Help with DCF model

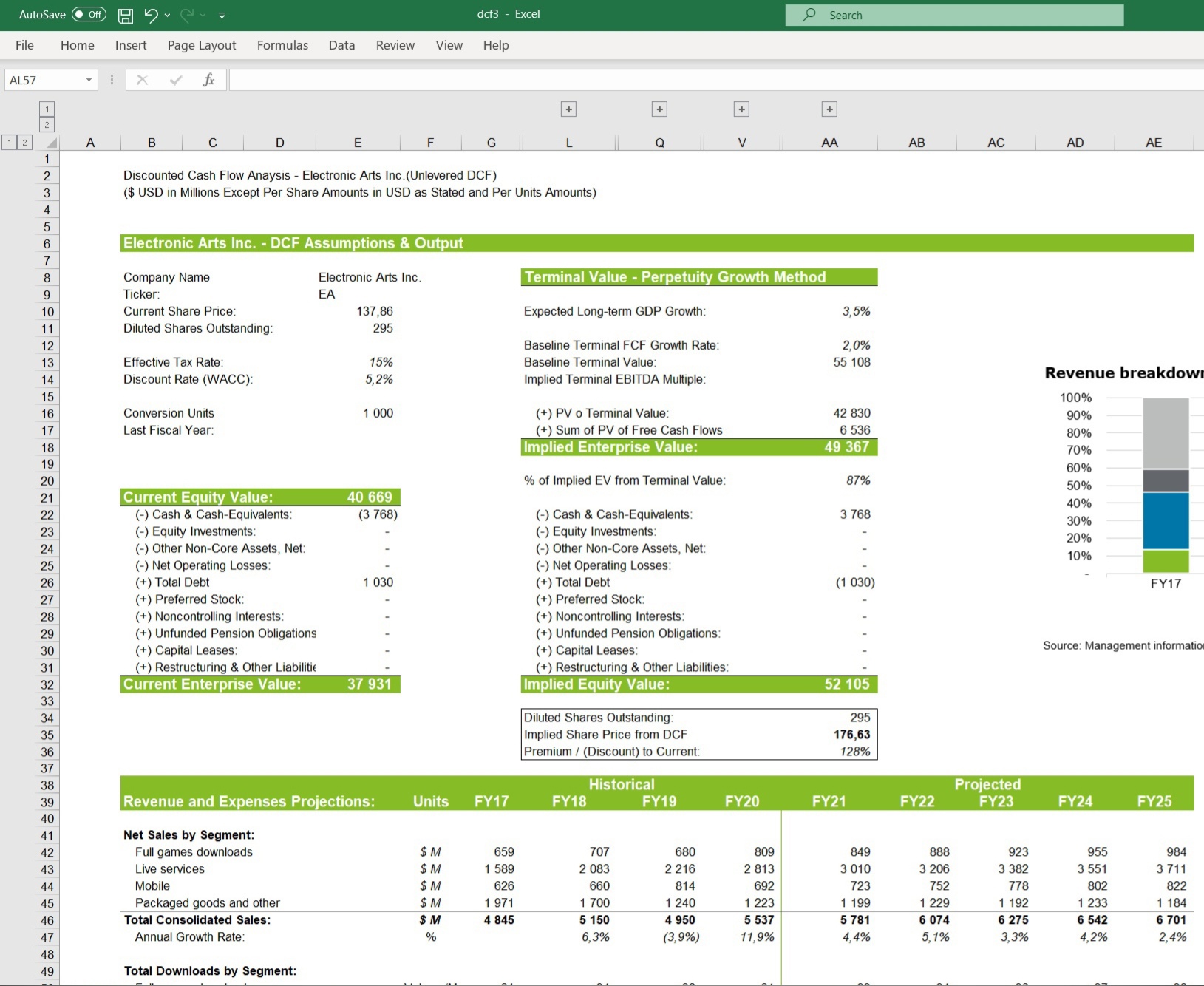

Hi guys, I'm a second year student and I have a problem with my DCF model which was prepared for my paper work at university.

The problem is the following: % of Implied EV from TV is 87%. As far as I know, this is an extremely high percentage.

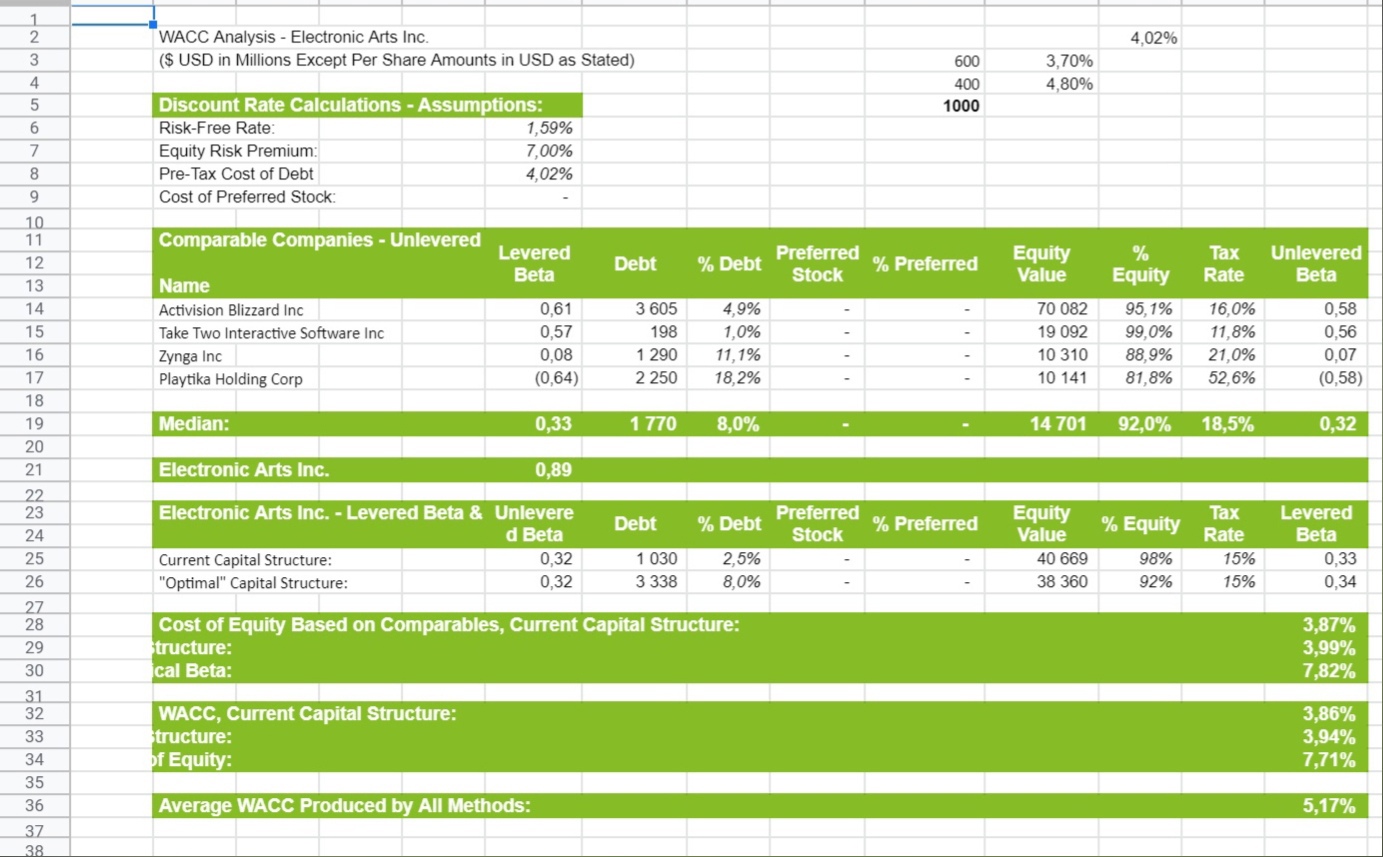

That is why, I would like to ask you for your help. I think, I did some dramatic mistakes which impact on the final result ( I got a very low cost of debt and equity).

Please, make a review and comments with your suggestions.

Impossible for me to check your work but here’s a few things: 1) it’s OK to have high TV as a % of your DCF if it’s a lower profibility company that is super high growth. That doesn’t seem to be the case with EA though. 2) your WACC is way way too low. Your cost of equity looks way way too low (cost of debt looks fine). Some of the least risky companies in the world don’t have WACCs that low. Should be closer to 8-10% MINIMUM. Smaller / riskier companies should be higher than that too

Thanks for review. I can send a link via pm to check more precisely, If you don't mind.

Unfortunately not spending my 1 day off auditing your excel. Your betas look wrong they should be closer to 1. Maybe the market volatility messed them up. Find numbers for forward looking beta estimates, that may fix it. Like zynga with a beta of 0.08 is super useless / wrong. Just get the WACC to be higher. Honestly people are just looking right mechanics in school projects

Correct. Marketwatch and yahoo finance return a beta around 0.8-0.9, which drastically raises the cost of equity from ~3-4% to around 6.5%. That’ll help.

Thank you very much any way)

Veniam quia odio sapiente reprehenderit dolor hic quisquam cupiditate. Tempora rerum accusantium autem nam. Iste voluptates incidunt et repellat sit libero. Minima nulla nihil incidunt est impedit ducimus laudantium. Exercitationem hic accusantium omnis ex. Dolore quas dignissimos iure unde et autem est.

Sit rerum magnam ut porro odio et qui. Eos aperiam aliquam explicabo est odit eum est.

Sit qui tempora occaecati illo laboriosam excepturi nemo quo. Ut ex aut nesciunt et suscipit enim. Suscipit atque omnis aperiam sit sit nihil omnis. Dolore qui est laboriosam animi hic qui. Culpa sit vero est distinctio modi.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...