How to Calculate FCFE from Net Income

It measures the cash flow attributable to a company's equity shareholders; after all expenses, reinvestment, and debt are paid and accounted for

What Are Free Cash Flow To Equity (FCFE) And Net Income?

Free cash flow to equity (FCFE) measures the cash flow attributable to a company’s equity shareholders; after all expenses, reinvestment, and debt are paid and accounted for.

It is also known as a “levered” free cash flow (FCF) due to the inclusion of debt repayment capacity.

Net Income (NI), also known as net earnings, is the final profit of a company after accounting for all its costs, variable & fixed expenses, interests, taxes, as well as any non-cash charges, and can be found in a company’s income statement.

You can calculate it using the formula below:

FCFE = Net Income + Depreciation & Amortization + Net Borrowing - Capital Expenditure - Change in Working Capital

Note that expressing the terms differently across different websites, but the core idea is the same.

-

Depreciation & amortization are typically regarded as non-cash expenses

FCFE, unlike many other items, cannot be found straight from a company’s financial statements.

Instead, to derive it we have to make use of other items which we can find, with a critical method involving:

Key Takeaways

-

FCFE = Net Income + Depreciation & Amortization + Net Borrowing - Capital Expenditure - Change in Working Capital

-

Free cash flow to equity, also known as levered free cash flow, measures the amount of cash that is attributable to equity shareholders of a company after all expenses, reinvestment, and debt is paid.

-

FCFE is used when:

-

DDM is not suitable to be used.

-

FCFs align with a company’s profitability that can calculate with a reasonable forecasting period.

-

You do not care about the cash flow available to financiers of the company

-

-

Due to the similarity between the 2, FCFE = FCFF + Net Borrowing – Interest Expense (1 – Tax Rate).

FCFE from Net Income Formula and Financial Statements

| Net Income (NI)< | Income Statement/Cash Flow Statement |

|---|---|

| Depreciation & Amortization (D&A) | Income Statement/Cash Flow Statement |

| CapEx | Balance Sheet: Differences in PPE over a time period Cash Flow Statement: Investing Activities, Investment in PP&E |

| Change in Working Capital (WC) | Balance Sheet: When it comes to cash flow calculations, WC = Current Operational Assets - Current Operating Liabilities - Different from the traditional definition of Working Capital (Current Assets - Current Liabilities). - It is exclusive of cash, short-term investments, and short-term debt, for they would be double-counted if included. - Items needed for calculations can be found under Current Assets/Liabilities. To find out more, check out this article by NYU Stern. Cash Flow Statement: Operating Activities, Change in Operating Assets/Liabilities |

| Net Borrowing | Balance Sheet: Net Borrowings = Debt Issued - Debt Repaid - Keep in mind this is not total debt, where cash is subtracted from the outstanding long and short-term debt. Cash is excluded in this item as well. Cash Flow Statement: Financing Activities |

In its simplest terms,

FCFE = NI + D&A + (Total debt issued - Total debt repaid) - (Cash outflow - Cash Inflow from Investing Activities) - Change in (Accounts Receivable + Inventory - Accounts Payable)

Before we go into the calculations, let’s understand more about what FCFE is about and the benefits of using it as a valuation method. It is widely used to value a company’s equity using the discounted cash flow (DCF) valuation model.

Earning figures such as:

- EBIT

- EBITDA

- net income

- cash flow from operations (CFO)

cannot be used as cash flow methods to value firms, for they do not paint an accurate picture of the cash flows.

They either double-count certain items which are part of the necessary cash flow calculations or leave them out entirely.

Where can you use FCFE?

There are quite a few ways to value a company, with absolute valuations involving:

- Dividend Discount Models (DDM)

- DCF models

- residual income methods

- asset-based methods

Normally, analysts will use this as part of a DCF model when:

-

The company does not pay dividends.

-

E.g., High-growth companies such as those in the tech sector: Google, Meta (Facebook, etc.)

-

-

The company pays dividends, but the dividends paid to vary greatly from the company’s ability to pay.

-

FCFs align with a company’s profitability that can calculate with a reasonable forecasting period.

-

The analyst views from a “control” perspective, after which acquisition/control over a company through a controlling interest gives them discretion over how the FCF is used.

-

For example, the majority stakeholder can now exercise the ability to increase the dividend payout to utilize better the company’s ability to generate cash flows.

-

Or, the acquirer plans to utilize the cash flows generated to pay off the debt undertaken for the acquisition and may reduce the dividends accordingly.

-

However, it may also not be an optimal choice when:

The company being valued does not have a stable capital structure.

-

Late/mature stage companies that pay reliable dividends.

-

Huge debts to service, resulting in negative/overly low FCFE.

Calculating FCFE from Net Income

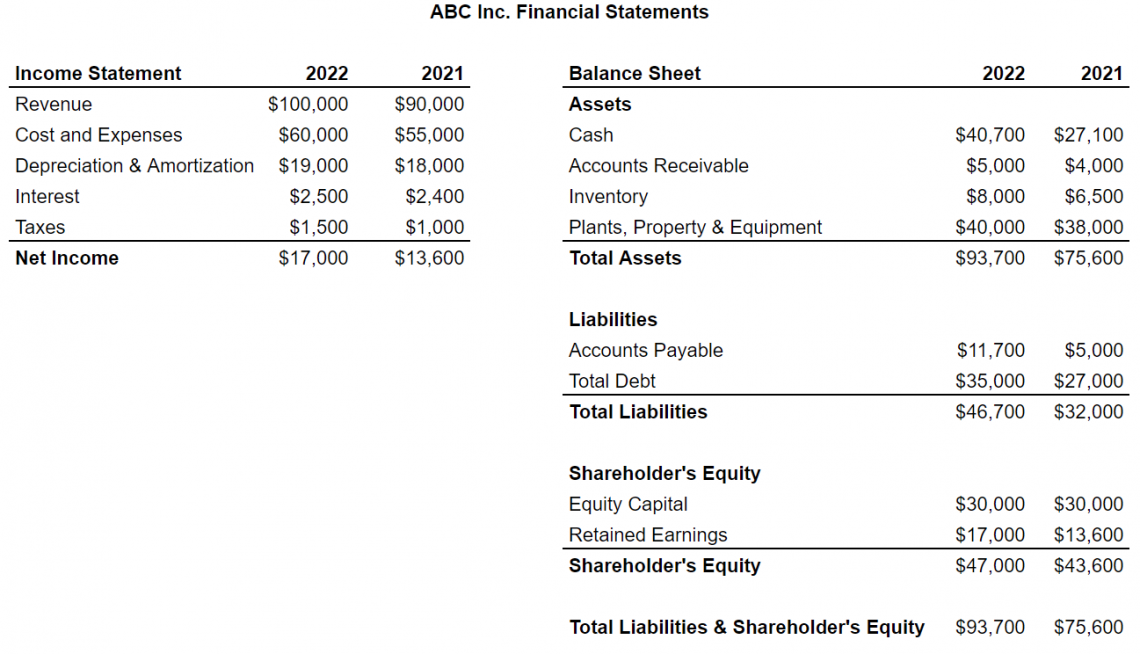

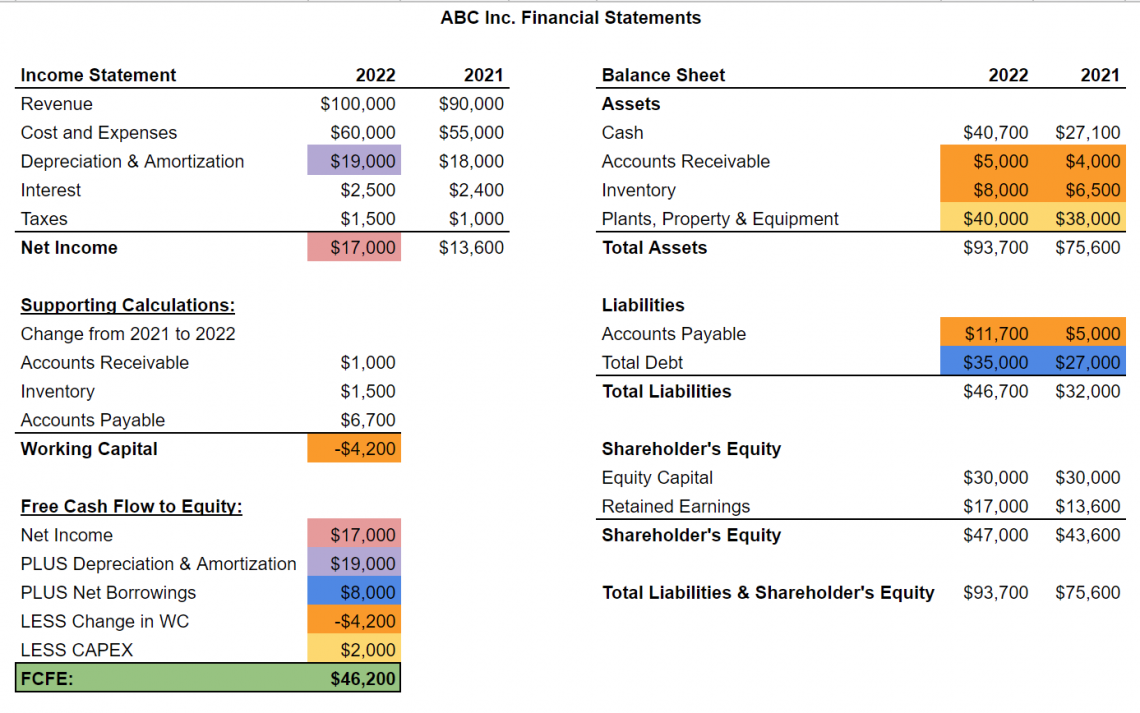

Let’s use the example of ABC Company Inc. and its simplified financial statements to derive our free cash flow to equity. As a fictional example, it may differ from other listed companies, so remember to read through the Notes in Financial Statements for those firms.

While most numbers required can be found directly in a company’s cash flow statement, we will walk through how they are derived using items found on the balance sheet/income statement so that you can better understand the process.

To calculate free cash flow to equity for 2022, let’s start by locating our net income figure, which is $17,000.

Next, depreciation and amortization are $19,000.

To calculate net borrowings over the year, deduct the total debt of 2021 from that in 2022: $35,000 - $27,000 = $8,000.

Capital Expenditure is the change in PP&E from 2021 to 2022, which is $40,000 - $38,000 = $2,000.

For Change in Working Capital, slightly more calculation is required. Changes in accounts receivable, accounts payable, and inventory can be found by deducting the account amount from an earlier time period from the later time period’s account:

Change in Working Capital = Change in (Accounts Receivable + Inventory - Accounts Payable)

= $5,000 - $4,000 +$8,000 - $6,500 - $11,700 + $5,000

= -$4,200

Note

*As mentioned above, items like Cash, Debt and Financial Investments are excluded for valuation. Sometimes, companies also include longer-term operational items, such as Deferred Revenue, in their Working Capital.

It largely depends on the type of company and the sector they are in. Always check the Notes to Financial Statements in their 10K/10Q filings to the SEC.

As such,

FCFE = $17,000 + $19,000 + $8,000 - $2,000 - (-$4,200) = $46,200.

So $46,200 would be the cash available to all equity shareholders after operating, and capital expenses and debt are accounted for. If one has a controlling interest in ABC Inc., they can decide on distributing $10,000 or even the whole sum of $46,200 as dividends.

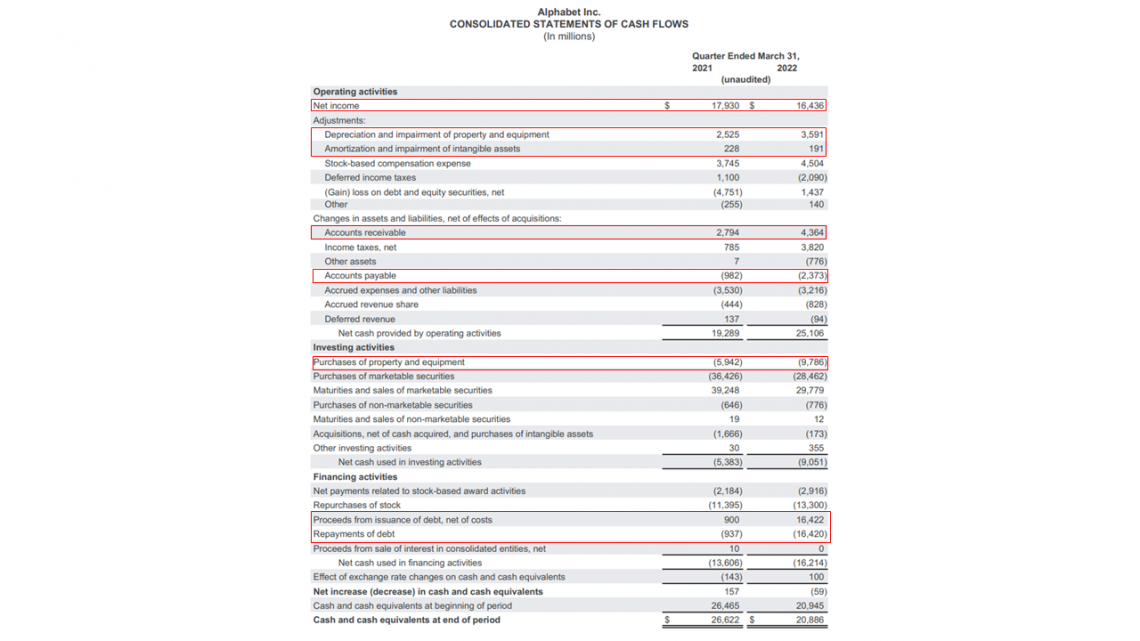

When it comes to the actual valuation of companies, apart from calculating the figures themselves using balance sheets and income statements, one can look to the cash flow statement, which readily provides the data you require.

Above is the cash flow statement for Alphabet Inc. (Google), and it provides many items required for calculating free cash flow to equity on it. Adjust the items accordingly depending on the sector and type of company before computing it as part of your valuation.

As free cash flow to equity is a core concept in valuation methods, it’s prevalent in all areas of finance, equity research, investment banking, asset management, etc. It’s easier to find an area where it is unused.

significance of calculating the fCFE

Analysts use free cash flow to equity to determine if dividend payments and/or stock buybacks are paid for with the cash flow figures or other forms of financing. Optimally, investors would want to see such value-adding methods fully covered by FCFE.

Suppose free cash flow to equity is less than the number of dividends issued or stock repurchased. In that case, the company is undertaking new debt, diluting its existing shares, or dipping into its existing capital (cash reserves stockpiles through prior retained earnings).

It may not be an optimal arrangement even in a low-interest environment. If the company cannot generate significant free cash flows to pay out dividends, they continue doing so. In that case, they are either tapping into their reserves or putting more strain on their capital structures.

Instead of using the cash flows to reinvest in their business and improve their current operations, such actions are more reminiscent and targeted at improving/maintaining the stock’s short-term price.

By diluting existing shareholders to have capital, shareholder value erodes too. Taking on debt results in a heavier interest burden and may strain their cash flows in the future; if a company is overleveraged, the risk of bankruptcy increases as well.

If the company’s dividend payments are significantly less than the FCFE, the firm uses the excess to increase its cash level for future use. However, as mentioned above, certain growth companies like Meta (Facebook) reinvest it all for future growth and thus do not give dividends.

An excellent practice to abide by would be that dividends issued as per proportion to the FCFE figure need to be in moderation, where it provides yield to the investors, as well as leave enough cash for future operations and growth.

There is no magic percentage, for it depends mainly on the sector and stage of growth the company is in. Still, most, if not all, investors want the free cash flow fully provide their dividends to equity generated.

Differences between DDM and FCFE

DDM valuations are a popular way of valuing mature companies that offer dividends. It also does demonstrate similarity to the FCFE method since both are based on valuing earnings attributed to investors.

However, summing up below are a few key differences.

1. FCFE is more of a measure of “Potential Dividends” instead of “Actual Dividends.”

2. FCFE is the amount of cash attributable to equity investors after accounting for debt holders.

3. As part of the earnings, dividends are paid to shareholders (dividend payout).

-

Dividends paid can be from a portion of the FCFE figure.

-

For various reasons, certain companies may pay a greater dividend than their FCFE figure.

4. The presence and amount of dividends are at the discretion of the company’s board of directors.

-

Therefore, a company’s long-run profitability may not be a good sign

-

They may reinvest profits into the business even when doing well instead of issuing dividends.

-

They may issue dividends without being supported by their cash flows.

5. DDM does not enable one to have a “control” perspective. Such valuation takes the perspective of a minority shareholder as they do not have control over the dividends distributed.

6. Therefore, a free cash flow method is more suitable for takeover transactions such as mergers and acquisitions (M&A) or leveraged buyouts (LBOs).

Differences between FCFF and FCFE

FCFF, also known as a free cash flow to the firm, represents the cash flow available to all investors and financiers to the firm, consisting of debt and equity. It’s also an” unlevered” form of free cash flow.

Typically, FCFF tends to be the main figure that’s calculated as it takes into account cash going towards debt holders, also known as investors who purchased bonds/gave loans. Enterprise value compared to equity value from FCFE was used to calculate.

FCFF = Net Income + Depreciation & Amortization – CapEx – Change Working Capital + Interest Expense (1 – tax rate)

FCFF is discounted using the weighted average cost of capital (WACC). In contrast, FCFE is discounted with the cost of equity (Ke).

As such, FCFE can be equivalent to the FCFF if there is zero debt in the capital structure. However, if a company has some debt, its FCFF will be higher than FCFE by the after-tax cost of the debt amount.

Companies that take on a high level of debt or have an unstable capital structure can be more accurately assessed by the FCFF approach compared to the FCFE approach, largely due to FCFE being a negative value or fluctuating too much.

FCFE and FCFF share similar terms, such as D&A, CapEx, and changes in working capital. The key difference between the two measures is the interest expense on the debt undertaken and their impact on taxes via a “tax shield,” where FCFF factors that in.

As such, the FCFE can be calculated using the FCFF formula too:

FCFE = FCFF + Net Borrowing – Interest Expense (1 – Tax Rate)

or Want to Sign up with your social account?