Free Cash Flow (FCF) Formula

The free and available cash can be utilized for productive means for the business's or its stakeholders' sole benefit

What Is Free Cash Flow (FCF)?

Free Cash Flow (FCF) is a financial metric that represents the amount of cash a business generates from its operations after accounting for all expenses. FCF is a crucial indicator of a company's financial health and its ability to generate cash that can be used for various purposes.

This free and available cash can be utilized for productive means for the sole benefit of the business or its stakeholders. By productive means, the company can improve the quality of its business by using such money wisely.

The Free Cash a business generates is the amount of cash it has gathered from its core business operations that exceeds the amount utilized in expenditure. The expenditure incurred may be of two types, i.e., either working capital expenditure (day-to-day) or fixed assets capital expenditure.

Generally, we use capital expenditure known as Capex. The cash generated from operations is an important component that yields free cash flow. Most analysts and investors give more preference to FCF than the profits/net income.

Key Takeaways

- Free Cash Flow (FCF) is surplus cash generated by a business's core operations after expenses, used for productive growth and financial decisions.

- FCF supports growth strategies like debt repayment, dividends, buybacks, machinery investments, and diversification.

- FCF has two types - Free Cash Flow to Equity (FCFE) and Free Cash Flow to Firm (FCFF), with FCFF being commonly used.

- FCF can be computed using Cash Flow from Operations, EBIT, Dividend Discount Model, Direct, or Indirect methods.

- FCF reveals cash position, competitive strength, accurate net income, capital spending, working capital changes, operating cash flows, and tax-interest effects. FCFF is preferred for analysis.

Uses of Free Cash Flow

A business uses its Free-Cash-Flow to grow in a way that yields productivity in the output.

A company may use its FCF from time to time in the following ways:

- Repaying its long-term and short-term debt.

- Providing dividends to the investors.

- The company may go for a buyback of shares to increase the market value per share.

- Increasing the production efficiency of the core business by purchasing new machinery assets.

- Increasing the growth of the business.

- Diversification of business by investing such free cash into lucrative ventures.

- Buy a plant or land to increase its operations and make more money.

It may be said that FCF is the real cash that the company is left with.

The ability of the business to use such cash effectively and efficiently defines the level of growth of such business by this sort of management of funds.

Investors come across the term FCF while finding better investment opportunities.

Note

To compare and get the answer to whether the such flow of free cash is higher or lower can be done by either checking the past trend of the Free-Cash-Flow or by comparing the current scenario of a certain company with its peers.

Different Types of FCF

There can be many types of FCFs(discussed further), as investors get confused by such different types. They also get confused about which type of formula is correct or which formula will help to get the right FCF.

We will break this down, but first, we need to understand from where the Free-Cash-Flow is derived.

FCF is derived from different parts of the financial statements, comprising the following:

- Income Statement

- Balance Sheet

- Cash-Flow Statement

Now, coming back to the topic of discussion, there are 2 types of FCFs that are widely used:

1. Free Cash Flow to Equity (FCFE)

It is the amount of free cash available to the company’s equity shareholders, which can be used for dividends or buybacks. It is also called Levered Free Cash Flow.

Levered Free Cash Flow (FCFE) = Unlevered Cash Flow + Net-Borrowings - Interest Payments*(1-tax)

Where,

Net Borrowings = New Borrowings - Debt Repayment.

Debt Repayment can be found in Cash Flow from Financing Activities, and Cash Interest Payments can be found in Non-Operating Expenses of Cash Flow from Operations.

2. Free Cash Flow to Firm (FCFF)

The total amount of free cash available to the business or firm can be used differently. It is also called Unlevered Free Cash Flow. But, most conventionally, it is the difference between Cash Flow from Operations and Capital Expenditures.

Unlevered Free Cash Flow (FCFF ) = Cash Flow From Operations - Capital Expenditures

Both components can be found in Cash Flow Statement.

Most investors and analysts use the Free-Cash-Flow to Firm, as it is simple and easy to calculate.

Note

There are two types of FCF, Free Cash Flow to Firm(FCFF) and Free Cash Flow to Equity(FCFE). The former is used mostly by analysts and investors.

Formulas and Ways for Calculating FCF

There are many different ways to calculate FCF. The following are different types of such methods:

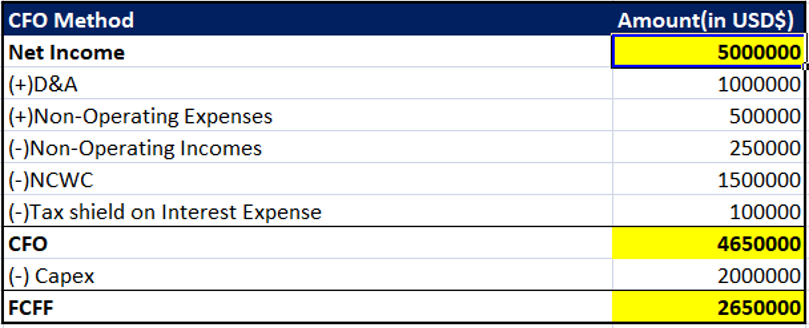

1. Cash Flow from Operations Method

Under this method, we just need to calculate the FCFF (Unlevered Free Cash Flow). As discussed in the previous section, both components are available in the Cash flow from the Operating Activities of the Cash Flow Statement.

Free Cash Flow to Firm (FCFF) = Cash Flow from Operations (CFO) - Capital Expenditure (Capex)

Where,

Cash Flow from Operations (CFO) = Net Income + Depreciation & Amortization + Non-Operating expenses - Non-Operating Incomes (+/-) Net Changes in Working Capital - Tax Shield on Interest Expense

Net Changes in Working Capital (NCWC) = Current Year Working Capital - Previous Year Working Capital

We can easily find CFO from the Cash Flow Statement, but we can also calculate CFO by adding Net Income and Depreciation & Amortization, Non-Operating expenses, and deducting non-operating incomes, all of which can be found in the income statement.

After deducting such things, we further deduct/add NCWC. This depends on the fact that if the figure is positive, we deduct(-), and if the figure is negative, we add(+).

Further, we deduct the Tax shield on interest expense found in the Income Statement. By this, we get the CFO from which we subtract Capex found in the Income Statement.

Note

There are five types of FCF calculations, but the most important, simple, and commonly used method is the Cash Flow From Operations Method.

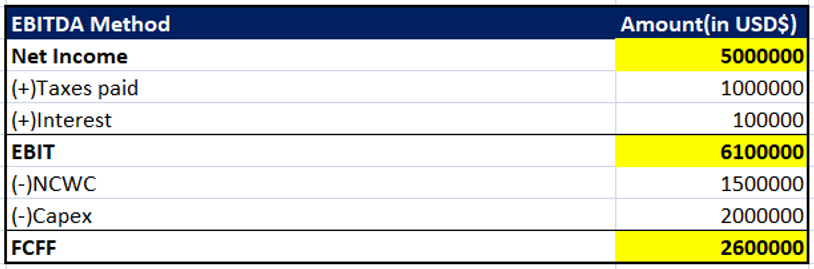

2. EBIT Method

Under this method, we calculate the FCF using EBIT, also called operating profit or the profit from the core business. This formula deducts all the components as it did in the CFO method. We don't consider depreciation, amortization, or non-operating incomes/expenses in this method.

Free Cash Flow to Firm (FCFF) = Earnings before Interest and Taxes (EBIT) (+/-) Net Changes in Working Capital (NCWC) - Capital Expenditure (Capex)

Where

CFO = EBIT (+/-) Net Changes in Working Capital (NCWC)

EBIT = Net Income + Taxes + Interest

NCWC = Current Year Working Capital - Previous Year Working Capital

EBIT can be easily available in the Income Statement or produced using the EBIT formula.

As discussed in the previous method, the balance of NCWC will either be positive or negative. If positive, then subtract (-) and vice versa.

Ultimately, we need to subtract Capex, which can be found in the income statement, and then we will obtain FCFF.

“EBIT is used as a measure for operating profits and not EBITDA (which is a better measure of cash flows). This is because the amount charged to depreciation can be used as a proxy for the maintenance of Capex.

Effectively, EBIT is the cash profit earned without any growth in capacity additions. Therefore, the business can pay the debt holders and equity shareholders from this cash profit. If EBIT > Amounts due to debt and equity holders, then the business generates Free Cash and uses that Free Cash further.”

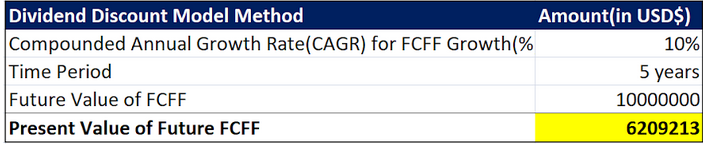

3. Dividend Discount Model(DDM) Method

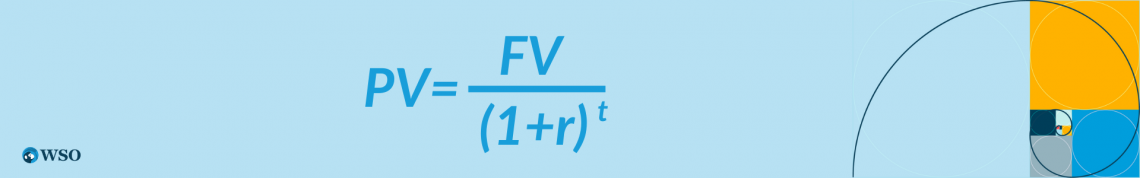

This method calculates FCF by projecting the Future flow of free cash to the Firm. These projections are generally based on many factors, which are internal and external to the company.

To project Future FCF, one may look at the estimated revenue growth, the growth rate of the business operations, etc. Now we discount back these future figures to the present value by using a proper discount rate.

Where FV = Future Value of the FCF,

PV = Present Value of the FCF,

r = Rate of growth, and

t = number of years

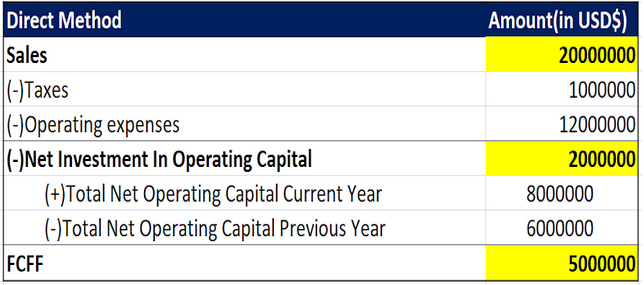

4. Direct Method

This method calculates the FCF after deducting Operating Expenses(Opex), taxes, Capex, and Depreciation from the Sales Revenue.

Where,

Net CAPEX or Net Investment in Operating Capital (NIOC) = Total Net Operating Capital Current Year - Total Net Operating Capital Previous Year

Net Capex = Capex - Depreciation & Amortization

By this method, we ascertain the amount of actual cash the business possesses after paying taxes and operating costs.

Sales can be found in the income statement, then we deduct taxes and operating costs such as Cost of Goods Sold(COGS), Selling and General Expenses(SG&A Expense), etc.

Ultimately, we deduct NIOC or Net Capex, which is found in the income statement, to get FCFF.

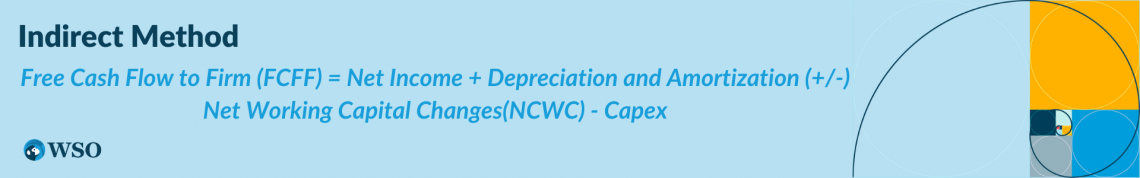

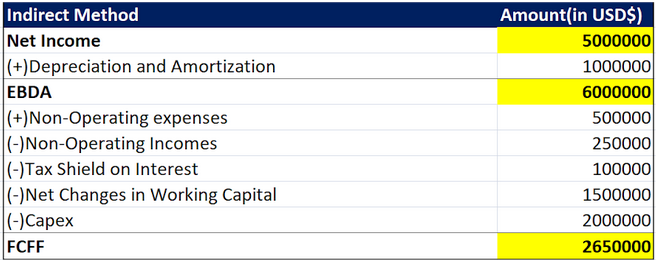

5. Indirect Method

Under this method, Net Income is the starting point, as it was in the CFO Method(discussed above). Net Income includes non-cash adjustments such as Depreciation & Amortization, which never influence the FCF and all the non-operating expenses and incomes. We add/deduct such adjustments.

This process leaves us with Earnings before Depreciation and Amortization(EBDA), then we deduct Net working Capital Changes and Capital Expenditure, which gives the FCFF.

The Formula looks like this:

Items such as Net Income, D&A, and Capex can be ascertained from the income statement.

Apart from this, we need to figure out the NCWC, which either gets added if the figure is negative or subtracted if the figure is positive.

Note

We add NCWC when negative because there is a cash outflow; hence it neutralizes the effect and vice-versa.

Interpreting FCF

We should always ensure that we generally use the FCFF instead of FCFE because the former is calculated differently. The latter is calculated through the former.

The following are the interpretations that investors and analysts can use to determine the viability of the FCF:

1. Competitive Advantages

When the business generates a surplus or free cash, only then will it have the ability to invest in capacity expansion and grow revenues.

The most important aspect of the managerial personnel is to utilize such cash to its fullest by reinvesting back into the business. This will help in expanding future growth and deepen the competitive advantages.

2. Net Income

The total amount of profit a firm earns in a particular financial year, though it is not the actual cash profit.

Actual cash profit can be ascertained by determining the CFO, making necessary adjustments, and getting the FCF.

Note

Net Income provides a rosy picture, but FCF provides the true picture of the firm's profits.

3. Depreciation & Amortization(D&A)

It must be remembered that D&A being a non-cash expense, reduces the profit and does not show the real cash profit, so we usually add D&A back to the Net Income.

By doing this, we get a better reflection of the company.

4. Capital Expenditure (Capex)

It is the amount a company invests in buying assets, such as plants, machinery, building, land, etc.

When a company is making huge investments in assets by increasing the Capex, that means the company is confident about future growth and increasing revenues.

But when a company refrains from investing in such ventures, it can be said that it is willing to save cash for the future, or maybe it wants to go for a buyback, pay dividends to stockholders, or wants to retain earnings for the future where it might need this cash.

5. Net Changes in Working Capital

Working capital is the difference between the Current Assets and Current Liabilities, and the Net Changes in Working Capital is the difference between the Working Capital of the Current Year and the Previous Year.

The result can be a positive or negative figure. For example, a positive NCWC shows that the business uses more cash in the current year for its financing activities. Conversely, a negative figure shows that the business has made more cash in the financial year.

Note

Positive NCWC is deducted(-), and negative NCWC is added(+) to calculate FCF.

6. Operating Cash Flows

This measures the total cash the business generates through its core operations, and it does not consider the non-cash and non-operating expenses and incomes. It also neutralizes the effect of NCWC.

This gives the true picture of the total cash generated by the company.

Note

By comparing FCF to CFO, we can get an invaluable insight into how the company allocates cash.

7. Taxes and Interest

Taxes are directly impacted by the Central Bank policies, which indirectly impact the FCF. Higher taxes yield lesser profits and lesser FCF.

Interest payments are influenced by the amount of debt the firm has taken and the rate of interest rate. As a result, higher interest payments reduce the levered FCF and vice-versa.

Examples of practical use of Free-Cash-Flow Formulas

Under these examples, we have calculated the unlevered FCF only because levered Free-Cash-Flow has the same formula across all the methods.

1. CFO Method

This is the most commonly used method worldwide by investors and analysts. Here, we have calculated the Cash Flow from Operations(CFO) by using the formula which has been discussed.

From this CFO, we have deducted Capex to arrive at the FCF to Firm of $2.65 Million. This amount is available for the business to invest in productive avenues.

We also recommend using this formula because it almost gives the correct figure.

2. EBIT Method

In this method, we haven’t considered the Non-operating expenses and incomes, and D&A. Hence the Free-Cash-Flow to Firm is $50,000 less than the CFO Method.

We have calculated EBIT and deducted NCWC and Capex to get FCFF.

3. Dividend Discount Model Method

Under this method, we wanted to earn a Free-Cash-Flow to Firm of $10 Million in 5 Years at a CAGR of 10%. So, to achieve such a target, the firm needs to earn close to $6.2 million, which is the present value of FCF to the Firm.

In simple words, the value of 1$ today is not the same. Similarly, the $10 million is converted to the current value using a discount factor of 10%.

We have discounted back the future value to the present value.

4. Direct Method

When preparing a Cash Flow Statement, the accountant has two choices: to prepare it directly or indirectly.

Direct Method uses every receipt and every expense made by the business, i.e., all the cash inflow and outflows are used to make a Cash Flow Statement.

As it is a tedious process, it is not preferred. But it can help us obtain the Free-Cash-Flow to Firm.

It is obtained by getting the difference between Sales and the sum of operating expenses and taxes, which gives us $7Million ($20Million - $ 1 million - $ 12 million), thereby deducting another $2Million of Net Investment in Operating Capital which gives $5 Million as FCF to Firm.

Free-Cash-Flow to Firm here is highly influenced by not using the NCWC and Capex, which has increased it almost two-fold.

This is why we don't use this method, as there is a high chance of discrepancy.

5. Indirect Method

To cut short a long story, it is used exactly like the CFO method, but we haven’t used the CFO directly.

Free Cash Flow (FCF) FAQs

In a nutshell, the higher the Free-Cash-Flow, the better the ability of the company to perform its business.

As discussed earlier, anything that must be compared must have something relative to it to draw a comparison.

So, we can compare the FCF of the business to the industry standards by comparing it with its peers or by tracking past trends.

- If the Free-Cash-Flow of the business is better than the industry average, it has a huge scope for future growth. Also, the investors may get benefitted from dividends or buybacks.

- By comparing with the peers/competitors of the company, we have a strong idea of where it stands in a competitive and dynamic environment.

- Either graphically or in a tabular manner, we can ascertain the level of productivity the business can incorporate by utilizing the free cash effectively and efficiently.

Many companies which are in a quick pace of growth stage may not be able to sustainably give a positive FCF, although posting positive Net Incomes.

This phenomenon can be witnessed when the business's cash is stuck in the working capital, and it may face working capital inadequacy, which results in negative Free-Cash-Flow.

Although the business growth may seem very good, a new company’s inadequate working capital may show negative FCF.

On the other hand, if we look at this situation from another perspective, a company may have negative Free-Cash-Flow because of its poor operational efficiency, making it survive the inadequacy of cash.

We categorize the factors into 2 parts:

A. Internal Factors: These factors are responsible for the company's internal management. It includes

- Management of the company

- Suppliers

- Production capacity

- Creditors

- Debtors

- Shareholder/Bondholders

- Employees

B. External Factors: These are the factors that are not controllable by the firm, as they remain out of the company’s premises. But they impact the company indirectly. It Includes

- Political factors,

- Price of competitor’s products

- Socioeconomic factors,

- Legal factors

- Technological factors

- Economic factors

or Want to Sign up with your social account?