FP&A Interview Questions and Answers (30 Samples)

30 common FP&A technical, fit, behavioral, and logic questions to help you join the industry

Financial Planning & Analysis (FP&A) teams have established themselves as crucial to an organization’s long-term growth and success through budgeting, modeling, forecasting, and analyzing financial metrics utilized by management executives to make informed decisions.

The FP&A interview process is designed to identify capable candidates with strong attention to detail and critical thinking qualities. Given this, answering the technical and behavioral questions with confidence and consistency is key to converting an interview into an offer.

The following free WSO FP&A interview guide serves as a comprehensive resource designed to cover multiple aspects of the interview process, drastically improving your odds of receiving an FP&A offer at your dream F500 company.

This guide features 30 of the most common technical and behavioral questions, along with proven sample answers, that are asked by FP&A hiring professionals to candidates during the hiring process.

This resource further includes 15 firm-specific questions asked to candidates by professional FP&A hiring teams at F500 companies (Morgan Stanley, Deloitte, etc.) and other world-renowned firms (Houlihan Lokey, Vanguard Group, etc.), and there are sample answers to each question.

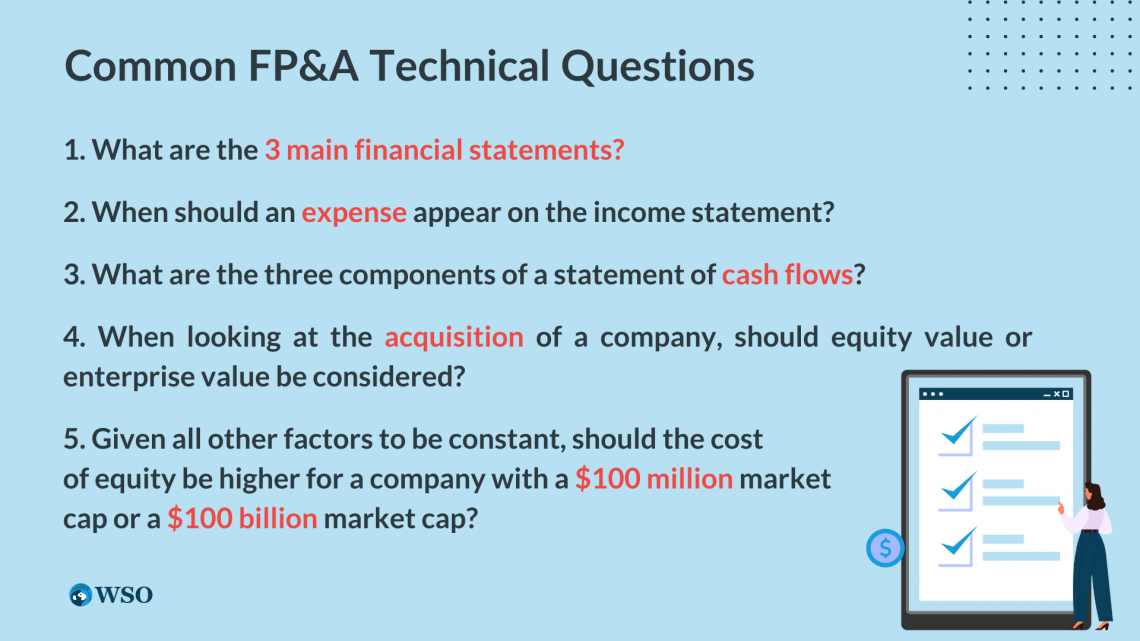

10 Common FP&A Technical Questions

Technical questions are a critical component of almost every FP&A recruiting process. Generally, FP&A teams look for a solid understanding of basic concepts in finance and accounts, which you can consequently apply to technicals asked to you - as opposed to asking common questions easily memorized by candidates.

Therefore, naturally, your answers must demonstrate in-depth knowledge and expertise of the topic at hand.

The following section features 10 common FP&A interview questions, all of which have been provided sample answers. At the end of these 10 questions, we have provided you with 10 exclusive firm-specific technical questions to kickstart your mock interview training.

1. What are the 3 main financial statements?

- Income Statement – This statement displays a company’s revenues alongside its expenses for the duration of a particular accounting period

- Revenues – Cost of Goods Sold – Expenses = Net Income

- Expenses include both cash and non-cash expenses and both operating and non-operating expenses.

- Net Income DOES NOT equal cash flow and should not be considered an accurate representation of a company’s ability to generate cash because the Income Statement includes non-cash expenses and does not reflect the cash impact of changes in Working Capital or Capital Expenditures.

- Balance Sheet – This is the company’s statement of financial position on one given day, typically the final date of a particular accounting period

- Assets = Liabilities + Shareholder’s Equity

- Assets and Liabilities are often shown in order of “liquidity”, or the rate at which that asset or liability is expected to be realized in cash (ordered from most current/liquid to least current/liquid)

- Statement of Cash Flows – This statement indicates how a company’s Net Income is adjusted upwards or downwards for non-cash and non-operating expenses to calculate a company’s Cash Flow from Operations.

- SCF also shows capital expenditures (a non-operating cash outflow) as well as cash inflows from the sale of capital assets (for example, Plant, Property & Equipment) in the Cash Flow from Investing section

- SCF also contains the Cash Flow from Financing section, which shows the cash impact (inflow or outflow) of activity with a company’s investors (both debt and equity). This includes debt capital raised or repaid, equity capital raised or repurchased, or dividends paid.

- Beginning Cash + CF from Operations + CF from Investing + CF from Financing = Ending Cash

Sample Answer:

The three primary financial statements are the Income Statement, the Balance Sheet, and the Statement of Cash Flows.

The Income Statement shows a company’s revenues, costs, and expenses, which together yield net income.

The Balance Sheet shows a company’s assets, liabilities, and equity and represents the company’s financial health/position on one particular day in time.

The Cash Flow Statement starts with net income from the Income Statement; then, it shows adjustments for non-cash expenses, non-expense purchases such as capital expenditures, changes in working capital, or debt repayment and issuance to calculate the company’s ending cash balance.

2. When should an expense appear on the income statement?

Sample Answer:

In order to be presented on the income statement, the expense must be tax-deductible and must have been incurred during the period of the income statement.

Expenses that end up on the income statement are factors such as marketing expenses, employee salaries, etc.

3. What are the three components of a statement of cash flows?

The Statement of Cash Flows is one of the three financial reports that all public companies are required by the SEC to produce quarterly. Most non-public companies also prepare the Cash Flow (CF) Statements.

It comprises the three main components described below, showing all of the company’s sources and uses of cash. However, since companies tend to use accrual accounting, their net income may not (and most of the time does not) portray how much cash flows in or out due to non-cash expenses, investing activities, financing activities, changes in working capital, etc.

Because of this, even profitable ones may have trouble managing their cash flows, and non-profitable ones may be able to survive without raising outside capital.

Sample Answer:

Cash from operations: Cash generated or lost through normal operations, sales, and changes in working capital (more detail on working capital below).

Cash from investing: Cash generated or spent on investing activities; may include, for example, capital expenditures (use of cash) or asset sales (source of cash). This section will also show any investments in the financial markets and operating subsidiaries.

NOTE

This section can explain a large negative cash flow during the reporting period, which isn’t necessarily bad if it is due to large capital expenditure in preparation for future growth.

Cash from financing: Cash raised to or paid for financing the business; may include proceeds from debt or equity issuance (source of cash) or cost of debt or equity repurchase (use of cash).

The three components of the Cash Flows Statement are Cash from Operations, Cash from Investing, and Cash from Financing.

4. When looking at the acquisition of a company, should equity value or enterprise value be considered?

Sample Answer:

Since the acquiring company must purchase both liabilities and equity to take over the business, the buyer will need to assess the company’s Enterprise Value, which includes both the debt and the equity.

5. Given all other factors to be constant, should the cost of equity be higher for a company with a $100 million market cap or a $100 billion market cap?

Sample Answer:

Typically, a smaller company is expected to produce greater returns than a large company, meaning the smaller company is riskier and would have a higher cost of equity.

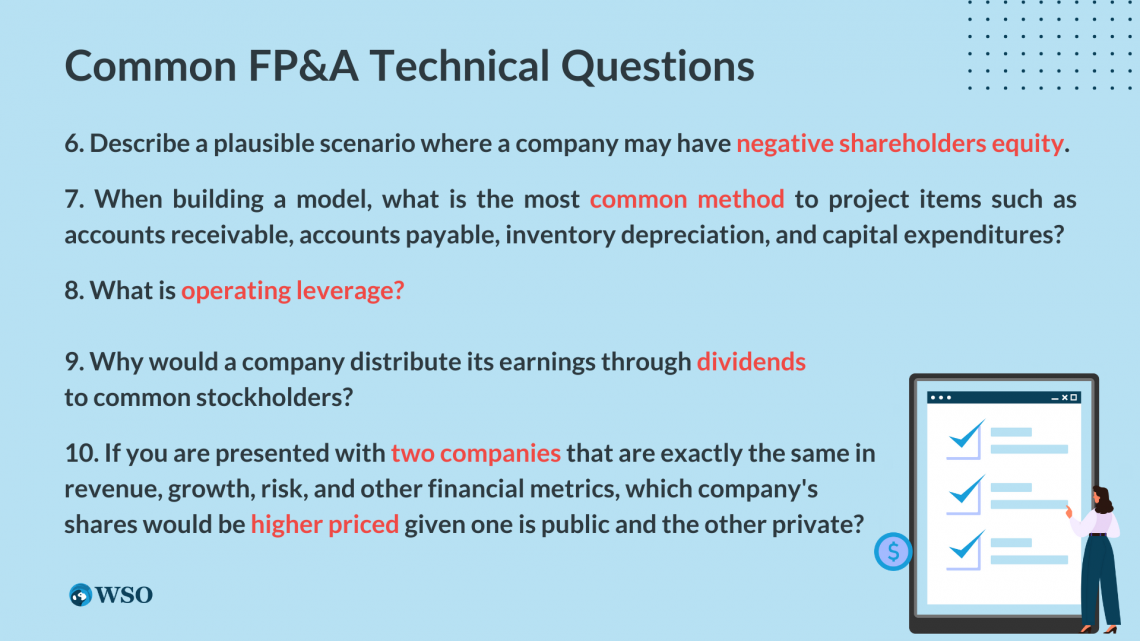

6. Describe a plausible scenario where a company may have negative shareholders equity.

Sample Answer:

If a company has had negative net income for a long time, it would have a negative retained earnings balance, which would lead to negative shareholders equity. A leveraged buy-out could have the same effect, and so would a large dividend payment to the owners of the business.

Sample Follow-up Question: If a company with a highly levered capital structure was attempting to execute a large dividend recap (which may or may not create a negative shareholders equity balance), what might a debt holder do to enforce any protections he/she has as a debt investor?

Sample follow-up Answer:

Suppose a company has a highly levered capital structure. In that case, the legal documents governing the debt financing will generally limit the amount of total leverage (or indebtedness) that the company could raise. These limits are called negative covenants and will also be so specific as to clarify how much debt could be incurred that is senior to the existing debt in the capital structure and how much could be junior debt in the capital structure.

7. When building a model, what is the most common method to project items such as accounts receivable, accounts payable, inventory depreciation, and capital expenditures?

Sample Answer:

- Accounts receivable is usually projected as a percentage of revenues or using a ratio like Days Sales Outstanding.

- Accounts payable is generally projected as a percentage of the cost of goods sold or using a ratio like Days Payable Outstanding.

- Inventory is typically projected as a percentage of the cost of goods sold or using a ratio like Inventory Days.

- Depreciation can be calculated very simply using a percentage of the prior years’ PP&E or can be calculated at the individual asset level using different schedules, useful lives, etc.

- Capex is normally projected as a percentage of revenues, or from company guidance, you will have a relatively good idea of what CAPEX requirements are going forward.

8. What is operating leverage?

- Operating leverage is the percentage of costs that are fixed versus variable.

- A company whose costs are mostly fixed has a high level of operating leverage.

- Suppose a company has a high level of operating leverage. In that case, it means that much of any increase in revenue will fall straight to the bottom line in the form of profit because the incremental cost of producing another unit is so low.

- For example, a swim club is a business that operates with a high level of operating leverage. Once the club is built and opened, its costs are relatively fixed. With the same number of staff, same size pool, same locker rooms, same maintenance expense, the club could go from 500 members to 510 members with little additional cost. Nearly 100% of the membership fees collected from the 10 new members boost the bottom line.

Sample Answer:

Operating leverage is the relationship between a company’s fixed and variable costs. A company with relatively higher fixed costs as compared to variable costs has a higher level of operating leverage.

While a company with a high degree of operating leverage will have a higher earnings growth potential than a company with a largely variable cost structure, certain financial institutions will prefer to lend to businesses with a variable cost structure to help mitigate their downside risk – the financial institution is comforted by the fact that the company they are lending to still has the ability to cut back on some of their expenses should they see an economic downturn approaching or other signs of a decrease in financial performance.

Equity investors benefit the most from earnings growth potential and, as such, will prefer to invest in companies with a higher degree of operating leverage.

9. Why would a company distribute its earnings through dividends to common stockholders?

Sample Answer:

The distribution of a dividend signals that a company is healthy and profitable, thus attracting more investors, potentially driving up the company’s stock price.

10. If you are presented with two companies that are exactly the same in revenue, growth, risk, and other financial metrics, which company’s shares would be higher priced given one is public and the other private?

The public company most likely will be priced higher due to the liquidity premium one would pay to be able to buy and sell the shares quickly and easily in the public capital markets.

Another reason the public shares should be priced higher would be the transparency required for the firm to be listed on a public exchange. For example, publicly traded companies are required to file audited financial statements, allowing investors to view them.

Sample Answer:

The public company is likely to be priced higher for several reasons. The main reason is the liquidity premium investors will pay for the ability to trade their stock quickly and easily on the public exchanges. A second reason is a sort of “transparency premium” that derives from the public company’s requirement to make their audited financial documents public.

10 Hard FP&A Technical Questions And Answers

Understanding the critical underlying concepts of the 10 technical problems covered above will undoubtedly result in a competitive edge over the applicant pool. However, to further capitalize upon this and achieve technical expertise, we believe it’s critical to tailor your preparation to the company you are applying for.

The following section features 10 exclusive questions asked to candidates by professional FP&A hiring teams at F500 companies (Morgan Stanley, Deloitte, etc.) and other world-renowned firms (Houlihan Lokey, Vanguard Group, etc.)

The following questions have been taken from WSO’s Company Database, which is sourced from the detailed experiences of more than 30,000 people with FP&A interviews.

Morgan Stanley FP&A Technical Questions:

Sample Answer:

- This question is used to gauge your general interest in the financial markets. You probably will not be expected to know the number to the penny, but knowing the levels of the three major exchanges/indices, as well as whether they were up or down and why will show your interviewer that you keep track of what is going on in the world of finance.

- You should know how the market moved (up or down) the previous day and why it moved. You can find this information by watching CNBC, reading the WSJ, or using Google.

- Yesterday the XXXX closed at XXXX, up/down XXX from the open. I also noticed that it was up XXX from the day before due to …

- It would also be a good demonstration of market interest to know the overall valuation levels of the three major indices. The P/E ratios for the overall Dow, S&P 500, and Nasdaq are publicly available on major financial news publications.

Sample Answer:

Quantitative Easing is the name given to government policy to increase the money supply by injecting liquidity into the economy. This is done by repurchasing government assets from the market.

The reason behind using this policy is that it will increase the capital within the financial sector and, therefore, increase the amount that banks lend to consumers and small businesses to promote economic growth. However, this policy is usually only done when interest rates are already extremely low, and there are no other measures that can be taken to stimulate economic activity.

NOTE

To see the complete definition, check out WSO’s Financial Dictionary Quantitative Easing page.

Nordstrom Corporate Technical:

Sample Answer:

I would determine who to go after by running down the corporate structure. Then, in the event that the parent company went bankrupt, I would consult with our counsel to see what legal action we could take.

Houlihan Lokey Technical Questions:

Sample Answer:

If you have a company with very unpredictable cash flows, then attempting to project those flows and create a DCF model would not be practical or accurate. Instead, you will most likely want to use a multiples or precedent transactions analysis in this situation.

Sample Answer:

Beta represents a given investment’s relative volatility or risk concerning the market.

- β < 1 means less volatile than the market (lower risk, lower reward).

- β > 1 means more volatile than the market (higher risk, higher reward).

- A beta of 1.2 means that an investment theoretically will be 20% more volatile than the market. If the market goes up 10%, that investment should increase by 12%.

- Beta is a measure of the volatility of an investment compared with the market as a whole. The market has a beta of 1, while investments that are more volatile than the market have a beta greater than 1, and those that are less volatile have a beta less than 1.

Nordea Bank Technical Question:

Sample Answer:

If interest rates fall, bonds prices will rise, so you should buy bonds.

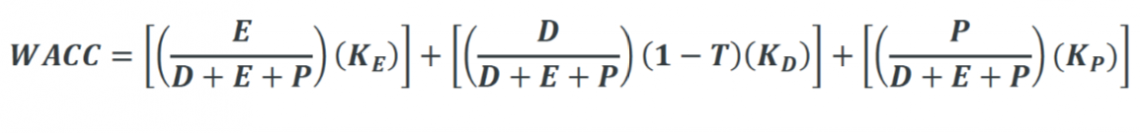

Deloitte Technicals:

Sample Answer:

WACC is the acronym for Weighted Average Cost of Capital. It reflects the overall cost for a company to raise new capital, which represents the riskiness of investment in the company (the higher the risk, the higher the cost of capital). It is commonly used as the discount rate in a discounted cash flow analysis to calculate the present value of a company’s cash flows and terminal value.

The formula below helps you calculate the WACC of a company if you are put on the spot and asked to calculate it as part of your technical interview:

Where

E = Market value of equity

D = Book value of debt

P = Value of preferred stock

KE= Cost of equity (Calculate using CAPM)

KD = Cost of debt (Current yield of debt)

KP = Cost of preferred stock (Interested rate on preferred stock)

T = Corporate tax rate

Keeping your technical overview at a high level in an interview is vital. Start with a high-level overview and be ready to provide more detail upon request.

Sample Answer:

- Project out cash flows for 5 - 10 years depending on the stability of the company

- Discount these cash flows to account for the time value of money

- Determine the terminal value of the company - assuming that the company does not stop operating after the projection window

- Discount the terminal value to account for the time value of money

- Sum the discounted values to find an enterprise value

- Subtract the present value of debt (this is generally the market value of debt) and then divide by diluted shares outstanding to find an intrinsic share price

Common questions that follow this are:

Why do you multiply by (1-tax rate)?

Sample Answer:

You do this because interest expense (the cost of debt) is tax-deductible, so you need to account for the benefit provided by this "debt tax shield."

What is the cost of equity?

Sample Answer:

The cost of equity is usually calculated using the Capital Asset Pricing Model (CAPM).

CAPM = Risk-free rate + Beta * (Expected market return - Risk-free rate)

What is the exit multiple method for determining the terminal value?

Sample Answer:

Find an industry average multiple and multiply it by final year revenue (if using EV/Revenue) or final year EBITDA (if using EV/EBITDA).

The Vanguard Group FP&A Question:

- You can base your answer on the implied probability for future fed funds interest rates, which is what the market is pricing in. You can find this from the CME searching CME FedWatch. World interest rate monitors are available from a variety of places as well.

- There’s no lack of other interest rate commentary out there as well. Focus on primary resources like Fed Statements, studying the Treasury Curve, and economic indicators.

Sample Answer 1:

I believe we’re in a lower for longer interest rate environment, and I think the Fed will remain cautious with any hikes until global economic conditions improve. However, the Fed Funds are currently implying a 53% chance for a rate hike by December, and I believe we’ll get the next rate hike in December or early next year.

Sample Answer 2:

I have a hard time believing that the Fed would pull out the rug on the market with quick interest rate hikes while other global central banks are still cutting their rates amidst sluggish global growth.

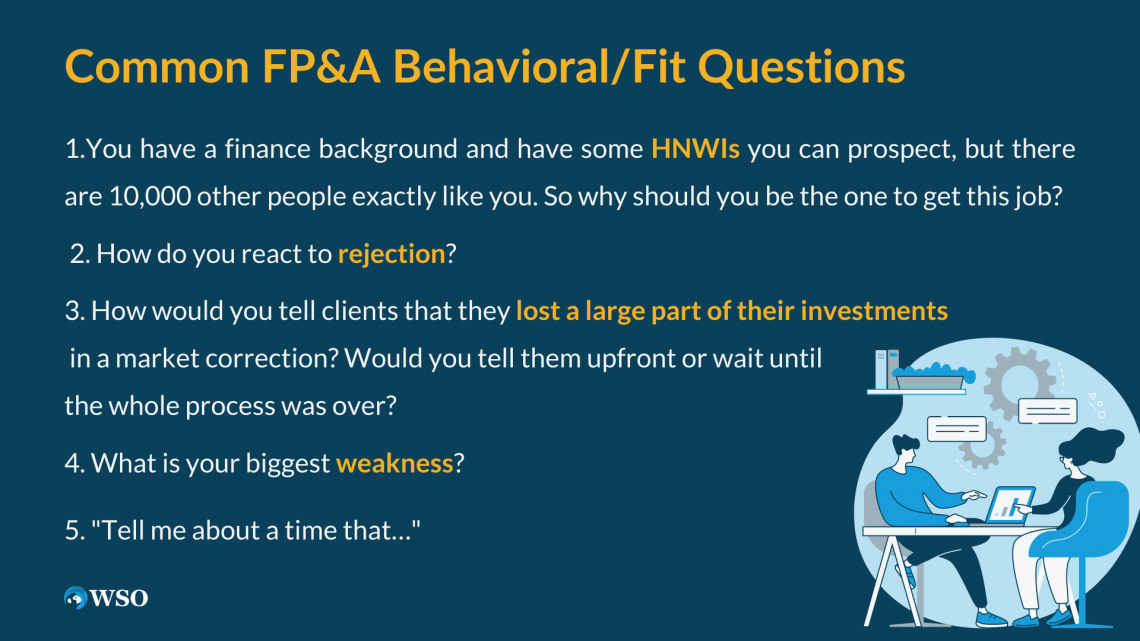

5 Common FP&A Behavioral/Fit Questions

Behavioral questions, also commonly referred to as “fit” questions, are designed to determine your attitude, work ethic, and personality in relation to the firm you are applying to. The FP&A interviewing team, on the other side, looks for an alignment between your values and that of their company.

FP&A teams typically take fit extremely seriously because you must collaborate over long hours and under tight deadlines, and therefore strong chemistry between team members is ideal.

This section walks you through 5 of the most common types of fit questions and suggests approaches for answering them. The proposed approaches and sample answers are meant to be illustrative. But, always remember, you need to adapt your answers to be true to yourself and your own words.

"Coming from someone in FP&A, I would highlight your ability to model and, in specific terms, how modeling can improve their processes. Fit is a big part of FP&A because you’re going to work on a lean team and deal with all the chaotic moments together. You have to be on the same page. FP&A isn’t rocket science - you just need to be down to earth and show your willingness to be a team player!"

NOTE

The following extract has been edited and was taken from WSO User @deadpool7’s comment on the “How To Prep For FP&A Interviews” post on WSO Forums.

1. How do you see yourself contributing to our firm in both the short-term and long term?

Sample Answer:

The short-term goal should just be to accomplish everything you are given quickly and correctly while learning as much as possible during your first few years. Longer-term goals can be things such as: learning to lead and manage a team, bringing in new business, etc.

2. What serves as your biggest motivation?

Some factors you can list are:

- Outperforming expectations

- Hitting deadlines,

- Earning respect from your peers

- Maximizing efficiency

- Learning

Rather than just saying what motivates you, have a story prepared that shows you are motivated by whatever you answer.

Sample Answer:

My biggest motivation is earning the respect of my peers and boss. For example, in my job last summer, I was the sole intern responsible for building a model for a client. My boss, Mike, gave me the specifications and told me when he needed them. I wanted to make a positive impression, so I worked almost around the clock, including time at home, to build it in only three days. This allowed me time to sit down and go through it with Mike before it was needed and still get it edited well before the deadline. Mike respected me for getting it done early, and earning that kind of respect is what keeps me going.

3. Describe your ideal work environment.

The most important thing about your work environment, especially in an industry like finance where you spend so many hours together, is the people you work with.

Talk about the fact that you want to be in an environment with others who are all as dedicated, driven, and hard-working as you are, where everyone can rely on one another to get tasks done efficiently.

Say you excel in an environment with excellent communication and teamwork, one that will allow you to grow professionally and intellectually, where you are evaluated and rewarded based on your performance.

Sample Answer:

In my mind, at least in finance, the most essential aspect of the working environment is the people you are working with. When working side-by-side for countless hours per week, for years, if you do not enjoy the company of your colleagues, the environment will be challenging. My ideal workplace is one where everyone communicates well, works hard, and trusts each other to get the job done right and on time—and then the team is evaluated and rewarded based on performance.

4. Can you explain a concept to me that you learned in one of your classes in 60 seconds?

While this may seem a bit daunting, as long as you have thought about it at least a little bit in advance of your interview, you should be able to come up with a pretty good response.

Typically the interviewer is looking for something quantitative, likely from finance, accounting, engineering, class, etc. However, if you are explaining something from engineering or biochemistry, make sure it’s in plain English, and you aren’t throwing around acronyms that the average person wouldn’t understand. If you can explain something that maybe the interviewer doesn’t already know, in layman’s terms, that may be more engaging. But, if you are more comfortable explaining a financial or accounting topic, that’s fine too.

Sample Answer:

Let’s take the theory of the time value of money. This theory says basically that a dollar in hand today is worth more than a dollar in hand in the future. The reasoning behind this, in its simplest form, is twofold. First, due to inflation, today’s dollar is worth more than a dollar in X years because it can buy more goods. Second, if you have a dollar today, you can invest that dollar, which will appreciate in value.

5. Why do you wish to go into finance rather than entering another industry or starting your own business?

Talk about the learning experience FP&A will provide.

Acknowledge that the idea of starting your own business someday sounds exciting, but at this point, you don’t even know what it takes for a business to succeed; working in finance will teach you the skills and give you the experience to help make that happen.

Starting a business is difficult, especially with no track record.

Sample Answer:

My school was focused on entrepreneurship, which is definitely something that appeals to me. However, I concentrated on finance because I knew I wanted to get experience before ever trying to start something on my own. I knew that getting into finance would give me exposure to many different businesses and how they really work, allowing me to have a solid foundation for anything that I would want to do, whether staying in finance, going back to school, or starting a new venture. I know that this is the best step to building my career coming out of college.

5 Firm-Specific Behavioural/ Fit Questions for FP&A Interviews

Knowing the culture of each FP&A team before walking into an interview is key to clicking with the interviewer and walking out with an offer.

The following section features 5 exclusive questions that interviewers ask in the world’s biggest firms during interviews. It aims to help you jumpstart your training for the respective firms and tier FP&A you are interviewing for.

WSO’s company database

The following questions have been taken from WSO’s company database, which contains detailed interviews experiences of more than 30,000 people.

Morgan Stanley FP&A Behavioral Assessment:

1. You have a finance background and have some HNWIs you can prospect, but there are 10,000 other people exactly like you. So why should you be the one to get this job?

Sample Answer:

"You're absolutely right. However, I believe my unique background working as a buy-side analyst with my good presentation skills with clients allows me to build credibility faster with HNWIs versus someone from a less technical background. People can smell a sales pitch, but I actually have the portfolio management skills to back it up."

2. How do you react to rejection?

Sample Answer:

I take it as an opportunity to overcome an objection, and if that fails, I learn from it. I look at rejection as a necessary consequence of speaking with a diverse group of people. It's not a personal reflection on me, assuming I did a good job highlighting my portfolio management services to the prospect. Rejection doesn't discourage me because I know I have something of value to offer, which motivates me to continue speaking with prospects until I find a good fit for my services.

Bank of America FP&A Fit Questions:

3. How would you tell clients that they lost a large part of their investments in a market correction? Would you tell them upfront or wait until the whole process was over?

When this question is asked - they want to see you have good ethics and integrity.

Sample Answer:

I would inform the client upfront, explain the situation to them, and explain the preventive measures I would undertake to minimize the risk of such an instance occurring again. I don’t believe in covering up our mistakes, and I believe integrity is key to establishing a long-lasting relationship with clients.

4. What is your biggest weakness?

Seeing how common this question is (even outside of the finance industry), we have a dedicated page for this question to support you in answering it ideally during the interview. The “Good Responses To Biggest Weakness Questions” page can be found here.

5. “Tell me about a time that…”

There are countless variations of this question, from “Tell me about a time you acted with integrity” to “Tell me about when you had difficulty dealing with coworkers”. It is key to have a well-rehearsed response for each and a general guideline to follow.

Ideally, you can develop 6-8 stories that cover the 30-40 basic questions, with only slight modifications. DON’T wing it. For every potential question, map out the story using the SOAR framework.

Describe the Situation (10-15 seconds), Obstacle (10-15s), Action (60-75s), and Result (15-30s).

Stories for these questions should be 1.5 - 2 minutes long and focus only on what’s important.

WSO Interview Prep Guides & Additional Resources

Over recent years, breaking into a lucrative finance career has tremendously increased in difficulty with an extremely high number of qualified applicants applying for a limited number of positions. Given this, professionals and students alike should capitalize upon every resource available to them to ensure success in their job search.

WSO offers premium 1:1 services, such as the WSO Resume Review and WSO Mentor Service, that will match you with an elite professional in your target industry for one-on-one help to drastically increase your odds of landing your dream FP&A job. With a successful track record of delivering results to over 2,300 clients over the last 10 years, you can rest assured our premium service will deliver results.

Check out WSO Resume Review and WSO Mentor Service by clicking on the buttons below.

Additionally, finetune your preparation and training towards your dream FP&A position. From our comprehensive Investment Banking Interview Prep Course, which features 7,548 questions across 469 investment banks, to our WSO Elite Modeling Package covering Excel, 3 Statements, LBO, M&A, Valuation + DCF Modeling, we’ve got you covered for every career path of finance!

Check out our complete collection of courses offered by clicking the button below.

Additional WSO resources:

The following additional resources are recommended by WSO for taking a look at.

Additional interview resources

To learn more about interviews and the questions asked, please check out the additional interview resources below:

or Want to Sign up with your social account?