you guys for making WSO such a great resource -- without it being a decent size when that story hit, I doubt Schultz would have ever come across it.

On another note, I think Eddie deserves a big congratulations (it is infinitely cooler that the story is basically about him and his plan) and all of the credit. I had one 2 hour interview, he had several FULL DAY interviews. It was definitely a fun ride to hear about it all unfold.

I will have some of my buddies up in the states read it to me so no need to overnight me a copy in BA...should be here about a week later. Hopefully this leads to many more stories about WSO so we can continue to grow the community (we're about to hit 40,000 registered members) into an even better resource.

Thanks again to Eddie and all the users on WSO, Patrick

Gotta feel good to see your site coming into its own, Patrick, congrats.

Tremendous credit where it is due - congrats Eddie and I look forward to checking this out in a couple days.

Can we not just scan the article and email it to you?

Copyright infringement aside, that would be pretty cool.

@SanFran WH Smith carries the American version here in Paris.

Eddie, what are the chances you could write an article about how the whole process came about, what went down, etc. Just curious as to what the day long interviews and such were like.

I'm especially curious about who contacted you within thiry minutes of posting the article. Guys on this site? The feds 8| ? Congrats Eddie.

That is just brilliant. You have co article written about you in PLAYBOY. Can life get any better? Also good that wso finally gets good mainstream attention. Hopefully however this doesn't mean that the rite gets crowded with unfunny trolls. Although funny trolls could be helpful

congrats guys, awesome publicity for the site. well-deserved

gratz

F*cking baller, Ed! I honestly doubt any WSO member can top this in their lifetime.

I'll persuade my roommate to buy it and I'll snag it off him before he gets his jizz all over it.

Luckily I've got a bookstore here which can get me the US version until Saturday. Congrats to this, really impressive.

Very cool...even I'll go ahead and get a copy...and give it to my BF once I'm done reading the article.

:-)

Very cool; even got a shout out from the NYT:

http://dealbook.blogs.nytimes.com/2010/10/14/could-main-street-break-a-…

Eddie,

Read the article this morning. Nice one. I can see why you didn't reveal your identity.

While I agree that something drastic needs to happen for good changes to be made, I have to say I just don't think the plan would work. For me it comes down relying on regular people to execute the plan. See the link (http://www.newyorker.com/reporting/2010/10/04/101004fa_fact_gladwell) for an interesting article by Malcolm Gladwell that covers activism via the internet. While its not directly comparable, it makes some good points which I think relate to your tank-a-bank plan. What you would be doing is building a weak-connection network, which really isn't an instigator for change. Not trying to stir the pot, just offering another perspective.

Again, congrats to both you and patrick.

I just read the article.

I was surprised by the simplicity of the plan. I was expecting something much more complex. The plan was mainly working out logistics of a bank run, which now that I think about, would probably be the only way to go about doing this.

Also, that guy from U of Missouri pretty much outlined why the plan wouldn't work. When I read the plan, I got the sense it wouldn't work as well, only because there was such a large period of waiting from threat to action, and that would give more than enough time to the fbi/whoever to start tracing down who set up the website and arrest them. Also, there is the obvious problem of getting enough people to act.

But still, it was a pretty interesting read. Congrats again.

anyone ever submit any photos?

Eddy, I didn't get a chance to read your original article but I'm guessing it has something to do with a massive collective withdrawal of capital from the banks. There was an incident that I read about in California where the citizens did that and tried to live off a local economy. They took their money out of the banks and tried growing their own food, in addition to not purchasing goods from any major corporations. They might of even tried printing their own currency, I'm not sure about that though. I can't remember where this exactly happened but I remember reading that the armed forces intervened and stopped their movement. Do you or any monkey's know what I'm talking about? I've tried searching for the story but I'm having trouble finding it now.

Tempore in deserunt exercitationem quam. Vel dolorem dolores repellat aut. Autem eveniet sint adipisci eum totam vero iste corrupti.

Quia labore aut placeat deserunt optio. Maiores architecto placeat dolor animi nemo nihil dolorum. Doloribus eos in incidunt non voluptas enim iure. Eum ipsam amet quaerat repellat est ad.

Dolorum ex eum deserunt corporis aut quaerat sed dolores. Sint blanditiis est nostrum id. Consequatur enim accusamus in consequuntur ad. Facilis itaque saepe id cum accusantium consequatur unde quibusdam. Laboriosam explicabo porro adipisci accusantium.

Libero autem sequi repellendus ullam sunt qui. Illum autem consequuntur ipsum quisquam assumenda reiciendis molestiae.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Omnis ipsa ratione illum enim qui. Ipsam enim sit reprehenderit dolorem.

Fuga illo recusandae aut ea odio dolores. Dolor error in quia dolor consequatur sed est quaerat. Enim nihil dolorem nam est ipsum. Perspiciatis sit quae quia. Repellendus nobis molestias reprehenderit voluptas assumenda accusantium. In reprehenderit at dicta aut ut molestias. Autem magni non est in sint velit.

Facilis id at nisi. Omnis ab sint excepturi corrupti. Repellat in distinctio explicabo maxime repellat ducimus.