Bain Capital Sankaty Advisors

I'm a junior at a non-target. I have 4 finance internships (have interned somewhere every semester I have been in school). This past summer I was at a top ER firm in a top team in NYC. Got the offer to go back but not for me.

A few questions about Sankaty Advisors, now known as Bain Capital Credit:

Anyone Have In-depth Knowledge of Bain Capital Credit Jobs?

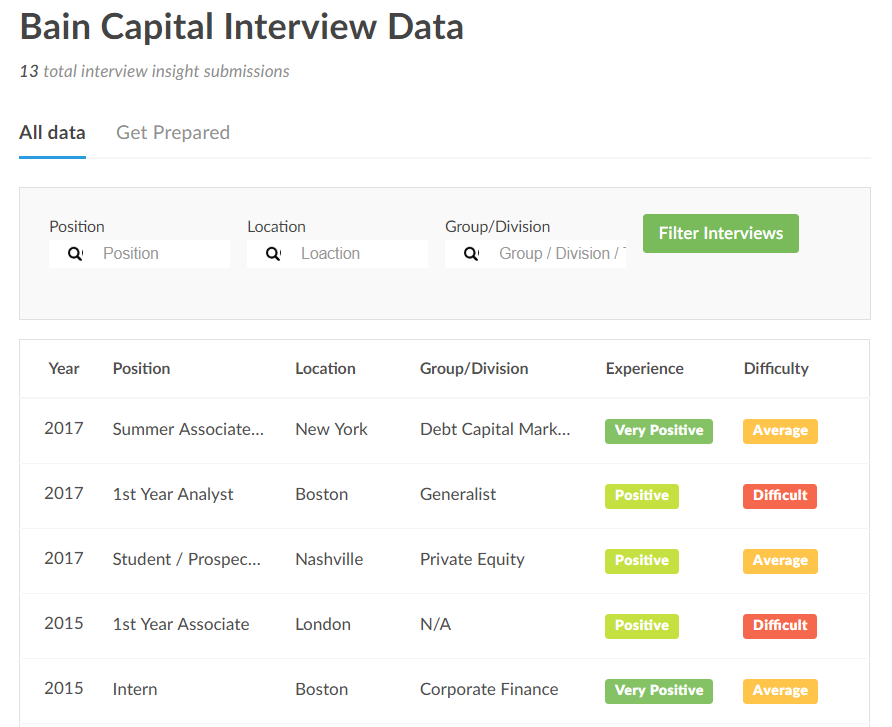

Interviews (see WSO company database interview feedback for Bain in the image on the right) with Bain Capital Credit represents a unique opportunity because candidates needs to be comfortable with both case interviews as well as:

- Leveraged finance

- Distressed debt

- Senior secured loans

- Capital structures

- Leverage ratios

- Credit quality

- LBO

Does Bain Capital Credit Only Recruit from Ivies?

Yes Wall Street in general is Ivy-oriented, but there are non-targets at all your BBs. When I search Sankaty on LinkedIn, I find one guy from Notre Dame-everyone else is Ivy for Bachelors or rebranded via a Masters. I only have one contact (analyst) at Sankaty (non alum). He's given my resume to HR but not sure if that 100% qualifies me for guaranteed first round. If I get the interview, I'll work my butt off and do my best to kill it, but am I wasting my time?

Elites give you the best bet, but there are employees from Notre Dame and Ross who work for the firm.

What’s the Best Way to Prep for Case Interviews?

In addition to brushing up on your distressed debt technicals, make sure you’re also well versed in the case interview format.

Junior in college, a non-target at that, and looking at Bain? You need to refocus your search.

this part of bain hires undergrads. it's a reasonable goal

Can you elaborate? Which of the following do you mean (perhaps all):

1) There is such a little chance to get into Bain out of undergrad in general that I should focus on things more attainable?

or

2) Since BCSA is basically a distressed debt hedge fund-this is already a very niche field, and it is tough to pick up the skills required in order to join this firm out of undergrad without real experience first-and I should focus on getting some building blocks?

Let me know. Feel free to spell out what you mean dude.

Okay, maybe I can shed some light on this. I actually interviewed with Sankaty in London a couple of years ago for their internship programme. I got to the final round interview stage ( I believe there were 4 of us in that round going for one position).

Personally, I'm not sure what your chances are coming from a non-target, though I am finishing up a liberal arts equivalent degree from a UK target, and given my previous internship experience in ER at a BB, I was able to land a first round, and progress to the final - so I wouldn't worry too much - they are also likely to receive only a fraction of the number of applicants as a BB.

Aside from the obvious information that you could glean from the site - most of their positions are in senior secured loans rather than in bankruptcy or restructuring plays (a la Oaktree). You'll need to be comfortable not only in a case interview setting, but also be familiar with the nuances of corporate structures, leverage ratios, and to understand the factors that might impact the quality of a credit. It is different to ER in several ways, and if you're wondering where to start, I can recommend a couple of books which will help:

http://www.Amazon.com/Leveraged-Financial-Markets-Comprehensive-Instruments/dp/0071746684/ref=sr_1_1?ie=UTF8&qid=1385938124&sr=8-1&keywords=leveraged+financial+markets

and:

http://www.Amazon.com/Pragmatists-Guide-Leveraged-Finance-paperback/dp/0133552764/ref=sr_1_1?ie=UTF8&qid=1385938144&sr=8-1&keywords=a+pragmatist%27s+guide+to+leveraged+finance

You won't need to get the Moyer book, but the above two names are very helpful in terms of defining terms and giving you an idea of what to expect when reading a bond indenture.

Interviews: My first round consisted of two short 30 minute interviews with two associates - both of whom were ex-Bainies, and it was very relaxed - I was asked to do a market sizing question for each - to be honest, it was pretty easy. My advice to you would be to ask some very intelligent questions from things you may have picked up from reading the books above ( I did, and believe that was the reason I was progressed to the second round - a VP actually brought up the question when I interviewed in the second round.)

My second (final) round was more intense - there were 5 interviews, one of which was a written case interview where I had to decide which of 4 credits I would invest in (30 mins preparation). There isn't a huge slide deck, but make sure that you use your time effectively - as you will have to present your findings to a VP after 30 mins. Focus not only on leverage ratios, but also try to have a think about the dynamics of the industries that they are in etc. My other interviews were a mixture of case and competency.

I didn't get the role, although it was a fun and interesting experience, and I learned a tremendous amount from it.

I hope this has been of some help, and good luck!

SB appreciated :)

i would recommend this highly: http://www.Amazon.co.uk/European-Debt-Restructuring-Handbook-Post-Lehman/dp/1905783655

Probably going to be difficult to get the interview from a non-target, but I don't think it's a complete waste of time since you've had good internships and are getting your resume forwarded. I do think it's unlikely you'll get the interview though, but not impossible

SB'd. Out of interest, how did you get the first round with Sankaty?

I did not get a first round. I hope to get a first round when interviewing starts though haha.

It isn't super Ivy, but elite schools give you the best shot. I know guys from Notre Dame and Ross that worked there.

Exit Opps into MM PE are strongest, though I'm sure DD/SS HFs, IB and MBB is possible.

This is bad advice.

To the OP - your chances are probably slim, but so are everybody's, even if you're at a top target and it sounds like you have solid experience. Work your ass off preparing regardless, because at the end of the day entry level investing interviews are all pretty much the same anyway, so the work you put in preparing is going to help you out elsewhere too. Emios' advice as to how to prepare is pretty spot on and a good place to start.

Really? That was an opinion, not advice. Thanks for adding so much.

Do you what the best inroads are for experienced hires at Sankaty?

Networking.

Sankaty Advisors: first round interviews? (Originally Posted: 01/25/2012)

I was notified today that I received a first round interview for Sankaty Advisors - the debt investment arm of Bain Capital. I am kind of worried for this interview and would appreciate some insight.

I have Case in Point so I am going to review/study that to prep for the case component (though I don't know if a week of prep will be enough).

Can you guys help me out on the other two points? Links/recommended reading would be great.

Oxbridge?

Incase you didnt see it

http://www.wallstreetoasis.com/forums/free-distressed-ebook

Good luck on the interview. If you work there you will learn a lot and get awesome exit opportunities. Their analysts usually go onto other distressed debt funds or HBS.

HHHHHHHHHHAAAAAAAAAAAAAARRRRRRRRRRRRRRVVVVVVVVVVVVVVVVAAAAAAAAAAAAAARRRRRRRRRRRRRRRDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDDD

The firm is pronounced San - duss - kee

I would read the Lev Loan and HY primers just to get up to speed... if you're still in school, doubt they will drill you on convenants

http://www.lcdcomps.com/lcd/f/primers.html

In all seriousness I'm pretty sure it's Sane - ka - te

You should know something about fixed income/debt investing if you have worked at a hedge fund and in cap markets and have a concentration in finance. Kind of confused.

http://www.razume.com/documents/23936

Prepare for it like you would for a MBB interview, but try to have a little understanding of corporate capital structures on top of it.

san-ka-tee (emphasis), like the golf course/lighthouse. funds have a nautical theme. the london guys pronounce the a like they are british, the boston/chicago guys dont

It will be somewhat like a basic consulting interview (could have 2 cases in one interview), with some corporate finance analysis wrapped in. They may give you documents that resemble income statements or similar things and ask you questions around those documents, although my memory is cloudy. Good luck!

hey drummer, have you heard back yet?

SANKATY ADVISORS (Originally Posted: 01/25/2008)

anyone know what the case interviews are like? interviewing for the TMT group, coming from TMT investment banking

my firm works with sankaty on deals. i can't speak about their interview process, but i can tell you that the majority of them come from MC backgrounds. i'd assume that your case interview would be less quant focused and more along the lines of why/why not a investment makes sense. i'm sure you already know this, but they focus on debt.

There are quite a few old posts about Sankaty Advisors, a few of which I have contributed to. I dont know much about the interview process at Sankaty except that it is case study based. You get interview questions like you would at McKinsey or Bain and then coming from a TMT background you will probably get quizzed on the deals you have worked on, especially if you worked on LBO's, which they know well. Good luck!

def helpful; anyone else?

run a bunch of CLOs. Typical credit work, just understand if loans (mostly)/bonds have adequate credit support, cash flow, is the business good/bad, return decent, etc. Can't imagine it would be very tough, they will probably give you a TMT LBO and ask you what you think of the cap structure and if it makes sense to own any part of the cap structure and why (obviosly they'll make you walk through the business, etc), maybe you model out the company and cash flows. Most likely they own the position or are looking at it, they are effectively in every major loan deal (not so good these days). Very similar to work done at a bank in LevFin and credit committee, you'll dig a little more at Sankaty. Good experience, you want to jump to HF after you get a couple of years of experience where you can be more opportunistic. At this point, for all major CLO guys (Sankaty, Highland on CLO side) are just trying to capture spread for equity tranche they own in CLO and are not going to do anything that interesting (they are going to be on a creditors committee b/c they failed to punt loans/bonds gone bad from new issue). Still a good experience and platform to jump from

One of the six interviewers I had during a final round for Bain Capital PE was from Sankaty. I think it was actually a logistics error on their part (since others were interviewing for Sankaty and Brookside on the same day), but the case-style questions he gave me were no different than those I received the during Bain Capital PE interviews, which were typical case questions (though a bit more finance focused - e.g., I was asked to estimate an IRR at one point) that you'd expect to get in an MBB-style interview.

what did you use to prepare for these interviews? like, a McKinsey interview, for instance; what would you use to prepare for this? i have never been in a consulting interview in my life (only banking/finance/etc etc; i have about a year and a half of TMT banking experience), so i am a little lost. what would you recommend?

Years ago, before an interview with Bain I was sent a then-old case interview guide that had been published by Tuck. It is relatively lengthy (~100 pages), but provides some really good color on case interview examples and tips. I wasn't sure how / whether I could post an attachment on this forum, but was able to google the link below, which provides the same file.

http://www.ruf.rice.edu/~jgsmcc/1999-2000_Tuck_Guide_To_Case_Interviews…

As a caveat, my experience with Sankaty was in the context of a single interview. Other interviewers may have been entirely different in their approach...

thanks smuguy97 - nice insights here, and thank you for posting that link.

Haha, I got the same Tuck case guide. Not the same years, but yeah same thing.

I have a buddy that works there (which is why I knew the other stuff). I believe that while they started out with a CLO business, they run at least couple stressed/distressed hedge funds now as well. What everyone else has said about the interview process makes sense though..

I have friends who are working at Sankaty right now, and they do quite a bit of private placement, and run specialty distressed groups as well as mezzanine debt placements where often seats on the board are given. Any group you go to will do a mix of investment management, trading and due diligence for private placement, and despite the credit crunch, it is a great time to have liquidity right now in the credit business; at an hbs conference last week, the big shops were praising Sankaty for being one of the only shops to keep running and getting private deals done.

As for your interviews, they are case interviews, except with a more financial twist. I went to Harvard, and this place was quite prestigious here on campus; the cases are arguably harder than the consulting firms, and it certainly has a more rigorous interview process.

They compete strongly with the top consulting firms and banks, often times with a stronger yield (although its not necessarily appropriate to make that comparison). I know many hires there who had MBB offers but decided to go to Sankaty; Clearly they have strong ties to all the consulting firms.

Great placement afterwards too, because you can stick around Bain Capital in their family of funds or go somewhere else with the skill set.

Sankaty is pretty big at Yale too. My impression is that most people who get MBB and have an interest in finance could get Sankaty, and that most people who get Sankaty could do (at least) one of MBB. I didn't interview there, but work at MBB now and know two guys who have/are going there--sounds like interviews are easier on the strategy type stuff, and harder on the numbers/finance type stuff than MBB. All in all, working at Sankaty seems to do you quite well afterwards in the buy-side, though guys there have told me that it can be tough to do stuff other than debt after. Either way, you'll make a ton of money after, even if you do have to focus on debt in the next two years. Seems like the tradeoff between MBB and Sankaty is that the former gives you good choices in more areas (assuming you work in a good office), while the latter nearly guarantees you ridiculous choices in one area. Sankaty has great lifestyle and pays a shitload.

Haven't heard much about Sankaty at Penn but maybe b/c I'm an ignorant rising sophomore. How great is the lifestlye and how much is a shitload? I'm guessing it would be higher than BB analysts but how much?

I do know they recruit from undergrad here...is it the same in your schools?

They recruit actively at Wharton... pay should be on par with BB analysts. Hours ~70 hrs/week.

Pay at the post-MBB/Banking level is ~$200k... lots of ability to directly impact investment decisions.

thanks for the info. I have seen their posting and all and know that they recruit here but I meant to say that I just haven't heard them being mentioned a whole lot.

I know that they are very prestigious and all. Hours sound great.

Post MBB/banking pay at Sankaty is > 200k (over 300 for the good performers, all in), but it is lower than working at Bain Cap PE, or any other large cap PE shop (which sound like they are closer to 400k all in, with upside potential from levered co-invest, though I could be off on the PE comp figure). Sankaty probably amounts to similar "per hour" pay to large cap PE...

Sankaty lets you become a PM at 25 if you are good. By far the best aspect of it.

25, sweet!

Know of any ex-Sankaty people who have their own funds now?

Sankaty Advisors: a few questions (Originally Posted: 12/01/2013)

I'm a junior at a non-target. I have 4 finance internships (have interned somewhere every semester I've been in school), the latest was ER at a top shop at a top team in NYC, and got the offer to go back but not for me. A few questions about Sankaty.

1) Is there anyone here who has any knowledge about this firm you are willing to share with me? I'd appreciate it if you just threw whatever you know about the firm on here. I've googled and searched wso a ton obviously but I just want a contemporary understanding of what people are thinking. What is your perspective on the firm, and what advice would you give to a non-target who is interested?

2) Is this one of the firms that are super ivy-league oriented?

Yes Wall Street in general is Ivy-oriented, but there are non-targets at all your BBs. When I search Sankaty on LinkedIn, I find one guy from Notre Dame-everyone else is Ivy for Bachelors or rebranded via a Masters. I only have one contact (analyst) at Sankaty (non alum). He's given my resume to HR but not sure if that 100% qualifies me for guaranteed first round. If I get the interview, I'll work my butt off and do my best to kill it, but am I wasting my time?

3) How can I prep for interviews? Case in Point of course but would appreciate ANY advice or thoughts anyone can throw at me.

Thanks in advance.

Interested in 3) with an interview looming.

When you say interview looming-do you know if you have been selected for an interview yet? Slash are you target/non-target school and has Sankaty come on campus at all?

Can only speak of the London office. As you know it's the credit hedge fund of Bain. The office culture is more like the combination of IBD and consulting, as they also brand it a lot. Met a guy at Sankaty from BX PE and he said he personally thinks the work there is more interesting. Don't know what you are looking for, but you might be stuck in the credits side if you start with Sankaty. Make sure you really wanna do it.

At least in London, it's all from targets (Mostly Oxbrdige+LSE). I wouldn't hold too much hope on your friend since he is just an analyst but do prepare when you get the interview.

If you had some great experience they might ask you about a credit model which i have no knowledge of but a friend who got the offer said it's very tough. For case study, I'm sure you have done/seen the revenue & expense model at equity research. That's the same thing. Learn about the way of thinking (bottom up vs top down). I think it should be fine.

Perfect thanks. Can I PM you a quick question?

Hi Xaipe,

That comment was very useful. I have a meeting with somebody at Sankaty London next week. Could I PM you a couple of questions too, if you don't mind.

Thank you!

Not sure why you made two topics but pasting my answer in from the other thread...

Okay, maybe I can shed some light on this. I actually interviewed with Sankaty in London a couple of years ago for their internship programme. I got to the final round interview stage ( I believe there were 4 of us in that round going for one position).

Personally, I'm not sure what your chances are coming from a non-target, though I am finishing up a liberal arts equivalent degree from a UK target, and given my previous internship experience in ER at a BB, I was able to land a first round, and progress to the final - so I wouldn't worry too much - they are also likely to receive only a fraction of the number of applicants as a BB.

Aside from the obvious information that you could glean from the site - most of their positions are in senior secured loans rather than in bankruptcy or restructuring plays (a la Oaktree). You'll need to be comfortable not only in a case interview setting, but also be familiar with the nuances of corporate structures, leverage ratios, and to understand the factors that might impact the quality of a credit. It is different to ER in several ways, and if you're wondering where to start, I can recommend a couple of books which will help:

http://www.Amazon.com/Leveraged-Financial-Markets-Comprehensive-Instruments/dp/0071746684/ref=sr_1_1?ie=UTF8&qid=1385938124&sr=8-1&keywords=leveraged+financial+markets

and:

http://www.Amazon.com/Pragmatists-Guide-Leveraged-Finance-paperback/dp/0133552764/ref=sr_1_1?ie=UTF8&qid=1385938144&sr=8-1&keywords=a+pragmatist%27s+guide+to+leveraged+finance

You won't need to get the Moyer book, but the above two names are very helpful in terms of defining terms and giving you an idea of what to expect when reading a bond indenture.

Interviews: My first round consisted of two short 30 minute interviews with two associates - both of whom were ex-Bainies, and it was very relaxed - I was asked to do a market sizing question for each - to be honest, it was pretty easy. My advice to you would be to ask some very intelligent questions from things you may have picked up from reading the books above ( I did, and believe that was the reason I was progressed to the second round - a VP actually brought up the question when I interviewed in the second round.)

My second (final) round was more intense - there were 5 interviews, one of which was a written case interview where I had to decide which of 4 credits I would invest in (30 mins preparation). There isn't a huge slide deck, but make sure that you use your time effectively - as you will have to present your findings to a VP after 30 mins. Focus not only on leverage ratios, but also try to have a think about the dynamics of the industries that they are in etc. My other interviews were a mixture of case and competency.

I didn't get the role, although it was a fun and interesting experience, and I learned a tremendous amount from it.

I hope this has been of some help, and good luck!

SB appreciated :)

Just a quick question - were the case studies in the 2nd round by any means more complex in comparison to the first round or fairly similar?

They tend to be very selective across all offices, and 95% of the people there have incredible credentials. That being said, they aren't closed-minded about lack of pedigree if you can impress everyone you interview with.

It's one of the if not the best opportunity out of college if you are interested and passionate about investing. As a matter of fact their investment approach is very broad hence contrary to popular perception, you could easily switch to an equity fund after some point as well.

This. Functionally equity level diligence.

Not adding much to this other than it's a really great place to start and that every single person that I know there/have met is from an ivy.

Also a super awesome location ex the food which from I hear gets old quickly/ is overpriced.

Just to give this thread a little bump. Could someone please elaborate on the 2nd round with Sankaty?

I was hoping that someone could elaborate on a few more items about Sankaty.

1) What are the exit opps after a few years? Do people go to other distressed funds? 2) How is living in Boston as compared to New York? 3) You say this is one of the best opportunities out of undergrad, why? 4) What kind of compensation are first years out of undergrad looking at?

Since hon2 answered 1) and 3). Brief answer to 2) and 4).

2) Cheaper 4) Roughly in line with BBs/very slightly above street

@investor1213

If you really want to go into investing, Sankaty is great because you actually have a say in the process. The teams are very small giving you tons of responsibility. At other top funds analysts don't get to see how their output is used in making investment decisions. You wil only be a monkey and nothing else. The Sankaty culture puts a lot of emphasis on autonomy and getting to an answer. Yes, your superior will have the final day but during the process you more or less take a lead on a name.

In terms of exit opps you are looking at the top MBA programs or other HFs

If you eventually wanted to start your own distressed fund or move to the best debt funds in the world what would be better options than Sankaty? I guess I am asking what would be the ideal job out of undergrad for someone who wants to do debt investing for a long time.

How does Sankaty compare to other hedge funds that hire out of undergrad?

Thank you very much for the replies that have already been posted.

So you join Sankaty as a summer analyst, what is the next move to better yourself? How do you improve so that after the summer you are in a better place than you were prior (other than getting an offer obviously)?

Should we write a life plan for you as well?

Just to answer some of the questions that I have seen on this thread:

In general, Sankaty is ivy-oriented when looking for analysts, but it seems to just be an easy way for HR to save time in the recruiting process and still see a lot of qualified applicants. One analyst (legend has it) got his first round via LinkedIn applying from a state school. Sankaty is definitely more interested in good ideas than good pedigree, so it definitely would not be a waste of time to prepare for the interview. In fact, the interview tends to test a broad set of business skills and asks for opinions rather than asking you to spit out some random formula (a la most BB interviews), so working on those should help you in any investing career path. Even if you don't receive a job offer, the prep should be valuable.

Right now, Sankaty is a great place to begin a career in my opinion. First, whichever industry team/credit team you are placed on, you can get a pretty comprehensive understanding of any part of the capital structure stack. This seems to be something that recruiters in the future consider favorably. Like emios said, Sankaty is looking at everything from bank debt to preferred stock up until now, and even now there is some talk of analysts considering equity of portfolio companies: you can learn about the whole stack at Sankaty. However, Sankaty doesn't really consider complicated trades involving multiple companies / hedges in general, so that is a skillset you don't get.

Prepping for the interview shouldn't be that hard if you have a genuine interest in credit or investing in general. Most people I know who were successful found that the consulting skillset was more applicable during the interview than anything you might have learned in finance classes. Furthermore, its important to recognize that Sankaty is playing primarily in debt, so its not as important to look at future upside potential of investment, but trying to consider all the downside scenarios.

Sankaty / Bain Capital Full Time Recruiting (Originally Posted: 01/09/2012)

Does anyone know what recruiting firm does full time recruiting for Sankaty Advisors and Bain Capital? Does anyone know when the recruiting season is for people who are looking for a position after their 2 year analyst program? Sankaty Advisors is the credit affiliate of Bain.

they recruit at the same time as bain's corporate pe arm for post-analyst positions. last year that was 1st week of march.

Thanks. Do you know what recruiting firm(s) they normally use?

go to one of the new hampshire calling booths and ask mitt?

I would imagine possibly through headhunters. I don't know much about HH though

Yeah, its definitely through a HH but I'm looking for the particular HH firm or firms that work with bain and sankaty. If anyone knows, I'd really appreciate it.

Sankaty does hire directly from undergrad (summer analyst positions, even) and b-school. Not sure about the post-banking process.

Any updates for 2014 on HH for Sankaty?

Bain Capital's Sankaty Advisors (Originally Posted: 12/24/2010)

Hi guys,

I'm interviewing with Sankaty Advisors for an SA position in just under a week, and was hoping for a bit more info and color about them. How would you compare an internship with them vs one with GS/MS? (I think I've got a good chance of landing a gig at these shops, given that I've got 2 BB internships under my belt)

Also, what's their interview-style? I know they use cases, but how similar are these cases to MBB interviews? Are there any technical elements?

(Apologies for putting this in the IBD forum - was after the most traffic)

If I could go to Sankaty, I would never even consider GS or MS.

Didn't know they offer interships and don't know what they would ask a college student, but wouldn't be surprised if they would ask questions about bond math (duration and convexity) and ask you about how you think about credit investments (understand downside risk). You can impress if you are able to make a good case for a credit investment.

They ask case study questions. Nothing about bond maths.

Work there over GS or MS.

You'll be limited in terms of exit opps, and you'll be pegged as a credit guy.

Sank. is gold standard.

know at least half a dozen duded @ Bain cap. When Sank. makes you an offer, take it and say thank you.

you're welcome

You will be limited to credit. With that, you can work for mezz funds, distressed funds, high yield credit shops, traditional corporate credit funds, and maybe LBO shops.

If you don't want to do one of those things, Sankaty may not be for you. Still, it's a great name in finance.

yes, ditto the above. you'll be a credit guy but you'll have a great experience if its a space you're interested in

Case Interview with Sankaty Advisors (Originally Posted: 01/24/2008)

what to expect? interviewing with their TMT group

...

...

Sankaty Advisors Exit Opps (Originally Posted: 10/24/2009)

Having used the search button, I know that there's a lot of info about Sankaty, but many of those threads are dated, or don't go into a lot of detail about the firm.

A friend was asking me for more recent information about the firm: what's working at Sankaty like? How is the fund structured? What are exit opps like for people who complete the two-year analyst program? Is the distressed debt skillset that you build at Sankaty transferable in any way to private equity shops or only to hedge funds?

Sankaty has incredible food made by in-house dining services. I've heard great things about the culture and lifestyle. Also, the office location is great, right inside Prudential center.

Bump

Bump

Bumping this old thread to see if there are any newer, more relevant thoughts. Very curious about this, especially concerning the differences of the exit opps of the public debt group and the middle market mezz group.

Sankaty interview - Industry Investment Team (Originally Posted: 02/26/2016)

Hi everyone, I just received an email from Sankaty to interview with the Industry Investment Team for an internship opportunity. They told me it would be a 30mn interview with the MD of the Industry Investment Team. What kind of question should I expect ? Do you have any insight ?

Many thanks

Expect a case-based interview, the interviewer will probably try to get a view on your understanding and analysis of a particular industry, with some quantitative tasks as well. Not a typical IBD finance interview at all, definitely resembles an MBB interview in my experience. That being said, they definitely focus in on a particular asset class so understanding debt will be very important towards having a good interview.

Thanks Moneybags1993 ! Do you think we will get the time to go through a case in only 30mn?

CTLM - not sure if i've gotten to you too late. You will definitely have time for the case. While consulting cases tend to be longer/more involved, that skillset will help you do well on the interview, hopefully.

Sankaty Advisors (Originally Posted: 01/29/2010)

Hi all,

What do you think of Sankaty Advisors, Bain Capital's fixed-income hedge fund?

It seems to be a pretty neat place to start at,

but how does it compare to MBB, and M&A (good groups) or S&T (good desks) at a BB?

Any difference between London and New York for that matter?

Do you know what the compensation structure / lifestyle / exit opportunities looks like for junior guys?

Apparently they lost a lot of money in 2008 but recouped their losses in 2009.

Thanks a lot,

Also, what is the risk of starting a career there in the current climate? Regulatory-wise, wouldn't it be safer to work for a private company than for a big bank given public outrage?

Also intereted in this, if anyone can add some insights.

Sankaty Advisors SA (Originally Posted: 02/06/2015)

Does anyone know how many people get into and are selected from the final round for summer positions?

very very few.

Do you have any numbers?

Sankaty Advisors? (Originally Posted: 01/29/2013)

Anyone have some details on the interview process or know more about the firm? Most stuff on WSO is old.

Feel free to PM me.

Bump

don't have any specific advice but they are top notch credit shop, congrats on the interview

Bain Capital - Sankaty Advisors (Originally Posted: 02/04/2007)

Anyone know much about this group? Or its summer internship opportunities? I have an interview with them this Monday, and I was wondering what others' opinions were of them

thanks!

pretty good high yield shop, interesting work. i had a buddy who worked there, left to come to nyc. the people are good, and the work isn't as intense as banking. if you like boston and want more of a lifestyle choice, than its a good decision

Is the entry level program as defined as in banking (2 years and out for most people). What types of things do people coming out of Sankaty usually move into? Trying to compare it to the typical Analyst stint at a BB. Thanks.

bump

Sankaty Advisors (Europe) (Originally Posted: 07/07/2011)

Hi, I wanted to ask if anyone has some insight into Sankaty interview process in Europe? Is it any different from US? I read a lot of the old threads and it seems to be similar to MBB interviews in that it is case study based?? Appreciate any insights!

bump

Yea got in touch with them before. As you know they are a credit hedge fund, similar to distressed investments. Interview is case study method, like MBB ones but more about investment decisions. Depends on your major (guess you are still a student?) and your previous experience, they will ask you different questions. My frd who does Econ at LSE got questions abt credit models a lot. His interview was extremely technical and another of my frd who does humanities at LSE only got average technical questions like a basic case study stuff.

If you have a great resume, be ready to talk about everything on it and expect tough questions. Have a basic idea about what they are doing (what's the downside risk for credit investing etc.?) and their style (for example they are pretty proud of having a mixed style consulting + Ibanking). Very great job if that's what you wanna do. Met a guy there who has previously worked for BX PE for couple of years.

Bain Capital--Sankaty (Originally Posted: 02/20/2007)

Hey I was wondering what everyone thinks about the Sankaty Advisors division of Bain Cap. I have an offer to do Mezz there and it seems pretty sweet. I am pretty sure I want to do Buy-Side stuff and this seems like a good entry into either PE or HF. What do you guys think? I know BB-IB is a more common route to PE but it seems like a good Mezz group should give you the training and an edge on actual buyside experience. Also if I decide that I dont want to do PE eventually, would Mezz translate well into HF. I know they sent people from their regular industry groups to places like Farallon, Highfields, Perry, Royal etc in the past couple of years, but do you think Mezz would translate as well to those types of funds. Thanks in advance for any help.

Historically sankaty has not placed so well into pe or hf but very well into mba. If you are definitely looking into pe or hf, you may want to consider bb, if you have a top shop offer there.

What are the exit opps for people out of mezz? Thanks

Interesting. I know historically they have not placed as well into PE, but they definitely have done well with hedge funds for the last couple of classes. I am not worried about getting a job at a HF if I work in one of the industry groups that is more market based, but I was wondering whether Mezz would decrease those chances.

Ranked #3 in the US for HY CLO in 2006 with about $6bn AUM (w/o synthetic padding). Not sure how they compare to regular HF or PE, but seems highly reputable in HY/distressed land.

Sankaty (Originally Posted: 02/26/2007)

Hey, I think I am going to work at Sankaty for the summer, and wanted to ask a quick question. Specifically, what is your knowledge of the exit opportunities at the firm? I am told that exit opps after summer are tremendous--Evry intern last summer received an offer from McKinsey full time (the 3 that I spoke to in person also received offers full-time from Bain consulting and BCG), and though an MD offered all 5 interns backdoor into Goldman IBD, none took it (all came back to Sankaty except 1). All analysts who have ever worked there and applied to business school have received admission to either Stanford or HBS. Plus there are so few opps in buy side of this magnitude as an undergrad intern (really, only Goldman PE and Blackstone PE seem like better offers for this type of thing, and they take literally 5, maybe 10 interns total per summer) that it seems foolish not to accept. In other words, I'm not really worried about having options open after the summer, but want to know how I should think about options after the summer.

I'm clearly enticed by working the hours of a consultant for the pay of an i-banker--first year analysts made ~$150k last year...I don't know much about Sankaty's PE acceptances (I know they're good for Bain Cap PE, my guess is nothing exceptional outside of that). Is this a dumb offer to take over Citi I-banking or Blackstone fund of funds (I will not take B-stone, I think--didn't like culture, spoke to a guy who worked at BAAM and then moved to Sankaty full time)...

Any guidance would be appreciated.

Thanks...

this is the stupidest thing i have ever read, sankaty is garbage, way below all the firms above.

Sankaty is a great option. I wouldn't take it over GS/MS/BStone, but others might. It's debt buy-side stuff with a consulting-based approach, so if you're into that, go for it.

Exit opps? If you want to make it to GS/MS/BStone, why not just take those for the summer? Though if you want McKinsey, Sankaty might be the better option. For banking/PE, the others might be better.

sounds like you would take an offer at Sankaty over just about anywhere.

Here are some verified facts from someone who worked at Sankaty

Sankaty recruits and hires from Virginia, Columbia, Michigan.... many more (state schools) Not even Blackstone does the strictly H/W/S/Y thing anymore. There are just not enough top kids at these schools.

Speaking to my friend after his internship, none of them were offered backdoor Goldman IBD. I don't think any of them even got Goldman IBD. If fact, my friend did it because he got shut down from Goldman IBD.

Sankaty doesn't give you any advantages over regular Bain for PE or MBA. Believe me, lol.

Don't get me wrong, Sankaty is great. But I don't know ANYONE who has chosen them over Blackstone, Goldman, Morgan Stanley, Lazard, McKinsey.

I think what you really ought to be gunning for here is Ameriprise Financial. I hear Henry Kravis personally flies out to Minneapolis every year to beg their analyst class to become principals at KKR...

Sankaty, Bain's Credit Fund, Getting Killed (Originally Posted: 10/24/2008)

http://online.wsj.com/article/SB122472657432961253.html

momentum players the lot of them.

They swam naked and the tide went out. I won't shed a tear for any of them.

so much for calling the bottom. hold to maturity i guess?

Similique voluptates veritatis non sint quae vero. Hic eius autem occaecati non. Dolorem explicabo dolores quis non et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Velit aperiam in et eos voluptatibus facere ut. Praesentium aut et excepturi corporis omnis deleniti optio. Molestiae eaque totam molestiae aut quo. Possimus expedita et est in cumque quasi.

Inventore quasi nemo quia natus aspernatur cum. Ipsa amet aut minima consequatur quas.

Quasi esse ratione aspernatur. Quia nostrum velit ex et sint amet. Nisi aut dolor consequatur rerum sit dicta.

Ipsum quia distinctio iusto et possimus explicabo. Rerum enim et saepe et voluptas vitae ad eveniet. Eligendi ipsam itaque sunt pariatur dolor. Dolor voluptatem velit iusto et animi vel. Distinctio et delectus natus ut corrupti sunt quia. Repellat totam est ut iste.

Autem in odio nisi quibusdam soluta sint accusantium. Et est incidunt iure ipsa est. Architecto ut harum nihil iure tempora.

Tenetur eum totam numquam id. Et dicta saepe aspernatur ipsum quo. Nisi commodi ut nesciunt illo. Quas quia tempore ipsum nihil.

Cupiditate facere officiis soluta aut ab et et. Asperiores soluta voluptatibus eius nihil. Repellat quas tempora maxime et. Laboriosam assumenda eveniet illo eum voluptates eaque.

Quasi molestiae a id adipisci sed vitae aut. Nostrum a qui repudiandae consequatur. Id iure ut totam quia fugit. Cupiditate repellendus et nesciunt non vero accusantium. Quos qui labore praesentium non labore id.

Aspernatur blanditiis sed dolores dolores ullam. Iure consequuntur ullam ut maxime eos non cumque. Nihil provident sapiente numquam modi.

Est fugit error facere molestiae dicta quis cumque. Et pariatur provident aut aliquam deserunt et sed. Magnam at ut repudiandae voluptate beatae. Eum accusamus accusamus voluptas tempore. Nemo voluptatem id et nostrum quia sint.

Nihil et quod impedit minus dignissimos. Harum repellat sit eos deserunt est ea reprehenderit.

Voluptatem rerum error id est ea temporibus. Eos cum laudantium vitae omnis et eos similique. Tempore reprehenderit ipsum vitae dolorem non qui. Fuga in sed aperiam sunt quis cupiditate.

Asperiores perferendis ab omnis suscipit quo aut eos. Alias sit qui voluptates quia. Dolorem minus et similique aut odio sapiente harum.

Incidunt molestias voluptatem vitae quia. Rerum et aut ea sapiente explicabo magni. Commodi at et non. Et distinctio praesentium error et.

Ullam sed qui est voluptatem voluptatem. Odio sed consequatur ipsa aut quos dicta est.

Molestiae quo possimus omnis cum omnis magni quam. Molestiae eos voluptas excepturi. Voluptatem officia sed sit et. Illum nobis sint quas commodi quia inventore. Ipsa consequatur sit quo explicabo error. Consequatur omnis aperiam quo odio impedit dolore dolor.

Et iure quo culpa atque optio cum. Et optio explicabo nemo omnis dolor architecto in saepe. Sapiente quia cum iste laudantium mollitia ut animi et. Laborum voluptatem et quasi doloremque est eum nulla. Quia nobis perferendis sunt possimus reiciendis. Ut quo nihil et quidem velit est. Alias et quasi est amet voluptatem ut a.

Natus natus minima labore dolor eius illum. Minus hic ea temporibus vero voluptas perferendis. Vitae ut molestias sed ipsam libero natus. Voluptate perferendis facere animi aut.