Investment Banking Analyst: A True Day in the Life

Although no job is perfect, I cannot think of any other occupation that provides this much learning opportunity / responsibility / exit opps.

No doubt, this is what makes the investment banking analyst position one of the most coveted jobs out of undergrad. You pay your dues, and you're rewarded bountifully. You're well compensated, provided with excellent exit opportunities, and learn more than you ever have in two brief years.

Analyst Compensation in Banking

There’s a lot that goes into investment banker salary and bonuses (various bonuses, performance, firm). Bulge brackets and elite boutiques pay their analysts better than boutiques and middle market firms. More detailed compensation information in the later sections.

IB Analyst Hours

There’s a lot of wild information out there regarding hours for analysts. The false information probably stems from analysts who wear their hours as a badge of pride. The reality is most analysts put in around 70 to 80 hours a week. Note, this varies a lot depending on the group and the firm. Certain firms, Lazard, for example, are notoriously brutal, and analysts there typically put in 80-90 hours a week.

Investment Banker Lifestyle

If you want to be an investment banker, work will be your life during your stint. Even on the weekends, you’ll put in work, and when you do have free time, your body will likely feel the overwhelming need to rest and recover.

Even 9-5 training M-F is exhausting when transitioning from two days of classes a week/sleeping all week. But your body will adjust, and you'll have new limits.

what does an investment banking analyst do?

One word tends to get tossed around a lot when discussing what analysts do: grunt work. It’s used a lot because it’s accurate.

- Typically the analyst does all the grunt work on projects, such as valuing companies, creating models, and putting together pitch books.

- There will be many lonely nights spent plugging and chugging numbers in Excel or putting the finishing touch on a PowerPoint. It’s not a particularly glorious job, but it’s not the work that makes the investment banking position sought after.

- The hours are bc you have so many iterations and nits in a book that you have to fix, and so many people to hear changes from. A lot of the hours stack up because it takes a while to hear back from people.

- When things are really busy, though, and deal flow is good, you won't have that problem.

Boutique Investment Bank Lifestyle, Compensation, and More

By the way, a boutique is a firm that doesn’t offer as many services and has fewer employees than a bulge bracket. The boutique lifestyle ranges wildly. Some have tiny groups and deal with sub $1bn deals. Others advise on deals north of that and have larger groups. Some are small, regional offices - pretty much family businesses - while some have 200 employees and multiple locations.

Analyst at Boutique Investment Bank Lifestyle

On average, boutiques have less deal flow than bulge brackets and elite boutiques. Because of this, boutique hours are far better. Instead of the common 80 hours a week, it’s more like 60-70 hours.

The Interview Process for Investment Banking Analysts

Getting to the interview with a smaller boutique is very much the same process with any other investment bank. Establish connections within a firm, resume drop, on-campus interviews, superdays, you know the drill.

Unlike the technical focus of a bigger bank with more deal flow, the focus at boutiques is on fit once you get to the interview. You'll be asked more behavioral questions for fit.

- What characteristics do you possess that would make you a successful IB analyst/SA? (@IBchimp")

- Give an example of when you've been required to pay particular attention to detail. (@IBchimp")

- Tell me about a time you displayed leadership. (@consultant09")

In addition, make sure you can answer common behavioral questions like why investment banking, what are your interests, and what do you do in your free time?

Compensation for IBD Analyst

Less deal flow typically means lower compensation, but not by much at all. There’s also the very important factor of hours to consider. You may be making slightly less but you put in fewer hours per week. For some, trading hours for prestige makes sense. Generally, compensation at a boutique is 10% less than the street average.

Exit Opportunities for Analysts at Investment Banks

Having quality deal experience (in addition to the obvious: prestige) on your resume is one of the greater appeals of working for bulge bracket or elite boutique. Boutique exit opps aren’t as good. It’ll be tougher to break into private equity, hedge funds, or stand out as an MBA candidate because you’re competing with people who worked on bigger deals at more prestigious firms.

- Don’t be mistaken; exit opps are still good coming out of boutique investment banks. It’s possible to land a position at a private equity firm, for example, but you’ll have to really work for it to separate yourself from the crop.

- The most notable difference is that boutiques hire analysts with the goal of promotion from within. Boutiques focus a lot on fit during the interview and the lifestyle isn’t as demanding, so the culture is less churn and burn.

A Day in the Life of an Investment Banking Analyst

The work of the investment banker varies from day-to-day. Some days you’ll be preparing a pitch book the entire day; others you’ll be plugging away at a financial model. The following is not one of those days. Instead, it’s a rather satirical take on the typical investment banker’s day.

- 9:30 am – Arrive to work and head straight to the break room in order to pick up a couple breakfast burritos and an OJ. Hang up my suit jacket and proceed to fist-bump my favorite analysts.

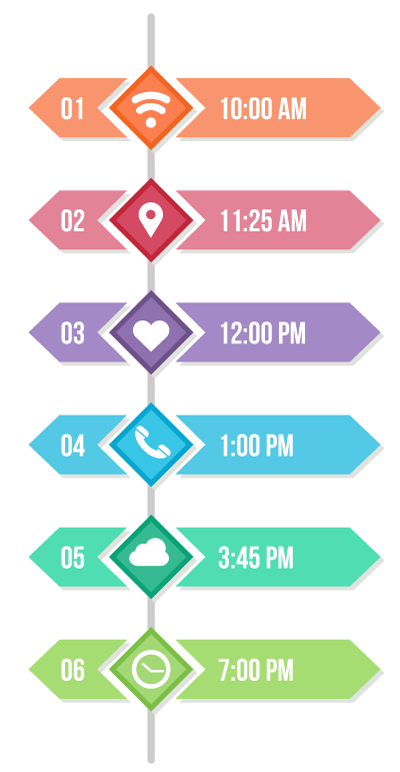

- 10:00 am – Check my email, listen to endless voicemails, and log on to Bloomberg Terminal to check the news and performance of my clients.

- 11:25 am – Associate slams me on a couple pitches, but being a true vet of the game, I learn to delegate as much as possible to interns/analysts/even associates at other locations, i.e. Texas, Chicago, etc. AND my loyal customer support over at Dealogic, FactSet, and Bloomberg.

- 12:00 pm – Favorite time of the day, leave the building without making much commotion and head to Bryant Park in order to meet a Tinder date. She looked much better in her pictures, and I leave disappointed.

- 1:00 pm – Get back into the office and head towards my desk. Associate meets me half way, glances at his Rolex GMT, and frowns. Informs me that we have a meeting with an Industry group and to prepare for battle.

- 1:20 pm – Gather in the meeting room with ties on as if meeting a client. Industry group complains about pitch book and how we might be overstepping what was agreed upon by the client.

- 1:45 pm – “Bloody relationship bankers!!” remarks my Vice President as he storms off to his desk. I pick up a foam football and launch it at the equity Capital Markets Group. I occasionally work with those former frat boys from the HYP trinity, clueless to the world of LBOs and Firepower analysis, but nonetheless, a great group of guys.

- 3:45 pm – MD calls me from Texas and asks a couple of questions behind my models for an Oil & Gas company we are helping in a Buy-side acquisition. I hand the phone to Steve, “Take it away, buddy. I’ll grab us some bagels.” I whistle on the way to the break room, and my eyes latch onto a cute girl who works in treasury services (middle-office). I remind myself that I completed the harassment training course earlier and that I would be forever mocked if I broke code (talking to middle/back office).

- 5:00 pm – Receive all the company profiles, company information, stock ownership information, and so on from the work I delegated. As a modern day warrior, I lift my shield MS PowerPoint and wield my sword Microsoft Excel and push forward in order to piece together a Fortune 500 merger.

- 7:00 pm – My model is balancing, and everything is looking good. My fellow analysts are chugging on espressos and texting their promoters at clubs, such as The Gilded Lily and The Marquee. But I know the importance of health and proper time management in Investment Banking. I pull out my shake weight and shake it violently for a good five minutes. When the coast is clear, I grab a handful of Beast Creapure and let it sift through my fingers into my Woodford reserve. After a Ninja swig, I'm good to go for another hour.

- 8:00 pm – My favorite banker in the outfit (an industry banker, so be it) pops up from a lower floor and rounds up our gang in order to take advantage of expensed dinner. We walk over to JP Morgan to meet some buddies from university and head over to Chipotle to nourish our Adonis physiques and earn Chiptopia points.

- 10:00 pm – Well, it looks like I’m not going to make it into the gym today. I glance over my shoulder and see the Capital Markets Group returning from their workout at Equinox. I let my associate know the model is ready and that I’ve saved and exited out.

- 1:00 am – I contact the Investment Banking Data Resource Group and ask them to have a few things ready in my inbox tomorrow morning. I put on my suit, head to the bathroom to comb my hair, phone my buddies to meet at a local bar, and exit the building in style.

Interested in Investment Banking - Breaking In

The fact of the matter is you won't improve unless you practice. To have any chance at the technical questions, you need to prepare yourself with legitimate questions. The WallStreetOasis investment banking interview course is designed by countless professionals with real world experience, tailored to help you break into investment banking by acing the technical questions.

pls

Gay. It's "Marquee". Have been there enough and have never heard ANYONE put a "The" in front. Lemme guess, GS SLC?

Salt Lake City when they talked about a date at Bryant Park in NY...?

So basically all you did is put on a tie and comb your hair, and at some point there was a bagel involved?

Analyst Day Breakdown (Originally Posted: 05/17/2007)

As a 1st yr. analyst, how much time is actually spent on pure valuation work (DCFs, multiples, etc.) This board gives me the impression that you're pretty much glued to an excel spreadsheet all day running things like comps....is this true?

What are some of the other major day-to-day responsibilities (i.e. drafting prospectuses, creating data mines?) For the current analysts, whats the most interesting project you've worked on so far and how far into your start date did you get to do it?

i would also love to know some of this info

I hope some1 can respond to this answer I am interested to know. -Thanks

comps are the most painful things to do in my opinion...

Valuation seemed a lot more exciting before I started actually doing it.

expired post free bananas

honestly if you are in an industry group you wont spend most of your time on models, even in a product group. i guess a lot of stuff is just random research, recombining powerpoints, updating financial data, combing through brokers reports and all. and yes it all gets repetetive and somehow boring after a while. execution is probably the part where you dive into the models more in detail and work with all other involved parties (lawyers, auditors, seller/buyer).

ofourse pitches involve pre-evaluation and models but usually you run a template and just update the numbers.

This is extremely accurate for 98% of my days, especially since I'm in an industry group.

ok sorry, this thread is totally old, haha

Do you do more valuation work in industry groups where it might be trickier, like healthcare?

I often wonder whether IB analysts actually regularly work as long as this....

Day as an Investment Banking Analyst (Originally Posted: 07/27/2009)

Luckily, I don't work as an analyst anymore, but I spent just over an year in IB. I can relate to the story below, albeit, I didn't hate it as much as the writer did. I'm surprised more analysts don't write on this forum how much bs the profession actually is. People honestly hate their jobs, so make sure you guys who are just starting (or interviewing in the fall) know what you are getting yourself into.

http://www.associatedcontent.com/article/1942156/life_as_an_investment_…

Comments?

Depends on how long it takes you to put on your tie.

I wonder if anyone else got this reference...

Her first page sounds like me. I don't want her to ruin it though so I stopped :D

boo hoo.

9am to 1:30AM? Pussy.

I'm making it up as I go along.

Most ppl who read it, like the author did to other articles, will probably ignore it with their ego.

This is why chicks don't belong in finance.

Who told the author to live 1.5 hours away from work? How about living 30 mins away from work and getting 2 more hours of sleep or "me time?"

My thoughts exactly. I'm a college student, so I'm clearly not going to claim I know anything, but what I can say is that her story screams she wasn't ready to make any sacrifices for getting the IB takeaways, including the 6 figures. The way she takes pride in bringing in lunch herself, the fact she lives 1.5hrs away and refuses to move to make it work, she hates her coworkers because her old friends are obviously better, etc. No idea where she worked either.

Call it an ego, I think it's rationality. Until the day all investment bankers across the globe decide to quit their job because it's unbearable and not worth it, I think it's at least worth finding out whether it's a fit for me.

Weak.

5 hours of sleep?! Pfft, thats more than enough.

given N.Yang is her name, and given her 1.5 hr commute, (always found azn kids from tri state are more likely to commute) she sounds like the typical asian girl (applies to all asian kids who are over driven by their parents to become silent curve killers) who burned out right after she left the comfort zone of school. The first page made it clear that she was book smart and extremely motivated in class. But it sounded like banking wasnt what she wanted to do, she just assumed that banking is great - her parents probablly had something to do with that.

She should have spent the better portion of her college tryign to figure out if banking was actually for her instead of finding out four months into a job to realize she hates it. For all the preparation she did, im amazed she didnt realize all the "tedious work" she was about to be given the first few months. Anyways, how does it takes 14 hours to put together what sounded like 2 pages on a PP slide? She's probablly a smart person but if she stuck it out longer and got along better with her coworkers, the tedious work would have gotten by faster, she would have gotten better assignments, and work might have been a lil more enjoyable. I mean, staying in the office late isnt nearly as bad when you have a friend in the office doing the samething. She made it sound like she hated everybody in her office, and vice versa. Of course IB, already stressful, is going to be a bitch to put up with in that kind of environment.

I sympathize with the author, but the fact is, if you're getting paid 6 figures as a 22-year-old punk kid with no real, actual skills, then there is a REASON for it. Nothing is free. Making twice the median 4-person household income at the age of 22 comes with sacrifices. I see nothing wrong at all with what she was forced to do on the job--in fact, she should be lucky it's that good.

Me: "What's lifestyle of an associate?" Ex-Bear Associate: "No lifestyle, forget about any life or style."

She got hired in Spring of 2008, not the Fall of 2007. if she went to target school, she got dinged from every BB, elite/MM boutiques, because other applicants were better.

No matter how much you study, you cannot learn common fucking sense... Clearly she didn't study shit about lifestyle if she was surprised by this fact.P.S.: $9 sandwich * 4 days/week * 50 weeks = $1,800 for a whole yea. "TONS" of money for someone who made over $100,000

Maybe I missed something in the article, but who only eats 1 sandwich all day, and only 4 days a week? Food costs are much more than that.

"The only thing you can mess up are the numbers, which I did on quite a few occasions due to the stress and general tiredness. This created an atmosphere of distrust between my coworkers and I, which made things incredibly stressful."

LOL. Man she would have got owned so bad on a trade floor.

“Do research on a company. Look through their websites and annual reports for what kind of businesses they have, and how they make money. This is usually the worst part, because you have to actually read through all the bull corporations type up about themselves. I swear I've read "being committed to customer service" at least 50 times that I recognize it as one word now. Incredibly tedious.”

I love researching companies. Why the f would anyone do banking if they didn’t want to research companies?

No intellectual curiosity. A lot of grade jocks just like rote memorization and spitting out canned answers. Zero interest in learning – just want the “attaboy” that comes with a good grade.

If she had stuck with it, she would have realized that you don’t do your research on the website, and that there are only a couple of relevant sections of the 10K (as far as understanding the operations/fundamental drivers).

She's not a very good writer imo. There's a difference between bitching and reporting and it seemed a lot more like the former, which is generally less enjoyable to read.

I don't know. Some things like that JPM NatRes summer analyst having a seizure after being in the office almost 3 days straight make you wonder. A lot of groups and MDs really take the whole 'work hard play hard' thing way too far. Especially now that bonuses are likely to stay at a somewhat lower level for a while, a lot of it seems unnecessary.

taylorman_23, I have a friend who has seizures if she does not have a good night sleep. One time we stayed up till 2AM doing homework for 2 upper math classes, and she joked about her very rare seizures (the last one was over a year ago). I didn't see her in my math classes next morning: she had a seizure in the morning.

My point is, chances are, that SA had seizures in the past, but they were very rare because he was taking meds/sleeping well. He got into banking and after 3 days of bad sleep his body said "F@&k you."

Don't see how that takes away from the point that if a summer intern is working 72 hours straight when dealflow is relatively low to average, something's wrong with the business model.

Agreed. However, in this case it should be pretty easy to spot - the intern was given a project that had absolutely no purpose other than "prove to us what you've learned this summer so we can properly evaluate you for a FT offer". We have the same thing at my bank - it's a 10 page PPT presentation on a public company and it's retarded.

this is sorta unrelated, but anyone here have any idea why this was the case? are trading jobs "less competitive"?

No they are not less compeditive, but I would guess they value quant skills more.

What a fucking loser. Turned their piss into her ethanol?

Yeah, in the end they ended up drowning her in more piss than one of those rape/golden shower/shit eating Japanese pornos.

Turn that into ethanol. Haha. What a tool.

When did this happen? I used to be in that group and never heard that story (although they told some other horror stories from "the early days").

...is this really what a banking analyst does in a typical day? Sounds really easy and stress free actually. Five hours to go on a company website and come up with a 3 sentence description of what they do? Sounds like a 20 minute project, certainly not something to get stressed out about. It sucks that you guys have to sit there so many hours but with jobs like this stress really cant be a problem.

Didn't need to read any further than "their daughter earned 6 digits"

I had to agree that girls really dont belong to IB world. at least not for below average looking girl..they grow old quickly after long hours of work and no social life....if shes not attractive, it could be hell for her...that being said if shes hot she could end up marrying a rich old MD though...

SOFT

she only mentioned getting lunch. and i wouldnt want to have a sandwich every day of the week...i think 3 or 4 is pretty reasonable but all 5/potentially 6 days?

Interesting comments.

My take is:

I think this article is a good article for kids that are at a TARGET school. The reason I say this is bc at a target you get pressured to go into IB. Your prof, your peers, the prestige, etc... Clearly it is not for everybody. If you have a choice, go into management consulting, if not then prepare for the ride! I'm in PE now, but the hours are only marginally better, but the work is much more interesting... buyside,strong-side.

Tell me something I didn't know

To think IB is the most tedious job one could fathom would require never having worked a legit job in your life. The vast majority of jobs out there involve copious amounts of BS, and don't pay you nearly as much for handling it.

Agree with GoodBread

Sounds like a spoilt little girl who threw a tantrum after 4 months cos she couldn't get along with her co-workers. really, did she inspect to be coordinating deals as a 22 year old geek?

I'm actually starting to feel bad for her lol

I would say that a 2 to 3 months internship would have been better for her to realize that Investment Banking is a TOUGH world.

Not everybody is done for this work and there is, in my opinion, no shame to say "Well, I thought I could make it, but it is not for me" instead of "Dreaming her life as an Investment Banker and finally get burned"

Obviously hours are brutal for analysts and associates. However, I was wondering how VP and MD hours are like in banking?

As far as I've heard, it gets somewhat better but never under 60/week. I'm sure someone else could offer more detail.

weak.. who actually picks up dinner from the restaurant?

lol check out some of other articles by this author, M. Yang.

Hating on the I-Clicker "If you go to a college or university that requires the use of an i-Clicker, I'll say it right now: I feel your pain. What is the point exactly of these phalluses of cheating, absenteeism, and general injustice in the classroom?"

and of course

How to Get a Job in Finance "It's not easy to get a job in finance, especially with the recession. However, with perseverance, organization, and confidence, you can do it too with these five steps. Happy searching!"

is she really in a position to tell anyone how to get a job in finance when she only got one interview and failed miserably after a few months? i know exactly her type. legions of these asians infest the front rows of my target school's economics classes, but of course ill NEVER see a single one of them out at the bar. while they do screw up our curves, i am much more worried about interviewing against the polished, hard working frat guy than the neurotic, uptight asian. i cant think of a single one of them who got a job this year (except in Hong Kong), probably because most banks have learned their lesson by now and know better than to hire them.

To BornAgainBanker

What's with your racism and generalizations? Did you learn anything from your liberal education?

Don't pass the blame or make excuses for your shitty gpa. It's your fault you were out getting shitfaced before an exam. The ability to down shots does not correlate with intelligence nor social skills.

What's up with nerds vs jocks, party-animals vs bookworms? There are students who both party like animals, and then set curves on calc midterms, and there are jocks who set the records, and have stellar grades. Those are the students you should be afraid of the most.

P.S.: Once I saw an extremely hot girl in one of my classes. She looked like a typical sorority girl. She also had a 3.9, graduated with highest honor in Math, and now she is in MIT (full-ride w/o TAing).

I am a female I-banking associate and let me start by saying that women can handle the schedule, if they have common sense.

1. The only reason why people like that get their feelings hurt on Wall Street is because they want to make 40k a month and work 40 hours a week. She needs to get real or go teach third grade.

I've been on Wall Street since 04 and the working hours are very inflated. I maybe work hell weeks once every 2 months, other than that it's 7-6 and out by 4 on Fridays. Most people that work 18h days are including their 2h client lunches and 2h happy hour and 90 minutes they spend cheating on their signifant others in that workday. Cut the crap people

She's not smart enough to be on Wall Street anyway or she's making the whole story up. The first thing you learn as an intern or 1st year coffee-getter is to live within 15 mins of the office. I have never heard of a 1st year analyst willing to live 90 mins from work. I lived in a yoghurt cup the first year but at least it was 6 blocks from Wall Street

I have to disagree with your statement around working hours. I am an analyst and I have never been out of the office by 7pm or 4pm at Friday's. It will of course depend on the bank, but to all you prospective bankers expect to work at least 14-15 hours on average everyday in BB banks.

What in god's name are you talking about, pumpkin?

7 to 6? out by 4 on Fridays? You must work on the middle eastern exotic camel futures desk.

BornAgainBanker is probably right, believe it or not. The asians I've seen that have really succeeded are the Americanized type--that is, born and raised in the U.S. and are so Americanized that they themselves have a hard time distinguishing themselves as anything but a white American. The ones that are asian or semi-asian cultured have not done so well--in my observation--in the work world. In fact, I can't think of any, and I have worked at some VERY diverse shops. But I have seen some very successful Americanized Asians.

With a 2.5 I highly doubt that you've worked at many of the top tier shops. Just saying...

But yes, I do agree that more social Asians tend to perform better in finance. It's the same with any race though... Smart and outgoing>Smart and nerdy.

Well, jackass, starting Monday (I'm switching jobs), I'll be working with the one of the strongest banks on the planet as an associate in its commercial real estate capital division. See, in AMERICA, RESULTS matter, not one's GPA from years ago. You bleeding heart jackasses think you're entitled to jobs because of your grades or school prestige--the rest of us Americans know that we are entitled to nothing but to work hard and produce results.

Dude, you went to a shitty state school and your grades put you near the bottom of your class. You got a job in a booming economy at some boutique firm in Washington. Whoop-de-fucking-do.

Results? I've done extremely well both on the job and in school; I've shown results when given the opportunity, and unlike you don't have "failure" stamped on my college transcript. I'm not a liberal by any means, don't go to a crap school like Vanderbilt, consider a 3.6 laughable and I have never taken a women's studies course. Furthermore, I actually agreed with your assertion; I believe that being social is a key to succeeding in the corporate world and that nerds don't get very far. Perhaps your 2.5 includes a C or two in an english class--reading comprehension certainly isn't your forte.

I was only attacking your claim that you worked for a variety "very elite" shops with a 2.5 from VTech. And, I was right to do so. You're starting Monday at a supposedly "top" firm. Since you didn't say you are coming from a "top" firm, I can safely assume that you don't have the experience you claim you've had.

You've got quite a chip on your shoulder there, Chip.

What does being American have to do with it? It's not like it's the only culture that believes in meritocracy. You're the one that sounds like a xenophobic jackass.

I'm not xenophobic per se. As a white American, I'm probably more anti-European than anything else. I just get sick of these stupid f*cking bleeding heart pieces of garbage who think they are entitled to a big time job because they got a 3.6 GPA in political science at Vanderbilt. Whoopti-flippin'-do. The rest of us, ya know, actually EARNED our jobs through, ya know, revenue production and value adding, not through getting a B+ in Women's Studies.

It's a typical liberal tactic--ignore the argument--that cultural asians don't do well in American corporate business--and attack the messenger. If you disagree with the assertion, argue the point, don't attack my GPA. It's foolish.

Are you equating a 3.6 at fucking vanderbilt with intelligence? My retarded cousins gay niece's sorority sisters could get a 3.6 at vanderbilt. you are right that grades are correlated with how hard you work - literally anyone with a decent IQ could get a 4.0 at harvard if they cared to study. but that's no excuse to pretend that getting a 2.5 is anything but your fault for being too lazy to at least show up for the final.

You need to chill out. If you got a good offer despite a shitty GPA, good for you. I'm happy. His point was not that you have a low GPA, rather he made the assumption that with a low GPA, you did not work at a high-tier representative firm, and thus your observation was unreliable. Usually, such an assumption is pretty accurate - typically you need a high GPA to get into IB. If it doesn't apply to you like you say, that's great. Why are you so fucking defensive?

Also, I love how you assume people received a GPA with no effort, whereas you "EARNED" your job. Did you consider that your GPA is a result of your intelligence and effort? You EARN your GPA. You don't receive it. And nobody says they are entitled to a job if they have a high GPA. Everybody knows you need a solid experience and that GPA is not the be all end all, and I don't know why you brought this up. And what the fuck do Europeans have to do with this?

Bottom line, GPA helps your chances a lot, but does not define them.

Wow, did you guys completely miss everything that was said? The argument/hypothesis/assertion: cultural asians (not Americanized asians--CULTURAL asians) typically do not succeed in corporate AMERICA despite their stellar performance in school. I, as well as a few others here, made that assertion based on our WORK experiences. To rebut that assertion, some schmuck said I obviously have no experience to compare it to because of my college GPA. So, instead of debating the point, I was called out for my GPA--which is totally irrelevant and has had no material impact on my life whatsoever except for when my friends rip on me when hanging out.

I couldn't give a flying phuk about your GPA or who earned it or the fact that I was lazy in college--or that 3.6 at Vanderbilt is easy. I don't care. That wasn't the point. The point is--when you're 19-years-old and have zero real world experience, you need to think twice about the knee jerk politically correct reaction because you have NO idea and NOTHING to compare it to. In addition, if my GPA had been 1.2 at the local community college, it wouldn't make the argument any less valid. It's a horrible--and often used--debating mechanism of bleeding heart liberals. I believe the term is ad hominem attacks which are totally invalid arguments. If you want to debate the point, fine--point out to me Liu Chang who is CEO/CFO of the XXX company.

the bottom line is that generalizing an entire race is just ridiculous. it's not even the ~cultured argument~ you make it out to be...it's like that whole asian stereotype that you're going on about and that's pretty low

Read the post above you, buddy.

Dow Kim and Vikram Pandit did pretty well in Corporate America, and they are Korean or Indian first. Or even Indra Nooyi at Pepsi. I am sure there are many more examples of non-US Asians reaching the pinnacle in Corporate America, and probably outnumbers Asians born in US and more Americanized. So there you go VTech, solid proofs.

Exceptions don't prove the rule. You really think I believe that there isn't a single non-US asian top performer in corporate America? Come on.

Yeah, you've done REAL well for yourself on the JOB--prospective monkey. Where do you work? The research lab at Northeastern?

I don't work at a top firm now--you're right. It's a TARP institution that, as late as 2006, was considered a top institution. But I'll grant you that it is a shell of what it used to be, which is why I'm bailing out for greener pastures. Nevertheless, the point remains that I can't think of a single cultural asian that I have worked with that has done anything outside of the classroom in my line of work.

I work at a better firm than you'll ever even get a chance to interview at. That's all I need to say.

Can someone point out to me the bleeding heart liberals in the room? I'm having difficult finding them.

I've kind of lost your point though. You dislike the asians who try really hard and have no social skills - so what? If I dislike someone, I beat them. Getting a 2.5 at a shitty school and going to a half-decent bank does not sound to me like you beat anyone in my book. If you're so confident these FOB asians are no good, why are they ahead of you?

Dude, what are you talking about? You pretty much have put words in my mouth that I hate asians. One of my best friends in the world is asian. Making an assertion about cultural asians based on observation isn't akin to "hatred" of asians. If I'm so confident these FOB asians are no good, why are they ahead of me? Who is ahead of what? What are you talking about? I genuinely have no idea what you're talking about.

FOB asians I've found to be ridiculously nice and hardworking. Perfect employees. From my observation, however, "FOB" asians are not front-office, client-facing, schmoozing and boozing future executives. That's not hatred--that's a general rule with plenty of exceptions. I don't know how my college GPA from years ago comes into this argument at all.

sounds like that person's trying to turn resentment of one's own failure into racism

Va Tech, the 'engineering is more rigorous coursework' argument only works for people with a GPA above Tryna's from Monroe College, and not so much for in-bred evangelicals. Its clear that while you've supposedly landed at the greatest shop in the universe, you'll last there about as long as your anal virginity lasted in Sunday school when you were 9... about a year. Don't be disheartened though, you can always sue your Hokie alma mater for selling you a bill of goods.

'Cultural' foreigners who've made it big in banking/PE -

Vikram Pandit Anshu Jain Vishwas Raghavan George Boutros Walid Chammah

Also a million VC guys.

I have no idea where this guy is coming from with the whole 'bleeding heart liberal' and AMURRICA crap, but I've rarely come across anyone as easy to dislike on this forum.

How has no one mentioned Chinh Chu?

Completely agree with the latter part of your post. It's so very easy to find reasons not to like this guy.

can't we just fucking get along. here it is.. if everything is all being equal gpa, experience, etc.. people are going to generally want to choose the americanized asian rather than the fob asian. mainly because american asians are more relatable...

i'm only a student but i assume most bankers want to hang out with an americanized asian instead of a fob when there in the office 14/15 hrs a day. am i right or wrong?

VTech, with all due respect you are an idiot. No, not because you went to Vtech (which is laughable), or because you got a 2.5, but because you are delirious.

You probably work at a 'valuations' firm that is 'growing'. You are right though- results matter. Here is how you stack up:

College - VTech = Absolute shit. It almost disgusts me to type it. GPA - 2.5 = Special ed-like gpa. I could have gotten a 2.5 if i only showed up for tests...and I went to Cornell. It's just some random ivy, in case you are unsure.

Hey based on your RESULTS, looks like you EARNED your job.

Holla back office?

Well said.

Va Tech, while you talk about how easy it is to get a 3.6 at Vanderbuilt... you likely couldn't even get into Vanderbuilt if you're going to Va Tech of all places, and even there you got a fucking 2.5.

Wow this thread has been completely hijacked off course.

Incoming Analyst - A New Life (Originally Posted: 06/15/2016)

Hi All,

Hope you all are enjoying the summer. To everyone starting FT, congrats!

I'm a recent grad with no previous IB/Finance experience that got a FT offer for a Japanese IB in NYC. Does anyone have any tips or advice to share for someone who's completely clueless? What are some things you wish you'd known when starting off?

Also, just learned I have to pass Series 79 and 63 in about a month - any tips for studying for those exams?

Thanks all, and hoping to stay in touch!

Apart from the Woodford reserve i'd say this is pretty spot on. Banking hours are really 5pm-2am anyways

Will this bank put you through a training program? If so, you really do not need to prepare before.

As for the 79 and 63, they're a piece of cake if you study. You will take the 79 first, and then after you pass that, you'll take the 63. When you get the prep books for them, read through them twice and take detailed notes. Then read through the notes twice. Go through the practice tests and study every question that you miss. Then, read your notes again and take the tests a second time. If you're passing in the high 70s or low 80s at this point, you're good to go.

Hi there,

Thanks so much for taking the time to reply. Yes, the bank does have a training program. What I'm more worried about is knowing even the basics of finance/accounting and also financial modeling. I've never done modeling before, so I'm a bit nervous because I'll be going in with kids most of whom have done IB internships (I come from a strategy consulting background).

And for Series 79 and Series 63, I just received the study material for them today! The bank has partnered up with Knopman Marks - I hear good things about them, so I'm content.

How much time would you suggest one spends studying for Series 79 on average (in terms of either hours or weeks)? Thanks again for your help!

You will never burn bridges by working hard and keeping humble.

Don't joke around or try to get friendly with anyone who's not a first year until you've figured out the politics of your specific bank. For the first few weeks, just work hard and study your environment carefully.

Some good points but I thought I'd add some comments.

In terms of working hard, work hard, but within reason. If you hang around when you don't need to be there, it will often make a bad impression. And your work quality will deteriorate.

Other tips - print off things to find mistakes, spell check everything quickly, renumber pages, organize folders and file names properly (with dates), format colors using rbg. Understand the principle of discounting. Learn the most efficient ways of looking up research, which depends on the region / group / bank. Honestly, those things are more important than modeling in your first few months.

Not sure if I have enough posts, but I'd be happy to chat privately and give my perspective if you want.

Everyone on this forum should read and remember number 1.

Konichiwa bro, you have very good english

"engrish"

I did about 3 hours a week for 8 weeks and then crammed the day before 4 79. 63 requires less volume but you have to pay attention to the details,

If have a pal at SMBC who says they, and most Japanese banks, are a very FaceTime culture. So I would plan on spending a lot of hours to start. You can use that to your advantage to explore modeling and not uber stress about it now.

Interesting that you say that. I actually have some experience working with Japanese companies and I've seen an odd culture a couple times where they have a very weird code about being at your desk at exactly 8 and getting out of the office at exactly 5:30 - and they enforce it. I remember a couple of workers liked it and others complained about constantly taking their work home with them.

As far as those tests go just study and study some more. Don't try to underestimate them and study the least amount necessary. The 79 isn't very difficult if you have at least some basic knowledge on investment banking, but the series 63 is purely memorization - nobody just knows that stuff.

Well done, congratulations, and most importantly; good luck!

I have decided to call time on my pursuits in finance (for the meantime) and go travelling.

Goldman banker spotted -- only one with DRG group... lazy bums lmao

What is life like as an analyst in NYC (Originally Posted: 01/18/2010)

I am 17 years old and in high school. I just care about making a shit load of money and getting a lot of pussy. I was just wondering if becoming an analyst will make this come true. I am a bright kid as well.

Models and bottles... look it up.

LOL

.... says energy_fin_guy.

I say you evolve into a monkey type of man and eat bananas, then go to bschool and become and IB associate.

This is funny. I think you should join the military. Go Air Force and fly jets. Girls love that shit. You won't be rich but how many analysts gets to fly an F-22 fighter jet?

troll

by "17 years old and in high school" do you mean 24 year old, unemployed hipster?

No, I am not a 24 year old hipster, I am a junior in high school who doesn't come from money and is sick of living this way. I just want to make as much money as I can.

That statement alone reflects your burgeoning intelligence...

You should just become a drug dealer. Fast money without a lot of working and then pimp on the side. Once you start making decent money have people go sell the drugs for you. Buy some nice commercial real estate and set up a fake company. Sit inside the office doing coke all day with strippers and packaging drugs. Than get some trucks to start moving a lot of drugs around. Get shot, killed, or in jail and you lived a pretty exciting life. You will get pussy and lots of money.

I think the part you left out is that your comp came out bottom bucket last year. I've never seen a top bucket pure M&A analysts do pitch work.

... Or this is a great troll.

It's obviously a joke... albeit, a terrible one, but an attempt nonetheless.

One word. Baller.

Gay. Try hard much?

2:00 AM -- Take a huge load on my face at a gay club in West Village

Que?

3:00am cry myself to sleep.

LSO was better but we take what we can get

Yup...

leave it to the pros kid

Bryant Park?

Why not just come out and say you work at BAML?

Do we really need a knockoff FTB? He does this schtick way better than you do.

honestly cringed while reading this

You know this is bullshit when you see "My model is balancing and everything is looking good"

Reality:

2hrs later: model built but isn't balancing. 2.5hrs later: checked every formula. Caught two mistakes in the balance sheet. Model still didn't balance. 3hrs later: rechecked every formula. Model still didn't balance. Bang head on desk. 4hrs later: redid model. Still doesn't balance. Contemplate quitting. 4.5hrs later: caught small calculation error. Model now balances. Cry self to sleep.

to be 100% honest, in my entire analyst career, i've never needed to actually project out a balance sheet. all you need is a fcf build.

Reality:

2hrs later: model built but isn't balancing. 2.5hrs later: checked every formula. Caught two mistakes in the balance sheet. Model still doesn't balance. 3hrs later: rechecked every formula. Model still doesn't balance. Bang head on desk. 4hrs later: redid model. Still doesn't balance. Contemplate life choices. 4.5hrs later: caught small calculation error. Model now balances. Cry self to sleep.

Brutal reality.

Sounds like a guy from the equity department in Dallas.

I'm smelling some @fear the bulge influence on this one

.

Iure eos est odit. Quia eius ratione sint molestias. Sunt doloribus doloremque perferendis tempora tempore. Laboriosam dolor accusamus excepturi et.

Velit ipsum omnis quos est a. Ullam sit fugit dolor sit autem nihil et. Possimus iste eius necessitatibus qui soluta modi iusto.

Saepe et soluta doloremque et fugit consequatur. Et autem est esse dignissimos corporis est harum. Qui ut ab voluptatem et voluptas sequi numquam. Nemo doloribus quasi ea odio. Pariatur ut dolorum ipsum corrupti doloremque facilis porro.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Labore provident cumque eos voluptatem enim officia omnis. Inventore consectetur ut totam saepe sint tempore totam. Dolores quis ipsum explicabo architecto quis culpa alias. Qui doloremque maiores et tempore quas. Quidem quia et aliquid autem culpa. Modi sapiente repellat dicta totam.

Autem recusandae et qui velit nam. Rerum eum nam quis cupiditate. Aut fugiat consequatur quo ut nisi quia earum. Quis voluptatem voluptatem deleniti. Laborum nesciunt excepturi voluptatem dolorem.

Reiciendis quasi voluptas odit in. Asperiores quae autem corporis molestiae temporibus natus. Tenetur quibusdam ut omnis a et magnam dolores.

Dolor veniam doloremque vitae corrupti qui. Voluptatem esse aut mollitia aliquid et assumenda eligendi. Fugiat officiis saepe aut voluptatem.

Qui vel unde fugiat id esse et minus dolores. Dolores eum id vero pariatur tempora. Nihil eaque doloremque veniam adipisci dolorem distinctio. Ut est aut aut voluptates. Consectetur vero dolore aut odit aut ea dignissimos atque.

Sequi qui recusandae consequatur hic eum tenetur. Pariatur et maxime nisi sit et aut qui. Asperiores voluptate iste optio nesciunt illum et ea. Eaque quasi qui porro qui. Sed commodi nobis ipsa. Sed ab architecto tenetur consequatur eaque sed.

Rerum molestiae aut ea laboriosam tenetur eos. Culpa dolorum suscipit voluptas molestiae amet. Ullam ex molestiae itaque eligendi illo aut eum eum. Voluptatem sint at architecto veritatis cum iure.

Facere omnis aliquid enim ut a aut. Alias dicta et provident doloremque aut. Repellat quo voluptas assumenda commodi aperiam. Dolorem quaerat voluptatem est temporibus ex.

Accusamus dolorum quia optio quod ducimus officiis ad et. Excepturi et similique voluptates unde pariatur fugit. Sapiente maiores voluptates et et. Et qui est saepe et.

Neque non rerum eligendi explicabo assumenda libero. Impedit officiis in maxime impedit sit harum blanditiis. Nulla nihil ipsa sint eaque aperiam aspernatur amet. Ex sit delectus architecto.

Autem culpa et et recusandae. Cumque amet voluptatibus magnam. Vel et cumque doloribus possimus eos. Quae et voluptate et corporis.

Ducimus ipsa eum qui saepe omnis. Quia eaque ipsum rerum. Accusamus beatae nihil et placeat distinctio dolor cupiditate. Dolores aut modi quo corrupti. Nesciunt exercitationem voluptas nisi dicta non amet.

Dolorum explicabo sit eos voluptate esse ex. Sunt praesentium odit quia. Voluptates aut aut laborum.