Why Equity Research

How to answer the question "Why Equity Research"

Equity research (ER) is a position for analysts to evaluate a company’s financial information and perform ratio analysis while forecasting future values by using applications like Excel to perform financial modeling.

More specifically, this role intends to find optimized scenarios to either buy or sell stocks and form investment strategies that would minimize risk while maximizing profit and return.

Upon compiling all the quantitative analysis and calculations, equity research analysts put their findings in an equity research report.

Some clients wanting to hire equity researchers include investment banks for the sell side, institutions for the buy side, or independent organizations.

Notably, equity research does not have a hierarchy or seniority like in investment banking. However, there are two main positions, which are associates and analysts. Unlike other fields of finance, an associate equity research professional is more junior than their counterpart.

Some of the most reputable companies that perform equity research include:

- JP Morgan Chase and Co

- Bank of America Merrill Lynch

- Credit Suisse

- Barclays Capital

- Citigroup

- Goldman Sachs

- Morgan Stanley

What Do Equity Research Professionals Do?

Equity research is a rather technical position to have, meaning that interview questions would entail a decent amount of conceptual questions.

This is because interviewers need to gauge how competent the candidate is in making approximations and investment decisions and understanding how different financial values indicate a company’s performance.

To understand what types of technical questions sales and trading candidates may encounter, we must also understand what people do in this department.

From an overview standpoint, here is a list of things these analysts do before submitting their reports.

1. Perform valuations of listed companies

By using stock exchanges like NYSE, Nasdaq, or Russell 3000, a researcher can find a general surface-level valuation of a company’s performance through metrics like stock price, trade volume, market cap, and P/E ratio, among others.

From an interview standpoint, you would need to have a very profound understanding of market trends and other concepts to determine the value of a company based on stock charts. Some questions may ask you to determine if a company is under or overvalued based on a ratio.

2. Research the industry and other economic parameters

Suppose the company has a positive outlook regarding its business performance. In that case, the researcher will then analyze factors like GDP, growth rates, market size, competitive landscape and fragmentation, and EBITDA margins to grasp a more market-specific understanding of the business’s prospects.

In potential case studies through an interview setting, interviewers may ask you to perform market research and comparative analysis to understand how a company is doing. This will also factor into making decisions in sales and trading.

3. Analyze fundamental financials

Upon learning about the industry’s landscape in more detail, the researchers can find the company's financial statements, including the balance sheet, cash flows, and income statement, and determine how well the company has been operating through trends.

Therefore, having great analytical skills and deconstructing financial statements are crucial when going into an interview. Some questions may entail coming up with an investment proposal after seeing a company’s financial information.

4. Project growth, revenue, and profits

Using the data from the financial information, researchers will then create projections from a managerial perspective on a company’s potential for expansion and increase in revenue or profits. Factors like customer retention and industry trends will also factor into this evaluation.

5. Use financial evaluation models

Some of the company equity valuation models include discounted cash flow (DCF), initial public offering (IPO), leveraged buyout (LBO), relative valuations, or sum of the parts valuation. Researchers will undergo these calculations to assess a company's potential more holistically.

This also means some interview questions may require you to walk through a financial modeling process. Make sure to be concise and straightforward when answering questions like this.

6. Compare findings to the stock exchange

The researchers will find a fair price for the company after going through the evaluation procedure above. Their goal is to compare this finding to the current market price displayed on the stock exchange.

7. Conclude if the stocks are overvalued or undervalued

Here is how an equity researcher determines if a stock is overvalued or undervalued.

If,

Fair price < Current market price

Then the stocks are overvalued, meaning that it is recommended for investors to sell their holdings.

If,

Fair price > Current market price

Then the stocks are undervalued, meaning that it is recommended for investors to buy stocks from the company.

Of course, if the fair price equals the current market price, the stock is neither overvalued nor undervalued, meaning it is fairly priced and that investors should hold. This also means minimal incentives exist to buy or sell the stock, depending on the investor’s personal projections and risk preferences.

8. Recommend investment strategies and work with clients

With the report in hand and a conclusive suggestion established through financial modeling calculations, equity researchers will talk to their clients about the results.

This means that being in sales and trading requires great communication skills. Some of the behavioral questions will assess this.

Why Equity Research Interview Question

This question is an opportunity for you to demonstrate your interest, passion, and commitment to the role.

As one of the most common questions when undergoing any interviews in the finance industry, you should always come prepared with an answer as you should expect this to come up.

This question could be asked in various ways, so let us cover some of the sample questions and answers.

NOTE

Please note that the example answers we provided are merely for consideration. The intention is to give you a general idea and framework for how you should prepare for and answer these questions.

Why do you like ER?

This question assesses the candidate’s passion for the field. When responding, make sure to be genuine and authentic. Avoid mentioning money, exit opportunities, or irrelevant information that will harm your chances of being selected.

This is because companies want salespeople and traders to be committed to their company and stay long. Having monetary or other non-sales and trading ambitions shows that you do not have a genuine interest in the role and do not have a passion or the motivation to excel in the position.

Therefore, you should be more personable and creative in how you structure your reasons. A way you can approach answering this question is by stating how your previous work experiences made you gravitate towards analyzing numbers and dive into quantitative reasoning.

Another way is to show how a club activity or research paper you have done made you wonder more about market trends and stock performance.

Sample answer:

“As someone who likes to immerse myself in determining the movement of stocks and the future prospects of a company, I am fascinated by deconstructing financial information to find the value of a business.

To me, finding the answer to whether the company is overpriced, undervalued, or fairly priced is like solving a math problem. I love to know the reasons behind a company’s performance and how an industry follows trends while undergoing this process.”

Here is another example of a similar question the interviewer might ask you:

What about equity research appealed to you?

Sample answer:

“From a young age, I have been fascinated with drawing conclusions from numbers and data. In high school, I began investigating financial models and using Excel sheets to craft surface-level analyses of stocks.

Through my quantitative strengths, I eventually began using my models to drive investment decisions after acquiring a Robinhood account. Eventually, I participated in many clubs during college where I could craft in-depth analytical reports on stock performances and compare them.

Thus, I became drawn to equity research, and I view it as a mathematical game that requires a comprehensive understanding of the market.”

Why do you want to become an equity analyst?

Sample answer:

“One of my hobbies is data storytelling. I like how numbers on a spreadsheet could draw a conclusion about a company or industry's financial and economic performance. It becomes more fascinating when these conclusions lead to investment strategies.

Having prior trading experience, I now incorporate my strengths into my research to find undervalued stocks. The process of finding financial information, using financial modeling, and writing analytical reports to me is like building a puzzle.”

Other Equity Research Interview Questions

Here are some common ER questions with some sample responses to provide a basic framework as to how you should approach answering them.

Please acknowledge that the sample answers in this article are surface-level and general. In your interview, make sure to dive deeper when possible and make the answers personal and specific.

Other Interview Questions

This is a general behavioral question where the interviewer wants to know more about your past achievements and reflective skills. If possible, mention something that your resume may not have best reflected.

Sample answer:

“I am proud to have founded a nonprofit addressing food scarcity. From establishing an entity and recruiting members to cold calling and emailing businesses and establishing partnerships for donations, my team and I donated many servings to those in need.

Beyond the statistical achievements, I felt joy by working with volunteers, restaurants, and food banks throughout the process. It is a warm feeling knowing that my work and effort have made a difference in my community.”

This question intends to see if you are capable of managing tough situations that will be inevitable as an ER. By learning about how you cope with challenges, the interviewer assesses how fitting and capable you are of working in that environment.

Sample answer:

“Every Sunday, I plan my upcoming week’s schedule and reserve some free time in case of any changes or additional requirements. In my previous role, I had a lot of reports to make over a short interval.

By managing my time ahead and regularly updating my clients on the report’s status, I completed my tasks on time and alleviated stress by knowing what was planned ahead. Since transparency and honesty are two crucial values I stand by, I make sure to fulfill my customer’s satisfaction.”

This is a basic technical question to ensure you know the fundamental finance concepts that will play a prominent role when evaluating companies and stocks as an ER professional. Make sure to be concise in your answer while being clear and simple.

Sample answer:

“EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a common metric used to assess a company’s financial health and performance and how much cash is allocated to operations.

Removing factors like interest and depreciation makes this valuation more effective and insightful than the net profit or revenue. Thus, EBITDA helps to estimate the free cash flow and evaluates a company through the EV/EBITDA multiple, which varies depending on the industry.”

This question intends to assess your ability to differentiate between two commonly used financial values. The interviewer wants to make sure you understand the distinction, and it is best if you can answer concisely and orderly by providing the equations and examples.

Sample answer:

“Here is the equation for the enterprise value:

Enterprise value = Market value of equity + Debt + Preferred stock + Minority interest - Cash

Whereas:

- Equity value = Total shares outstanding * Current share price

- Equity value = Enterprise value - Debt

This means that equity value is a part of enterprise value, where it represents the residual value after a company satisfies its obligations to shareholders. Contrarily, enterprise value has values for both equity and debt holders.”

This question also wants to assess how well you can grasp the must-know concepts in your position. Like the previous question, make sure to reference the equation and state the components factored into the calculation.

Sample answer:

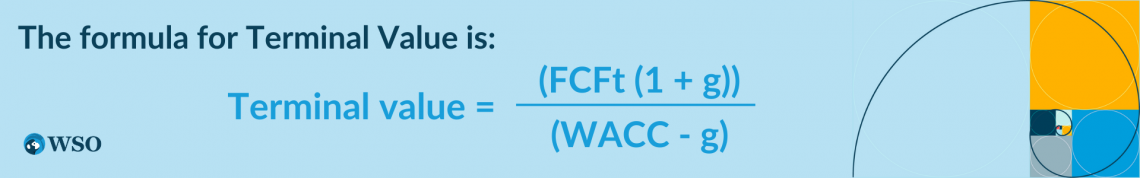

“Here is the equation for terminal value if we use the perpetual growth approach:

Where

FCFt = forecasted cash flow denoted at time t

WACC = discount rate or the weighted average cost of capital

The other method is by finding the EBITDA of a company and multiplying the number to the EBITDA multiple, which could be found when searching up the margin by industry or by finding a comparable company’s multiple values.”

Try to answer this question by coming up with two or three points that answer the question while providing brief reasons why this is.

Sample answer:

“Different valuation methods have different assumptions. Usually, the precedent transaction or DCF method results in higher valuations more than a comparable company’s analysis or market valuation.

Factors like control premiums in precedent transaction models and optimistic outlooks in DCFs contribute to higher valuations.

Moreover, private companies do not disclose financial information. Valuations like DCF would not calculate a reliable WACC value without knowing the equity beta. Using industry multiples may also differ from the company’s actual performance.”

Answer this question by providing the calculation method after briefly explaining what the market risk premium is by definition.

Sample answer:

“The market risk premium is the required excess return when investing in stocks and not ‘risk-free’ securities like Treasury bonds. You can calculate the premium by subtracting the risk-free rate, which is the yield on a 10-yr Treasury, from the S&P 500 average market return.”

This question does not have a correct answer as it depends on the industry. Since P/E is the number of dollars an investor is paying for one dollar of earnings, it could vary from one company to another.

For instance, high-growth industries like technology may consider this ratio low because companies have higher growth potential. On the contrary, pharmaceutical companies may consider this ratio high due to its slow but steady growth.

Sample answer:

“A P/E ratio of 13 can not be determined as a high or low number because it depends on the company’s industry. Whereas some companies may deem it as low because they are a tech company and expect higher valuations, pharmaceutical companies may consider it high.”

For more questions, including difficult technical questions and tricky brain puzzles, make sure to check them out here.

Why Equity Research Interview Questions - Final Tips

Here are some final recommendations and suggestions to keep in mind when going into an interview for ER.

- Be authentic, confident, and polite to showcase your personality and character when answering the questions.

- Make sure to organize your thoughts before you speak. Your responses should be concise but informative and straightforward.

- Please wait for the interviewer to finish before asking any clarifying questions.

- Always do your research on the firm you are applying to so you can demonstrate interest and diligence.

- Be appropriately dressed in the proper attire.

- Practice in advance, whether for the interview or the online assessments, especially the technical questions.

- Always aim to arrive roughly 10-15 minutes before the interview to make a good first impression.

- Saying phrases like “Thank you for your time” and asking “How are you” can go a long way.

- You want to show dedication and commitment in staying with the company if asked about your career or future goals.

or Want to Sign up with your social account?