Cash Conversion Ratio

It is a financial management measure used to calculate the cash flow-to-net profit ratio of a firm

The Cash Conversion Ratio (CCR) is a financial management measure used to calculate a firm's cash flow-to-net profit ratio. In other words, it compares how much company profits are converted into cash flow.

This is a one-step calculation that tells whether your business model is in excellent form or if there are any issues. Here's everything you need to know about this ratio and how to utilize it successfully to determine whether your firm is in an excellent financial position.

Cash flow is the total amount of cash created by a firm in a certain period, usually quarterly or yearly, depending on the company's accounting cycles. It is often divided into three categories:

-

Operating Operations: cash earned through business operations.

-

Investing Operations: include all purchases and sales of long-term investments and assets.

-

Financial Operations: any transaction involving capital raising (or repayment).

The ratio gauges how well you convert sales and earnings into cash.

A high ratio frequently results from strong working capital management, such as quick inventory turnover and good receivables management.

A low ratio might result from delayed inventory turnover from the outmoded product, poor receivable collection owing to bad debts, or suppliers tightening credit terms.

60% of business owners report experiencing cash-flow issues at some time, which is one of the top three stress sources. As a result, the CCR is a key instrument for financial investors and an indicator of a company's financial health.

The ratio is an economic metric that depicts the relationship between cash flow and net profit. It assesses how rapidly a business can convert revenues into accessible cash.

CCR is a relatively new metric used to assess managerial performance. It is mostly used by industrial enterprises, although it is gradually gaining appeal. The ratio assesses a firm's capacity to convert profits into cash.

It can be expressed as a number or as a %. The corporation is liquid if the ratio is more than one, but anything less than one implies a low CCR. The CCR is especially crucial for emerging businesses looking to achieve a tipping point where their efforts start to pay dividends.

Key Takeaways

- The Cash Conversion Ratio (CCR) measures a company's ability to convert profits into cash flow and assesses how well sales and earnings are converted into cash.

- A high CCR indicates strong working capital management and quick inventory turnover, while a low CCR may indicate issues like delayed inventory turnover or poor receivable collection.

- The CCR is especially crucial for emerging businesses aiming to achieve financial stability and growth.

- The formula to calculate CCR is: CCR = Operating Cash Flow / EBITDA, and a ratio greater than 1 indicates good financial health.

- Companies can improve their CCR by managing bills and receivables effectively, reducing spending, and boosting inventory turnover. Comparing CCR with competitors can provide valuable insights into a company's performance.

Formula for cash conversion ratio

The ratio may be calculated using a variety of cash flow and profit measurements.

The most popular method used to calculate he ratio is:

Cash Conversion Ratio (CCR) = Operating cash flow / EBITDA

The entire money gained or lost from running your firm, such as making sales and paying your staff, is referred to as cash flow from operations. The ratio assesses a company's ability to convert profits into cash.

If the CCR exceeds 1.0, it is typically a good indicator since cash will be available for investments and payouts to investors.

-

Anything less than 1 indicates a low CCR.

-

Anything negative indicates that the firm is losing money.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) is a rough proxy for operating cash flow, but it neglects two major cash outflows - Capex and working capital changes.

To evaluate a company's true performance, these additional non-cash (or non-recurring) adjustments are required to be accounted for. A firm's cash flow serves as the foundation for determining the cash conversion rate. In general, cash flow may be calculated in two ways:

1. Direct selection

All earnings made by a corporation can be utilized to repay investors. However, all operational expenditures, including material prices, labor, and income taxes, are subtracted, as are sales proceeds.

2. Indirect selection

This entails first adding depreciation or provisions and removing profits income and appreciating value.

Example of Cash Conversion Ratio

Here is an example of a question solved:

Step 1:

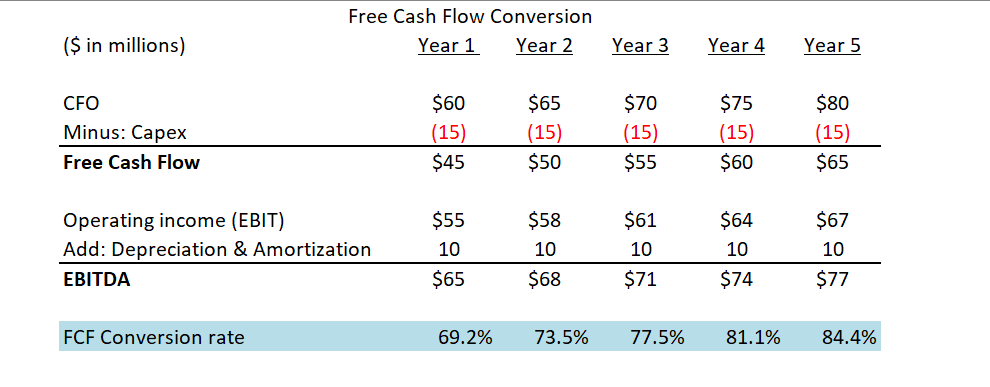

In our example, we'll make the following assumptions about our firm XY in Year 1:

-

CFO (cash from operations): $60 million.

-

Capex: $15 million in capital expenditures.

-

EBIT: $55 million in operating income.

-

Depreciation and Amortization (D&A): $10 million.

Step 2:

We can now calculate the cash flow and EBITDA:

Free Cash Flow = CFO ($60m) – Capex ($15m) = $45m

EBITDA = EBIT ($55m) + D&A ($10m) = $65m

We'll make a few additional assumptions:

-

Cash from Operations (CFO): Growing by $5 million per annum.

-

Operating Income (EBIT): Increasing by $3 million per annum.

-

Capex and D&A remain steady (i.e., straight-lined).

Using these variables, we can determine the free cash flow conversion rate for each year. For example, in Year 0, we'll divide $45 million in FCF by $65 million in EBITDA to reach an FCF conversion rate of 69.2%

In this case, we're determining how close a company's discretionary free cash flow is to its EBITDA. Finally, we can see how the FCF conversion rate has risen over time, rising from 69.2% in Year 1 to 84.4 % in Year 5, driven by FCF growth exceeding EBITDA growth.

What Is a Good Cash Conversion Ratio?

One would be an efficient cash-flow conversion ratio. This signifies that you are transforming every dollar of net income into cash during your accounting period. You may have a liquidity concern if your ratio is much less than one.

On the other hand, a ratio larger than one suggests that you have a lot of liquidity, either because clients pay their invoices in advance or because you've been able to postpone spending.

The debt-to-equity ratio (D/E) is an important measure of a company's financial health. A larger ratio indicates that the corporation is taking on more risk and is funding its expansion with debt.

Effective ways to improve the Cash Conversion ratio

There are a few things you can do to increase your cash-flow conversion ratio if it isn't where you want it to be:

1. Take a deeper look at your bills: pay special attention to who is past due so you can send reminders and ensure they are paid on time or have a high ratio of late payments. If you don't know, you may be behind on payments.

2. Encourage payment on time: offering early payment incentives and late payment penalties might encourage your customers to pay. Positive and negative reinforcement can encourage customers and clients to settle their bills.

If there are no incentives or repercussions, people may not be driven to perform specific behaviors.

3. Reduce your spending: consider where you may temporarily slow down spending in a financial shortage, such as paying invoices at the last minute or deferring equipment buying until the following accounting cycle.

This would allow your cash flow to catch up, putting your company in a better financial situation.

4. Receivables should be automated: if you don't have time to review your receivables, try employing software to automate the process.

5. Boost inventory turnover: unsold inventory cannot be used to pay your payments. Check whether your cash-flow conversion ratio is excessively high to determine if some goods aren't selling well or if you're overstocking.

You might also consider implementing a "just-in-time" inventory management system.

Where to use the cash conversion ratio

Businesses having problems converting may try automating their receivables, providing incentives or penalties for timely payment of invoices, or speeding up inventory turnaround.

Some applications of CCR are listed below:

Analysts commonly use the following method to determine the CCR in Leveraged Buyout (LBO) scenarios and when doing credit evaluations.

Cash Conversion Ratio = Free Cash Flow / EBITDA

Free Cash Flow (FCF) is the cash freely accessible to all capital suppliers. This ratio aids in determining a company's debt capacity. Companies having better cash conversion rates as a % of EBITDA will be able to handle considerably larger debt levels and vice versa.

2. DCF (Discounted Cash Flow) valuation

Discounted cash flow valuation estimates free cash flows to evaluate the value of a company. Many assumptions are employed in the DCF, and analysts develop ratios to verify their suitability.

They consider the cash conversion ratio, among other things. Because a company's investment requirements are lower during the steady state, the ratio should be higher.

3. Importance in Online Marketing

Compared to the industrial sector, the cash conversion rate values in internet marketing should be rather high. This is because when a customer puts an order online, the merchant will normally hold it until payment is received.

Companies like Amazon are taking this notion to a logical conclusion. They only pay their suppliers once they have received payment from their consumers.

When utilizing the cash conversion rate to examine and optimize the organization, internet marketers must consider the temporal context, industry type, and business strategy.

Regarding internet marketing, cash conversion rates should be rather high compared to the industrial sector.

4. What Are the Pros and Cons of CCR?

The cash-flow conversion ratio (CFC) is a straightforward method for assessing a company's financial health. It's especially critical for newer, developing organizations, which may overlook operational issues.

Because two companies with the same CFC may have different liquidity, it's vital to review your financial documentation.

As a result, in addition to cash flow, you should be able to assess all of your financial statements to get a full view of your company's financial health.

What Is the Cash Conversion Cycle (CCC)?

The cash conversion cycle (CCC) is one of the quantitative indicators used to assess a company's operations and management efficiency. CCC seeks to determine how long each net input dollar remains in the manufacturing and sales process before being turned into cash.

A tendency of falling or stable CCC levels across various periods is a healthy indicator; however, growing values should prompt more study and analysis based on other considerations.

The cash conversion cycle (CCC) is one of the indicators used by management to assess how successfully they utilize working capital. The CCC measures how quickly a corporation can turn its original capital investment into cash.

It pays suppliers, creates inventory, sells things, and collects consumer payments on average. So, the shorter the timescale, the better for the firm.

To calculate CCC, gather the following information from the company's financial statements. This data is used to compute the days of inventory outstanding, days of sales outstanding, and days of payables outstanding:

-

Average inventory during the period

-

Cost of goods sold or cost of sales (COGS)

-

Annual revenue

1. Days of Inventory Outstanding (DIO)

The first step examines existing inventory levels and forecasts how long it will take the firm to sell its inventory. Next, the cost of items sold determines the Days Inventory Outstanding (DIO). DIO is the number of days required to sell the whole inventory.

A lower DIO number shows that the company is making sales quickly, reflecting a higher business turnover. To compute it, first find the average inventory.

Average Inventory = 0.5 x ( Beginning Inventory + Ending Inventory )

DIO = ( Avg. Inventory / COGS ) x 365 days

2. Days of Sales Outstanding (DSO)

The second step concerns current sales and the time it takes to collect these purchases. A lower DSO score suggests that the firm can recover funds quickly. To begin, find out the average accounts receivable (AR):

Average Accounts Receivable = 0.5 x ( Beginning AR + Ending AR )

DIO = Avg. AR / Revenue Per Day

3. Days of Payables Outstanding (DPO)

The third step focuses on the company's existing overdue payables. It considers the amount of money owed to current suppliers for inventory and items acquired and the time range over which the organization must fulfill such commitments.

DPO stands for days payable outstanding. This indicator indicates the payment of the company's invoices or accounts payable (AP). If this can be maximized, the corporation can keep its capital for longer, increasing its investment potential.

As a result, a lengthier DPO is preferable for enterprises.

Average Accounts Payable = 0.5 x ( Beginning AP + Ending AP )

DPO = Avg. Accounts Payable / COGS Per Day

Let’s now calculate the CCC: The number of days in a matching period is 365 for a year and 90 for a quarter. All of the information outlined above is available as regular items in the financial statements of a publicly listed corporation.

They appear in the annual and quarterly reports of publicly listed companies. Finally, the Cash Conversion Cycle is computed using the following values:

CCC = DIO + DSO - DPO

Where:

- CCC: Cash Conversion Cycle

- DIO: Days of Inventory Outstanding

- DSO: Days of Sales Outstanding

- DPO: Days of Payables Outstanding

Applications of Cash Conversion Cycle

CCC is used selectively in various industrial sectors based on the nature of company operations. However, the metric is extremely important for merchants in charge of purchasing and maintaining stocks.

CCC does not apply to businesses that do not require inventory management. The corporation with the lowest CCC uses its resources most efficiently, but not always. As a result, businesses like online merchants eBay Inc. and Amazon.com Inc. can have negative CCCs.

Online merchants frequently receive payments in their accounts for selling products to third-party vendors. Because insurance and brokerage firms do not acquire things wholesale for retail, CCC does not apply to them.

CCC should be used to determine whether or not a firm is improving over time and to compare it to competitors.

Analyzing a Business when the CCC is tracked over time might reflect an increasing or deteriorating value. Examine external variables such as market and economic circumstances to discover whether anything impacts sales.

You should also compare CCC changes over time to get a good feel of how a firm changes.

Analyzing Competitors: To form a comparison, CCC should be determined for the same periods as the company's immediate rivals. For example, suppose Company A's CCC for the fiscal year 2022 was 160 days while Company B's CCC was 140 days.

Company B outperforms Company A by moving goods faster (lower DIO) or collecting what is owed faster (lower DSO). However, remember that CCC should not be the only statistic used to assess the organization or management.

Return on equity and return on assets are also useful indicators of managerial performance. For example, if Company A has an online store competition, Company C's CCC for the same period is -42 days.

This means that Company C does not pay its suppliers until the goods it acquires are paid for. In terms of CCC, internet dealers frequently have this advantage.

Cash Conversion Ratio (CCR) FAQs

The cash flow-to-debt ratio compares a company's operating cash flow to its total debt. This coverage ratio may calculate how long a firm would repay its debt if its cash flow was committed to debt service.

It is shown as a %. Cash on cash return (CCR): In real estate, it is a % statistic calculated by dividing a property's yearly cash flow by the amount of cash invested in the property (typically the down payment and closing costs.)

To generate more income, a bank lends or invests its excess reserves. The money supply grows by more than one dollar for every $1 rise in the monetary base. The money multiplier is the growth in the money supply.

The cash-flow conversion ratio measures how well a firm converts its profits into cash. It's a straightforward formula that divides operating cash flow by net income. One or more is an excellent ratio - one or more means the company's performance is very good.

To analyze, we use this formula:

Cash Conversion Cycle = days inventory outstanding + days sales outstanding - days payables outstanding

The cash conversion rate (CCR) is a key economic statistic that depicts the link between cash flow and net profit.

A lower CCC indicates that the firm is in better health, and a longer CCC suggests it is at risk of busting.

The Cash Reserve Ratio (CRR) is the % of the money that a bank must retain in cash with the RBI. In contrast, the Statutory Liquidity Ratio (SLR) is the ratio of liquid assets to time and demand obligations.

To lower the CCC, you can:

-

Enhance Cash Flow Management.

-

Accounts payable periods should be adjusted.

-

Collaborate with Your Customers.

-

Change your accounts payable.

-

Improve Your Inventory.

-

Automated A/R reduces cash conversion time.

The inverse connection indicates that the lower the value of CCC or the shorter the duration of the cash conversion cycle (CCC), the higher the profits. This is because the corporation acquired the proceeds from the sale before it had to pay its suppliers.

The CCC does this by tracing the cash, or capital investment, as it passes through inventory and accounts payable (AP), sales and accounts receivable (AR), and back into cash. So, the lower the CCC number, the better for the firm.

Operational working capital is the primary distinction between operating cash flow and EBITDA. Operating working capital is the short-term assets and liabilities necessary to run a firm.

Growing businesses with positive working capital are likelier to have a cash conversion ratio of less than 1.0. When the operating working capital is negative, operating current assets are less than operating current liabilities.

or Want to Sign up with your social account?