Incremental Cash Flow

It analysis evaluates the financial impact of decisions or investments by assessing net changes in cash inflows and outflows.

What is Incremental Cash Flow?

It is a key element of financial examination, offering perspectives into a company's influxes and effluxes of money. It functions as a crucial indicator of a corporation's fiscal well-being, liquidity, and capacity to fulfill its responsibilities.

Cash flow designates the movement of money into and out of a business account over a specific period. It represents the net amount of cash generated or consumed during a given time frame, providing insight into an entity's financial health and liquidity.

Cash inflows refer to the sources of cash entering the business. Cash inflows contribute to the overall cash position and can be a result of operational, investing, or financing activities.

On the other hand, cash outflows represent the uses or expenditures of cash. Cash outflows reduce the overall cash balance and are also categorized as operational, investing, or financing activities.

The context of incremental cash flow analysis involves assessing the net impact on cash flows resulting from a specific business decision or project. It implies comparing the incremental cash inflows and cash outflows associated with a proposed course of action or investment.

Total cash flow gives an overall picture of a company's financial position, and incremental cash flow refers to a more focused approach, specifically examining the changes in cash flow resulting from a particular decision or investment.

ICF analysis plays a major role in decision-making processes, particularly when evaluating potential investments or undertaking new business projects.

By separating the cash flow consequences that can be directly attributed to a particular decision or investment, enterprises can more precisely evaluate the financial feasibility and profitability of different possibilities.

In this report, we will explore the notion of ICF and investigate its importance in the process of making financial choices. Then, we will focus on the components of incremental cash flow, discuss the techniques used to calculate it and highlight the factors that influence its outcome.

Finally, we will explore real-life examples and address the limitations and challenges associated with this analysis. By the end, you will comprehensively understand incremental cash flow.

Key Takeaways

- Incremental cash flow analysis evaluates the financial impact of decisions or investments by assessing net changes in cash inflows and outflows.

- Components such as initial investment, operating cash flows, terminal cash flows, opportunity costs, and financing cash flows are crucial for evaluating feasibility and profitability.

- Techniques like NPV, IRR, payback period, sensitivity analysis, scenario analysis, and Monte Carlo simulation aid in calculating and assessing it.

- Use sensitivity analysis and scenario assessments to evaluate the robustness and identify risks and opportunities.

- Consider intangible and long-term effects, such as brand building or R&D investments, often not fully captured in cash flow analysis.

- Despite limitations, ICF analysis remains valuable when combined with careful analysis, alternative approaches, and regular updates of cash flow projections.

Understanding Incremental Cash Flow

It is a concept that focuses on the changes in cash flow resulting from a specific decision or investment. It goes beyond the total cash flow of a business and isolates the cash flow effects that can be directly attributed to a particular action.

One of the key distinctions between total cash flow and incremental cash flow lies in the scope of analysis. Total cash flow takes into account all cash inflows and outflows during a specified timeframe, presenting a summary of a firm's comprehensive financial results.

Conversely, incremental cash flow focuses on the extra cash flows produced or incurred as a result of a particular occurrence, such as the execution of a new initiative or the introduction of a fresh product range.

By isolating the cash flow effects associated with a specific decision, businesses can better understand the financial implications of their choices and assess the profitability and feasibility of various options.

When analyzing incremental cash flow, several factors come into play. Firstly, changes in revenue need to be considered.

These can originate from amplified sales volumes, price modifications, market enlargement, or the introduction of novel products or services. The analysis helps determine the additional cash inflows resulting from these revenue changes.

Note

Acquiring new assets, expanding production capacity, or entering new markets can influence a company's cash flow.

Similarly, variations in costs are an integral part of the analysis. By examining changes in production costs, operating expenses, and other relevant expenses, businesses can assess the impact on cash flow brought about by their decisions.

ICF analysis allows them to identify cost-saving opportunities, anticipate additional expenditures, and make informed decisions that optimize financial outcomes. It enables businesses to assess the additional cash outflows associated with these investments and evaluate the long-term returns they can generate.

To evaluate it, various techniques can be employed:

Note

These methods provide quantitative measures of the incremental cash flow, facilitating comparisons between different investment options and aiding decision-making processes.

Importance Of Incremental Cash Flow Analysis

The analysis holds significant importance in the realm of financial decision-making. It serves as a valuable tool for businesses to evaluate the financial viability and profitability of potential investments, new projects, and strategic initiatives.

Let us take a look at some of the importance below:

1. Accurate Financial Evaluation

The analysis provides a more accurate financial impact assessment by isolating the cash flow effects associated with a specific decision or investment. It enables businesses to distinguish between the cash flows directly attributable to the decision and those that would have occurred regardless.

This clarity allows for a more precise evaluation of the financial performance and feasibility of the initiative under consideration.

2. Optimal Resource Allocation

The analysis helps businesses allocate their resources optimally. Companies can determine the expected returns and risks associated with various options by assessing the additional cash inflows and outflows resulting from a decision.

Note

This analysis allows for informed resource allocation, ensuring that capital, labor, and other resources are allocated efficiently to projects and investments with the highest incremental cash flow potential.

3. Improved Decision-Making

The analysis facilitates informed decision-making by providing a quantitative basis for evaluating different options.

It enables businesses to compare the incremental cash flows generated by various alternatives, aiding in selecting the most financially advantageous choice.

By considering the potential impact on cash flow, businesses can make decisions that align with their strategic goals, maximize profitability, and mitigate financial risks.

4. Mitigation of Bias and Uncertainty

When making an investment or project-related decision, inherent biases and uncertainties may cloud judgment.

The analysis offers a systematic and objective approach to decision-making, reducing the influence of subjective biases.

Note

By focusing on incremental changes in cash flow, businesses can make decisions based on tangible financial metrics, reducing the impact of assumptions and uncertainties.

5. Evaluation of Long-Term Implications

Enterprises must consider the enduring consequences of their choices and investments. The analysis provides insights into the expected cash flows over the lifespan of a project or investment.

This analysis considers not only the initial cash outflows but also the subsequent operating cash flows and terminal cash flows.

By evaluating the long-term incremental cash flow, businesses can assess the sustainability and profitability of their decisions, ensuring they align with the company's long-term growth objectives.

6. Enhanced Financial Performance Monitoring

The analysis also serves as a valuable tool for monitoring and evaluating the financial performance of ongoing projects or investments.

Note

Businesses can identify any deviations by comparing the actual incremental cash flows with the projected ones and take corrective actions as needed.

This analysis helps in tracking the financial outcomes of decisions, enabling timely adjustments and ensuring the achievement of desired financial goals.

Components Of Incremental Cash Flow

The analysis involves considering various components that contribute to the overall cash flow changes resulting from a specific decision or investment.

Understanding these components is crucial for accurately assessing a particular action's financial impact and profitability.

1. Initial Investment

An essential analysis component is the initial cash outflow required to initiate a project or investment.

It includes expenses such as equipment purchase, facility construction, research and development costs, and any other upfront investments. Evaluating the magnitude and timing of the initial investment allows businesses to determine the cash flow effects at the project's onset.

2. Operating Cash Flows

Operating cash flows represent the incremental cash inflows and outflows the project generates over its lifespan.

Note

These cash flows include revenues, expenses, and taxes directly associated with the decision or investment.

By estimating the incremental operating cash inflows (such as increased sales revenue or cost savings) and outflows (such as additional operating expenses or increased taxes), businesses can assess the net cash flow impact periodically.

3. Terminal Cash Flows

Terminal cash flows refer to the cash flows that happen at the end of the project's life or when the investment is liquidated. These can include salvage value from the sale of assets, recouping of working capital, or any other cash inflows or outflows associated with project termination.

Note

Terminal cash flows are crucial for determining the final cash flow impact and the overall profitability of the decision.

4. Opportunity Costs

The analysis also considers opportunity costs, which are the potential benefits foregone by choosing one investment or project over another.

These costs reflect the alternative uses of resources (capital, labor) and the cash flows associated with those alternatives. Factoring in opportunity costs comprehensively evaluates the financial implications and potential gains from pursuing a particular decision.

5. Financing Cash Flows

Financing cash flows are relevant when considering the effects of debt or equity financing on incremental cash flow. Additional borrowing or equity issuance can inject cash into the project, while interest payments and dividends can create cash outflows.

These cash flows need to be accounted for to understand the overall financial impact of financing decisions and the resulting changes in incremental cash flow.

Note

By considering these components, businesses can accurately assess the net cash flow effects of a specific decision or investment.

The analysis enables a comprehensive evaluation of the cash inflows and outflows associated with the decision over time, allowing businesses to determine the initiative's financial feasibility, profitability, and overall value.

Techniques For Calculating Incremental Cash Flow

Calculating incremental cash flow involves applying various techniques to analyze the changes in cash flow resulting from a specific decision or investment.

These techniques provide quantitative measures of it, aiding in decision-making and financial analysis. Let us take a look at some:

1. Net Present Value (NPV)

NPV is a widely used technique that measures the present value of the incremental cash inflows and outflows associated with a decision or investment. It considers the time value of money by discounting future cash flows to their present values using a predetermined discount rate.

The net difference between the present value of cash inflows and outflows represents the incremental cash flow. A positive NPV indicates a potentially profitable investment, while a negative NPV suggests a project may not be financially viable.

2. Internal Rate of Return (IRR)

IRR is another important evaluation technique. It calculates the discount rate at which the present value of cash inflows equals the present value of cash outflows. The IRR represents the rate of return generated by the investment or decision.

Note

If the IRR exceeds the required rate of return or hurdle rate, the investment is considered financially viable. Conversely, the project may not be economically feasible if the IRR is lower than the hurdle rate.

3. Payback Period

The payback period is a straightforward technique that determines the time required for the incremental cash inflows to recover the initial investment. It measures the length of time it takes to recoup the cash outflow.

The shorter the payback period, the quicker the investment generates positive cash flows. However, the payback period does not consider the time value of money and may overlook the profitability beyond the payback period.

Sensitivity analysis involves assessing the impact of changes in key variables on incremental cash flow. By altering one variable at a time, such as sales volume, price, or cost, businesses can evaluate the sensitivity of the cash flow projections and identify potential risks or opportunities.

Note

Sensitivity analysis helps understand the investment decision's robustness and enables businesses to make adjustments to enhance financial outcomes.

Scenario analysis involves assessing the incremental cash flow under different scenarios or assumptions.

Businesses can evaluate the range of potential outcomes and associated cash flows by creating multiple scenarios based on different market conditions, economic factors, or operational variables.

This analysis helps in understanding the project's sensitivity to different circumstances and assists in decision-making under uncertainty.

6. Monte Carlo Simulation

Monte Carlo simulation is a sophisticated technique that involves running multiple model iterations using random inputs within specified probability distributions. It allows businesses to simulate various possible cash flow outcomes based on the probability of various events occurring.

Note

Monte Carlo simulation provides a comprehensive view of the potential cash flow distribution, incorporating uncertainties and risk factors into the analysis.

Factors Affecting Incremental Cash Flow

When analyzing incremental cash flow, it is crucial to consider various factors that can significantly impact the cash flow changes resulting from a specific decision or investment.

These factors influence the magnitude and timing of cash inflows and outflows, and understanding their effects is essential for accurate financial evaluation.

1. Sales Volume and Revenue

Changes in sales volume and revenue directly impact it. Increasing sales volume or implementing strategies to boost revenue can result in additional cash inflows.

Conversely, declining sales volume or pricing pressures may lead to reduced cash inflows. Considering the anticipated changes in sales volume and revenue is vital when assessing the incremental cash flow associated with a decision or investment.

2. Cost Structure and Expenses

The cost structure and various expenses incurred in the business operations significantly impact incremental cash flow. Changes in production costs, operating expenses, labor costs, and other relevant expenditures should be considered.

Example

Cost-saving initiatives or efficiency improvements can lead to reduced cash outflows, positively impacting incremental cash flow. Conversely, unexpected cost increases or inefficiencies may result in higher cash outflows and adversely affect cash flow.

3. Timing of Cash Flows

The timing of cash inflows and outflows plays a crucial role in the analysis. Differences in when cash is received or paid can affect the availability of funds for reinvestment or debt service.

For instance, accelerated cash inflows or delayed cash outflows can improve cash flow in the earlier stages of a project. Considering the timing of cash flows allows businesses to evaluate the impact on liquidity and the overall cash flow profile.

4. Capital Expenditures

New equipment, technology, or infrastructure investments can significantly impact incremental cash flow. These expenditures typically result in significant upfront cash outflows. However, they may generate additional cash inflows or cost savings over the project's lifespan.

Note

Analyzing the incremental cash flow associated with capital expenditures allows businesses to assess the investment's long-term benefits and payback period.

5. Financing and Interest Payments

Financing decisions and interest payments can influence incremental cash flow. Cash inflows from debt or equity financing can immediately boost cash flow, while interest payments represent cash outflows.

The terms and conditions of financing, including interest rates, repayment schedules, and associated costs, should be considered when evaluating the incremental cash flow impact of financing decisions.

6. Taxation

Taxes can significantly impact incremental cash flow. Changes in tax rates, tax deductions, credits, or incentives can affect the net cash flow generated by a decision or investment.

Note

Investigating the tax implications and calculating the after-tax cash flows is essential when analyzing incremental cash flow.

7. Market Conditions

Market conditions, such as competition, industry trends, and customer preferences, can influence incremental cash flow. Changes in market demand, price volatility, or shifts in customer behavior can impact revenue and expenses, consequently affecting cash flow.

Businesses should consider the potential market-related risks and opportunities when evaluating the incremental cash flow associated with a decision or investment.

8. External Factors

External factors, such as economic conditions, regulatory changes, and geopolitical events, can impact incremental cash flow.

Economic downturns, changes in government policies, or shifts in the business environment can introduce uncertainties and alter cash flow dynamics.

Note

Assessing the potential impact of these external factors is essential for accurate financial evaluation.

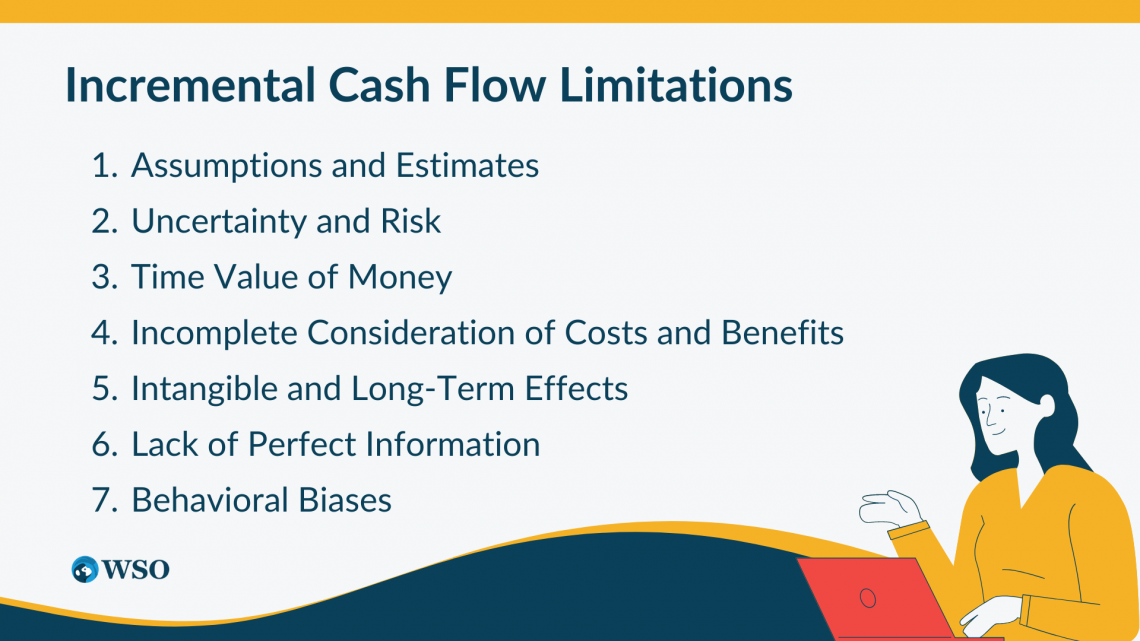

Incremental Cash Flow Limitations

While ICF analysis is a valuable tool for financial evaluation, it is important to acknowledge its limitations and challenges. Understanding these limitations can help businesses make more informed decisions and avoid potential pitfalls.

1. Assumptions and Estimates

ICF analysis relies on a series of assumptions and estimates regarding future cash inflows, outflows, and other relevant factors. These conjectures are based on projections and forecasts, which are inherently uncertain.

The accuracy of the analysis depends on the quality of these conjectures and estimates. Flawed or overly optimistic assumptions can lead to inaccurate cash flow projections and misinformed decision-making.

2. Uncertainty and Risk

Future cash flows are subject to uncertainty and risk. External factors such as changes in market conditions, economic fluctuations, technological advancements, or regulatory shifts can significantly impact cash flow outcomes.

Note

ICF analysis may not fully capture the potential risks associated with these uncertainties. It is important to conduct sensitivity analyses and scenario assessments to evaluate the robustness of cash flow projections under different conditions.

3. Time Value of Money

While ICF analysis accounts for the timing of cash flows, it typically uses a single discount rate to calculate the present value. The concept of the time value of money implies that the worth of money at present differs from its value in the future.

Using a single discount rate may not fully capture the changing value of cash flows over time. Alternative techniques, such as discounted cash flow analysis or incorporating risk-adjusted discount rates, can address this limitation.

4. Incomplete Consideration of Costs and Benefits

ICF analysis focuses primarily on the cash inflows and outflows directly associated with a decision or investment. It might not comprehensively encompass all the expenses and advantages, particularly those that are challenging to quantify in monetary units.

Non-financial factors such as environmental impact, social benefits, or strategic considerations may be important but are not explicitly incorporated in traditional cash flow analysis.

Note

Businesses should consider a broader range of factors to ensure a comprehensive evaluation of the decision's impact.

5. Intangible and Long-Term Effects

Some investments or decisions may generate intangible benefits or long-term effects that are challenging to quantify in cash-flow terms.

For example, investments in research and development, brand building, or employee training may yield long-term benefits but have limited immediate cash flow impact.

ICF analysis may not fully capture these intangible or long-term effects, potentially underestimating the true value and impact of the decision.

6. Lack of Perfect Information

ICF analysis relies on the available information at the time of evaluation. The information may be partial or subject to change. New information, market trends, or unexpected events can alter the cash flow projections and impact the accuracy of the analysis.

Note

Businesses should regularly review and update their cash flow projections to account for new information and changing circumstances.

7. Behavioral Biases

Decision-makers may be subject to various behavioral biases that can affect the accuracy and objectivity of ICF analysis. Biases such as over-optimism, confirmation bias, or sunk cost fallacy can influence the estimation of cash flows and distort decision-making.

Conclusion

The analysis serves as a crucial framework for assessing the financial implications of specific decisions or investments. It enables businesses to evaluate the net changes in cash inflows and outflows resulting from a particular course of action.

By considering factors such as initial investment, operating cash flows, terminal cash flows, opportunity costs, financing cash flows, and various techniques for calculation, businesses can gain valuable insights into the financial feasibility and profitability of their initiatives.

Recognizing the limitations and challenges associated with the ICF analysis is important. Conjectures, uncertainties, and incomplete consideration of costs and benefits can introduce potential biases and inaccuracies in the analysis.

The dynamic nature of markets and the time value of money also require careful consideration. By applying sensitivity analysis, scenario assessments, and incorporating alternative techniques, businesses can mitigate these limitations and make more informed decisions.

ICF analysis is a valuable tool for financial evaluation, providing a framework to assess the potential impacts on cash flow resulting from various decisions or investments.

Note

If you want to study another cash flow, the OCF, here is a very interesting article: Operating Cash Flow

or Want to Sign up with your social account?