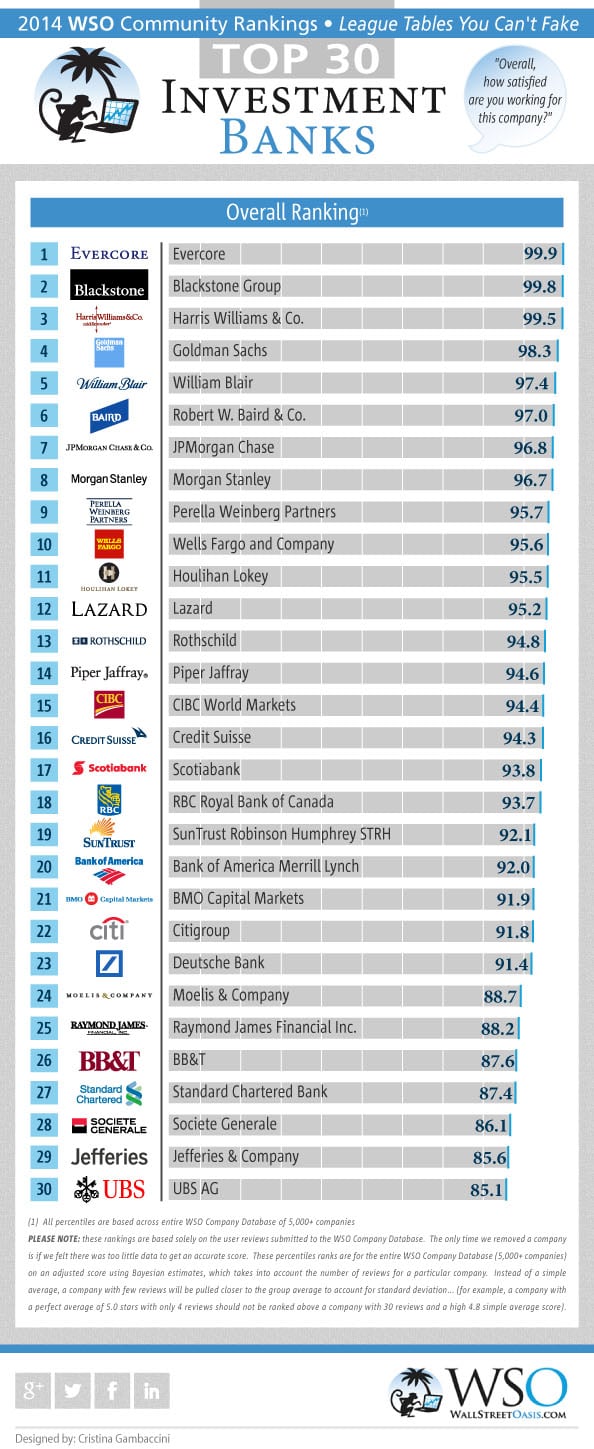

2014 WSO Rankings for Investment Banks: Overall Investment Banking Rankings (Part 9 of 10)

The WSO Community has spoken. Over the last month we have looked at the community rankings based on member reviews across a variety of Investment Banks. Without further ado...

Below you will find the following rankings:

Top 30 Investment Banks according to the WSO Community based on thousands of datapoints.

These firms are all ranked on a PERCENTILE basis across all 5,000 companies in the WSO Company Database based on thousands of WSO member rankings. Feel free to share the rankings below on your site by copying the html code below the graphic. Stay tuned because soon we are going to be announcing the WSO University Power Rankings for Wall St Recruiting!

Share this Image On Your Site

Missed an earlier part of the 2014 WSO Community Rankings - Investment Banks? Click below:

Part 1: 2014 WSO Rankings for Investment Banks: Release Schedule

Part 2: 2014 WSO Rankings for Investment Banks: Career

Part 3: 2014 WSO Rankings for Investment Banks: Interviews

Part 4: 2014 WSO Rankings for Investment Banks: Promotions & Fairness

Part 5: 2014 WSO Rankings for Investment Banks: Compensation

Part 6: 2014 WSO Rankings for Investment Banks: Senior Management

Part 7: 2014 WSO Rankings for Investment Banks: Prestige & Pride

Part 8: 2014 WSO Rankings for Investment Banks: Lifestyle

crap

LOL. Scotiabank and BMO > Moelis? Come on man...

high amounts of tomfoolery appear to be present here

THERE IS NO WAY Blackstone IS .1 WORSE THAN Evercore! THIS IS BULLSHIT

....kidding, but get ready

Hate to shit on a thoughtful WSO initiative but as with the previous parts of this series, this list is bogus and only serves to cement the idea that the WSO rankings are a joke. I guess the idea was to launch a proprietary data-driven WSO ranking system and develop its brand (next stop is PE/VC/AM rankings, right?)...but these rankings have all been flawed beyond any reasonable standard. If this is what the member rankings say then the member rankings are flawed and unusable - simple as that. Similarly, I'm sure Businessweek has the data to support its conclusion that Duke and the University of Toronto are the two best business schools in the world but that only tells us that the data is useless.

What is such a joke about this set of rankings? I don't think the goal here was to make a definitive list from 1-30 of where every single person should aspire to work. Haven't looked through them all too harshly, but seems like they are all defined quite specifically -- the percentile that a given company places in with regards to a single question. Here, "Overall, how satisfied are you working for this company?" And this set seems to confirm something I would have guessed: people that work at MM banks like HW, Blair and Baird tend to be slightly more satisfied than some firms with questionable culture or dealflow issues. Definitely some sort of selection bias in their database that I would question, though. These aren't a bible to IB, but just something to look at for fun I guess.

Again, we state specifically that these are the WSO COMMUNITY RANKINGS based on VERY specific questions. This is what the members / users said, not us with some crystal ball deciding who gets ranked where.

I think if overall satisfaction of employees is a reasonable metric to look at, I don't see how these are flawed? If you want to point to league tables and argue that "this bank does 10x more deal flow than this bank" and is "more prestigious" then that is your right...and I'd actually agree with you.

Oh, and we already did one on "pride" which I'd argue is a rough proxy for "prestige" ...which based on how upset you seem maybe was more in line with what you see as the "true rankings"?

http://www.wallstreetoasis.com/forums/2014-best-investment-banks-presti…

ps - it's just another data point, it's not like we are arguing that most people would take an offer at XYZ boutique over Goldman TMT (for example), so I think you shouldn't read so much into it or be so upset...

How were the final rankings compiled compared to the more granular previous ones? How is Harris Williams better than Lazard, Goldman Sachs and Moelis?

That's kind of an ignorant question to ask. IF you are talking about the quality of the shop, HW is one of the best MM IBD shop out there. MM PE firms have a lot of respect for HW and I guarantee if you ask most MM PE shops, they will say HW is one of the IBD shops that shows them the most quality deals. If you are talking about exits, HW places extremely well into the buy-side, mostly MM PE or Corp Dev. If you are talking about quality of analysts, plenty of top analysts would prefer to go to HW over some the BBs/EBs, the only real knock against the firm is the lack of an office in NYC.

You can't just say Lazard is better than HW because they work on larger deals. HW is a dominant player in the MM space just like Laz is one of the dominant shops in the bulge bracket space. Plenty of people prefer the MM space over the bulge bracket space for many different reasons.

basically this just measures popularity of these banks amongst WSO members. If WSO members typically dont work at MS ... then MS would be mentioned less and would be lower on the list.

Being that I am Canadian, I can comment that looking at the 4 canadian banks this list is wrong.

RBC is the best Canadian bank HANDS DOWN.

CIBC is actually the smallest and worst. They sold their US investment bank in 2008. In Canada, they are known for having the worst culture and high turnover. They also made an effort to focus on retail banking post 2008 ... so their investment bank is proportiontly smaller... I'm guessing this list is interested in an institution's Investment Bank not retail division no?

Despite that, the list actually places CIBC as the best and RBC as #3... doesnt make any sense.

As a side point, TD is the 2nd largest bank in Canada and is typically fairly high on the Canadian league tables (i.e. #2-3)... yet for some reason, it didnt make the list altogether. Imagine if the 2nd largest bank in the US didnt make the list amongst the top 5 banks... wouldnt that stick out like a sore thumb?

Maybe WSO members are getting more interviews at these firms (because CIBC is rebuilding) ... and therefore it is mentioned more on this blog?

they are not second in M&A in Canada, unless the parameters are nuanced. Maybe second in capital markets. Would therefore say it passes the sniff test as "prestige" is probably below that of the balance of the Canadian cohort

I agree. RBC is by far and away the biggest and best out of the Canadian banks. The only one who really competes is BMO and thats solely in the Metals & Mining space (which is in the shitter).

Disagree with TD though. TD has huge P&C especially with their expansion to the US, but their investment bank isn't all that.

Your last point is interesting though, I've heard a bunch of people getting interviews there and that might have affected rankings.

Would put RBC as #1, followed by TD, BMO, Scotia, and CIBC in terms of the large Canadian banks

Aside from a presumable cut-off for lack of data on certain banks, "number of mentions" has no influence on these rankings.

Must not have many Canaccord bankers in this community. No I am not at Canaccord.

I have seen these lists before (and lists on other sites) and what always amazes me is the 'comp set' - ie, it doesn't make any sense whatsoever to have firms like Blackstone (75% private equity and Asset Management and 25% (MAYBE) advisory services and capital markets business - overall it built it's brand as a PE shop first and foremost) on any list that includes the likes of a Standard Chartered (where corporate finance is (well) less than 15% of their total business - and which is largely a commercial bank) or real bulge bracket firms like BAML, BARC, BofA, etc or true, elite boutiques like Evercore and Lazard -- this apples and oranges (and peaches, watermelon, etc) mix is a huge flaw.... I like to help where I can and I think this site provides tremendous value to junior bankers and would-be bankers but these lists are just awful - it's nonsensical garbage

This is a fair point that a lot of these rankings are not pure apples to apples. Would you be more interested if we bucketed the rankings into sub-rankings? So, for example, if we were able to only compare the elite boutique and MM banks and only compare the BBs?

Yes - you could still keep this amalgamated list if you want but it would definitely be more insightful and, I think, useful to young bankers/bankers-to-be if there were sub-rankings that just compared the true comparables: bulge-bracket vs bulge bracket, MM vs MM, boutique vs boutique, maybe even 'commercial banks vs commercial banks' (ie StandChart) and PE vs PE (for Blackstone v KKR, etc)....

Aut quisquam ea rerum optio. Recusandae eligendi a minus laborum eum. Non sint dolorem maxime est vel. Deserunt commodi veniam delectus ut dolorum cum.

Sunt et laboriosam reprehenderit modi dolorem fugiat mollitia voluptas. Officia rem earum et et qui id accusamus similique. Magnam ut nobis aut et sequi. Adipisci autem possimus inventore. Et id consequatur harum possimus.

Quidem non eaque dolor iusto quaerat. Et nihil ipsa quaerat voluptas et placeat incidunt.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...